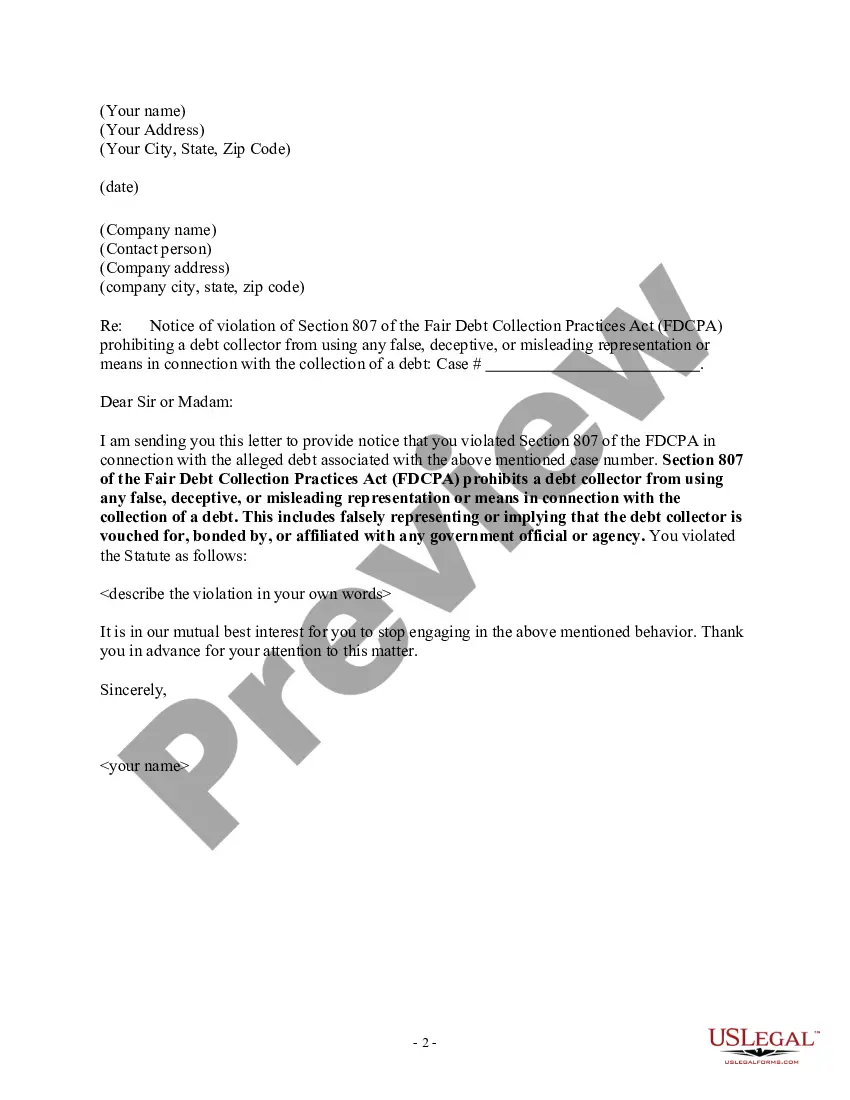

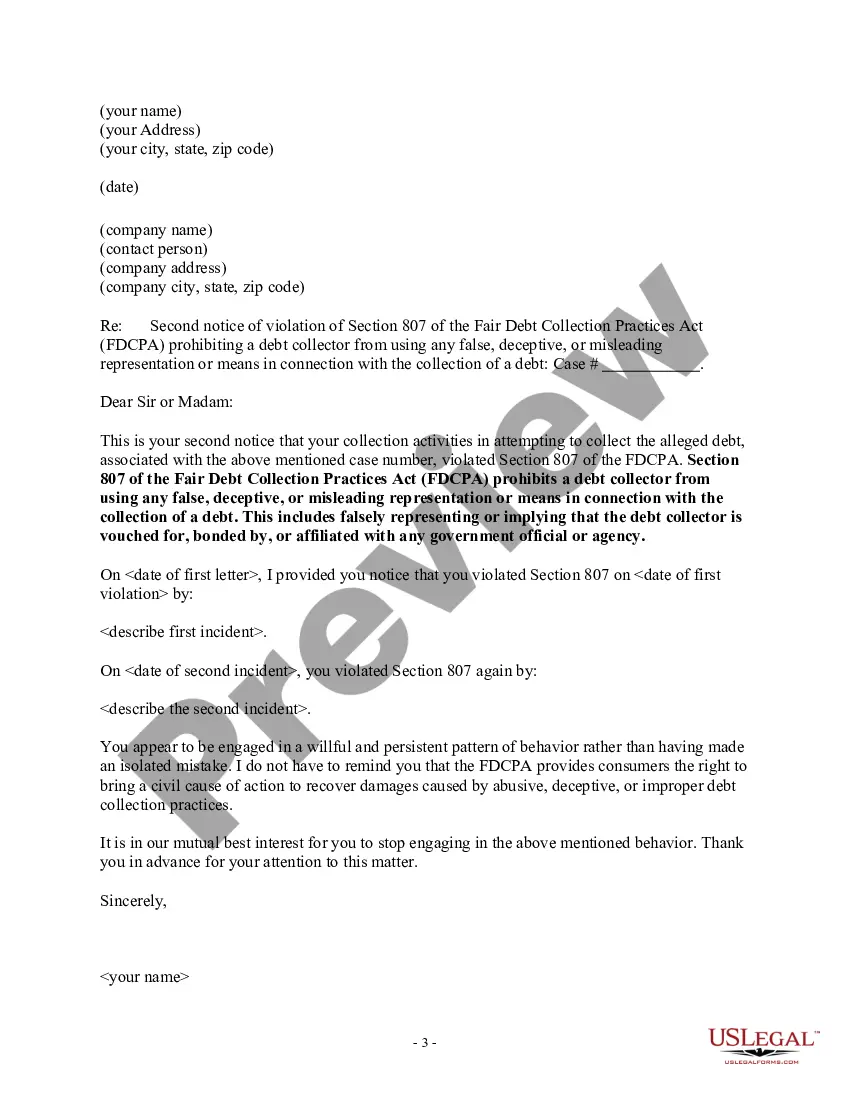

Arkansas Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Arkansas Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

If you need to full, acquire, or print lawful papers themes, use US Legal Forms, the most important selection of lawful forms, that can be found on the web. Use the site`s simple and easy handy lookup to get the files you need. Various themes for company and personal reasons are categorized by types and states, or key phrases. Use US Legal Forms to get the Arkansas Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself in just a number of clicks.

Should you be presently a US Legal Forms customer, log in in your account and then click the Obtain option to get the Arkansas Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself. You may also entry forms you previously downloaded within the My Forms tab of the account.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for the appropriate metropolis/region.

- Step 2. Utilize the Preview option to look over the form`s information. Don`t forget about to see the explanation.

- Step 3. Should you be not happy together with the form, use the Search industry on top of the display to find other versions from the lawful form web template.

- Step 4. Upon having identified the form you need, click the Get now option. Select the costs strategy you like and add your qualifications to register on an account.

- Step 5. Process the deal. You can use your credit card or PayPal account to finish the deal.

- Step 6. Pick the structure from the lawful form and acquire it on your system.

- Step 7. Comprehensive, change and print or indication the Arkansas Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

Every lawful papers web template you get is your own for a long time. You have acces to each form you downloaded within your acccount. Click the My Forms segment and decide on a form to print or acquire once more.

Contend and acquire, and print the Arkansas Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself with US Legal Forms. There are millions of professional and status-particular forms you can use to your company or personal requires.

Form popularity

FAQ

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

In California, the statute of limitations on most debts is four years. With some limited exceptions, creditors and debt buyers can't sue to collect debt that is more than four years old. When the debt is based on a verbal agreement, that time is reduced to two years.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

The FDCPA defines a "creditor" as the person or entity that extended you the credit in the first place (in other words, your original lender). Because the FDCPA is designed to protect debtors against third-party debt collectors, it doesn't apply to your original creditor or its employees.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

In cases against consumers for unpaid debts, the statute of limitations is three years in Arkansas. To achieve this short statute of limitations period, it must be filed as breach of contract claims, and there cannot be proof in writing, under A.C.A. 16- 56-105.

The statute of limitations for most debts, under Arkansas law, ranges from two to five years. Debt collectors are not allowed to call you at work. Ever. If they call after you have asked them to stop, you may have a claim under the Fair Debt Collection Practices Act.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Unless your state law provides otherwise, the FDCPA only requires debt collectors, not original creditors, to verify debts in certain circumstances. This requirement includes law firms that are routinely engaged in collecting debts.