Arkansas Proxy Statement with appendices of West Point-Pepperell, Inc.

Description

How to fill out Proxy Statement With Appendices Of West Point-Pepperell, Inc.?

Choosing the right lawful record web template could be a struggle. Naturally, there are a variety of web templates available on the Internet, but how would you find the lawful form you require? Take advantage of the US Legal Forms site. The support gives thousands of web templates, including the Arkansas Proxy Statement with appendices of West Point-Pepperell, Inc., which you can use for company and personal requirements. All the varieties are checked by pros and meet federal and state specifications.

Should you be presently registered, log in to the bank account and then click the Acquire switch to find the Arkansas Proxy Statement with appendices of West Point-Pepperell, Inc.. Use your bank account to appear through the lawful varieties you have acquired formerly. Proceed to the My Forms tab of your respective bank account and get another version of your record you require.

Should you be a whole new user of US Legal Forms, allow me to share simple recommendations so that you can stick to:

- Very first, ensure you have selected the right form for your personal city/county. You may examine the form while using Preview switch and browse the form explanation to make sure this is basically the right one for you.

- When the form fails to meet your needs, utilize the Seach discipline to discover the appropriate form.

- When you are positive that the form is suitable, go through the Get now switch to find the form.

- Select the rates prepare you would like and enter in the needed details. Make your bank account and pay for the order using your PayPal bank account or credit card.

- Select the file formatting and down load the lawful record web template to the device.

- Full, change and print and sign the acquired Arkansas Proxy Statement with appendices of West Point-Pepperell, Inc..

US Legal Forms is the most significant local library of lawful varieties that you can discover different record web templates. Take advantage of the service to down load appropriately-produced files that stick to status specifications.

Form popularity

FAQ

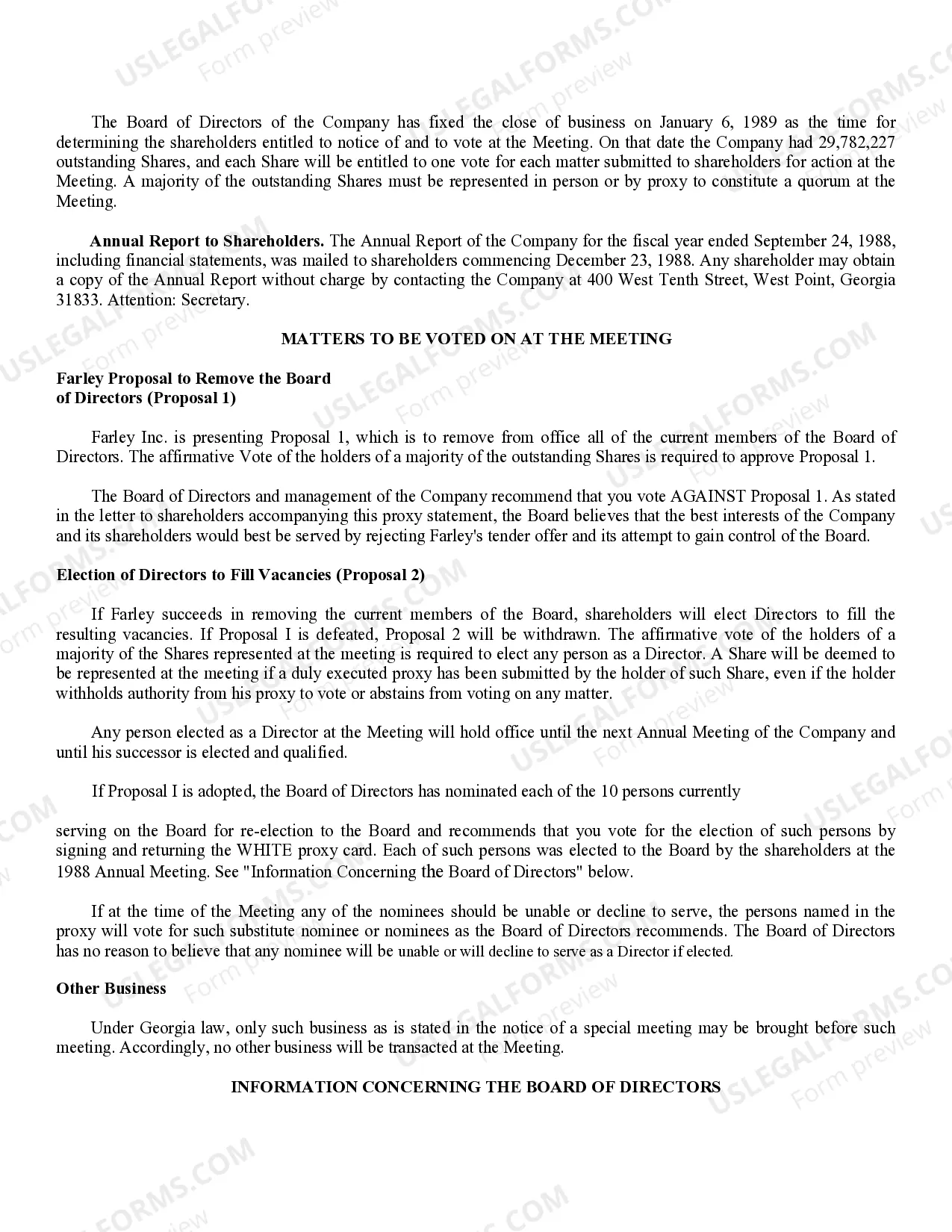

A document sent to shareholders letting them know when and where a shareholders' meeting is taking place and detailing the matters to be voted upon at the meeting. You can attend the meeting and vote in person or cast a proxy vote.

Proxy statements are documents that the Securities and Exchange Commission requires companies to give to shareholders so they can weigh in on important company issues. Proxy statements offer shareholders information about changes on the board and other important decisions the board needs to make.

Introduction. A proxy is an individual, legally allowed to act on behalf of another party or a format that would allow a participant to vote without being physically present at the meeting.

Filling out a voting proxy form is necessary in order to be able to have someone vote on your behalf in an election or referendum. Proxy voting, the act of having some else vote on your behalf, is often allowed in specific circumstances.

A general proxy is empowered to vote freely on any matter which arises at the meeting, whereas a limited proxy is only allowed to vote on certain matters which arise, or must vote in a particular way as determined by the principal voter.