Arkansas Stock Transfer Agreement is a legally binding document that outlines the transfer of stock ownership from one entity to another within the state of Arkansas. This agreement pertains specifically to the transaction between EMC Corp., Eagle Merger Corp., and the respective shareholders involved. The stock transfer agreement serves as a contract that establishes the terms and conditions under which the transfer of stocks will occur. It clarifies the process, rights, and obligations of each party involved. This agreement ensures a smooth transition of ownership and protects the interests of both the company and the shareholders. There may be different types of Arkansas Stock Transfer Agreements, based on the specific circumstances and objectives of the transaction. Some possible types could include: 1. Stock Purchase Agreement: This type of agreement is used when one party agrees to purchase stocks from another party. It outlines the purchase price, the number of shares being transferred, and any other terms and conditions related to the transaction. 2. Stock Transfer Agreement for Merger or Acquisition: In the case of a merger or acquisition between EMC Corp., Eagle Merger Corp., and their respective shareholders, this agreement would outline the terms and conditions for the transfer of stocks during the consolidation of the companies. It may include provisions related to the valuation of stocks, the exchange ratio, and any rights or benefits for shareholders post-merger. 3. Employee Stock Option Agreement: If the stock transfer involves the exercise of employee stock options, a specialized agreement may be drafted to govern the transfer. This agreement would outline the terms under which employees can exercise their stock options, including exercise price, vesting schedule, and any applicable restrictions or limitations. When drafting an Arkansas Stock Transfer Agreement, several key elements should be included. These may comprise the names and addresses of the parties involved, the number and type of shares being transferred, the purchase price or exchange ratio (if applicable), representations and warranties of each party, conditions for closing the transaction, and any post-closing obligations or considerations. To ensure compliance with Arkansas state law, the agreement should adhere to the Arkansas Business Corporation Act and any other applicable statutes or regulations. It is advisable to consult with legal professionals experienced in Arkansas corporate law when preparing and executing the Arkansas Stock Transfer Agreement. In conclusion, the Arkansas Stock Transfer Agreement plays a crucial role in documenting and facilitating the transfer of stock ownership between EMC Corp., Eagle Merger Corp., and their respective shareholders. The agreement ensures a fair and transparent process by outlining the rights, responsibilities, and conditions associated with the stock transfer.

Arkansas Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders

Description

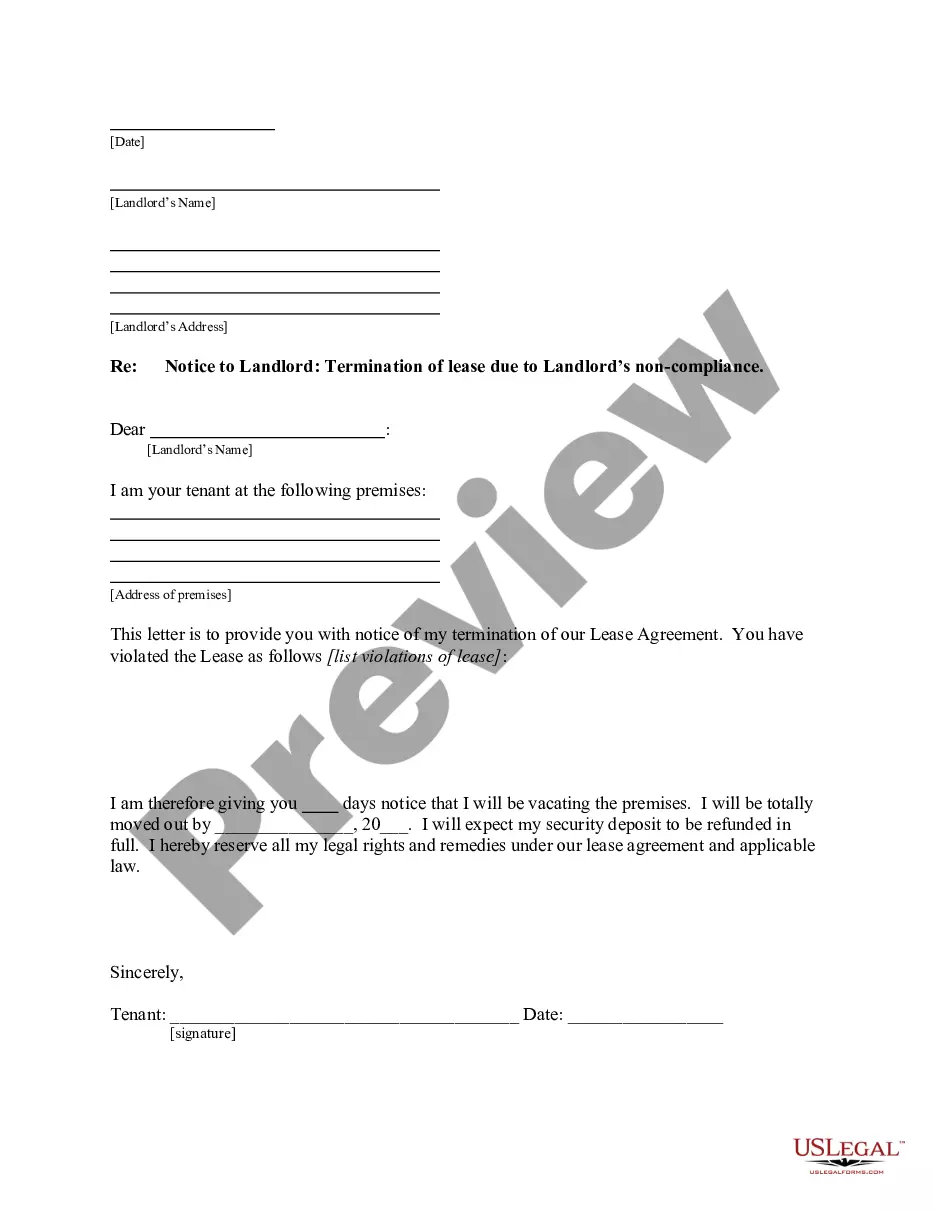

How to fill out Arkansas Stock Transfer Agreement Between EMC Corp., Eagle Merger Corp., And Shareholders?

Are you currently inside a situation in which you will need files for either enterprise or person functions just about every working day? There are a variety of legitimate record web templates available online, but locating ones you can rely on isn`t easy. US Legal Forms gives thousands of develop web templates, such as the Arkansas Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders, that happen to be written to meet state and federal specifications.

In case you are currently knowledgeable about US Legal Forms internet site and also have an account, basically log in. Following that, you are able to download the Arkansas Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders web template.

Should you not have an bank account and need to begin to use US Legal Forms, follow these steps:

- Obtain the develop you require and make sure it is for that right town/state.

- Use the Review switch to review the shape.

- Look at the explanation to ensure that you have chosen the proper develop.

- In case the develop isn`t what you`re trying to find, take advantage of the Research discipline to find the develop that suits you and specifications.

- Whenever you find the right develop, click Get now.

- Pick the pricing strategy you need, fill in the necessary info to create your bank account, and pay for your order making use of your PayPal or Visa or Mastercard.

- Select a practical file structure and download your backup.

Find each of the record web templates you possess bought in the My Forms menu. You can get a extra backup of Arkansas Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders anytime, if required. Just select the essential develop to download or print out the record web template.

Use US Legal Forms, the most substantial variety of legitimate varieties, in order to save efforts and stay away from errors. The services gives appropriately produced legitimate record web templates which you can use for a range of functions. Create an account on US Legal Forms and begin producing your way of life a little easier.