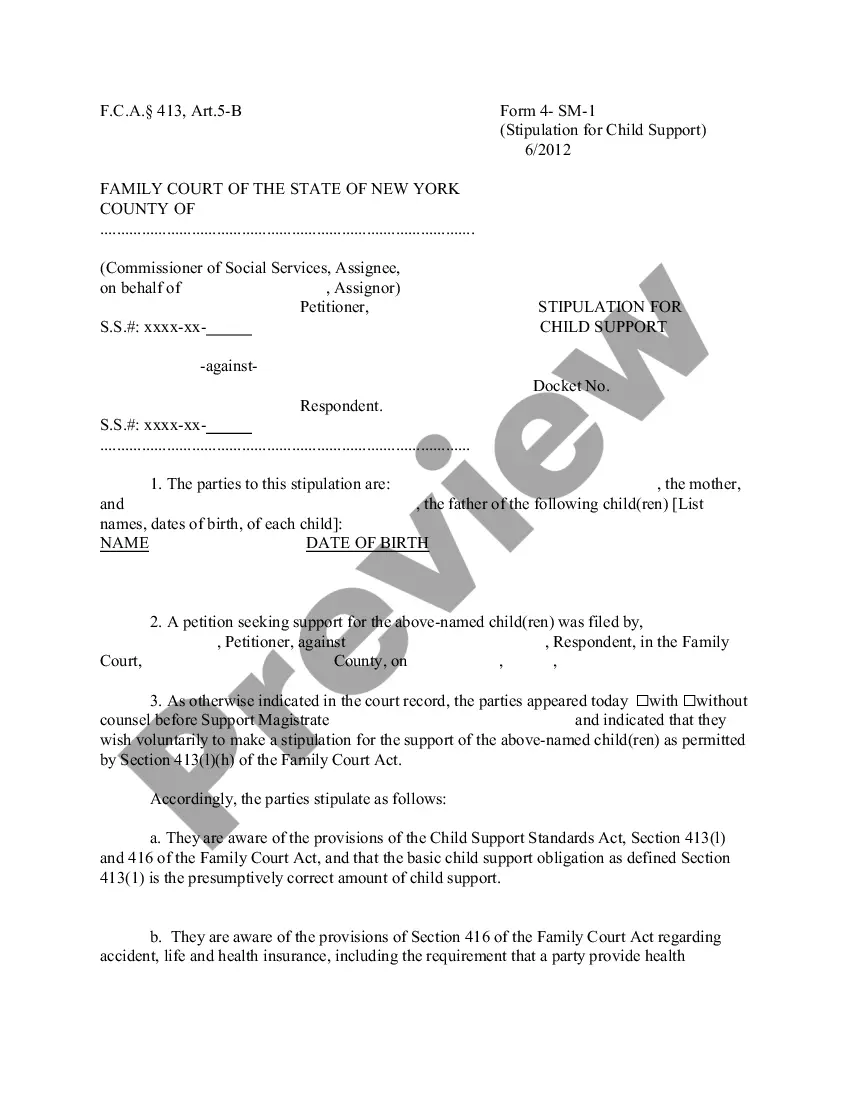

Arkansas Stock Option Grants and Exercises and Fiscal Year-End Values

Description

How to fill out Stock Option Grants And Exercises And Fiscal Year-End Values?

Choosing the best legal file template might be a battle. Of course, there are plenty of web templates available on the Internet, but how will you discover the legal kind you want? Use the US Legal Forms internet site. The assistance provides a large number of web templates, including the Arkansas Stock Option Grants and Exercises and Fiscal Year-End Values, which you can use for enterprise and personal requires. Every one of the forms are examined by specialists and meet federal and state needs.

When you are currently authorized, log in to the bank account and click the Download button to get the Arkansas Stock Option Grants and Exercises and Fiscal Year-End Values. Make use of your bank account to check throughout the legal forms you have acquired earlier. Go to the My Forms tab of your respective bank account and get one more backup of the file you want.

When you are a new consumer of US Legal Forms, listed here are easy directions for you to follow:

- Initially, make sure you have selected the right kind for your personal metropolis/state. You can check out the form utilizing the Review button and study the form information to guarantee this is basically the right one for you.

- In the event the kind fails to meet your requirements, take advantage of the Seach area to get the proper kind.

- Once you are positive that the form is proper, click on the Get now button to get the kind.

- Pick the costs program you want and enter in the needed information. Make your bank account and purchase an order using your PayPal bank account or bank card.

- Choose the document format and obtain the legal file template to the device.

- Complete, change and print and signal the acquired Arkansas Stock Option Grants and Exercises and Fiscal Year-End Values.

US Legal Forms is definitely the most significant local library of legal forms where you can find a variety of file web templates. Use the service to obtain professionally-made papers that follow condition needs.

Form popularity

FAQ

What is the Arkansas nexus standard? Arkansas imposes income tax on every corporation doing business in the state. This includes any corporation seeking the benefit of economic contact with Arkansas by licensing intangibles in an intragroup intangible licensing transaction.

Hiring out-of-state employees in Arkansas means you'll need to establish a business nexus and make sure your business is registered with the state as a licensed employer. Not only that, you'll need to make sure your policies, provisions, standards, and employment practices align with Arkansas' employment requirements.

US Nexus means where there is any US involvement or connection, including (without limitation): (i) any US dollar denominated transaction; (ii) any payment in any currency that is cleared through the US financial system, including foreign branches of US banks, and US branches, agency or representative offices or US ...

Non-residents and part-year residents who have received income from any Arkansas source must file an Arkansas income tax return regardless of their individual income level. A non-resident is defined as someone who does not maintain a home or other residence in Arkansas.

Code R. § 51-802(b) Any taxpayer with an interest in a partnership which has gross income from sources within Arkansas must directly allocate the partnership's Arkansas income to Arkansas, rather than include partnership income and apportionment factors in the taxpayer's apportionment formula.

As previously reported (Tax Alert 2023-0779), on April 10, 2023, Arkansas Governor Sarah Huckabee Sanders signed into law SB 549, which, retroactive to January 1, 2023, lowers the top marginal personal income tax rate from 4.9% to 4.7%.