Arkansas Accredited Investor Self-Certification Attachment D

Description

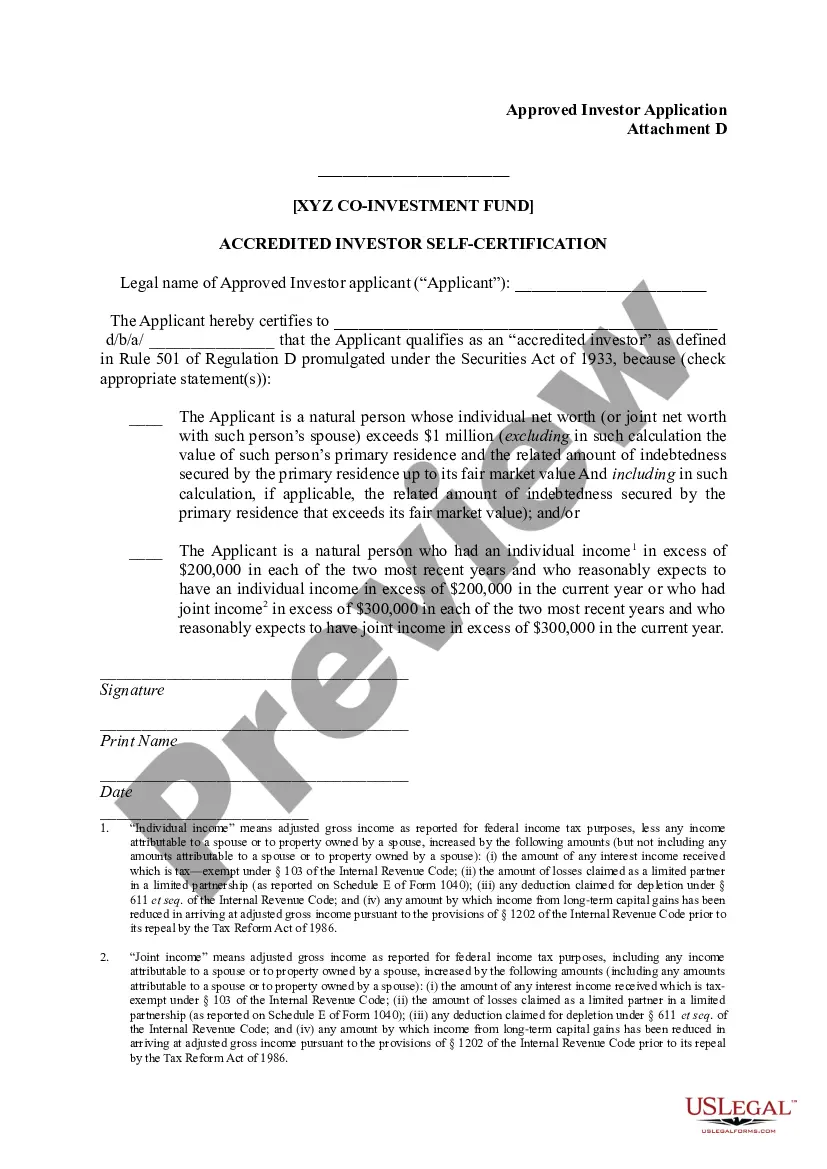

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Self-Certification Attachment D?

It is possible to invest time online trying to find the lawful record web template that suits the federal and state needs you need. US Legal Forms offers a huge number of lawful forms that happen to be reviewed by experts. You can easily down load or print the Arkansas Accredited Investor Self-Certification Attachment D from my services.

If you currently have a US Legal Forms account, it is possible to log in and click the Download switch. After that, it is possible to full, revise, print, or sign the Arkansas Accredited Investor Self-Certification Attachment D. Each lawful record web template you acquire is yours forever. To obtain another duplicate of the obtained develop, proceed to the My Forms tab and click the corresponding switch.

If you use the US Legal Forms web site initially, adhere to the easy guidelines below:

- Very first, ensure that you have selected the correct record web template for your region/metropolis of your choice. See the develop information to make sure you have picked the right develop. If readily available, make use of the Review switch to appear throughout the record web template too.

- If you wish to discover another version from the develop, make use of the Research industry to obtain the web template that fits your needs and needs.

- When you have found the web template you need, just click Get now to carry on.

- Find the pricing strategy you need, key in your credentials, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You should use your credit card or PayPal account to purchase the lawful develop.

- Find the formatting from the record and down load it for your system.

- Make modifications for your record if possible. It is possible to full, revise and sign and print Arkansas Accredited Investor Self-Certification Attachment D.

Download and print a huge number of record themes making use of the US Legal Forms site, which offers the most important assortment of lawful forms. Use skilled and status-specific themes to tackle your company or person requires.