Arkansas Proposal to decrease authorized common and preferred stock

Description

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

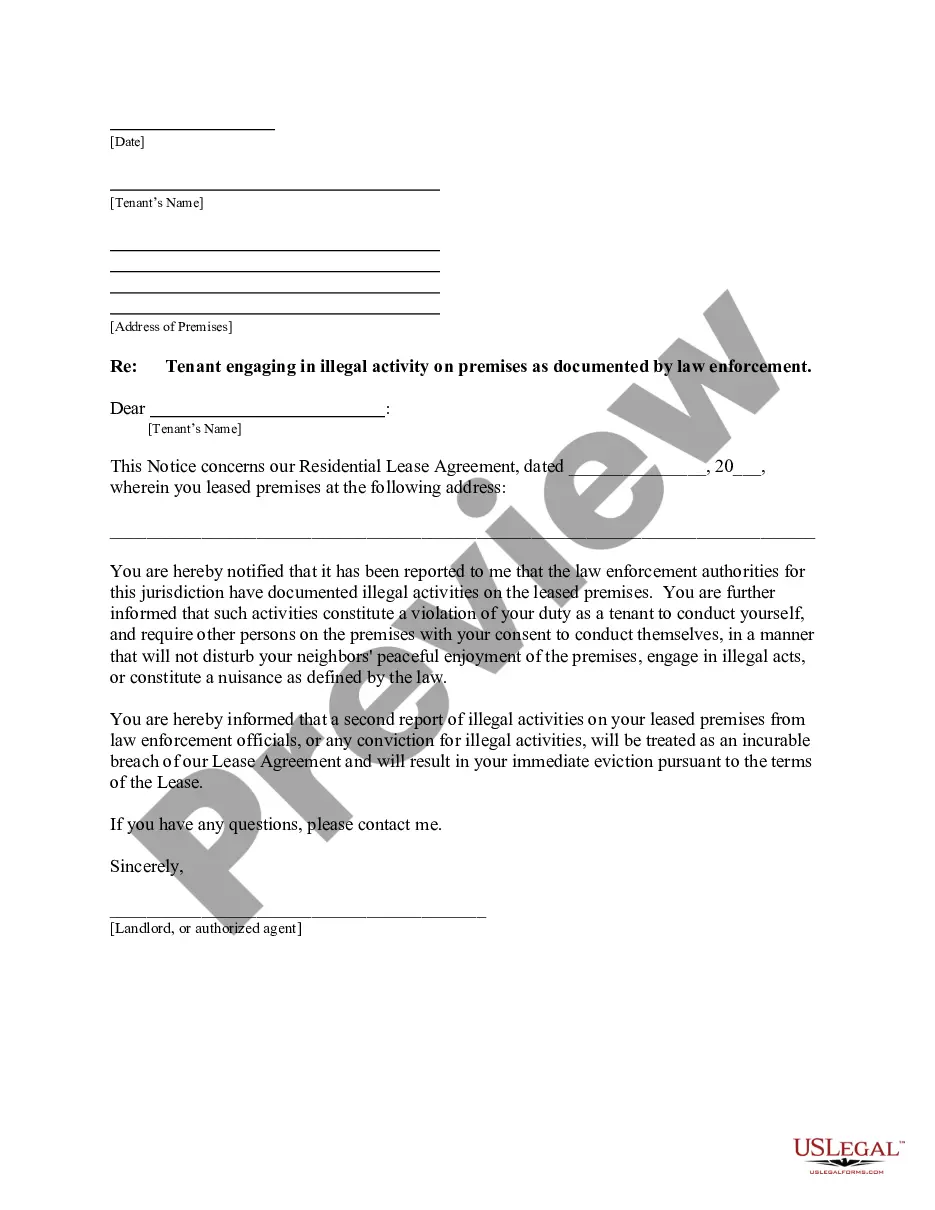

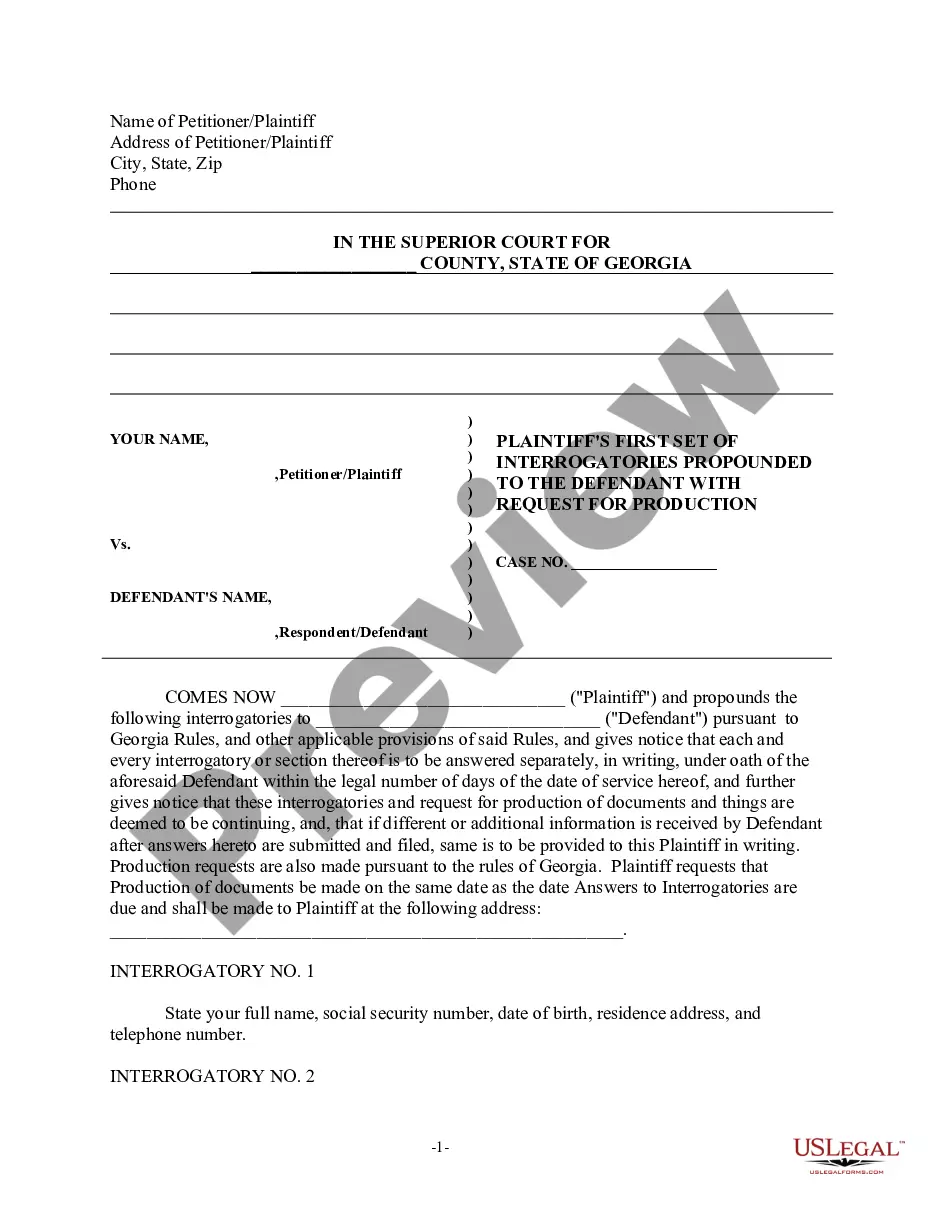

Are you currently inside a placement the place you require papers for sometimes organization or person reasons almost every day? There are tons of authorized record templates available on the Internet, but getting types you can depend on is not effortless. US Legal Forms provides a large number of develop templates, just like the Arkansas Proposal to decrease authorized common and preferred stock, that are created to fulfill state and federal demands.

In case you are already acquainted with US Legal Forms internet site and get an account, basically log in. Afterward, it is possible to obtain the Arkansas Proposal to decrease authorized common and preferred stock format.

If you do not offer an bank account and wish to begin using US Legal Forms, follow these steps:

- Discover the develop you want and make sure it is for the right metropolis/region.

- Make use of the Review button to review the shape.

- See the description to actually have selected the right develop.

- If the develop is not what you`re trying to find, utilize the Search discipline to discover the develop that meets your needs and demands.

- Once you find the right develop, click Buy now.

- Opt for the pricing strategy you need, submit the specified information and facts to generate your money, and pay money for an order using your PayPal or charge card.

- Pick a convenient document format and obtain your copy.

Get all of the record templates you possess purchased in the My Forms food list. You can obtain a extra copy of Arkansas Proposal to decrease authorized common and preferred stock at any time, if needed. Just click the required develop to obtain or print out the record format.

Use US Legal Forms, probably the most considerable variety of authorized varieties, in order to save efforts and avoid errors. The assistance provides skillfully manufactured authorized record templates which can be used for a range of reasons. Make an account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

Arkansas income taxes Retirees age 59.5 or older can exempt the first $6,000 of an IRA distribution. Up to $6,000 of income from private or government employer sponsored retirement plans is also tax-exempt in Arkansas. Arkansas income tax rates currently max out at 4.7%. The top tax rate will reduce to 4.4% in 2024.

Act 748 of 1991, codified at Ark. Code Ann. § 26-51-506, provides an incentive to taxpayers to engage in the business of reducing, reusing or recycling solid waste for commercial purposes by providing a credit against the tax imposed by the Income Tax Act or 1929, § 26-501 et seq.

For the tax year beginning January 1, 2022, an individual taxpayer who files an Arkansas full-year resident income-tax return having a net income up to $101,000 or joint filers with a net income up to $202,000 are allowed an income-tax credit against the individual income tax liability.

(a) The total indebtedness to any state bank of any person shall at no time exceed twenty percent (20%) of the capital base of the bank.

Code R. § 51-802(b) Any taxpayer with an interest in a partnership which has gross income from sources within Arkansas must directly allocate the partnership's Arkansas income to Arkansas, rather than include partnership income and apportionment factors in the taxpayer's apportionment formula.

Arkansas Requirements § 26-51-303. an income return for an exempt organization unless it has unrelated business income. Report Unrelated Business Income to the DFA on Form AR1100CT ? Due by the 15th day of the 3rd month after the end of your tax year. For filers on the calendar year, the due date is March 15.

What is the Arkansas nexus standard? Arkansas imposes income tax on every corporation doing business in the state. This includes any corporation seeking the benefit of economic contact with Arkansas by licensing intangibles in an intragroup intangible licensing transaction.