Arkansas Complex Will - Credit Shelter Marital Trust for Spouse

Description

How to fill out Complex Will - Credit Shelter Marital Trust For Spouse?

Are you currently in the situation where you require papers for sometimes business or individual purposes just about every working day? There are a variety of legal record web templates accessible on the Internet, but getting kinds you can depend on is not straightforward. US Legal Forms provides a large number of kind web templates, like the Arkansas Complex Will - Credit Shelter Marital Trust for Spouse, that happen to be written to fulfill state and federal specifications.

Should you be previously acquainted with US Legal Forms site and get a free account, basically log in. Next, you may acquire the Arkansas Complex Will - Credit Shelter Marital Trust for Spouse design.

Should you not provide an account and wish to begin using US Legal Forms, follow these steps:

- Discover the kind you will need and make sure it is to the appropriate city/state.

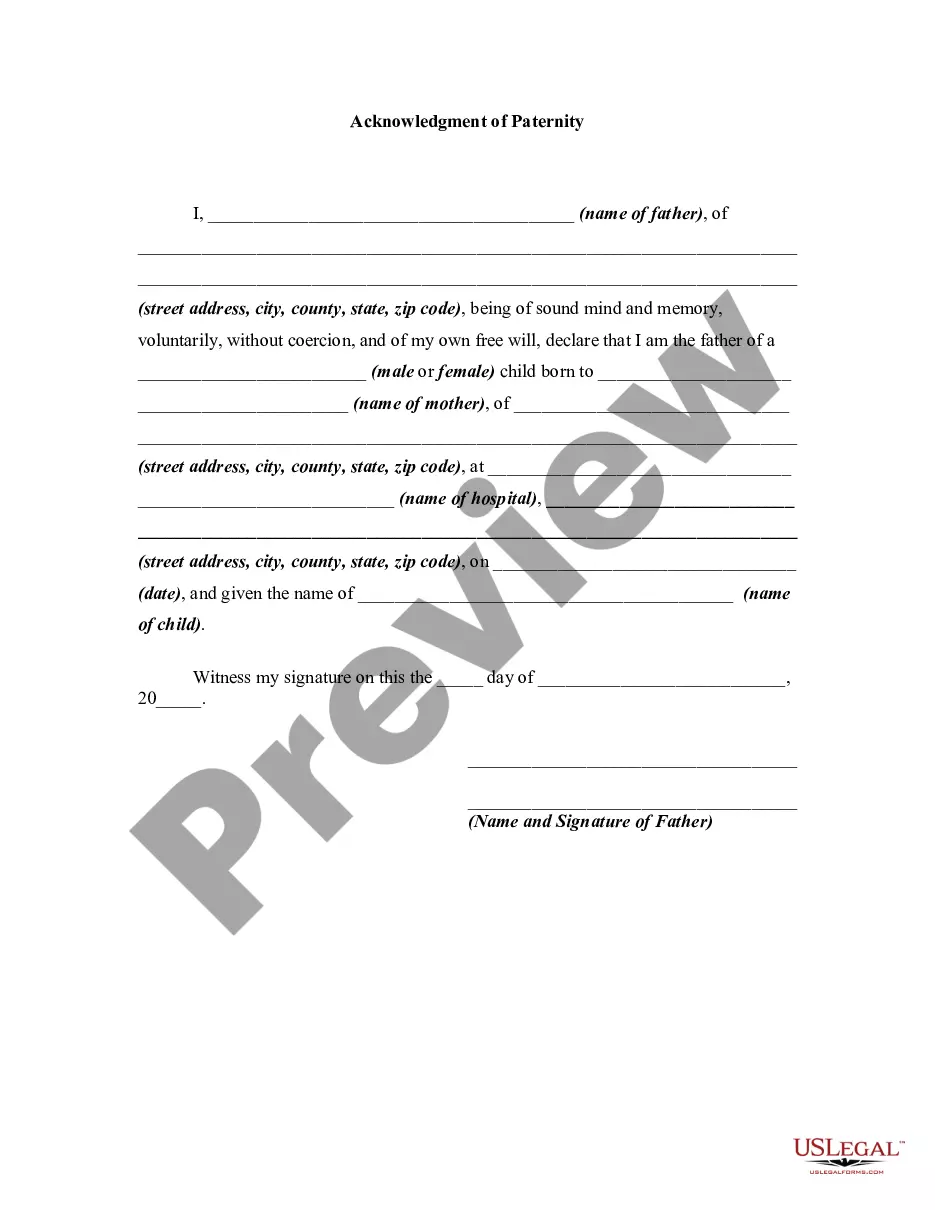

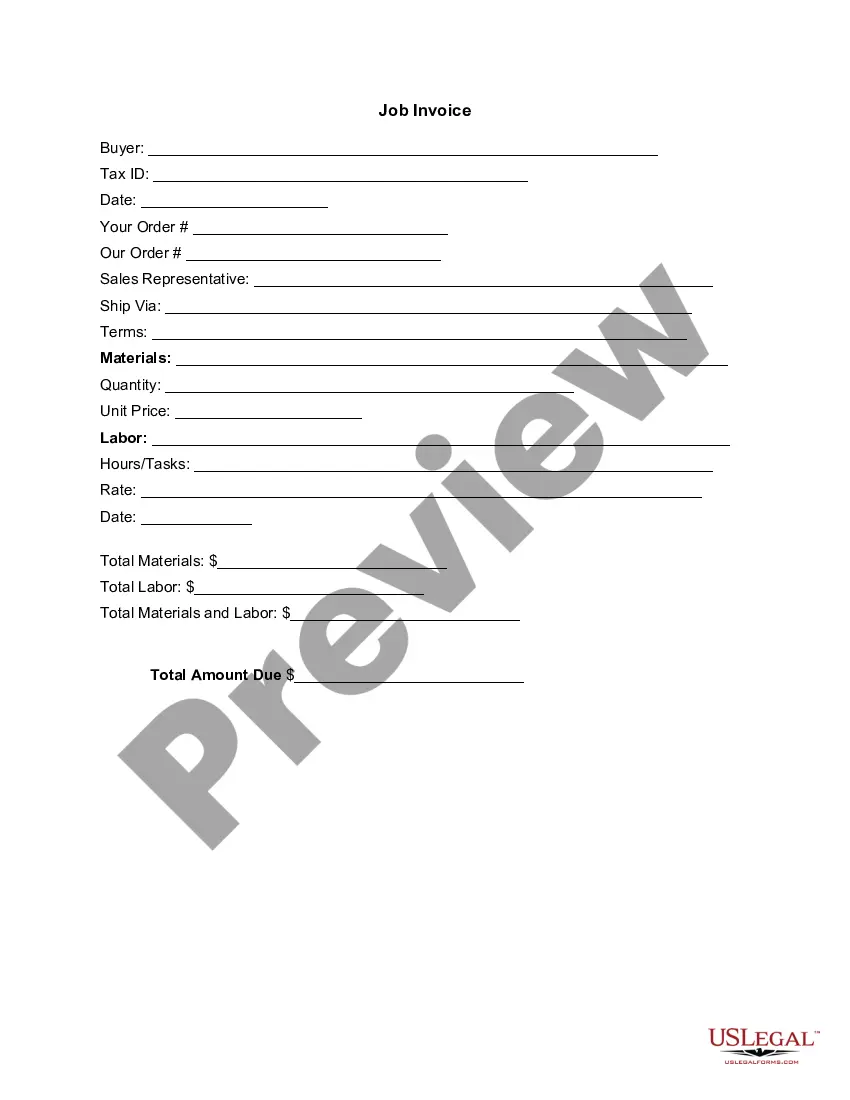

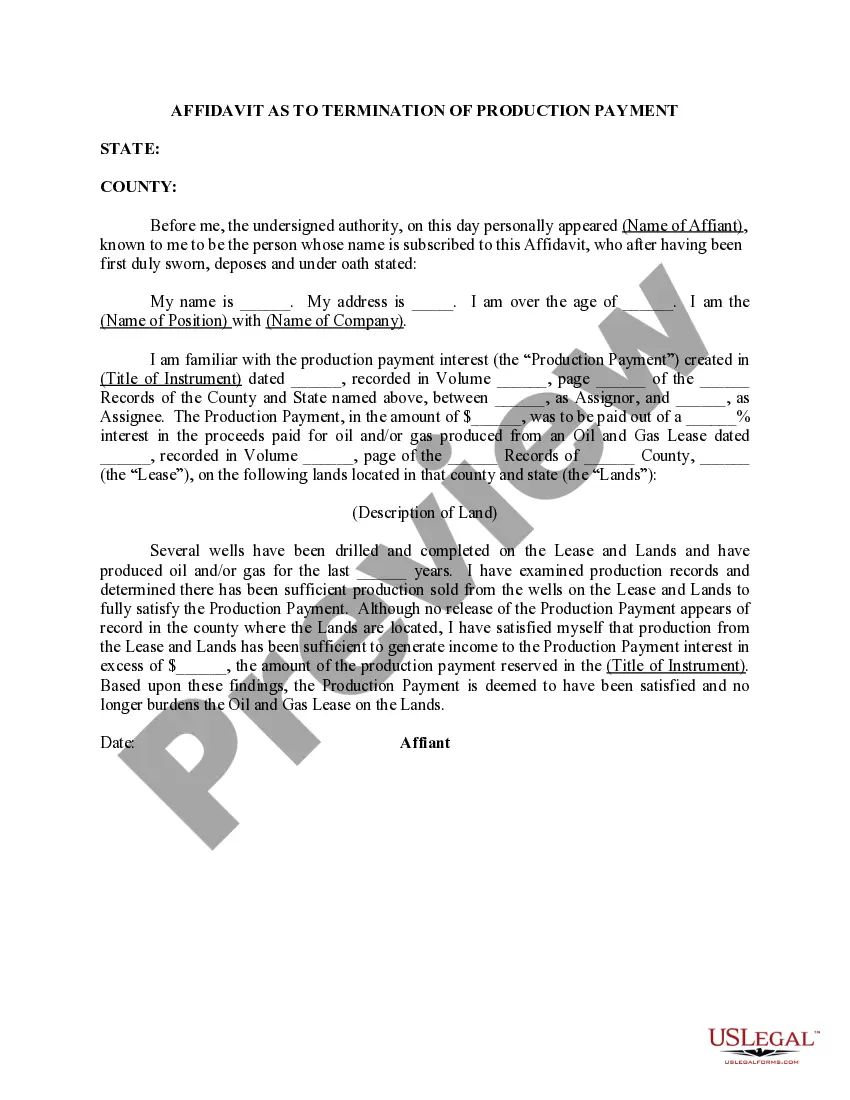

- Utilize the Preview button to check the shape.

- See the explanation to actually have selected the proper kind.

- In case the kind is not what you`re searching for, make use of the Search industry to find the kind that suits you and specifications.

- Once you obtain the appropriate kind, click on Purchase now.

- Opt for the pricing program you would like, fill in the necessary information to produce your account, and pay money for an order utilizing your PayPal or credit card.

- Pick a handy document formatting and acquire your backup.

Find each of the record web templates you possess purchased in the My Forms food selection. You may get a additional backup of Arkansas Complex Will - Credit Shelter Marital Trust for Spouse whenever, if required. Just click the required kind to acquire or printing the record design.

Use US Legal Forms, by far the most considerable variety of legal varieties, to save lots of some time and steer clear of errors. The services provides appropriately created legal record web templates which you can use for an array of purposes. Generate a free account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

When the credit shelter trust is initially funded upon the death of one spouse, the assets that are placed under the trust receive a step-up in basis. This is an important consideration, because any assets held in a CST don't receive a second step-up in basis upon the death of the surviving spouse.

No. Credit Shelter Trusts are a popular tool for estate planning, and there are two main types of CSTs, the Marital Gift Trust and the Qualified Terminable Interest Property Trust (QTIP). Both of these Trusts preserve wealth via estate tax exemptions.

The primary benefit of CSTs is that the surviving spouse can use the trust's principal and income during the remainder of their lifetime, for example, for medical or educational expenses. The remaining assets then pass to the beneficiaries and are not subject to estate taxes.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.