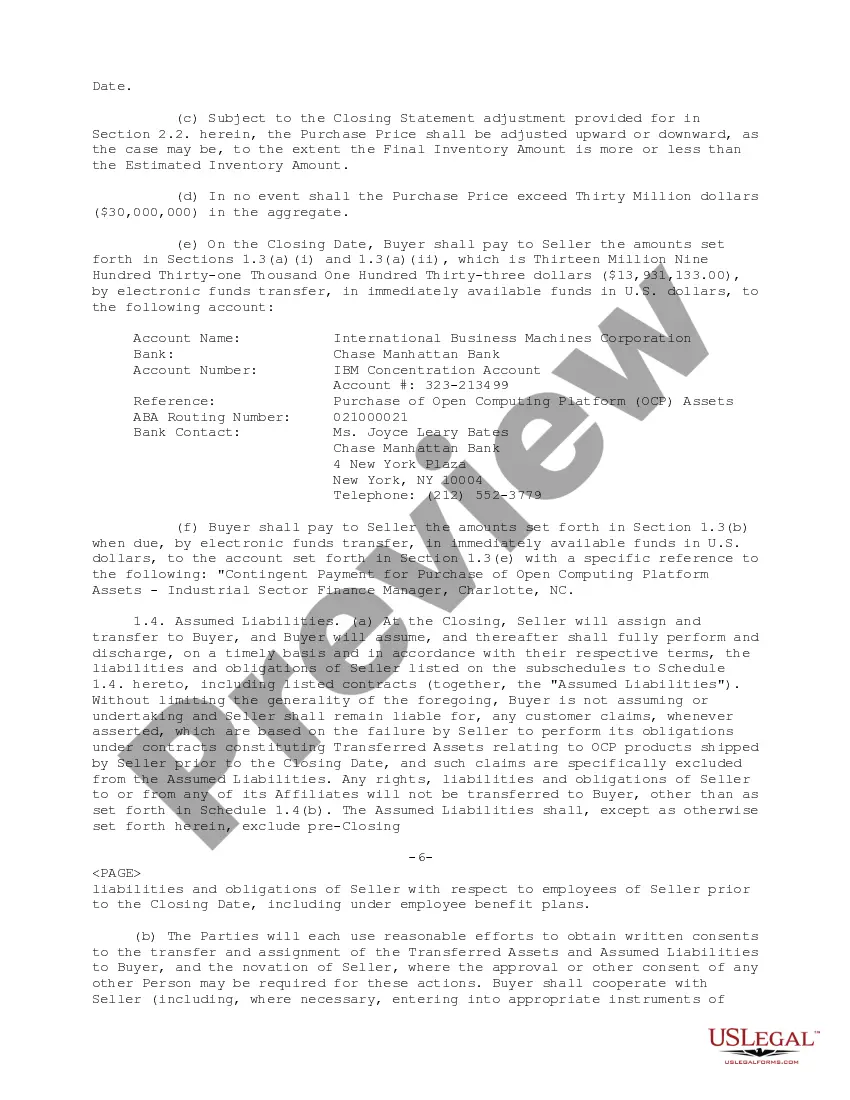

Arkansas Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample

Description

How to fill out Sample Asset Purchase Agreement Between RadiSys Corporation And International Business Machines Corporation - Sample?

You are able to devote hours on the Internet attempting to find the authorized record template that meets the federal and state demands you want. US Legal Forms gives a large number of authorized forms that happen to be analyzed by professionals. You can easily download or print out the Arkansas Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample from my service.

If you have a US Legal Forms accounts, you may log in and click on the Down load button. Next, you may full, revise, print out, or signal the Arkansas Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample. Each and every authorized record template you purchase is the one you have eternally. To have one more backup associated with a purchased kind, go to the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms website the very first time, adhere to the basic directions under:

- Initial, ensure that you have chosen the correct record template for that state/city of your choosing. Browse the kind description to ensure you have picked the proper kind. If offered, use the Preview button to look throughout the record template at the same time.

- In order to find one more model in the kind, use the Search field to find the template that suits you and demands.

- After you have discovered the template you need, click Get now to proceed.

- Select the costs strategy you need, key in your accreditations, and sign up for an account on US Legal Forms.

- Total the deal. You should use your credit card or PayPal accounts to cover the authorized kind.

- Select the formatting in the record and download it to the product.

- Make modifications to the record if required. You are able to full, revise and signal and print out Arkansas Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample.

Down load and print out a large number of record web templates making use of the US Legal Forms site, which offers the largest selection of authorized forms. Use expert and state-certain web templates to take on your organization or individual demands.