Arkansas Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

How to fill out Stock Appreciation Rights Plan Of The Todd-AO Corporation?

Are you presently within a place the place you need paperwork for both business or individual reasons just about every day time? There are tons of legitimate document templates accessible on the Internet, but discovering versions you can rely on isn`t simple. US Legal Forms provides a large number of form templates, such as the Arkansas Stock Appreciation Rights Plan of The Todd-AO Corporation, that are published to satisfy state and federal demands.

If you are already acquainted with US Legal Forms web site and also have a merchant account, simply log in. After that, you can down load the Arkansas Stock Appreciation Rights Plan of The Todd-AO Corporation template.

Unless you have an accounts and want to begin to use US Legal Forms, abide by these steps:

- Obtain the form you want and ensure it is for your appropriate metropolis/region.

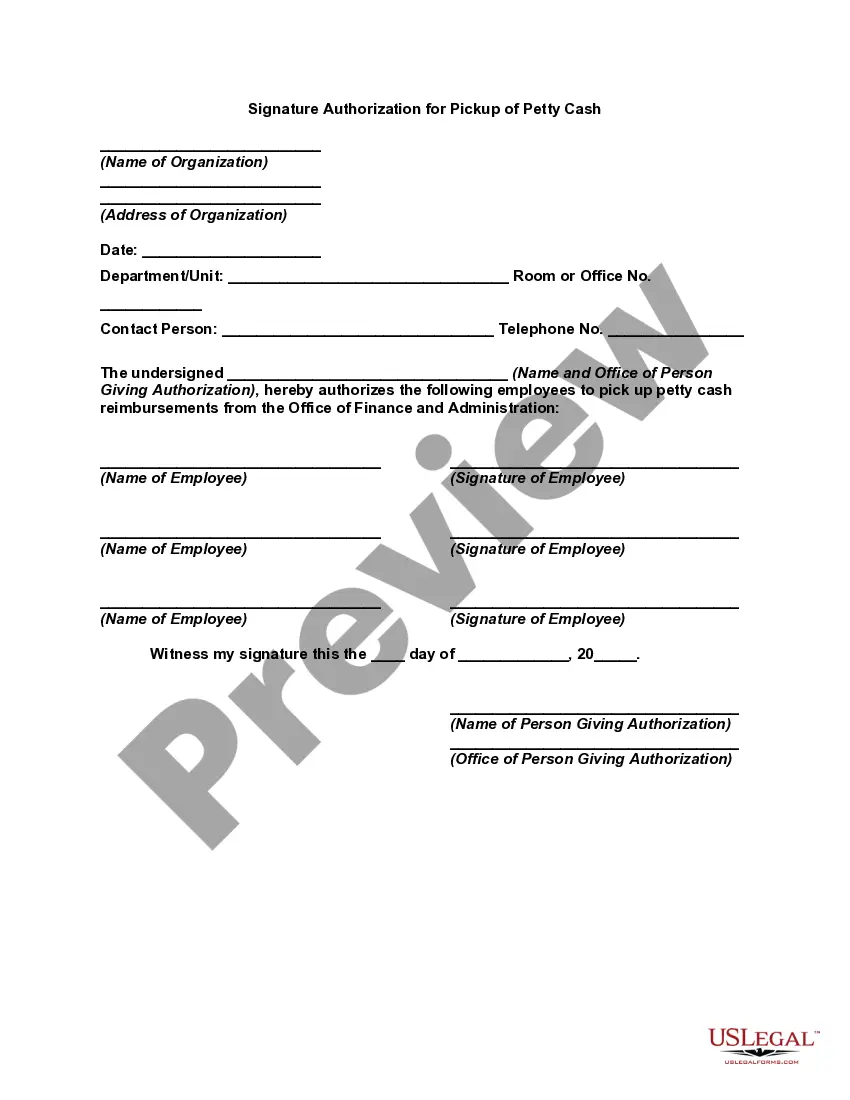

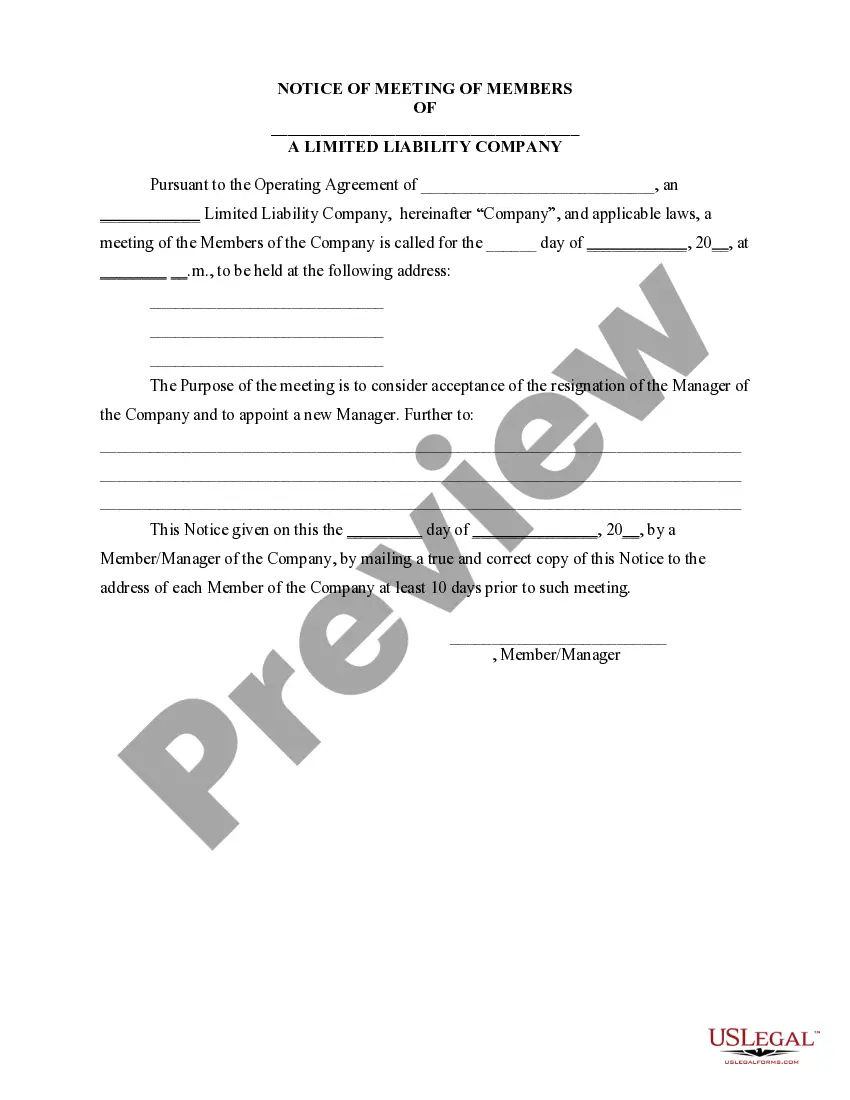

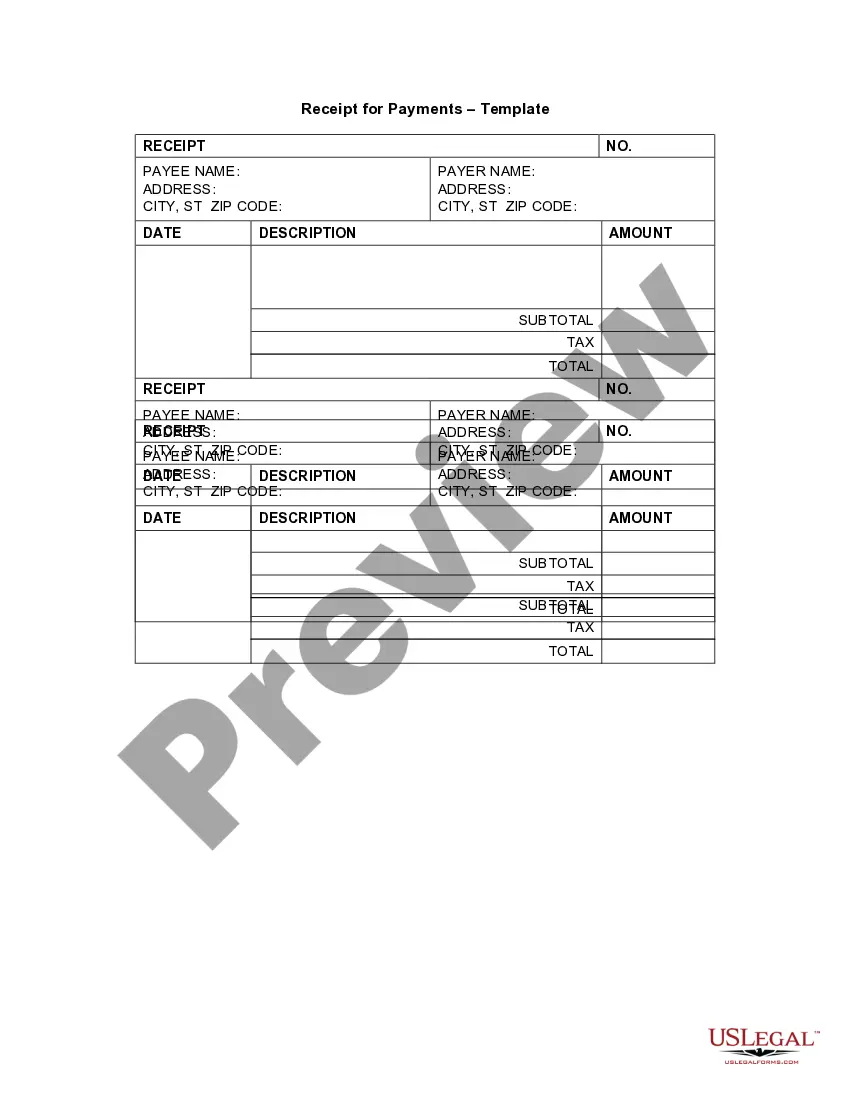

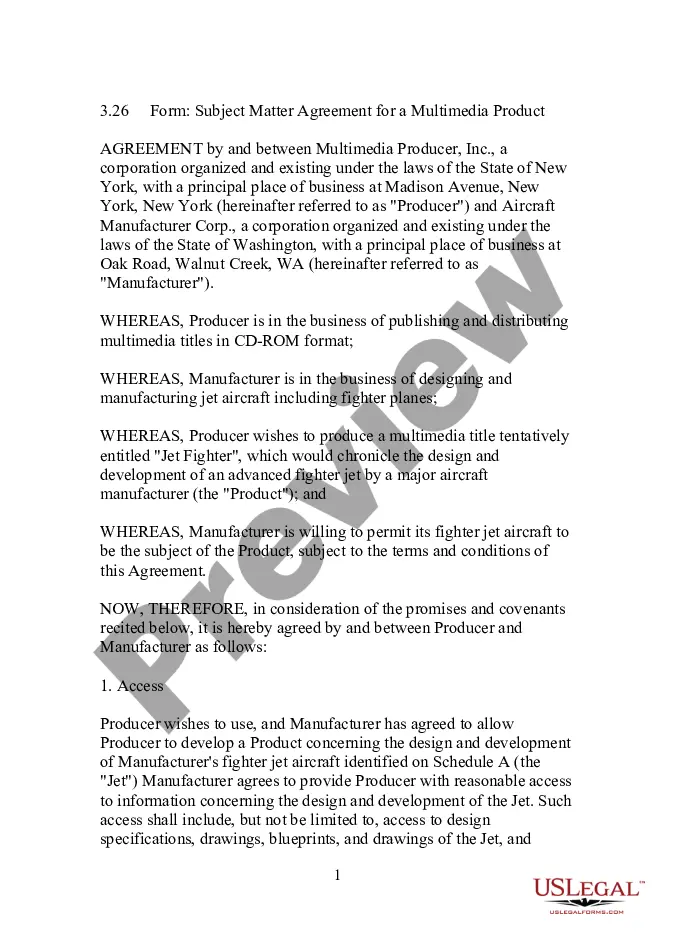

- Take advantage of the Review key to check the form.

- Read the explanation to ensure that you have selected the appropriate form.

- If the form isn`t what you`re trying to find, make use of the Research area to discover the form that meets your needs and demands.

- If you find the appropriate form, just click Purchase now.

- Select the prices program you need, fill in the required details to generate your account, and pay money for your order using your PayPal or charge card.

- Pick a handy document structure and down load your backup.

Locate all the document templates you might have bought in the My Forms food selection. You can obtain a additional backup of Arkansas Stock Appreciation Rights Plan of The Todd-AO Corporation anytime, if possible. Just go through the needed form to down load or printing the document template.

Use US Legal Forms, the most substantial collection of legitimate forms, to conserve time as well as prevent mistakes. The support provides professionally produced legitimate document templates that you can use for a range of reasons. Generate a merchant account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

Unexercised SARs will expire without value on the expiration date. The gross value realized upon the exercise of a SAR will equal the difference between the price at the time of exercise, and the Grant Price. The recipient will generally receive shares of Common Stock upon exercise.

A ?Stock Appreciation Right? is the right to receive a payment from the Company in an amount equal to the ?Spread,? which is defined as the excess of the Fair Market Value (as defined in Plan) of one share of common stock, $1.00 par value (the ?Stock?) of the Company at the Exercise Date (as defined below) over a ...

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

Once a SAR vests, an employee can exercise it at any time prior to its expiration. The proceeds will be paid either in cash, shares, or a combination of cash and shares depending on the rules of an employee's plan.

Typically, stock options expire if they're not exercised within 10 years from when they're granted. Many companies have an exit within 10 years or go public. However, some companies are staying private for longer, particularly in the current economic climate.

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.

Stock appreciation rights do expire. The expiration period varies from plan to plan. Once your rights expire, they are worthless. There are often special rules for terminated, retired, and deceased employees.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).