Arkansas Approval of deferred compensation investment account plan

Description

How to fill out Approval Of Deferred Compensation Investment Account Plan?

US Legal Forms - among the largest libraries of authorized forms in the States - offers a wide range of authorized papers themes you are able to download or print out. Using the web site, you can find 1000s of forms for organization and person purposes, categorized by classes, states, or key phrases.You can find the most up-to-date types of forms like the Arkansas Approval of deferred compensation investment account plan in seconds.

If you already possess a subscription, log in and download Arkansas Approval of deferred compensation investment account plan from the US Legal Forms library. The Obtain option will appear on each develop you perspective. You get access to all previously downloaded forms inside the My Forms tab of your own bank account.

In order to use US Legal Forms the first time, listed here are straightforward recommendations to help you get started out:

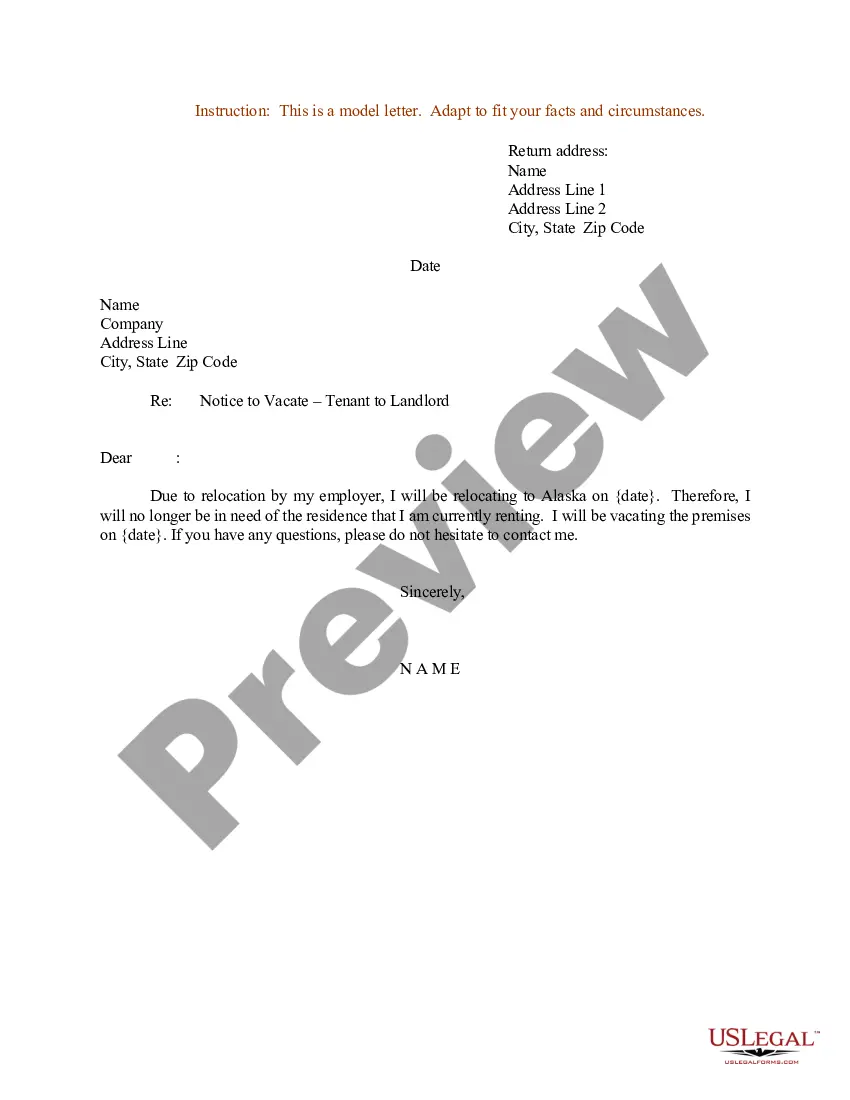

- Ensure you have selected the correct develop for the city/area. Go through the Preview option to review the form`s information. Browse the develop information to actually have selected the correct develop.

- In case the develop doesn`t match your specifications, utilize the Lookup discipline towards the top of the monitor to discover the one who does.

- Should you be content with the shape, validate your option by simply clicking the Purchase now option. Then, select the costs plan you want and offer your references to sign up on an bank account.

- Approach the financial transaction. Use your Visa or Mastercard or PayPal bank account to accomplish the financial transaction.

- Choose the formatting and download the shape in your gadget.

- Make changes. Load, revise and print out and signal the downloaded Arkansas Approval of deferred compensation investment account plan.

Each web template you included in your account does not have an expiration date and is the one you have permanently. So, if you wish to download or print out yet another backup, just visit the My Forms portion and click on on the develop you will need.

Get access to the Arkansas Approval of deferred compensation investment account plan with US Legal Forms, probably the most substantial library of authorized papers themes. Use 1000s of expert and status-particular themes that fulfill your organization or person requirements and specifications.

Form popularity

FAQ

Diamond Plan representatives can be contacted through the Little Rock office at 1-866-271-3327 or 501-301-9900.

Diamond Plan representatives can be contacted through the Little Rock office at 1-866-271-3327 or 501-301-9900.

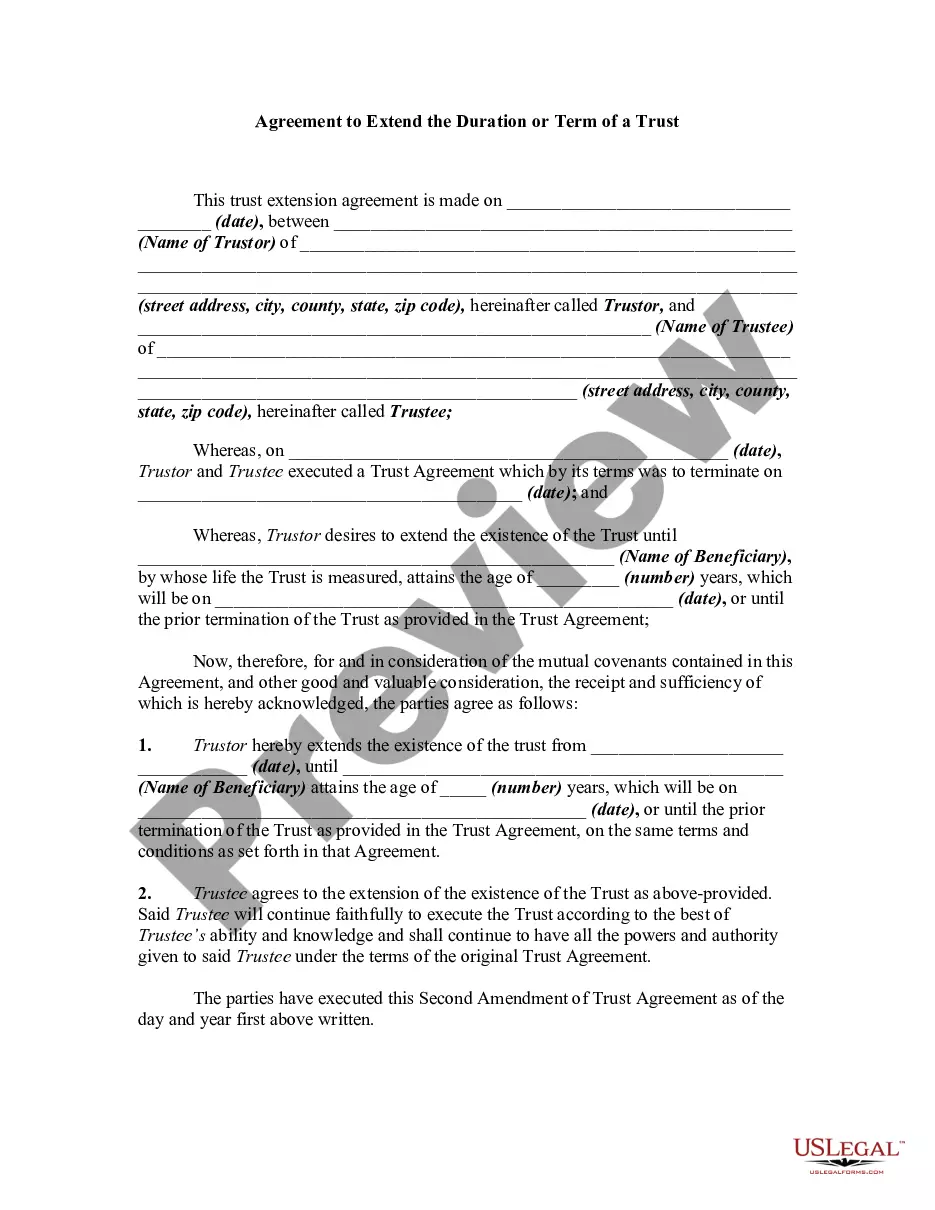

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

Deferring compensation reduces your current year tax burden, which is valuable for high income earners in top tax brackets. Recognizing deferred compensation income at lower tax brackets when you're retired can save you money on taxes. Choosing to defer income is very difficult to reverse if your circumstances change.

The Plan is designed to help you save for retirement. But there are specific situations where you may be able to withdraw money from your account before retirement to help with certain financial hardships or you may even qualify for the low balance provision.