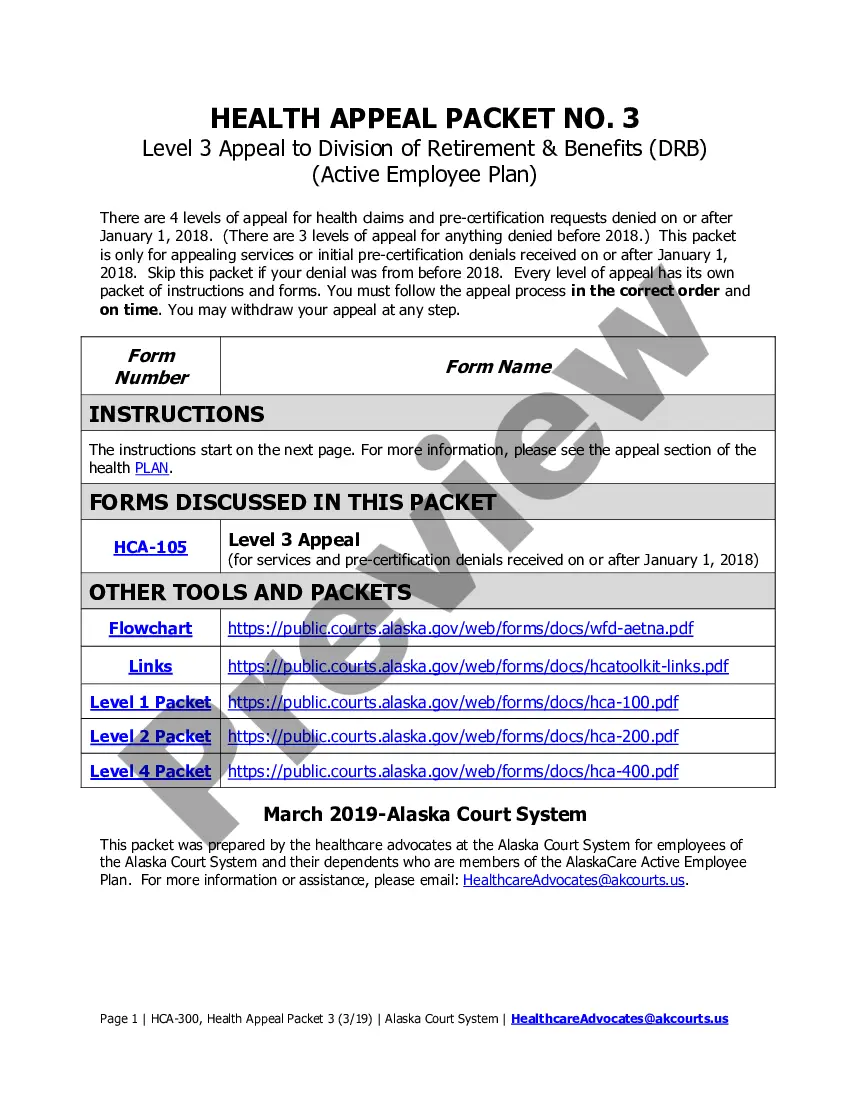

Arkansas Employee Stock Ownership Plan of Aura Systems, Inc.

Description

How to fill out Employee Stock Ownership Plan Of Aura Systems, Inc.?

Are you presently inside a position that you require paperwork for possibly company or person functions nearly every time? There are tons of legal record layouts available online, but discovering versions you can depend on isn`t simple. US Legal Forms provides a large number of form layouts, like the Arkansas Employee Stock Ownership Plan of Aura Systems, Inc., that happen to be created to fulfill state and federal needs.

When you are presently familiar with US Legal Forms internet site and possess an account, just log in. Next, it is possible to obtain the Arkansas Employee Stock Ownership Plan of Aura Systems, Inc. format.

Unless you have an profile and need to start using US Legal Forms, adopt these measures:

- Get the form you want and make sure it is to the correct metropolis/region.

- Make use of the Preview option to analyze the form.

- Read the information to actually have selected the correct form.

- In the event the form isn`t what you`re seeking, use the Look for industry to obtain the form that meets your requirements and needs.

- Whenever you find the correct form, simply click Acquire now.

- Pick the costs program you desire, complete the specified information to make your account, and pay money for an order with your PayPal or credit card.

- Decide on a convenient paper format and obtain your duplicate.

Find each of the record layouts you may have bought in the My Forms food selection. You may get a further duplicate of Arkansas Employee Stock Ownership Plan of Aura Systems, Inc. at any time, if required. Just go through the necessary form to obtain or produce the record format.

Use US Legal Forms, the most considerable assortment of legal varieties, to save lots of some time and steer clear of blunders. The services provides skillfully made legal record layouts that can be used for a selection of functions. Generate an account on US Legal Forms and start producing your life a little easier.

Form popularity

FAQ

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. ESOPs encourage employees to give their all as the company's success translates into financial rewards.

When an employee leaves a company, their options under an Employee Stock Ownership Plan (ESOP) will depend on the specific terms of the plan, as well as the reason for their departure. If an employee quits their job voluntarily, they will typically lose any unvested options.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

In addition, when you retire, you may be subject to additional taxes on any distributions you receive from your ESOP plan. Another possible drawback of an ESOP is its limited liquidity. Generally, you cannot access the funds in your ESOP account until you retire or leave the company.

An employee stock ownership plan (ESOP) is a structure set up by a company to give employees an ownership stake in the business. Companies set up ESOPs to compensate and incentivise employees, and to align everyone in the business behind the same mission and vision.

In 2018, Employee Stock Ownership Plans Distributed a total of $126.7 billion. An estimated $1.37 trillion in value is held by ESOPs in the US, that's an average of $129,521 per employee owner.

An ESOP grants company stock to employees, often based on the duration of their employment. Typically, it is part of a compensation package, where shares will vest over a period of time. ESOPs are designed so that employees' motivations and interests are aligned with those of the company's shareholders.