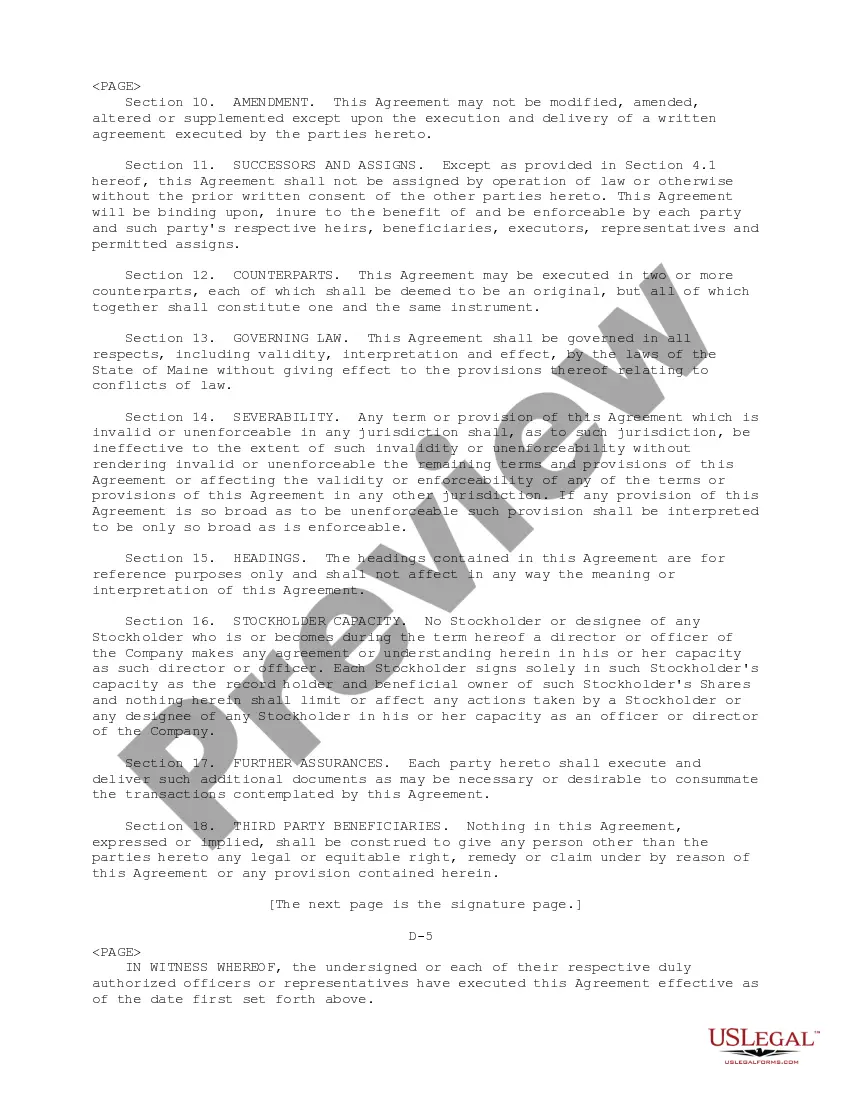

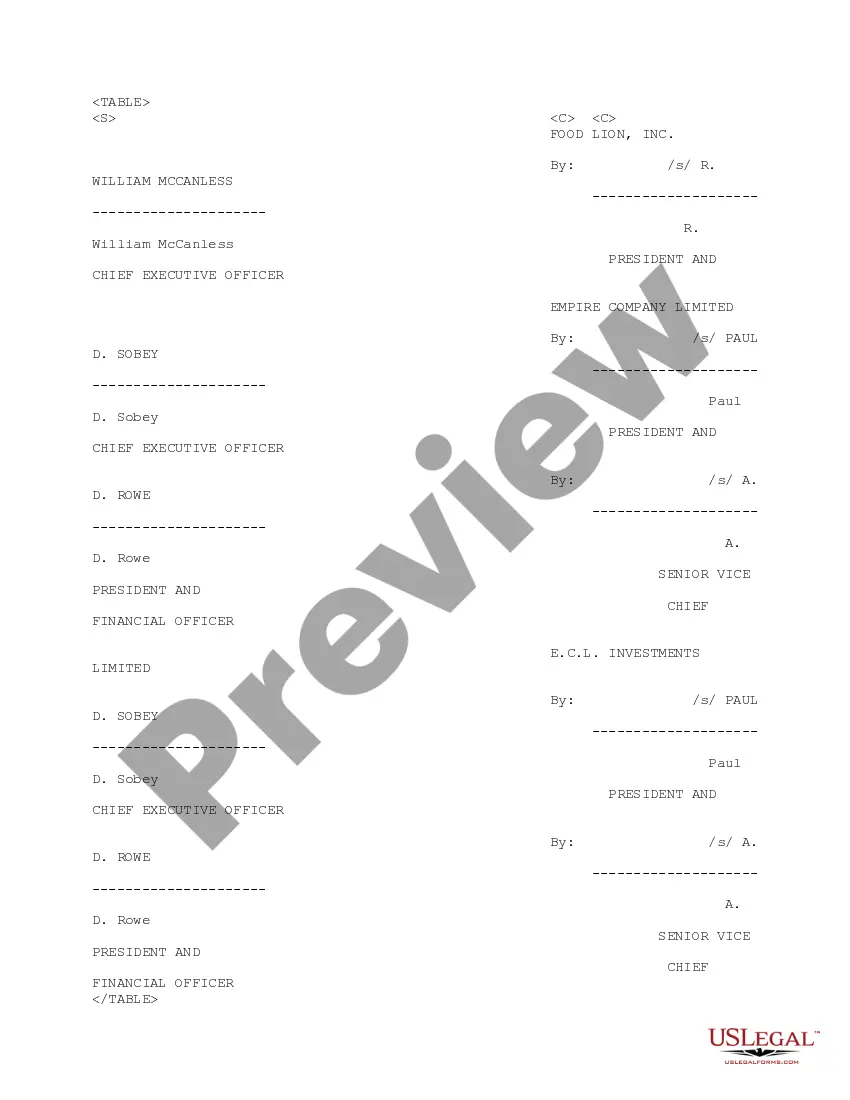

Arkansas Voting Agreement between Food Lion, Inc. and ECL Investments Limited regarding approval of Plan of Merger

Description

How to fill out Voting Agreement Between Food Lion, Inc. And ECL Investments Limited Regarding Approval Of Plan Of Merger?

Discovering the right lawful record template might be a have a problem. Of course, there are a variety of layouts accessible on the Internet, but how do you get the lawful kind you will need? Take advantage of the US Legal Forms website. The service gives a huge number of layouts, including the Arkansas Voting Agreement between Food Lion, Inc. and ECL Investments Limited regarding approval of Plan of Merger, that you can use for enterprise and personal requires. Every one of the kinds are checked by experts and fulfill federal and state needs.

When you are currently listed, log in for your profile and then click the Down load switch to find the Arkansas Voting Agreement between Food Lion, Inc. and ECL Investments Limited regarding approval of Plan of Merger. Make use of profile to check throughout the lawful kinds you may have bought earlier. Check out the My Forms tab of your profile and obtain an additional copy of your record you will need.

When you are a new consumer of US Legal Forms, allow me to share easy recommendations so that you can follow:

- Initially, ensure you have chosen the correct kind for your personal city/region. You may look through the shape while using Review switch and study the shape description to ensure it will be the best for you.

- If the kind will not fulfill your preferences, take advantage of the Seach discipline to discover the proper kind.

- Once you are certain that the shape would work, select the Buy now switch to find the kind.

- Choose the costs plan you need and enter in the necessary info. Build your profile and pay for an order with your PayPal profile or charge card.

- Select the document format and acquire the lawful record template for your gadget.

- Complete, revise and produce and indicator the received Arkansas Voting Agreement between Food Lion, Inc. and ECL Investments Limited regarding approval of Plan of Merger.

US Legal Forms will be the most significant collection of lawful kinds in which you will find different record layouts. Take advantage of the service to acquire skillfully-manufactured documents that follow state needs.