Arkansas Proposal to Increase Common Stock for Pursuing Acquisitions — Unlocking Profit and Growth Opportunities Introduction: In an ever-evolving business landscape, companies must explore new avenues for expansion and profitability. The Arkansas Proposal to Increase Common Stock aiming to pursue acquisitions offers a strategic approach for companies to drive growth, harness synergies, and maximize their profit potential. By utilizing this proposal, businesses can position themselves for long-term success through strategic transactions and capitalize on emerging opportunities. This detailed description examines the key benefits and various types of Arkansas Proposal to Increase Common Stock with a focus on transactions providing profit and growth. Key Benefits of Arkansas Proposal to Increase Common Stock for Pursuing Acquisitions: 1. Enhanced Market Position: By pursuing acquisitions, companies can strengthen their market position, increase market share, and gain a competitive edge in the industry. Integrating complementary businesses or acquiring niche players allows for a broader product/service offering and wider market reach. 2. Diversification: Acquisitions enable diversification of business portfolios, mitigating risks associated with reliance on a single market or product. By entering new markets or venturing into different sectors, companies can tap into new revenue streams and reduce vulnerability to market fluctuations. 3. Synergy and Cost Efficiency: Through acquisitions, companies can unlock synergies, combining resources, technology, talent, and distribution networks to streamline operations and reduce costs. Synergistic collaborations can boost overall profitability and efficiency. 4. Access to New Consumer Segments: Acquiring businesses catering to different consumer segments can expand a company's customer base and provide unique insights into target markets. This leads to increased brand recognition, customer loyalty, and revenue growth. 5. Innovation and Research Opportunities: Acquisitions of innovative startups or businesses with technological advancements can enhance a company's research capabilities, foster innovation, and accelerate product development. This enables staying ahead of competitors and meeting evolving market demands effectively. Different Types of Arkansas Proposal to Increase Common Stock for Pursuing Acquisitions: 1. Horizontal Acquisitions: Involves acquiring competitors operating in the same industry or market, leveraging synergies, eliminating competition, and expanding market share significantly. 2. Vertical Acquisitions: Involves acquiring businesses in the supply chain, either upstream or downstream, to control various stages of production and distribution. This allows for cost control, improved efficiency, and better integration. 3. Conglomerate Acquisitions: Involves acquiring businesses operating in different industries, diversifying the company's portfolio, reducing risk, and exploiting growth opportunities across multiple sectors simultaneously. 4. Market Extension Acquisitions: Involves acquiring businesses in new geographic markets to access untapped customer bases, local expertise, and distribution networks. This strategy helps expand market reach and drive growth in previously unexplored regions. 5. Asset Acquisition: Involves acquiring specific assets, such as intellectual property rights, patents, trademarks, or machinery, rather than purchasing an entire business. This approach can provide companies with a competitive advantage and bolster their product offerings. Conclusion: The Arkansas Proposal to Increase Common Stock offers businesses the opportunity to pursue acquisitions strategically, enabling profit maximization and long-term growth. By considering the various types of acquisitions mentioned above, companies can identify the most suitable approach to expand their operations, enhance market presence, and unlock synergistic opportunities. Embracing this proposal will empower businesses to remain competitive, innovate, and drive sustainable growth in today's dynamic business environment.

Arkansas Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth

Description

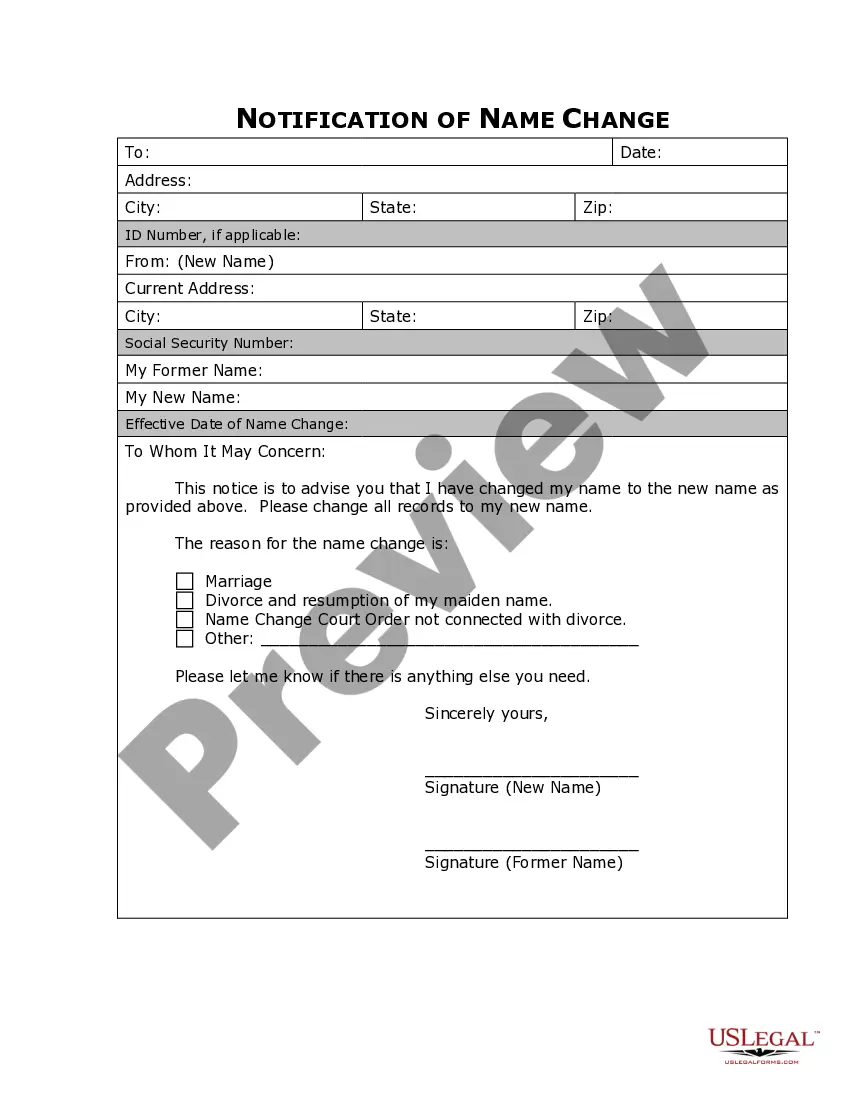

How to fill out Arkansas Proposal To Increase Common Stock Regarding To Pursue Acquisitions - Transactions Providing Profit And Growth?

Choosing the best legal document design can be a have a problem. Naturally, there are plenty of templates available on the Internet, but how do you obtain the legal develop you need? Utilize the US Legal Forms site. The support gives thousands of templates, like the Arkansas Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth, that you can use for organization and private needs. Every one of the types are inspected by specialists and meet up with federal and state demands.

In case you are already authorized, log in to the profile and click the Download switch to have the Arkansas Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth. Make use of profile to look from the legal types you have purchased formerly. Go to the My Forms tab of the profile and acquire an additional version of the document you need.

In case you are a brand new consumer of US Legal Forms, allow me to share simple recommendations so that you can adhere to:

- Initially, make sure you have chosen the right develop for your area/area. You may look over the form utilizing the Review switch and look at the form description to ensure this is the best for you.

- If the develop does not meet up with your expectations, make use of the Seach area to obtain the appropriate develop.

- When you are positive that the form is suitable, click the Purchase now switch to have the develop.

- Select the pricing program you would like and type in the essential information. Make your profile and buy your order utilizing your PayPal profile or bank card.

- Select the document formatting and obtain the legal document design to the product.

- Comprehensive, change and print out and indication the received Arkansas Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth.

US Legal Forms may be the greatest local library of legal types that you can discover different document templates. Utilize the service to obtain appropriately-manufactured paperwork that adhere to condition demands.

Form popularity

FAQ

Acquiring a company comes with a cost, which is called a premium. The acquiring company pays the premium for the work that built the company from scratch. The stock prices of the acquired/target company tend to rise as they receive a premium from the acquiring company.

M&A activity has slumped in early 2023 due to a range of factors. The financial environment has had a blend of recession fears and inflation. The Federal Reserve's move to raise interest rates and counteract inflation has left many players wary of borrowing money at inflated rates.

?We're relatively optimistic about the outlook for 2024, as deal activity shows promising signs of recovery,? said Jens Kengelbach, BCG's global head of M&A and a coauthor of the report.

We have seen a drop in deal values and volumes in 2023, as caution in the market continues. Despite macroeconomic instability, we observe M&A drivers in some industries, such as Financial Services. Crucially, less volatility in the debt markets will be vital if we are to see a revival in M&A transactions in 2024.

Here are the largest recent M&A deals predicted to or already closed in 2023. UnitedHealth acquisition of LHC Group Inc. ... CVS Health Co. ... Leap Therapeutics acquisition of Flame Biosciences. ... L3Harris acquisition of Aerojet Rocketdyne. ... Amgen acquisition of Horizon Therapeutics. ... Thoma Bravo acquisition of Coupa Software.

As a rule, the acquiring company's stock tends to fall for a short period when the deal is announced since it pays a premium ? either with its cash reserves or with the help of debt.

When A Company Is Bought, What Happens to the Stock? The stock of the company that has been bought tends to rise since the acquiring company has likely paid a premium on its shares as a way to entice stockholders. However, there are some instances when the newly acquired company sees its shares fall on the merger news.

Overall global M&A value is down 44% in the first five months of 2023. Macroeconomic and interest rate uncertainty continues to complicate dealmaking and foster caution among sellers and buyers alike.