The Arkansas Management Agreement between Advisers Managers Trust and Berger and Berman Management Inc. is a legally binding contract that outlines the terms and conditions of the management services provided by Berger and Berman Management Inc. to Advisers Managers Trust in the state of Arkansas. 1. Description: The Arkansas Management Agreement is a comprehensive document that defines the roles, responsibilities, and obligations of both parties involved in the management of investment funds and assets. It outlines the scope of the services provided by Berger and Berman Management Inc., including investment management, advisory services, and other related activities. The agreement emphasizes the fiduciary duty of Berger and Berman Management Inc. to act in the best interests of Advisers Managers Trust and their clients. It specifies the investment objectives, guidelines, and restrictions, as well as the risk tolerance and investment strategies to be employed. Furthermore, the agreement sets forth the compensation structure, including management fees, performance-based fees, or any other fee arrangement agreed upon by both parties. It also addresses the termination provisions, governing law, dispute resolution mechanisms, and confidentiality obligations. 2. Types of Arkansas Management Agreement: While the specific types of Arkansas Management Agreements between Advisers Managers Trust and Berger and Berman Management Inc. may vary depending on the specific needs and circumstances of each engagement, there are a few common types worth mentioning: a) Investment Management Agreement: This type of agreement primarily focuses on the delegation of discretionary investment authority to Berger and Berman Management Inc., giving them the power to make investment decisions on behalf of Advisers Managers Trust and manage their portfolios. b) Advisory Services Agreement: This agreement typically covers non-discretionary advisory services, where Berger and Berman Management Inc. provides recommendations and advice to Advisers Managers Trust regarding investment options, asset allocation, risk management, and other related matters. The final investment decisions in this case are made by Advisers Managers Trust. c) Fund Administration Agreement: In this type of agreement, Berger and Berman Management Inc. takes on administrative responsibilities for the investment funds managed by Advisers Managers Trust. This includes tasks such as accounting, reporting, compliance, legal and regulatory filings, and record-keeping. d) Performance-Based Fee Agreement: This agreement structure allows Berger and Berman Management Inc. to earn compensation based on the performance of the investment funds managed. The fees may be calculated as a percentage of profits or a share of the exceedable over a specified benchmark. These are just a few examples of the various types of Arkansas Management Agreements that can be established between Advisers Managers Trust and Berger and Berman Management Inc. The specific terms and provisions may differ based on the specific requirements and intentions of the parties involved. It is essential to consult legal professionals and review the agreement thoroughly before execution.

Arkansas Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.

Description

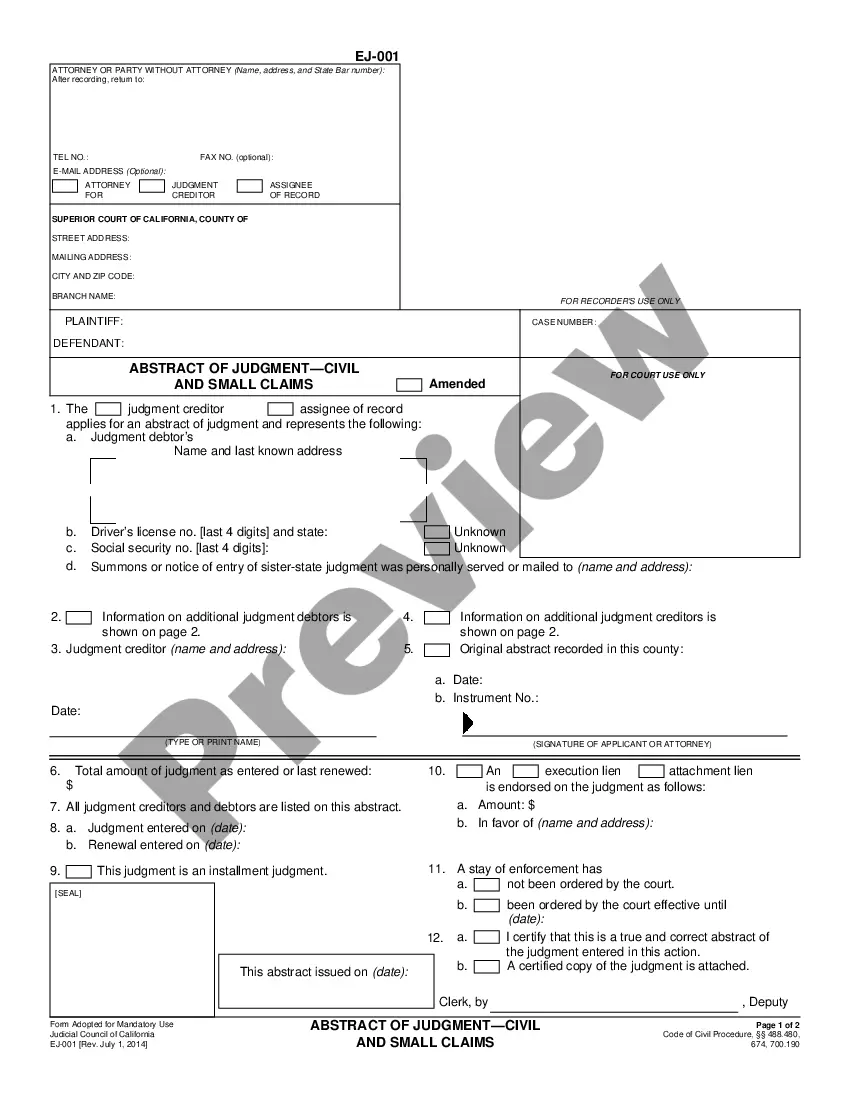

How to fill out Arkansas Management Agreement Between Advisers Managers Trust And Neuberger And Berman Management Inc.?

It is possible to devote several hours online attempting to find the lawful file format that suits the federal and state needs you require. US Legal Forms supplies a huge number of lawful varieties which are reviewed by pros. It is possible to download or print the Arkansas Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. from my support.

If you already have a US Legal Forms bank account, it is possible to log in and click the Acquire key. Next, it is possible to full, revise, print, or indicator the Arkansas Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.. Each and every lawful file format you acquire is your own property permanently. To get yet another duplicate for any obtained develop, visit the My Forms tab and click the related key.

If you are using the US Legal Forms web site the first time, stick to the straightforward directions listed below:

- Initially, make certain you have selected the proper file format for that state/town of your choice. Read the develop information to make sure you have chosen the right develop. If readily available, use the Preview key to check through the file format also.

- In order to find yet another edition of your develop, use the Look for area to find the format that meets your needs and needs.

- After you have found the format you desire, just click Buy now to move forward.

- Select the costs program you desire, type in your references, and register for your account on US Legal Forms.

- Total the transaction. You may use your charge card or PayPal bank account to cover the lawful develop.

- Select the structure of your file and download it for your system.

- Make alterations for your file if possible. It is possible to full, revise and indicator and print Arkansas Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc..

Acquire and print a huge number of file themes while using US Legal Forms Internet site, that offers the greatest variety of lawful varieties. Use specialist and status-specific themes to tackle your organization or individual requirements.

Form popularity

FAQ

Neuberger Berman peak revenue was $2.8B in 2022. Neuberger Berman annual revenue for 2021 was 2.4B, 17.17% growth from 2020. Neuberger Berman annual revenue for 2022 was 2.8B, 17.35% growth from 2021.

We believe this approach is the reason more than 600 employees are owners of the firm and we have a 96% retention rate for our senior investment professionals1.

With 749 investment professionals and 2,799 employees in total, Neuberger Berman has built a diverse team of individuals united in their commitment to client outcomes and investment excellence.

For nine consecutive years, Neuberger Berman has been named first or second in Pensions & Investment's Best Places to Work in Money Management survey (among those with 1,000 employees or more). The firm manages $436 billion in client assets as of March 31, 2023.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.