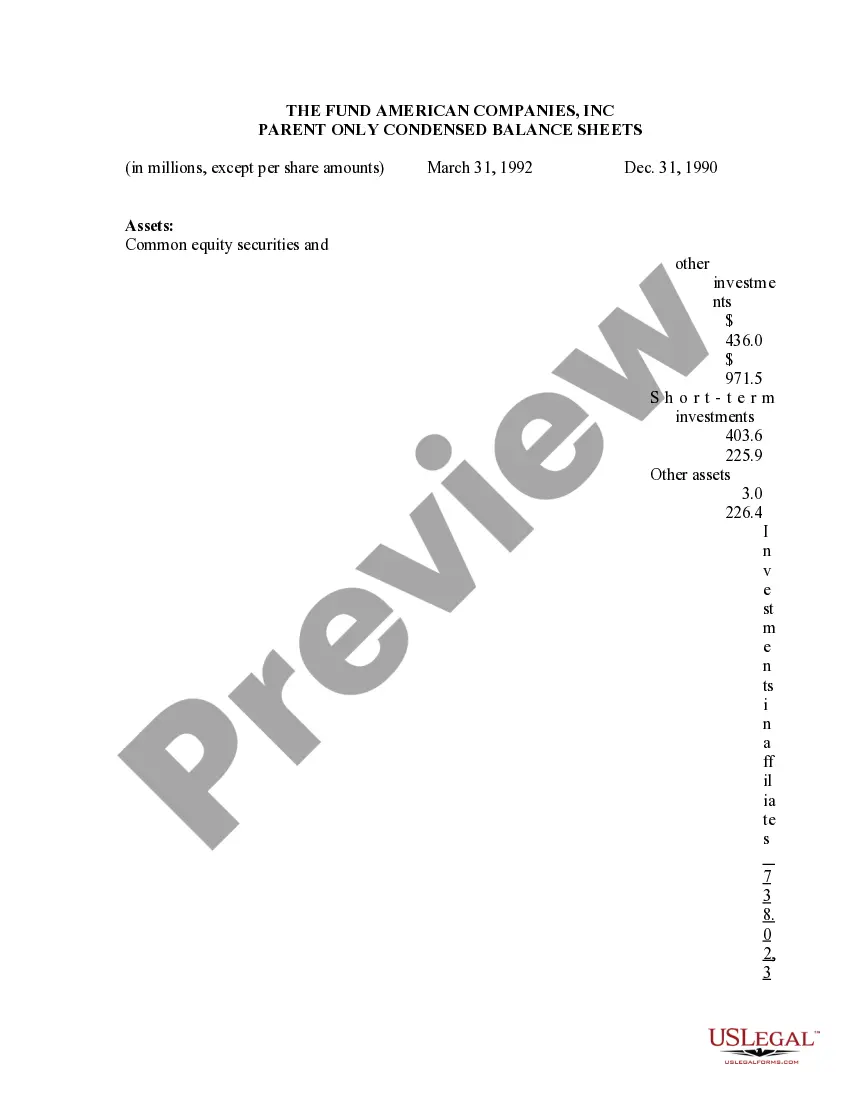

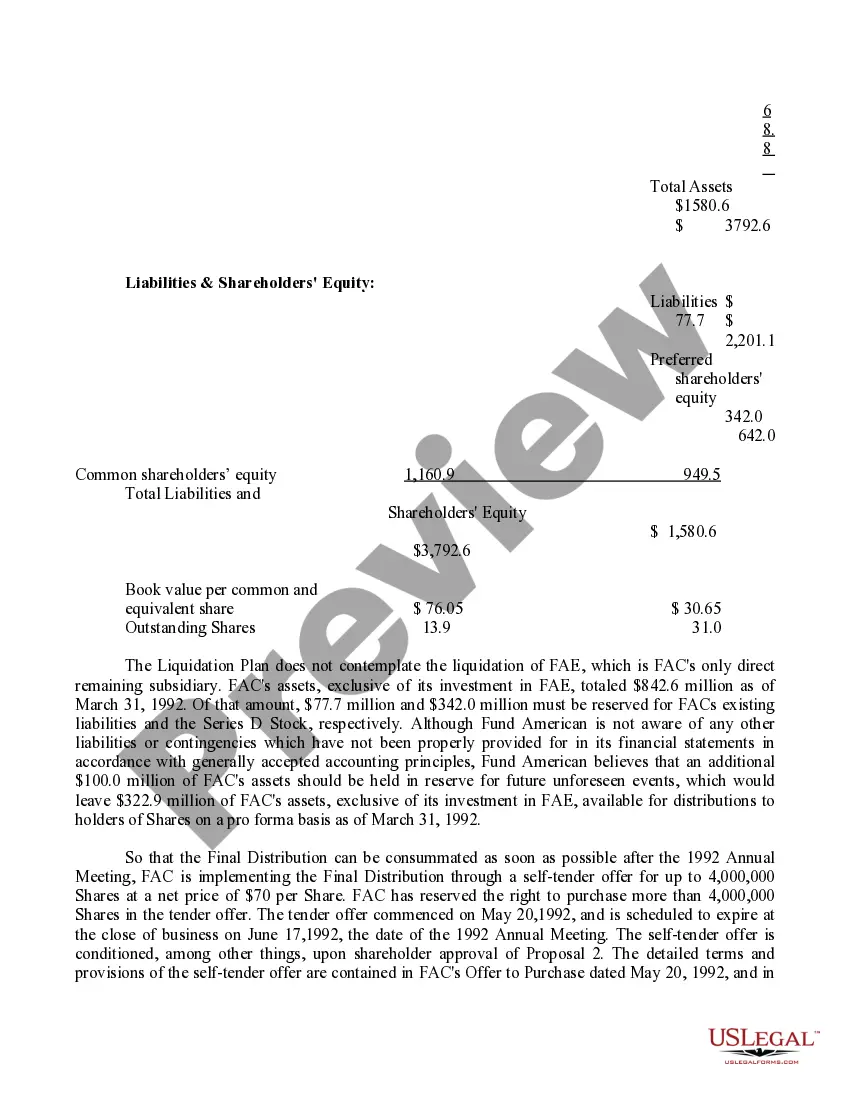

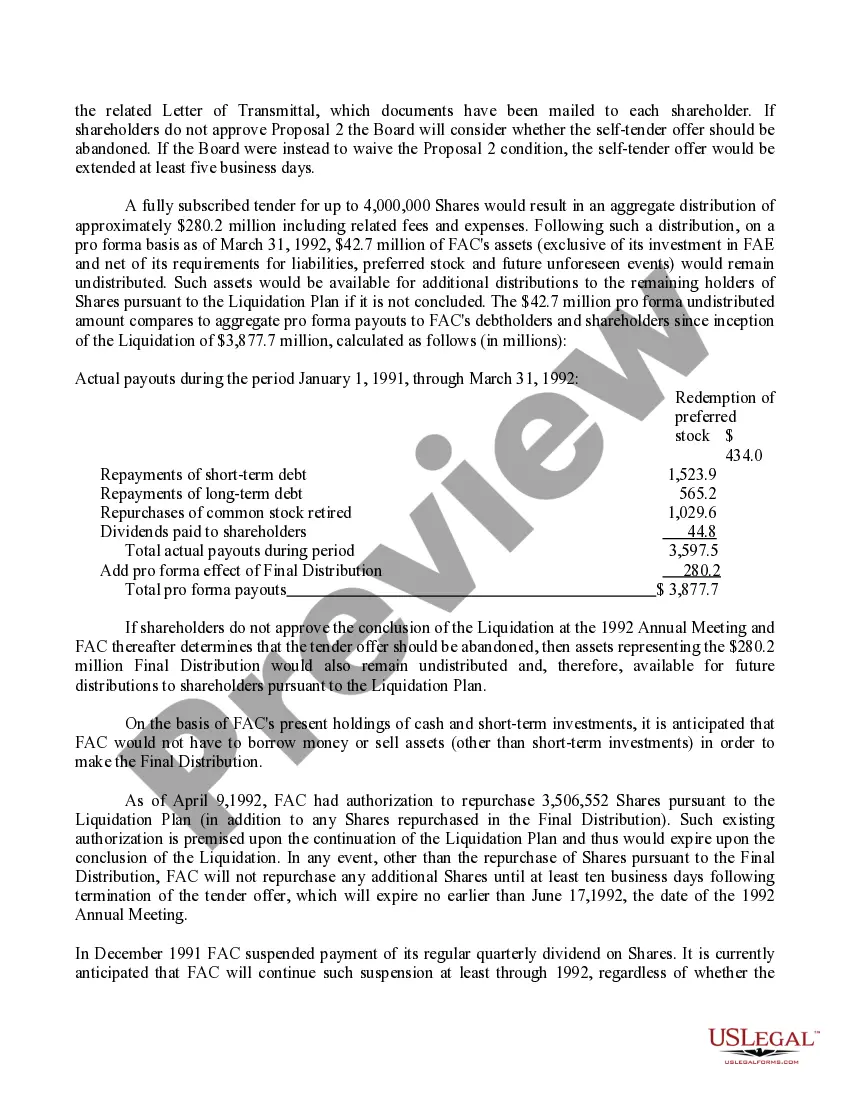

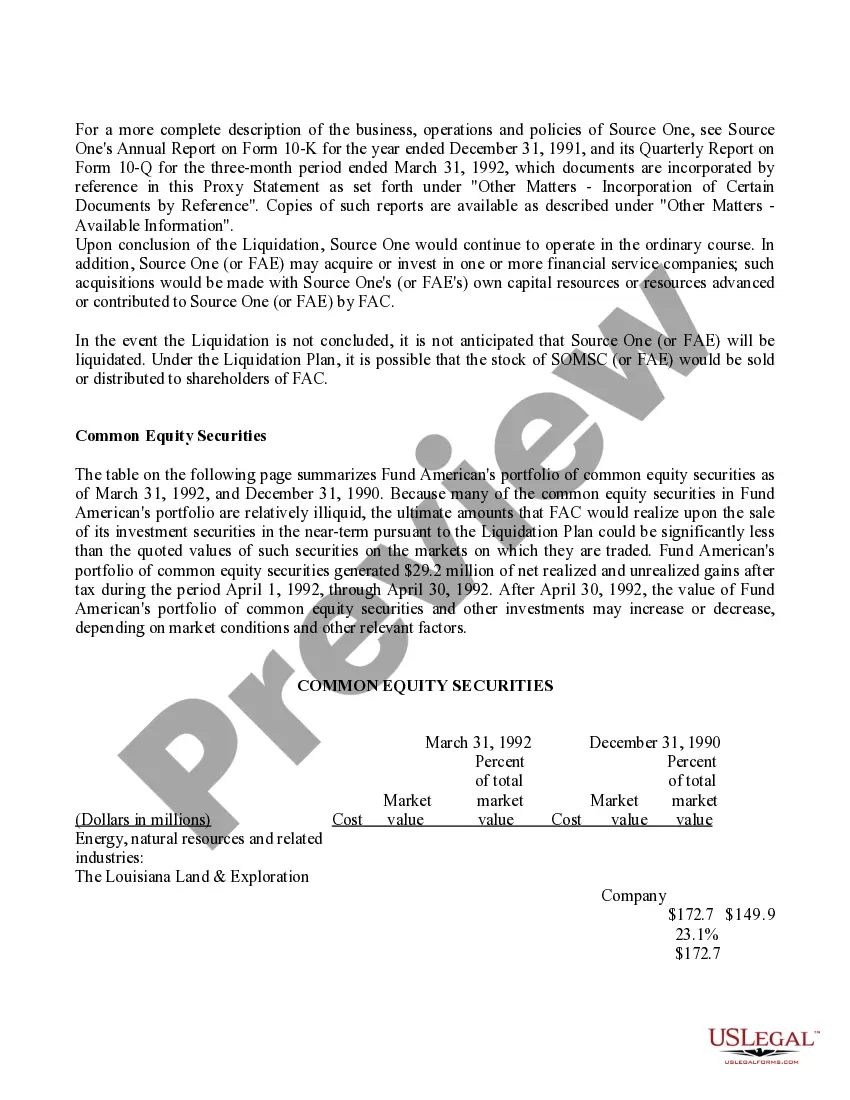

Arkansas Proposal — Conclusion of the Liquidation refers to the formal resolution of the liquidation process in the state of Arkansas. It involves the final and comprehensive steps taken to wind up the affairs of a business or organization, settling all outstanding debts, distributing assets to creditors and members, and terminating the entity's existence. In this proposal, various exhibits play a crucial role in providing supporting evidence and documentation related to the liquidation process. These exhibits may include financial statements, tax returns, asset valuations, creditor lists, and any other relevant documents that demonstrate the transparency and fairness of the liquidation proceedings. Different types of Arkansas Proposal — Conclusion of the Liquidation with exhibits may include: 1. Corporate Liquidation Proposal: This type of proposal is specifically designed for the dissolution of a corporation in Arkansas. It outlines the steps to be taken to ensure the completion of the liquidation process, including the sale of assets, payment of outstanding debts, and the final distribution of remaining assets among shareholders. 2. Nonprofit Liquidation Proposal: Nonprofit organizations in Arkansas may require a specific liquidation proposal to document the conclusion of their operations. This proposal would typically include exhibits such as the approval of the board of directors, the distribution plan for remaining assets, and any necessary approvals from regulatory bodies. 3. Partnership Liquidation Proposal: Partnerships undergoing liquidation in Arkansas would require a proposal that outlines the process of distributing assets among partners and settling liabilities. Exhibits for this type of proposal would feature the partnership agreement, creditor claims, and statements of accounts. 4. Limited Liability Company (LLC) Liquidation Proposal: This proposal is tailored for LCS looking to conclude their liquidation process in Arkansas. It would include exhibits such as the operating agreement, asset valuations, tax returns, and any necessary approvals from members or managers. Overall, the Arkansas Proposal — Conclusion of the Liquidation with exhibits ensures a transparent and systematic approach to concluding the liquidation process, providing relevant documentation to support the fair distribution of assets and settlement of obligations in compliance with Arkansas state laws and regulations.

Arkansas Proposal - Conclusion of the Liquidation with exhibit

Description

How to fill out Arkansas Proposal - Conclusion Of The Liquidation With Exhibit?

Discovering the right legitimate file template might be a have a problem. Of course, there are tons of themes available on the Internet, but how can you get the legitimate type you need? Use the US Legal Forms site. The support delivers 1000s of themes, like the Arkansas Proposal - Conclusion of the Liquidation with exhibit, which can be used for business and private requirements. Each of the forms are inspected by professionals and fulfill federal and state demands.

If you are presently listed, log in for your account and then click the Down load button to find the Arkansas Proposal - Conclusion of the Liquidation with exhibit. Utilize your account to look throughout the legitimate forms you have bought earlier. Proceed to the My Forms tab of your account and obtain an additional duplicate of your file you need.

If you are a brand new consumer of US Legal Forms, here are easy instructions that you can comply with:

- Initially, ensure you have chosen the correct type to your city/region. You are able to look through the shape while using Review button and read the shape description to make sure this is the right one for you.

- When the type will not fulfill your requirements, utilize the Seach area to discover the right type.

- Once you are sure that the shape would work, select the Buy now button to find the type.

- Select the costs prepare you desire and type in the needed information and facts. Design your account and pay for your order with your PayPal account or Visa or Mastercard.

- Opt for the data file format and obtain the legitimate file template for your product.

- Full, modify and print and signal the attained Arkansas Proposal - Conclusion of the Liquidation with exhibit.

US Legal Forms is the largest local library of legitimate forms in which you can see different file themes. Use the service to obtain appropriately-made files that comply with state demands.