Arkansas Plan of Reorganization is a strategic agreement that outlines the terms and conditions for the reorganization process between Ingenuity Capital Trust and Firsthand Funds. This plan aims to streamline operations, optimize resources, and enhance the overall financial performance of the organizations involved. Through this agreement, both parties collaborate to achieve common objectives and cater to their respective stakeholders' interests. The Arkansas Plan of Reorganization serves as a roadmap for the transition, addressing various aspects such as asset allocation, debt restructuring, management changes, and legal considerations. It ensures a smooth and efficient reorganization process by providing a comprehensive framework for decision-making and execution. Key aspects covered under the Arkansas Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds may include: 1. Asset Allocation: The plan outlines how the combined assets of both organizations will be allocated in the reorganized entity. This may involve a reassessment of portfolios, identifying synergies, and enhancing diversified investment options. 2. Debt Restructuring: If there are existing debts or liabilities, the plan may entail restructuring or refinancing them to optimize the financial structure of the reorganized entity. This aims to minimize the financial burden and create a more sustainable capital structure. 3. Management Changes: The plan may address the need for any changes in leadership or management structure following the reorganization. It could include the appointment of new executives or a reshuffle of current roles to ensure effective governance and operational efficiency. 4. Legal Considerations: The Arkansas Plan of Reorganization outlines the legal procedures, compliance requirements, and regulatory approvals necessary for the successful implementation of the reorganization. This ensures that the process adheres to applicable laws and regulations. 5. Stakeholder Communication: The plan emphasizes clear and efficient communication with stakeholders, including shareholders, clients, employees, and regulatory bodies. It aims to maintain transparency and manage expectations throughout the reorganization process. It's important to note that different types of Arkansas Plans of Reorganization can exist between Ingenuity Capital Trust and Firsthand Funds based on their specific goals, industry, or organizational structure. Examples may include: 1. Merger Plan of Reorganization: If the reorganization involves a merger of both organizations, the plan would outline the integration strategy, operational synergy goals, and how the consolidated entity will create value for shareholders. 2. Acquisition Plan of Reorganization: In cases where one organization acquires another, the plan would detail the financial terms, asset transfer process, and plans for integrating operations to leverage the strengths of both entities. 3. Restructuring Plan of Reorganization: If the reorganization aims to restructure the organizations' financial or operational aspects, the plan would entail strategies for cost reduction, business process optimization, and realignment of resources to enhance overall performance. In summary, the Arkansas Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds represents a collaborative effort to optimize operations and financial performance. It encompasses various aspects ranging from asset allocation to stakeholder communication, ensuring a seamless transition while maximizing value for all parties involved.

Arkansas Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

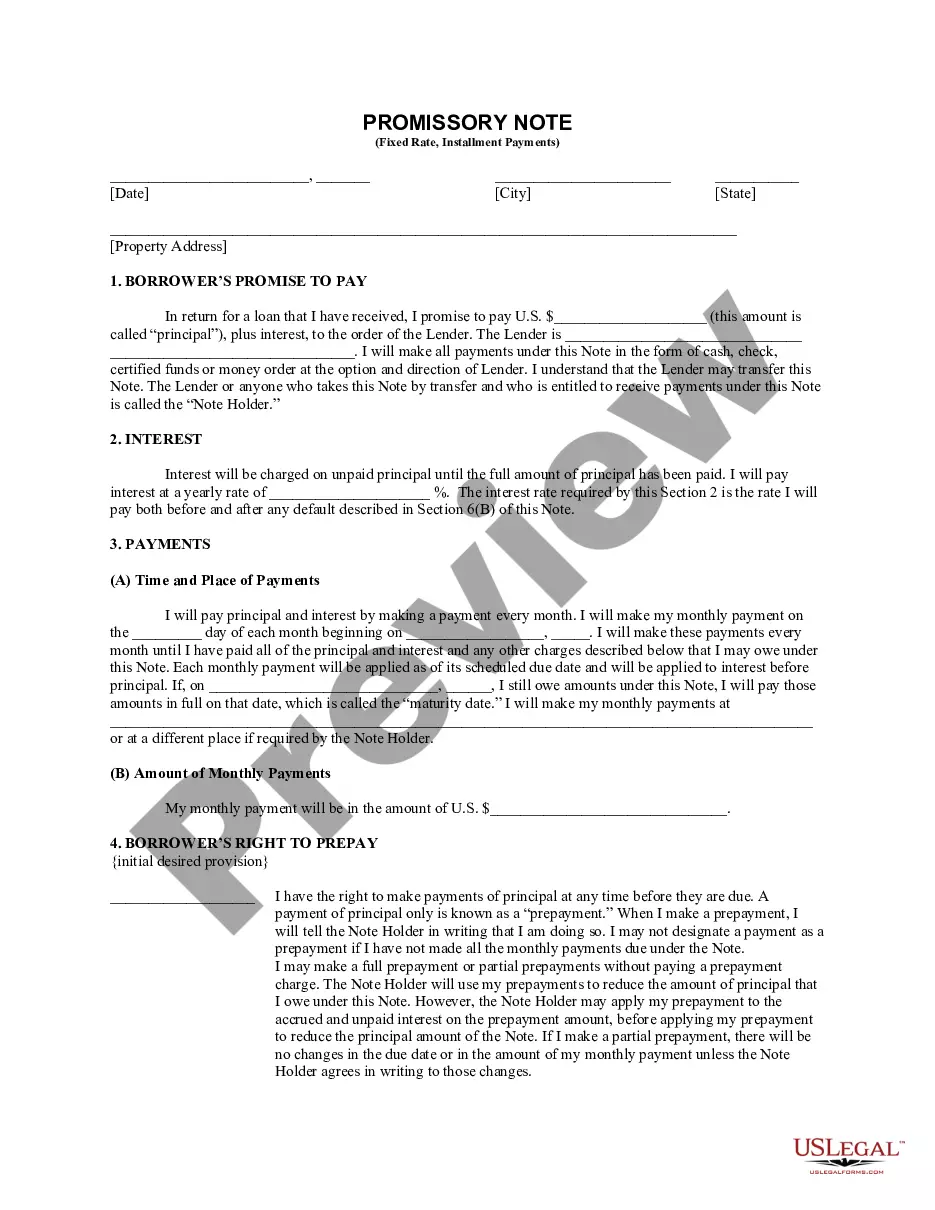

How to fill out Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

Choosing the best lawful file design can be a battle. Needless to say, there are a lot of web templates available on the net, but how do you find the lawful type you need? Utilize the US Legal Forms internet site. The support gives a large number of web templates, including the Arkansas Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds, that you can use for business and personal requirements. Each of the forms are inspected by specialists and meet up with federal and state requirements.

When you are already signed up, log in to the account and click on the Down load switch to obtain the Arkansas Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds. Utilize your account to search through the lawful forms you may have purchased formerly. Visit the My Forms tab of the account and get an additional version of the file you need.

When you are a whole new customer of US Legal Forms, allow me to share simple instructions so that you can adhere to:

- Initially, ensure you have chosen the right type for your area/state. It is possible to check out the form utilizing the Preview switch and look at the form information to ensure it is the right one for you.

- In the event the type will not meet up with your needs, make use of the Seach discipline to discover the right type.

- When you are positive that the form would work, click the Get now switch to obtain the type.

- Pick the prices plan you desire and enter in the necessary details. Build your account and buy your order using your PayPal account or Visa or Mastercard.

- Opt for the file file format and obtain the lawful file design to the system.

- Complete, revise and print out and indicator the received Arkansas Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

US Legal Forms will be the most significant collection of lawful forms where you can discover different file web templates. Utilize the company to obtain professionally-produced papers that adhere to state requirements.