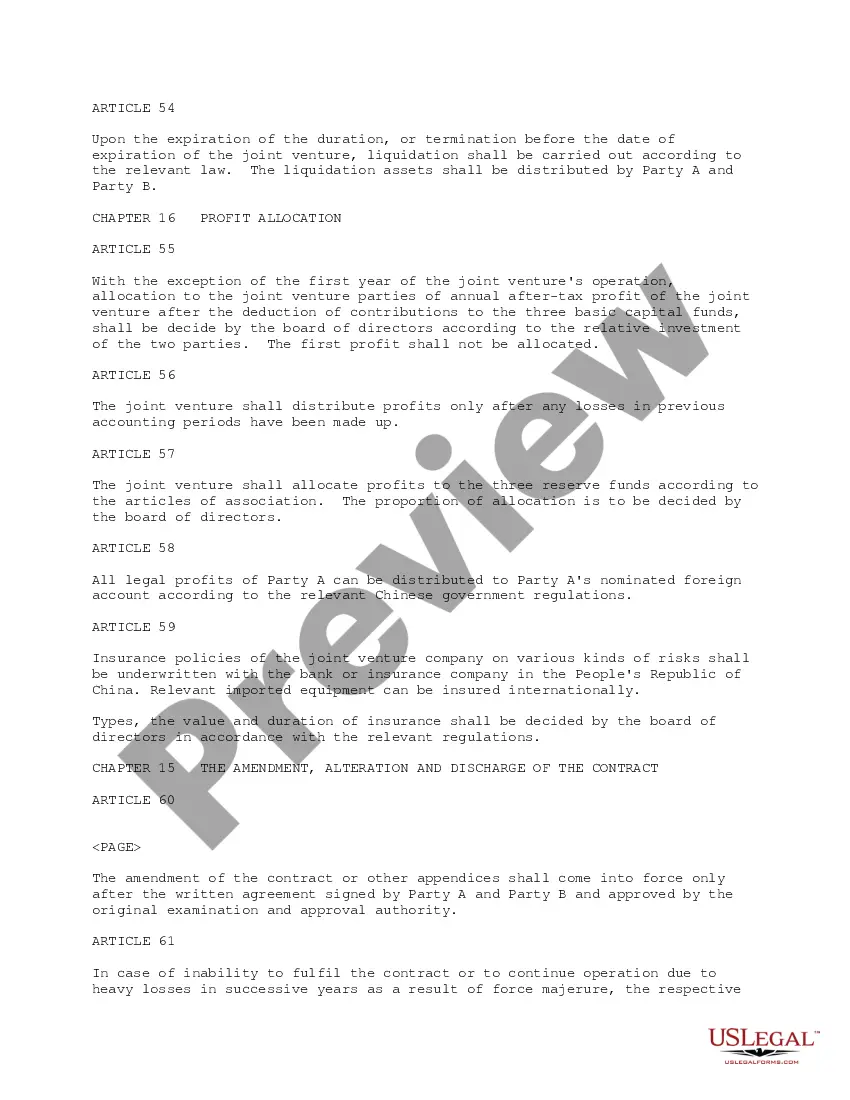

Arkansas Sample Joint Venture Agreement regarding the use of Chinese and foreign investments

Description

How to fill out Sample Joint Venture Agreement Regarding The Use Of Chinese And Foreign Investments?

US Legal Forms - one of several greatest libraries of legal kinds in the USA - delivers a wide range of legal file templates you are able to acquire or print. Using the website, you will get a large number of kinds for enterprise and individual functions, sorted by types, states, or keywords and phrases.You can find the most recent types of kinds such as the Arkansas Sample Joint Venture Agreement regarding the use of Chinese and foreign investments within minutes.

If you already have a membership, log in and acquire Arkansas Sample Joint Venture Agreement regarding the use of Chinese and foreign investments through the US Legal Forms collection. The Obtain switch will appear on every single kind you view. You have accessibility to all earlier downloaded kinds within the My Forms tab of your respective profile.

In order to use US Legal Forms the very first time, here are easy recommendations to get you began:

- Ensure you have picked the best kind for your personal area/area. Click on the Review switch to examine the form`s articles. Read the kind information to ensure that you have selected the correct kind.

- In case the kind does not match your requirements, utilize the Look for discipline on top of the screen to get the one who does.

- In case you are satisfied with the shape, affirm your choice by clicking the Purchase now switch. Then, select the pricing strategy you prefer and provide your qualifications to sign up for the profile.

- Method the transaction. Make use of your charge card or PayPal profile to finish the transaction.

- Pick the file format and acquire the shape in your system.

- Make alterations. Load, change and print and indicator the downloaded Arkansas Sample Joint Venture Agreement regarding the use of Chinese and foreign investments.

Every single template you included in your bank account does not have an expiration day and is your own property eternally. So, if you want to acquire or print yet another backup, just go to the My Forms section and then click in the kind you will need.

Obtain access to the Arkansas Sample Joint Venture Agreement regarding the use of Chinese and foreign investments with US Legal Forms, one of the most extensive collection of legal file templates. Use a large number of specialist and status-specific templates that meet your organization or individual demands and requirements.

Form popularity

FAQ

Names and addresses. Behind each joint venture agreement are participating members (from both legal entities) who contribute assets, capital and/or other resources to the project. Their names and contact information should be listed clearly. What should be included in a joint venture agreement? solomonhollettlawyers.com.au ? news ? what-sho... solomonhollettlawyers.com.au ? news ? what-sho...

BMW Brilliance is the name given to the joint venture that was established to manufacture and sell BMW vehicles in China. This is an example of a joint venture formed for the purpose of entering a foreign market. Joint Venture: Definition, Strategy & Example | StudySmarter studysmarter.co.uk ? international-marketing studysmarter.co.uk ? international-marketing

The agreement should clearly state the parties' intent to form a joint venture and what its purpose is. For one reason, this sort of mission statement helps manage the expectations of all parties involved. But also, joint ventures typically end once the stated goal is accomplished.

The proposal should provide clear details about the responsibilities of each party involved in the venture. It must outline any regulations or legal requirements related to the agreement. It should also list any conditions or restrictions that either party needs to agree upon before entering into a contract.

Updated August 21, 2023. A joint venture agreement is a legal contract that unites two or more parties, whether individuals or companies, in the pursuit of a common goal. The contract stipulates that the parties will combine their resources in order to achieve mutually beneficial ends. Free Joint Venture Agreement Template - PDF | Word - eForms eforms.com ? joint-venture eforms.com ? joint-venture

How to write a Joint Venture Agreement Establish the details of the joint venture. Add information about your industry, location, and which type of venture you'll form. ... Describe the members of the joint venture. ... Set terms for business management. ... Set terms to help avoid or manage disputes. Free Joint Venture Agreement - LawDepot lawdepot.com ? contracts ? joint-venture-ag... lawdepot.com ? contracts ? joint-venture-ag...

Elements of a Joint Venture Agreement Parties or Co-ventures: A joint venture agreement must identify the parties who have agreed to run a business together. Contribution of each party: A joint venture agreement shall identify how much money, time and such other essentials each party will invest.

A joint venture involves two or more businesses pooling their resources and expertise to achieve a particular goal. The risks and rewards of the enterprise are also shared.