Arkansas Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Term Sheet - Series Seed Preferred Share For Company?

Are you inside a position where you will need documents for either business or individual reasons nearly every working day? There are tons of lawful record themes available online, but locating versions you can rely is not effortless. US Legal Forms offers thousands of kind themes, just like the Arkansas Term Sheet - Series Seed Preferred Share for Company, that are created in order to meet state and federal specifications.

If you are already informed about US Legal Forms site and possess your account, just log in. Next, you are able to obtain the Arkansas Term Sheet - Series Seed Preferred Share for Company format.

Should you not have an account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you want and ensure it is for the appropriate city/area.

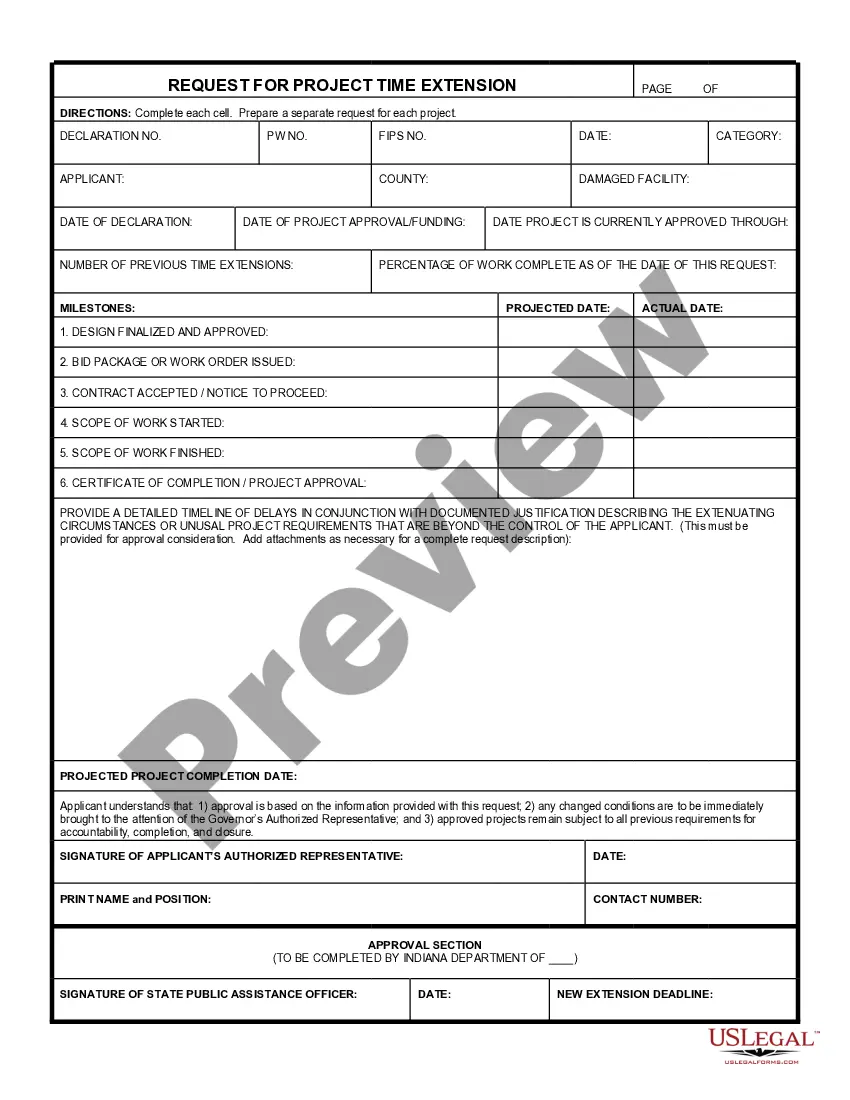

- Use the Review option to check the shape.

- Browse the explanation to ensure that you have chosen the proper kind.

- If the kind is not what you are seeking, utilize the Lookup area to find the kind that meets your needs and specifications.

- If you find the appropriate kind, just click Get now.

- Pick the pricing strategy you desire, submit the necessary information to make your bank account, and pay for an order using your PayPal or credit card.

- Choose a handy data file structure and obtain your copy.

Find all of the record themes you may have bought in the My Forms food selection. You can aquire a further copy of Arkansas Term Sheet - Series Seed Preferred Share for Company whenever, if required. Just go through the required kind to obtain or produce the record format.

Use US Legal Forms, the most substantial collection of lawful varieties, in order to save efforts and prevent faults. The support offers professionally made lawful record themes which you can use for a selection of reasons. Generate your account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

Is preferred stock safer than common stock? Yes, preferred stock is less risky than common stock because payments of interest or dividends on preferred stock are required to be paid before any payments to common shareholders. This means that preferred stock is senior to common stock.

Class A, common stock: Each share confers one vote and ordinary access to dividends and assets. Class B, preferred stock: Each share confers one vote, but shareholders receive $2 in dividends for every $1 distributed to Class A shareholders. This class of stock has priority distribution for dividends and assets.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

The Series A Preferred Stock, voting separately as a class at each annual meeting, shall be entitled to nominate and elect a number of directors equal to one-third of the total number of directorships (each director entitled to be elected by the Series A Preferred Stock, a ?Series A Director?).

What Is an Example of a Preferred Stock? Consider a company is issuing a 7% preferred stock at a $1,000 par value. In turn, the investor would receive a $70 annual dividend, or $17.50 quarterly. Typically, this preferred stock will trade around its par value, behaving more similarly to a bond.