Arkansas Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

How to fill out Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

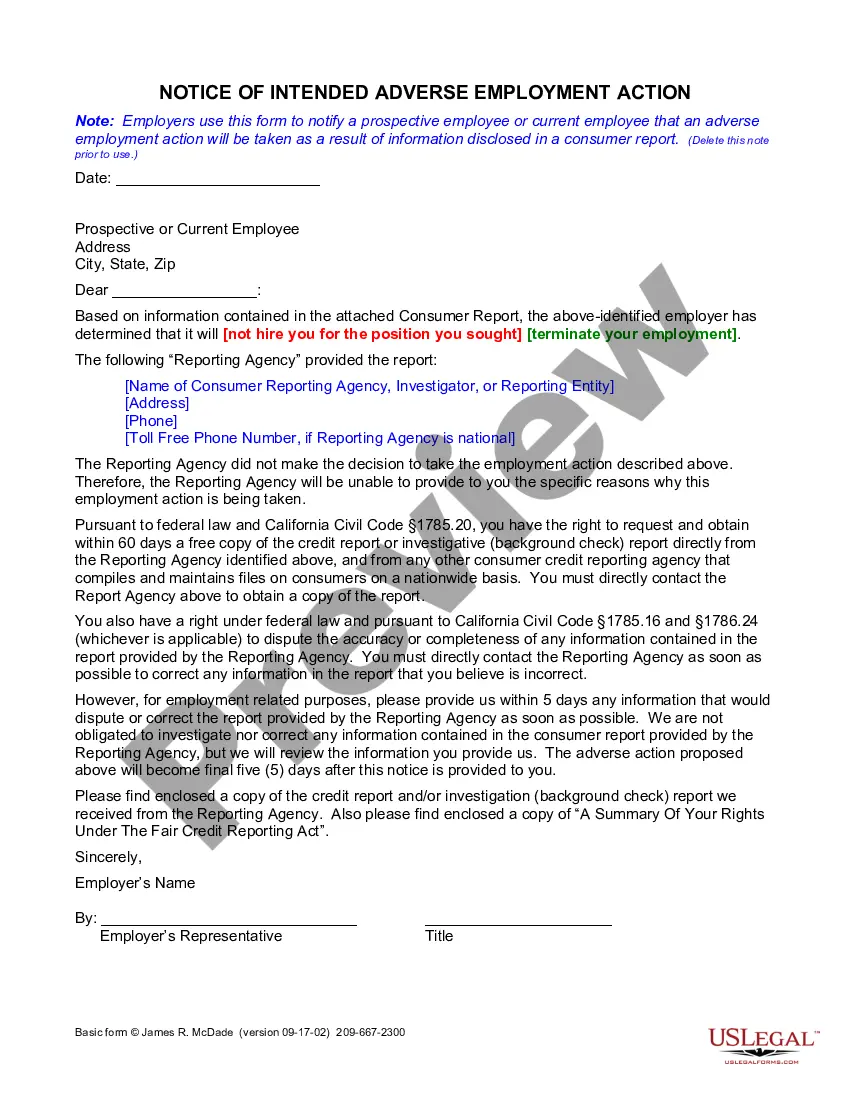

Discovering the right authorized document web template could be a have a problem. Of course, there are plenty of themes available on the net, but how would you find the authorized type you will need? Take advantage of the US Legal Forms website. The support provides 1000s of themes, including the Arkansas Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation, which can be used for organization and personal requirements. Every one of the types are checked out by pros and satisfy state and federal needs.

In case you are previously authorized, log in in your accounts and click on the Acquire option to find the Arkansas Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation. Use your accounts to search through the authorized types you may have purchased earlier. Proceed to the My Forms tab of your respective accounts and obtain an additional duplicate of the document you will need.

In case you are a brand new customer of US Legal Forms, listed here are straightforward recommendations for you to follow:

- Initially, ensure you have chosen the correct type to your city/region. You can look over the form utilizing the Preview option and look at the form explanation to ensure it will be the right one for you.

- In case the type does not satisfy your requirements, utilize the Seach field to find the proper type.

- When you are certain that the form is proper, click on the Acquire now option to find the type.

- Select the prices program you want and type in the essential information. Make your accounts and pay money for an order making use of your PayPal accounts or charge card.

- Opt for the data file structure and download the authorized document web template in your gadget.

- Complete, change and print out and signal the obtained Arkansas Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation.

US Legal Forms is the largest local library of authorized types for which you can discover different document themes. Take advantage of the service to download skillfully-made papers that follow condition needs.

Form popularity

FAQ

First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value. If stock options that had been granted are very far out of the money (i.e. "underwater"), however, they may be canceled.

Stock options at private companies are often issued with a low strike price. This allows you a chance to buy shares for a low cost, which requires less cash up front. This is a good thing when you consider how your cash flow will be impacted by an exercise ? but this is only one thing to consider.

If a startup never goes public, the stock options that employees have may become worthless or may have limited value. Stock options give employees the right to purchase a certain number of shares in the company at a predetermined price (also known as the exercise price or strike price).

If you've received a grant of RSUs at a private/not-yet-public company, it's possible that your RSUs could have a ?double trigger.? That means that not only will you have to wait the requisite period of time, but you will also be required to stick around until the company goes public.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

NSOs and Tax Considerations NSOs are seen as a form of normal income that is received from a company. The recipient is taxed on the date the stock options are exercised on the difference of the stock's market value and the grant price. This will appear on a W-2 just like other forms of compensation.

Vested employee stock options contain guarantees, so when a company is acquired employees with vested options will have some options. First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value.

When and how you should exercise your stock options will depend on a number of factors. First, you'll likely want to wait until the company goes public, assuming it will. If you don't wait, and your company doesn't go public, your shares may become worth less than you paid ? or even worthless.