Arkansas Fast Packet Services Payment Plan Agreement

Description

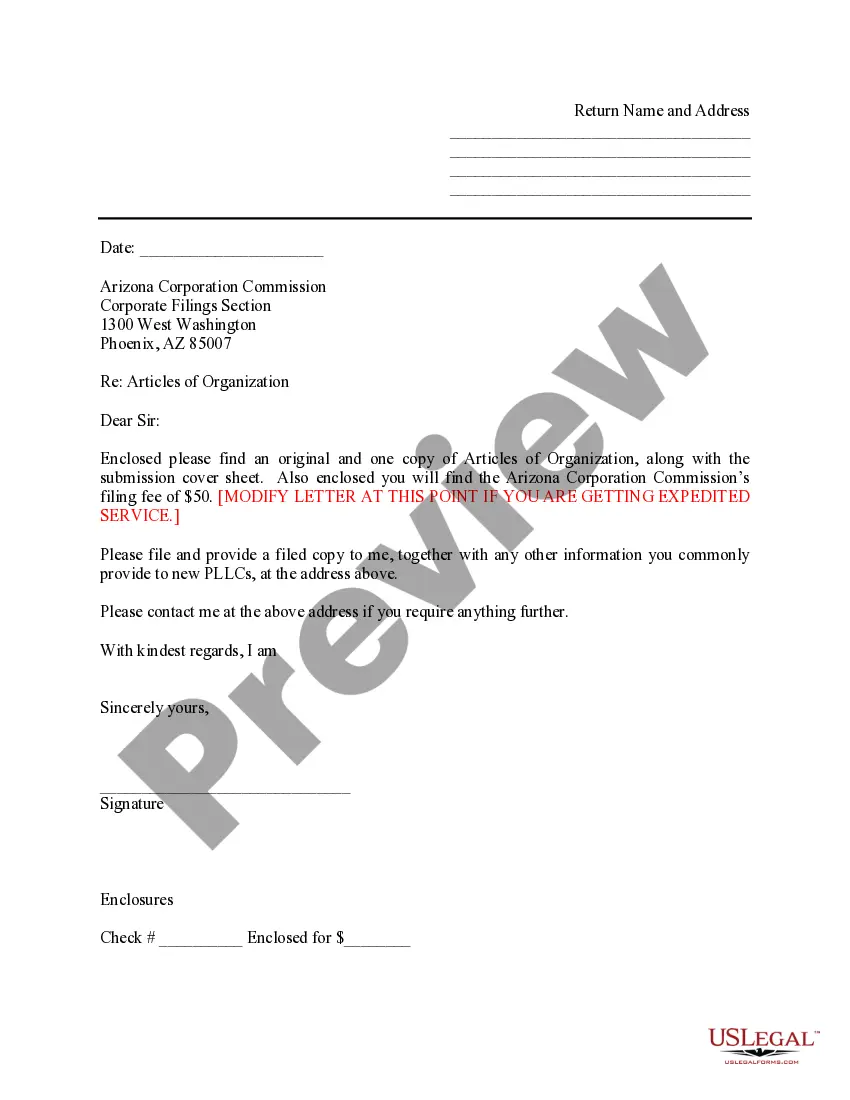

How to fill out Fast Packet Services Payment Plan Agreement?

If you want to total, acquire, or print out legitimate papers layouts, use US Legal Forms, the largest selection of legitimate types, that can be found on the Internet. Use the site`s easy and hassle-free search to find the paperwork you want. Numerous layouts for business and specific uses are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to find the Arkansas Fast Packet Services Payment Plan Agreement in just a number of click throughs.

In case you are presently a US Legal Forms client, log in to your bank account and click the Acquire button to obtain the Arkansas Fast Packet Services Payment Plan Agreement. You can even gain access to types you in the past delivered electronically from the My Forms tab of your own bank account.

Should you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for your proper town/nation.

- Step 2. Take advantage of the Preview method to check out the form`s articles. Never forget to read through the description.

- Step 3. In case you are unhappy with all the type, take advantage of the Look for industry at the top of the screen to find other types from the legitimate type design.

- Step 4. Once you have located the form you want, select the Buy now button. Opt for the prices prepare you like and add your credentials to register to have an bank account.

- Step 5. Method the financial transaction. You should use your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Pick the formatting from the legitimate type and acquire it on the system.

- Step 7. Total, revise and print out or indication the Arkansas Fast Packet Services Payment Plan Agreement.

Every legitimate papers design you get is your own property for a long time. You have acces to each and every type you delivered electronically inside your acccount. Click the My Forms portion and decide on a type to print out or acquire once again.

Be competitive and acquire, and print out the Arkansas Fast Packet Services Payment Plan Agreement with US Legal Forms. There are thousands of expert and express-distinct types you may use to your business or specific needs.

Form popularity

FAQ

Let's look at a quick example to illustrate the nature of a payment agreement. Person A (the debtor) borrows $5,000 from person B (the creditor). Both parties agree that person A must pay person B $1,000 a month over five months to repay the debt.

How to draft a contract between two parties: A step-by-step checklist Check out the parties. ... Come to an agreement on the terms. ... Specify the length of the contract. ... Spell out the consequences. ... Determine how you would resolve any disputes. ... Think about confidentiality. ... Check the contract's legality. ... Open it up to negotiation.

You can create a Promissory Note as a lender or borrower by following these steps: Select the location. Our Promissory Note template will customize your document specifically for the laws of your location. ... Provide party details. ... Establish the terms of the loan. ... Include final details. ... Sign the document.

While your agreement should fit your unique circumstances, there are a few essential elements every payment agreement should include: Payment timeline. Payment method. Interest rate. Terms and conditions. Parties involved. Contact information. Dispute resolution policy. Signatures.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

Explain the schedule of payments. You should include the date the loan will be paid in full. You also might want to attach to your payment agreement a schedule listing when monthly payments are due. On your schedule, list the day of each payment and the amount that the borrower should pay.

Creating a simple payment agreement for two parties can be a daunting task, so it's best to follow these steps to make sure everything is in order: Gather information. ... Create the agreement. ... Outline payment details. ... Get signatures. ... Send the agreement. ... Monitor the payment schedule.

Including a clear description of the payment plan Clearly state the date the payment plan agreement is being created. List the full names of the parties involved in the agreement. Provide an itemized list of the payments that need to be made, including the payment amount and due date for each payment.