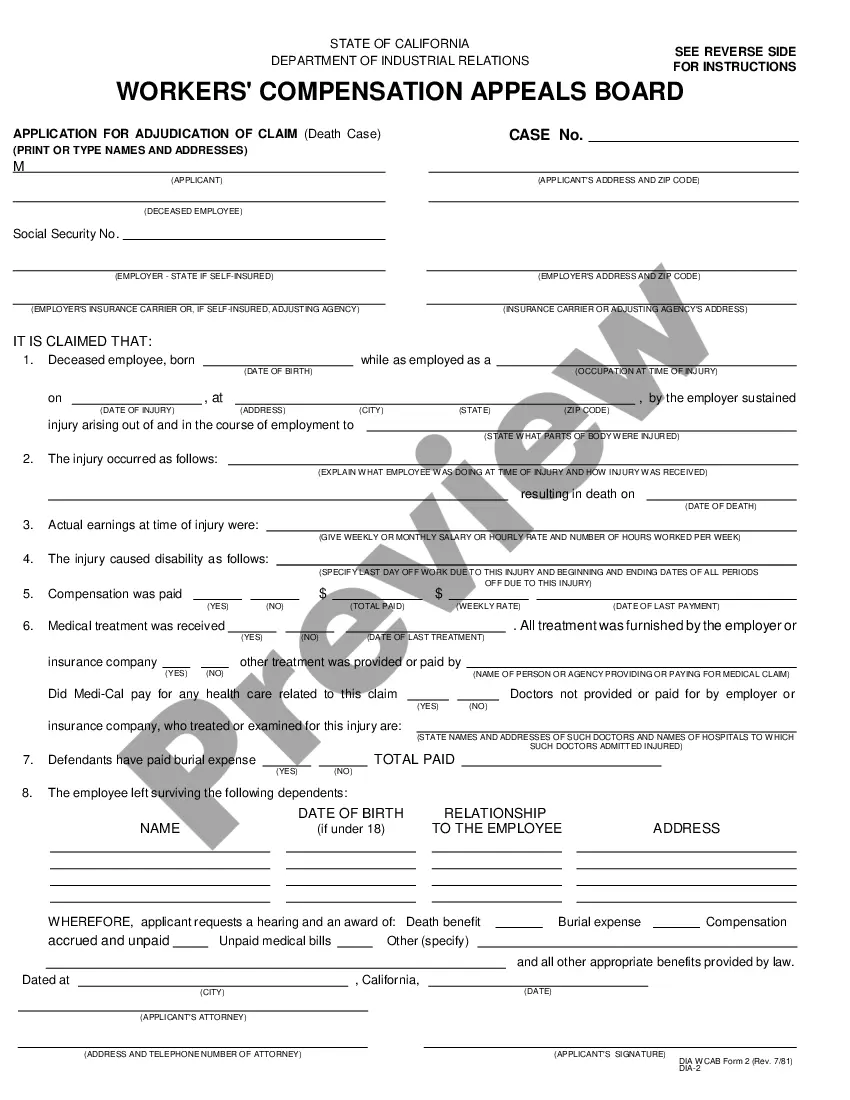

Arkansas Leased Personal Property Workform

Description

How to fill out Arkansas Leased Personal Property Workform?

If you wish to total, obtain, or print out authorized record themes, use US Legal Forms, the most important variety of authorized kinds, that can be found on the web. Utilize the site`s basic and practical search to obtain the files you need. Different themes for enterprise and person purposes are sorted by categories and says, or keywords. Use US Legal Forms to obtain the Arkansas Leased Personal Property Workform in a couple of click throughs.

When you are presently a US Legal Forms customer, log in for your accounts and click on the Down load button to obtain the Arkansas Leased Personal Property Workform. You can even access kinds you in the past delivered electronically in the My Forms tab of your accounts.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for the right city/nation.

- Step 2. Make use of the Preview method to look over the form`s articles. Do not forget to read the information.

- Step 3. When you are not satisfied using the form, utilize the Look for industry near the top of the display to get other variations from the authorized form web template.

- Step 4. When you have found the shape you need, select the Get now button. Choose the pricing plan you favor and include your credentials to sign up to have an accounts.

- Step 5. Method the financial transaction. You can utilize your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Find the formatting from the authorized form and obtain it in your system.

- Step 7. Complete, revise and print out or signal the Arkansas Leased Personal Property Workform.

Every authorized record web template you get is your own property forever. You have acces to each form you delivered electronically within your acccount. Click on the My Forms segment and pick a form to print out or obtain again.

Be competitive and obtain, and print out the Arkansas Leased Personal Property Workform with US Legal Forms. There are many specialist and condition-specific kinds you can use for your personal enterprise or person requirements.

Form popularity

FAQ

Arkansas collects income taxes from its residents at the following rates.0.9% on the first $4,299 of taxable income.2.4% on taxable income between $4,300 and $8,399.3.4% on taxable income between $8,400 and $12,699.4.4% on taxable income between $12,700 and $21,099.6% on taxable income between $21,100 and $35,299.More items...

Local millage rates determine the amount you pay per $1,000 of assessed value. Individual property tax bills are calculated by multiplying the assessed value of property by the total millage rate for that location.

The assessment is 20 percent applied to the "true market value" of real property and to the usual selling price of personal property. The tax due is calculated as the assessed value times the local mileage rate.

Arkansas businesses, including home-based businesses, are required to pay property taxes on their personal property, including office furnishings, machinery, equipment, vehicles, and inventories.

In Arkansas, all real and personal property is assessed 20% of market value. So, if you owned a property with a market value of $100,000, you would only be required to pay property taxes on $20,000.

Personal Property - Under Arkansas law, A.C.A. § 26-1-101, personal property is defined as Every tangible thing being the subject of ownership, and not forming a part of any parcel of real property as defined.

Real property is all tangible, owned real estate that is fixed and not readily movable. This includes land and all struc- tures and improvements made to that land, such as buildings, homes (including mobile homes) and barns. taxpayer.

Arkansans are required to pay personal property taxes every year. Personal property taxes are applied to items such as vehicles, trailers, motorcyles, etc. and are paid to your county collector. Most counties provide online property tax payments, which you can find by visiting ar.gov/tax.

Arkansans are required to pay personal property taxes every year. Personal property taxes are applied to items such as vehicles, trailers, motorcyles, etc. and are paid to your county collector. Most counties provide online property tax payments, which you can find by visiting ar.gov/tax.