Arkansas Incentive and Nonqualified Share Option Plan

Description

How to fill out Incentive And Nonqualified Share Option Plan?

US Legal Forms - among the biggest libraries of legal varieties in the States - offers a wide array of legal file templates you can down load or produce. Making use of the site, you can find thousands of varieties for company and specific purposes, sorted by types, claims, or keywords.You can find the latest versions of varieties much like the Arkansas Incentive and Nonqualified Share Option Plan in seconds.

If you currently have a subscription, log in and down load Arkansas Incentive and Nonqualified Share Option Plan from your US Legal Forms collection. The Obtain option will show up on every single develop you see. You have accessibility to all previously delivered electronically varieties inside the My Forms tab of your account.

If you want to use US Legal Forms for the first time, here are simple directions to obtain started off:

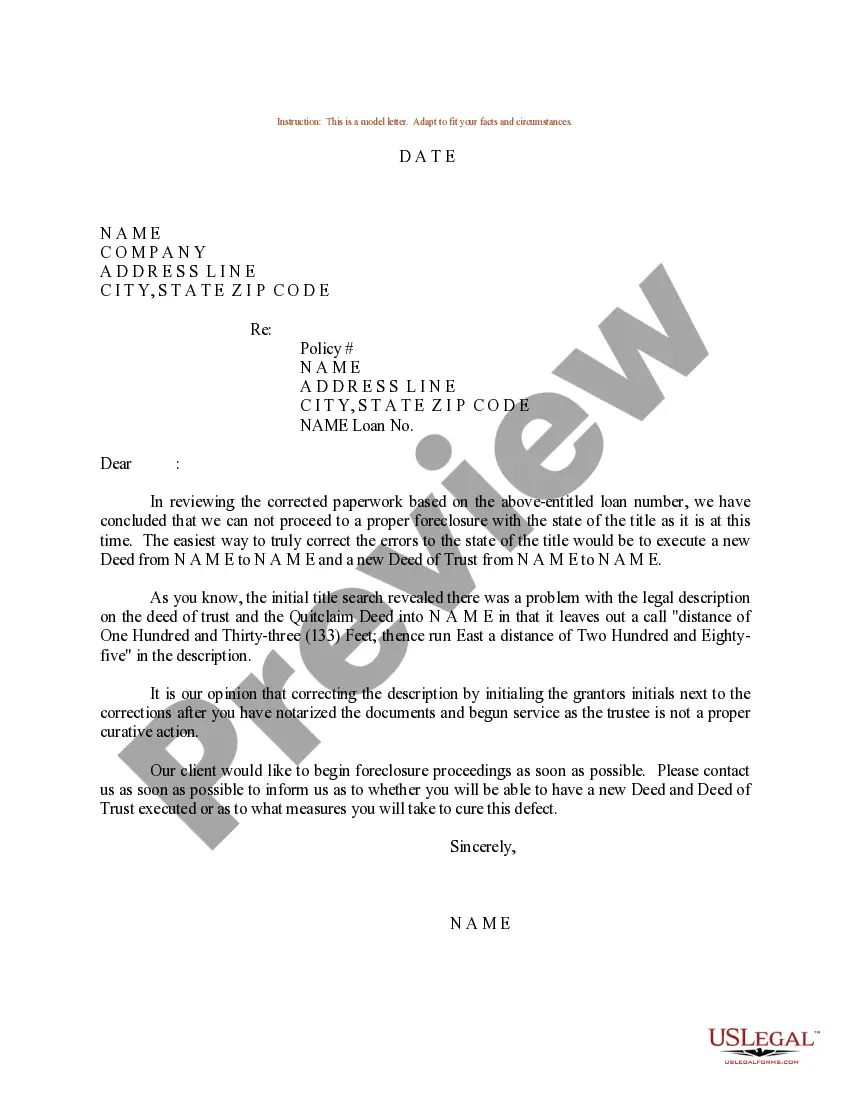

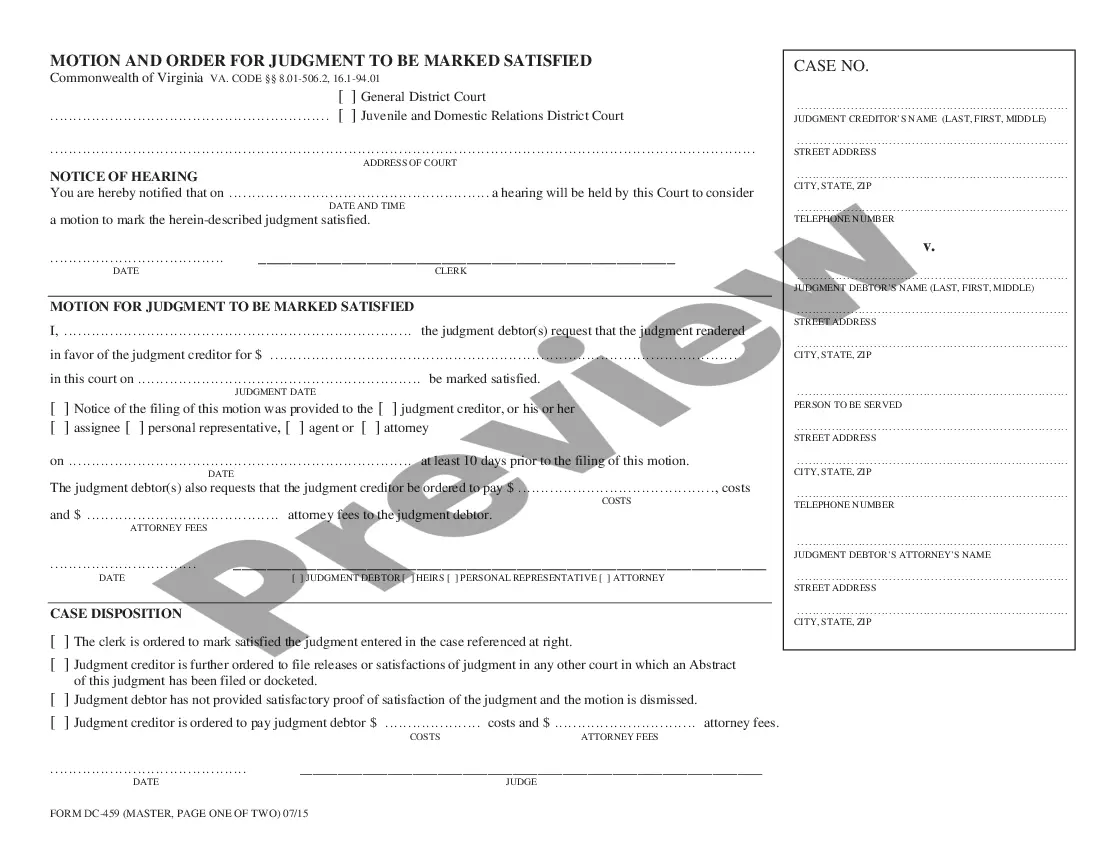

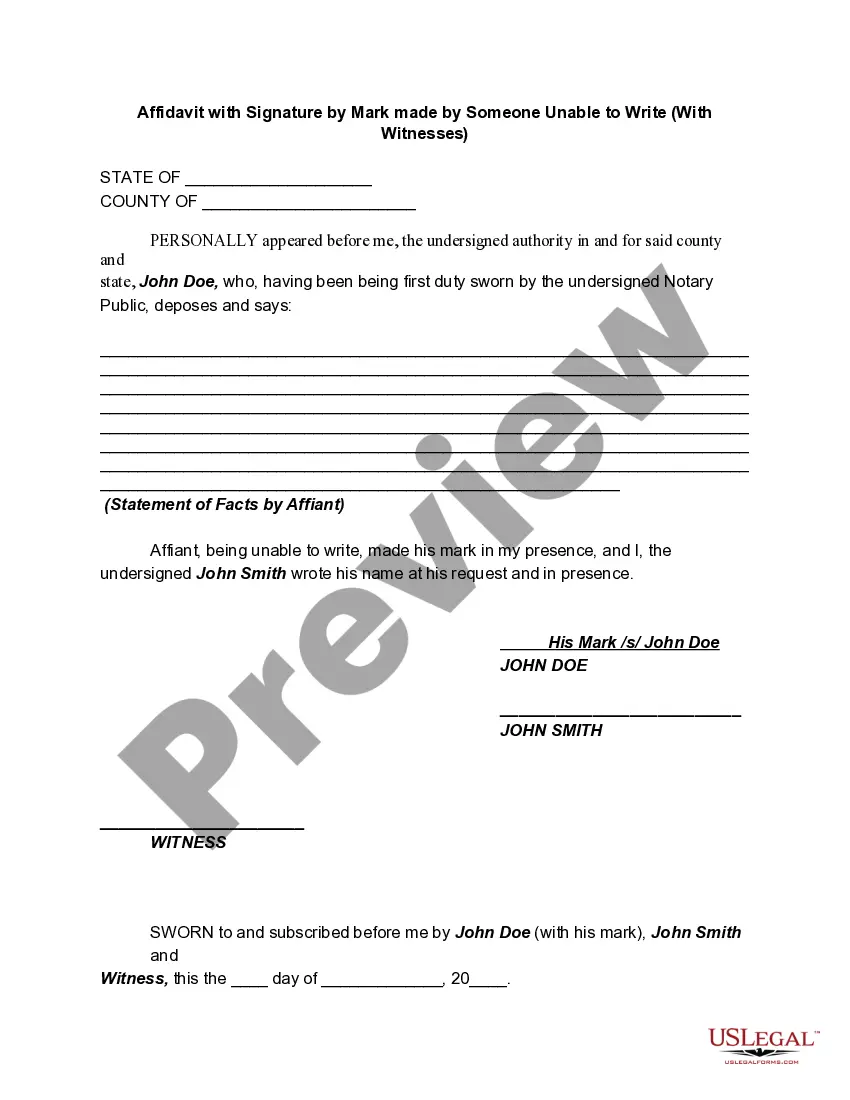

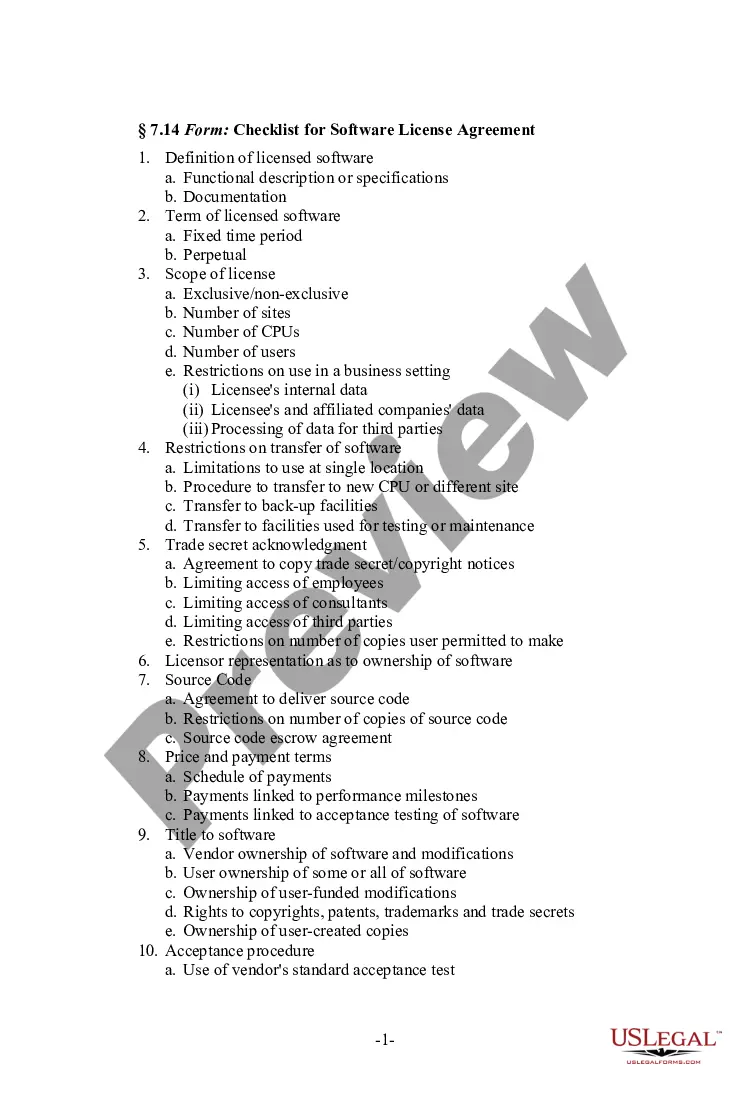

- Be sure to have chosen the proper develop for your area/area. Click the Review option to review the form`s content. See the develop information to ensure that you have chosen the right develop.

- In the event the develop does not match your requirements, take advantage of the Look for discipline on top of the display to discover the one which does.

- In case you are pleased with the form, affirm your option by clicking the Get now option. Then, choose the costs prepare you favor and offer your qualifications to sign up on an account.

- Approach the transaction. Use your charge card or PayPal account to accomplish the transaction.

- Find the structure and down load the form on your own device.

- Make changes. Fill out, revise and produce and sign the delivered electronically Arkansas Incentive and Nonqualified Share Option Plan.

Each template you included with your money does not have an expiry particular date and is also your own eternally. So, if you would like down load or produce an additional backup, just check out the My Forms segment and then click about the develop you will need.

Obtain access to the Arkansas Incentive and Nonqualified Share Option Plan with US Legal Forms, the most considerable collection of legal file templates. Use thousands of expert and state-certain templates that fulfill your small business or specific requires and requirements.

Form popularity

FAQ

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.

RSUs are easier to understand, manage, and most often considered less risky, with less downside. NSOs are more complex, harder to manage, and riskier, with more downside. Generally, you will receive more NSOs than RSUs. It is often helpful to breakout your considerations into tax and investment issues.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

Restricted stock (also called letter stock or section 1244 stock) is usually awarded to company directors and other high-level executives, whereas restricted stock units (RSUs) are typically awarded to lower-level employees. Restricted stock tends to have more conditions and restrictions than an RSU.

Taxation on nonqualified stock options As mentioned above, NSOs are generally subject to higher taxes than ISOs because they are taxed on two separate occasions ? upon option exercise and when company shares are sold ? and also because income tax rates are generally higher than long-term capital gains tax rates.

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

If you are on track toward meeting a retirement goal that is 10+ years out, it makes sense to choose options over RSUs. On the other hand, if you want to earmark this equity compensation for a retirement or education goal that is in five years or less, opting for more RSUs might be a better choice.