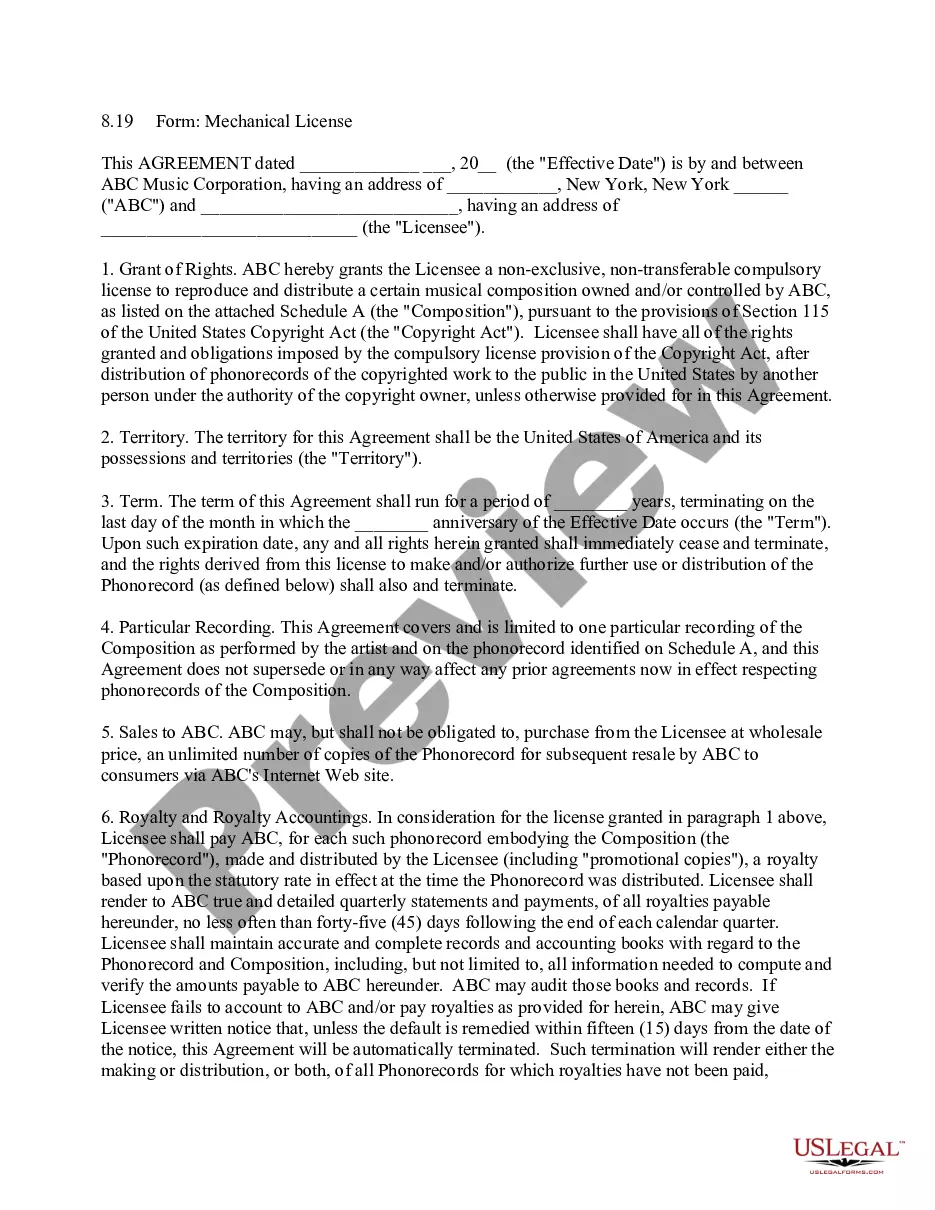

Title: Arkansas Letter to Stockholders Explaining Authorization and Sale of Preferred Stock and Stock Transfer Restriction to Preserve Tax Benefits Keywords: Arkansas, letter to stockholders, authorization, sale, preferred stock, stock transfer restriction, tax benefits. Introduction: Dear Stockholders of Arkansas Inc., We are writing to inform you about important decisions regarding the authorization and sale of preferred stock and the implementation of stock transfer restrictions aimed at safeguarding crucial tax benefits. This letter provides a detailed description of these actions, their significance, and the potential impact on our company and its stakeholders. 1. Authorization and Sale of Preferred Stock: In order to strengthen Arkansas Inc.'s financial position and drive future growth, the board of directors has authorized the sale of preferred stock. Preferred stock is a class of ownership that grants the holders certain privileges, such as priority dividend payments and a higher claim in case of liquidation. This issuance will allow us to attract additional capital while protecting the interests and rights of existing common stockholders. 2. Significance of Preferred Stock: By issuing preferred stock, Arkansas Inc. aims to enhance its financial flexibility, enabling investments in research and development, expansion into new markets, or strategic acquisitions. The sale of preferred stock enables us to capitalize on favorable market conditions, ensuring our ability to maintain a competitive edge, and generate long-term value for our stockholders. 3. Tax Benefits Protection: To preserve crucial tax benefits associated with the preferred stock issuance, Arkansas Inc. is imposing stock transfer restrictions. These restrictions are designed to prevent the transfer of preferred stock to ineligible parties who could potentially jeopardize or diminish the favorable tax advantages granted by regulatory authorities. The intent is to preserve our eligibility for tax deductions, credits, or incentives, which are instrumental in optimizing our financial performance. 4. Impact on Stockholders: Stockholders who hold common stock will not be affected by the sale of preferred stock unless they demonstrate an interest in participating. This allows common stockholders to maintain their existing ownership and voting rights while potentially benefiting from increased financial resources and future growth initiatives funded by the preferred stock offering. 5. Additional Measures and Compliance: Arkansas Inc. is committed to fully complying with all relevant securities laws, regulations, and reporting requirements throughout this process. Our board of directors and executive team are dedicated to ensuring transparency and accountability to protect the interests of all stockholders. Different Types of Arkansas Letters to Stockholders: 1. Arkansas Letter to Stockholders — Preferred Stock Offering: In this variant, the letter solely focuses on explaining the authorization and sale of preferred stock, potentially without including the stock transfer restriction aspect. 2. Arkansas Letter to Stockholders — Stock Transfer Restriction: This variant elaborates specifically on the stock transfer restriction implemented to protect tax benefits but might not discuss the preferred stock issuance in detail. Conclusion: Arkansas Inc. remains committed to creating long-term stockholder value while effectively managing its tax liability. The authorization and sale of preferred stock, coupled with stock transfer restrictions to protect tax benefits, demonstrate our proactive approach to securing financial stability and maximizing growth prospects for the benefit of all stockholders. Thank you for your continued trust and support. Sincerely, [Your Name] [Your Title] Arkansas Inc.

Arkansas Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits

Description

How to fill out Arkansas Letter To Stockholders Regarding Authorization And Sale Of Preferred Stock And Stock Transfer Restriction To Protect Tax Benefits?

Choosing the right authorized file web template can be quite a have a problem. Needless to say, there are tons of layouts available on the net, but how will you find the authorized kind you want? Make use of the US Legal Forms web site. The support provides thousands of layouts, such as the Arkansas Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits, which can be used for company and private needs. All of the types are examined by experts and satisfy federal and state demands.

In case you are already listed, log in in your bank account and then click the Obtain key to obtain the Arkansas Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits. Utilize your bank account to search with the authorized types you may have bought previously. Proceed to the My Forms tab of your own bank account and have one more backup of your file you want.

In case you are a new user of US Legal Forms, allow me to share easy directions for you to stick to:

- Very first, be sure you have selected the proper kind for your personal area/area. It is possible to look through the form making use of the Preview key and browse the form information to make certain this is basically the best for you.

- In case the kind is not going to satisfy your preferences, use the Seach area to get the right kind.

- When you are sure that the form is proper, select the Purchase now key to obtain the kind.

- Choose the pricing plan you want and enter the required information. Design your bank account and pay money for an order using your PayPal bank account or charge card.

- Pick the data file formatting and obtain the authorized file web template in your device.

- Complete, revise and printing and signal the acquired Arkansas Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits.

US Legal Forms may be the biggest catalogue of authorized types where you can see a variety of file layouts. Make use of the company to obtain appropriately-made papers that stick to condition demands.