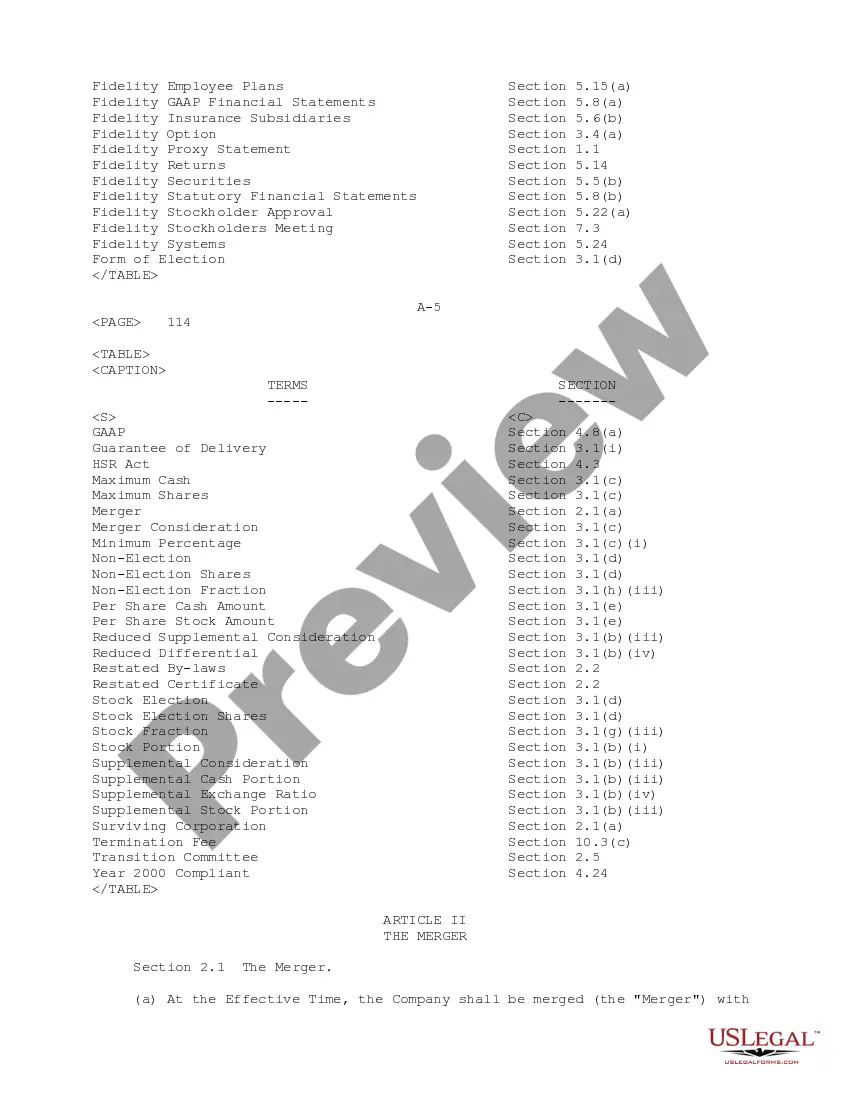

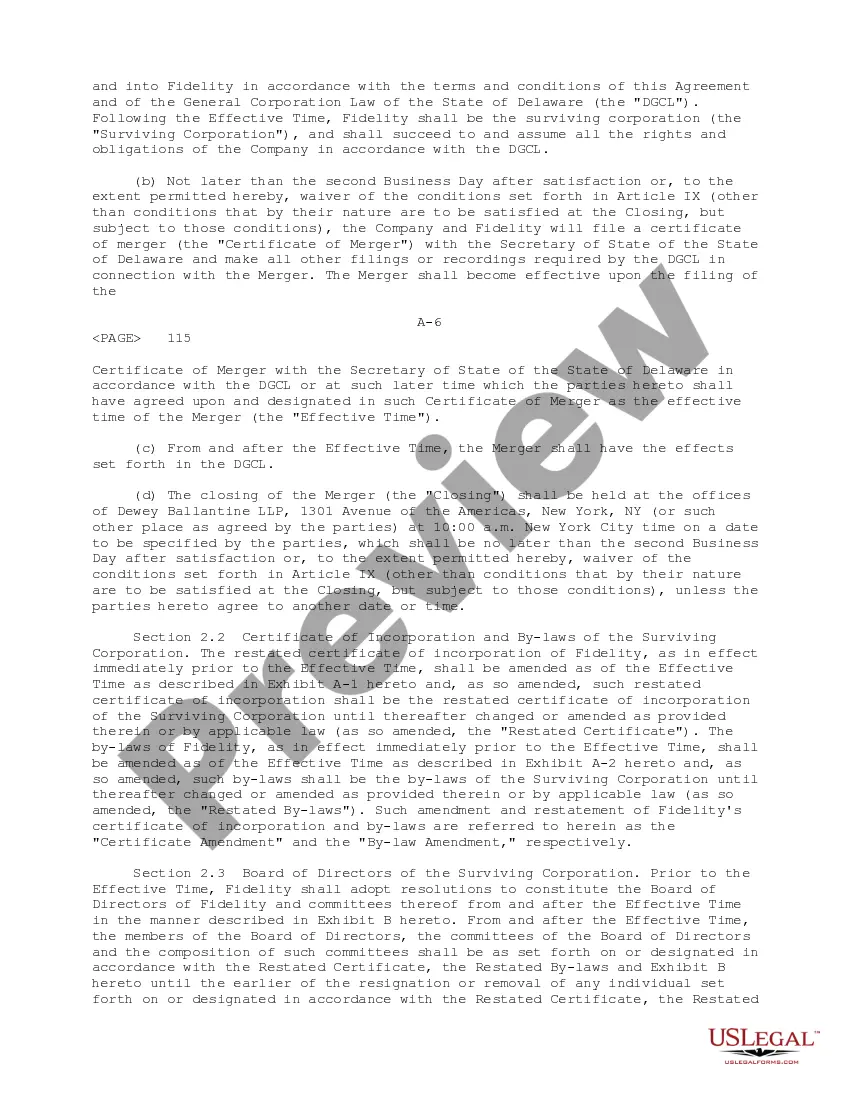

The Arkansas Agreement and Plan of Merger refers to the legal documentation that outlines the terms and conditions of a merger between Fidelity National Financial, Inc. and Chicago Title Corp in the state of Arkansas. This agreement is a crucial step in the process of combining two companies into one entity. The agreement typically includes comprehensive details on the financial aspects, business structure, and procedural requirements of the merger. It provides a roadmap for the consolidation of assets, liabilities, and operations of both Fidelity National Financial, Inc. and Chicago Title Corp. This agreement aims to ensure a smooth transition while maximizing shareholder value and minimizing any potential risks. Some important components that may be covered in the Arkansas Agreement and Plan of Merger include: 1. Merger Terms and Conditions: This section outlines the specific terms and conditions agreed upon by both parties involved in the merger. It includes information on the exchange ratio of shares, valuation of assets, and the treatment of outstanding stocks, options, or other securities. 2. Shareholder Approvals: The agreement delineates the requirements for obtaining shareholder approvals for the merger. This involves notifying and seeking consent from the shareholders of both companies to proceed with the merger. 3. Legal and Regulatory Compliance: The Arkansas Agreement and Plan of Merger ensures compliance with applicable laws, rules, and regulations governing mergers within the state. It may include obtaining necessary approvals from regulatory authorities and complying with antitrust regulations. 4. Governance and Management: This section outlines the composition of the board of directors, management structure, and key personnel appointments in the merged entity. It also includes details on any changes to the corporate governance framework or operating agreements. 5. Determination of Consideration: The agreement details how the consideration, usually in the form of shares, cash, or a combination thereof, is determined and allocated between Fidelity National Financial, Inc. and Chicago Title Corp shareholders. 6. Employee Benefits: If applicable, the agreement addresses the treatment of employee benefit plans, such as pensions, retirement accounts, and stock options, during and after the merger. It's important to note that the content and structure of the Arkansas Agreement and Plan of Merger may vary depending on the specific circumstances and objectives of Fidelity National Financial, Inc. and Chicago Title Corp. Other potential types of Arkansas Agreement and Plan of Merger involving these companies could include vertical mergers (where one company acquires another company in their supply chain) or horizontal mergers (where two competing companies merge to achieve economies of scale or market dominance). In conclusion, the Arkansas Agreement and Plan of Merger serves as a legally binding document that outlines the terms and conditions governing the merger between Fidelity National Financial, Inc. and Chicago Title Corp. Its purpose is to ensure a seamless transition while safeguarding the interests of both companies and maximizing shareholder value.

Arkansas Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp

Description

How to fill out Arkansas Agreement And Plan Of Merger Between Fidelity National Financial, Inc. And Chicago Title Corp?

You can invest hrs on the Internet attempting to find the legitimate document template which fits the state and federal requirements you need. US Legal Forms supplies a large number of legitimate forms which can be evaluated by specialists. You can easily download or print out the Arkansas Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp from our service.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Down load key. After that, it is possible to full, modify, print out, or indicator the Arkansas Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp. Every legitimate document template you buy is your own property forever. To have one more copy for any obtained develop, visit the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms web site the very first time, keep to the straightforward guidelines below:

- Initially, make certain you have selected the correct document template for that region/city that you pick. See the develop outline to make sure you have chosen the appropriate develop. If accessible, use the Review key to appear throughout the document template as well.

- If you want to discover one more version of the develop, use the Lookup area to obtain the template that meets your needs and requirements.

- After you have found the template you need, just click Acquire now to move forward.

- Find the pricing plan you need, key in your references, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You should use your Visa or Mastercard or PayPal bank account to purchase the legitimate develop.

- Find the file format of the document and download it in your device.

- Make adjustments in your document if necessary. You can full, modify and indicator and print out Arkansas Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp.

Down load and print out a large number of document layouts making use of the US Legal Forms Internet site, which provides the biggest selection of legitimate forms. Use professional and express-specific layouts to tackle your business or person requires.