The Arkansas Nonqualified and Incentive Stock Option Plan is a comprehensive program established by Intercargo Corp. that offers employees the opportunity to acquire company stock through stock options. This plan is designed to incentivize and reward employees, promoting long-term commitment and aligning their interests with the success of the company. Under this plan, Intercargo Corp. grants two types of stock options: nonqualified stock options (Nests) and incentive stock options (SOS). Both options provide employees the right to purchase company shares at a predetermined price, known as the exercise price or strike price. However, there are important distinctions between the two: 1. Nonqualified Stock Options (Nests): These stock options are more flexible and widely used. Here are some key features of Nests: — EligibilityNestsOs can be granted to all employees, including executives, directors, and non-executive employees. — Tax TreatmentNestsOs are subject to ordinary income tax rates on the difference between the exercise price and the fair market value of the shares on the exercise date. — Exercise Price: The exercisprincessesOs is usually set at or above the current fair market value of the company's stock on the grant date. — Vesting Schedule: The plan typically includes a vesting schedule, determining when employees can exercise their options. This helps to retain employees and promote organizational stability. 2. Incentive Stock Options (SOS): SOS offer certain tax advantages, but they possess stricter requirements compared to Nests. Below are some key characteristics: — Eligibility: SOS are limited to regular employees only and cannot be granted to non-employee directors or independent contractors. — Tax TreatmentSOSOs provide potential tax advantages. If specific holding periods and other requirements are met, employees may qualify for favorable long-term capital gains tax rates when they sell the shares. — Exercise Price: The exercise price must be equal to or greater than the fair market value of the company's stock on the grant date. — Vesting Schedule: SimilatestsOsSOSOs typically include a vesting schedule to encourage employee retention. Intercargo Corp. implements both Nests and SOS as part of their comprehensive employee stock option plan, allowing employees to share in the growth and success of the company. The specific terms, conditions, and eligibility criteria of the plan may vary based on individual employment agreements and the policies set by the company. Note: It is crucial to consult with a qualified tax advisor or a financial specialist to fully understand the tax implications and legal requirements associated with the Arkansas Nonqualified and Incentive Stock Option Plan or any stock option plan.

Arkansas Nonqualified and Incentive Stock Option Plan of Intercargo Corp.

Description

How to fill out Arkansas Nonqualified And Incentive Stock Option Plan Of Intercargo Corp.?

Have you been in the placement where you require files for either business or individual uses just about every day time? There are tons of lawful papers templates available online, but discovering kinds you can rely on isn`t effortless. US Legal Forms delivers 1000s of kind templates, like the Arkansas Nonqualified and Incentive Stock Option Plan of Intercargo Corp., which can be written in order to meet federal and state demands.

In case you are currently familiar with US Legal Forms site and also have your account, merely log in. Following that, you may obtain the Arkansas Nonqualified and Incentive Stock Option Plan of Intercargo Corp. web template.

Should you not offer an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Get the kind you want and ensure it is for the proper area/state.

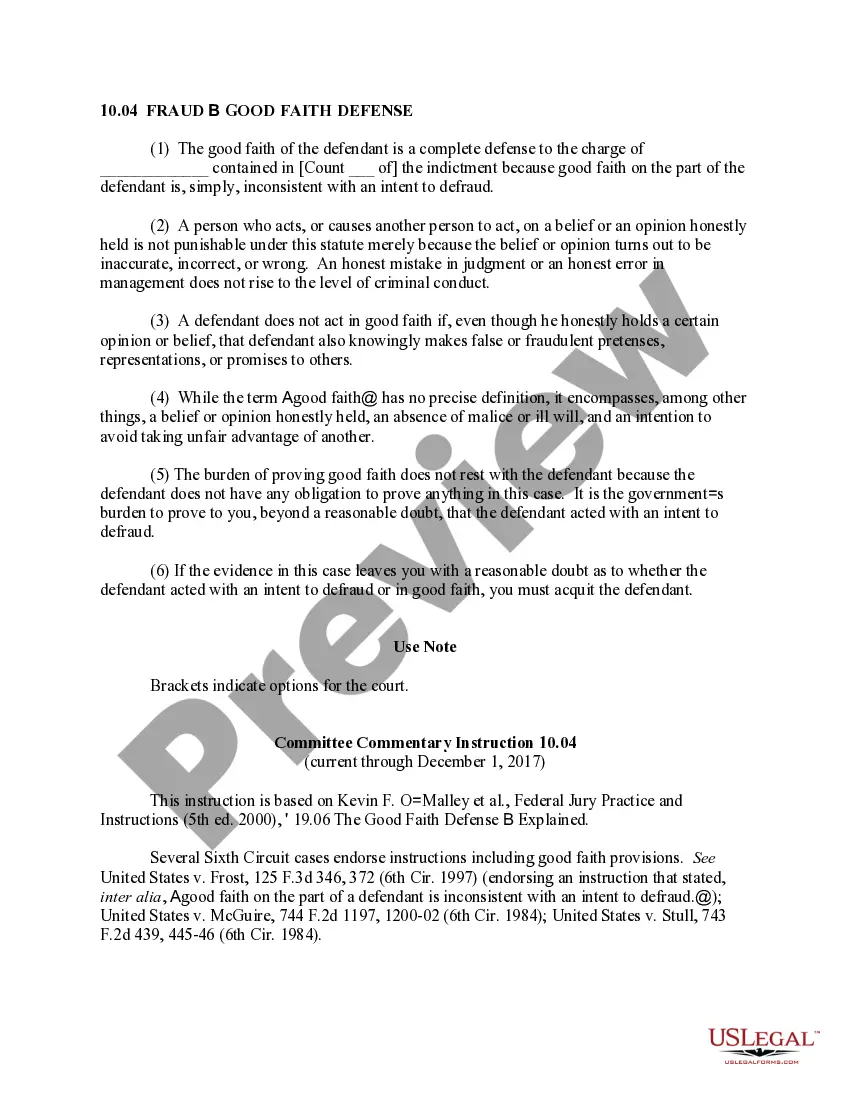

- Use the Preview option to examine the form.

- See the outline to actually have selected the correct kind.

- When the kind isn`t what you are looking for, utilize the Look for area to find the kind that suits you and demands.

- Once you get the proper kind, just click Acquire now.

- Opt for the rates prepare you desire, fill in the specified info to make your bank account, and purchase the order utilizing your PayPal or credit card.

- Choose a practical paper file format and obtain your copy.

Get every one of the papers templates you have purchased in the My Forms menu. You can obtain a additional copy of Arkansas Nonqualified and Incentive Stock Option Plan of Intercargo Corp. any time, if possible. Just select the necessary kind to obtain or printing the papers web template.

Use US Legal Forms, by far the most extensive variety of lawful kinds, in order to save some time and prevent faults. The assistance delivers professionally created lawful papers templates that you can use for a range of uses. Produce your account on US Legal Forms and begin making your way of life easier.