The Arkansas Stock Option and Incentive Plan of Church Companies, Inc. is a comprehensive program designed to reward and incentivize employees of the company located in Arkansas with stock options and additional performance-based incentives. This plan aims to attract and retain talented individuals who contribute to the long-term success and profitability of the company. Under the Arkansas Stock Option and Incentive Plan, employees have the opportunity to acquire stock options, which grant them the right to purchase a specified number of shares of Church Companies' common stock at a predetermined price. By offering stock options, Church Companies aligns the interests of employees with those of the shareholders, as the value of the options typically rises with the company's stock performance. The plan consists of different types of stock options and incentives available to eligible employees. These may include: 1. Non-Qualified Stock Options (NO): These stock options are granted at a specific exercise price, usually the market price of the stock on the grant date. Employees who exercise Nests may be subject to ordinary income tax on the difference between the exercise price and the market value of the shares at the time of exercise. 2. Incentive Stock Options (ISO): SOS are a type of stock option that is granted with certain tax advantages. To be eligible for SOS, employees must meet certain requirements set by the Internal Revenue Service (IRS). If exercised according to the rules, employees can potentially benefit from favorable tax treatment on the difference between the exercise price and the sale price of the shares. 3. Restricted Stock Units (RSS): In addition to stock options, the plan may also include RSS as a form of incentive. RSS are units granted to employees that represent the right to receive shares of Church Companies' common stock at a predetermined future date or upon achieving specific performance goals. RSS generally have vesting conditions that must be met before shares are granted. 4. Performance-Based Compensation: Church Companies' plan could also offer performance-based incentives to employees. These incentives are usually tied to the achievement of specific performance metrics, such as revenue targets, profit goals, or individual performance benchmarks. Performance-based compensation can be in the form of cash bonuses, additional stock options, or RSS. It is important to note that the specifics of the Arkansas Stock Option and Incentive Plan may vary based on the company's policies, legal requirements, and the employee's position within the organization. The plan is typically structured to reward employees for their contribution to Church Companies' overall growth and success, motivating them to excel in their roles and align their interests with the company's shareholders. Keywords: Arkansas Stock Option and Incentive Plan, Church Companies, stock options, incentive, employees, NO, ISO, RSS, performance-based compensation, share purchase, tax advantages, vested shares.

Arkansas Stock Option and Incentive Plan of Hurco Companies, Inc.

Description

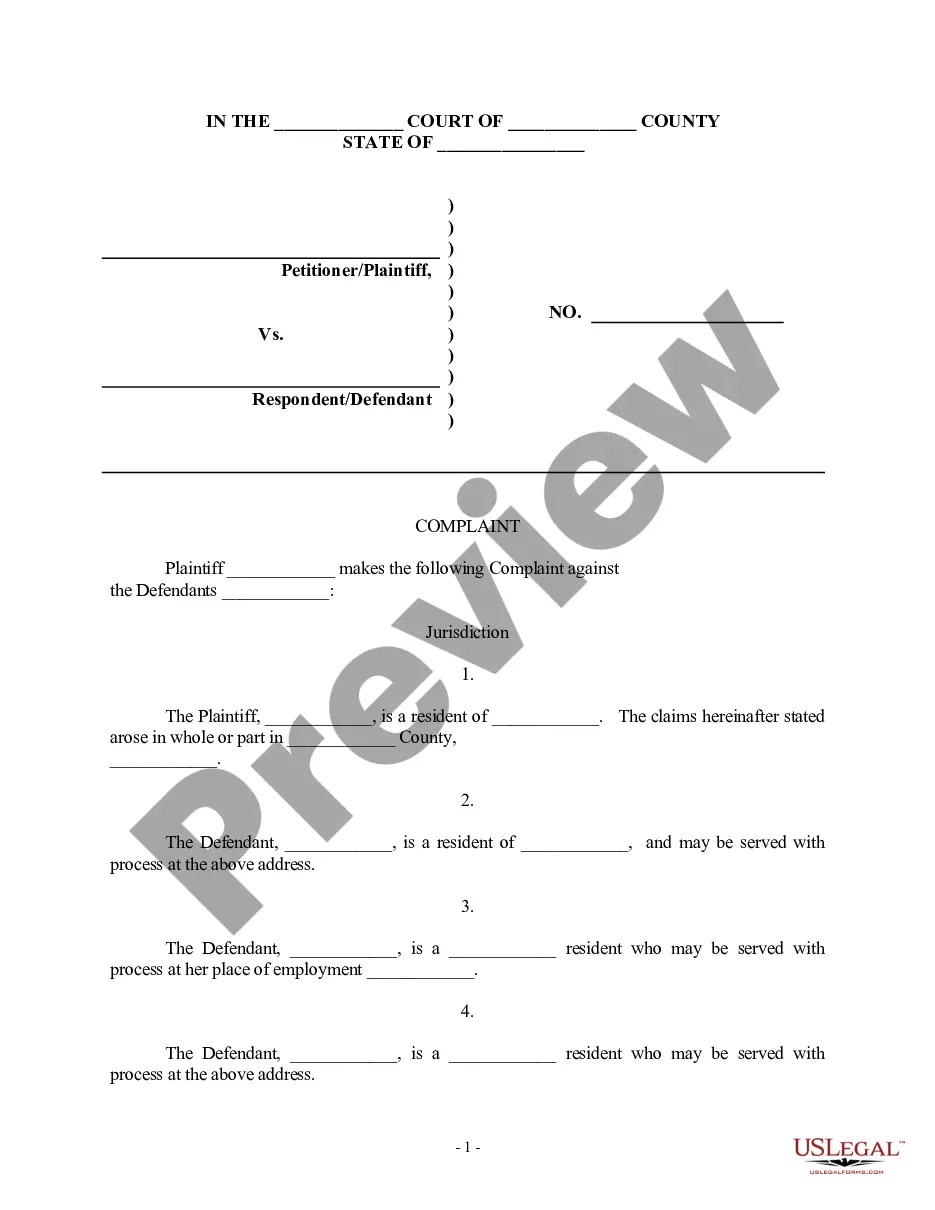

How to fill out Arkansas Stock Option And Incentive Plan Of Hurco Companies, Inc.?

If you have to complete, download, or printing legitimate record themes, use US Legal Forms, the greatest selection of legitimate types, which can be found on the Internet. Utilize the site`s simple and hassle-free research to discover the papers you require. Different themes for enterprise and person uses are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to discover the Arkansas Stock Option and Incentive Plan of Hurco Companies, Inc. with a few click throughs.

If you are previously a US Legal Forms customer, log in to the profile and click on the Acquire option to obtain the Arkansas Stock Option and Incentive Plan of Hurco Companies, Inc.. You can also entry types you formerly delivered electronically within the My Forms tab of your respective profile.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have selected the form to the correct city/country.

- Step 2. Use the Preview solution to check out the form`s information. Never forget about to learn the explanation.

- Step 3. If you are not satisfied together with the develop, utilize the Look for field near the top of the display to find other versions of the legitimate develop template.

- Step 4. Once you have identified the form you require, go through the Purchase now option. Pick the rates plan you like and put your qualifications to register for an profile.

- Step 5. Approach the purchase. You can utilize your credit card or PayPal profile to finish the purchase.

- Step 6. Select the file format of the legitimate develop and download it on the device.

- Step 7. Comprehensive, modify and printing or indicator the Arkansas Stock Option and Incentive Plan of Hurco Companies, Inc..

Every single legitimate record template you buy is your own property eternally. You have acces to every develop you delivered electronically with your acccount. Select the My Forms section and choose a develop to printing or download once more.

Compete and download, and printing the Arkansas Stock Option and Incentive Plan of Hurco Companies, Inc. with US Legal Forms. There are thousands of skilled and state-particular types you can utilize for your personal enterprise or person requires.