Arkansas Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

Description

How to fill out Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

Finding the right authorized papers design can be a battle. Of course, there are plenty of web templates accessible on the Internet, but how would you discover the authorized type you will need? Take advantage of the US Legal Forms site. The services delivers 1000s of web templates, like the Arkansas Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One, which can be used for company and private requires. Each of the varieties are inspected by experts and meet state and federal demands.

Should you be currently authorized, log in to the account and click on the Acquire option to get the Arkansas Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One. Utilize your account to check with the authorized varieties you may have bought earlier. Proceed to the My Forms tab of your own account and acquire one more copy from the papers you will need.

Should you be a brand new customer of US Legal Forms, here are basic directions that you can stick to:

- First, ensure you have selected the right type to your metropolis/area. You are able to look through the shape utilizing the Review option and look at the shape information to make certain this is the best for you.

- If the type fails to meet your preferences, utilize the Seach discipline to discover the right type.

- When you are sure that the shape is suitable, go through the Get now option to get the type.

- Choose the prices strategy you want and enter the essential information and facts. Make your account and pay for an order using your PayPal account or charge card.

- Opt for the submit structure and down load the authorized papers design to the gadget.

- Full, modify and printing and sign the received Arkansas Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One.

US Legal Forms will be the most significant library of authorized varieties for which you can discover numerous papers web templates. Take advantage of the service to down load skillfully-made paperwork that stick to express demands.

Form popularity

FAQ

Mortgage-backed securities are still bought and sold today. There is a market for them again simply because people generally pay their mortgages if they can. The Fed still owns a huge chunk of the market for MBSs, but it is gradually selling off its holdings.

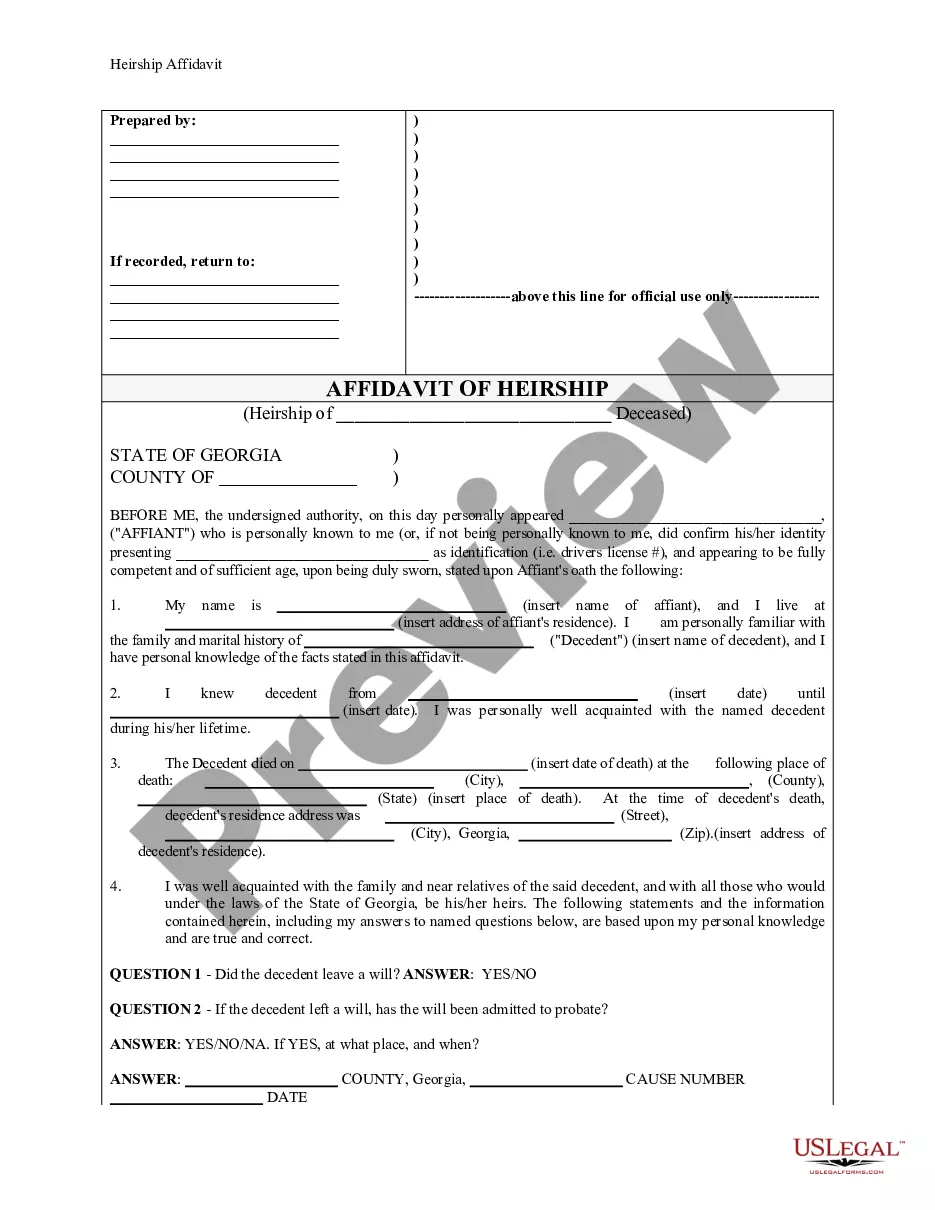

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

To create an MBS, the bank will bundle your loan with hundreds or thousands of other mortgages. These loans are then sold to an investment bank as a single bond. The investment bank then sections off the loans by their quality and sells them to other investors.

Mortgages are sold to institutions such as an investment bank or government institution, which then package it into an MBS that can be sold to individual investors. A mortgage contained in an MBS must have originated from an authorized financial institution.

MBSs are created by companies called aggregators, including government-sponsored entities such as Fannie Mae or Freddie Mac. They buy loans from lenders, including big banks, and structure them into a mortgage-backed security.

To create an MBS, the bank will bundle your loan with hundreds or thousands of other mortgages. These loans are then sold to an investment bank as a single bond. The investment bank then sections off the loans by their quality and sells them to other investors.