The Arkansas Simple Harmonious Agreement for Revenue and Equity (SHARE) is a legal document that establishes a mutually beneficial relationship between two or more parties in the state of Arkansas. It outlines the terms and conditions under which revenue and equity will be shared between the parties involved. SHARE aims to provide a simple and harmonious framework for managing financial transactions and promoting fairness in revenue sharing. The agreement ensures that each party's contribution to revenue generation is recognized and appropriately compensated. It fosters transparency, trust, and accountability among the parties involved, promoting a balanced distribution of both financial and non-financial benefits. There are several types of SHARE agreements that can be tailored to specific circumstances and business relationships, each with its own unique characteristics and provisions. Some common variations include: 1. SHARE for Partnerships: This type of agreement is commonly used when two or more parties collaborate to generate revenue and share ownership in a business venture. It outlines how profits, losses, and equity will be apportioned among the partners based on their respective contributions and roles. 2. SHARE for Joint Ventures: When two or more separate entities come together for a specific project or venture, this agreement ensures that revenue sharing and equity arrangements are clearly defined. It establishes the terms for collaboration, investment returns, and exit strategies. 3. SHARE for Licensing Agreements: In cases where intellectual property is licensed for revenue generation, this agreement specifies how the licensor and licensee will share the financial benefits derived from the licensed property. It addresses matters such as royalty rates, revenue thresholds, and sublicensing rights. 4. SHARE for Investor-Startup Relationships: Startups often use this agreement to secure funding from investors while effectively sharing revenue and equity. It outlines how the investor will be compensated, whether through equity ownership, profit-sharing, or a combination of both. SHARE agreements ensure that revenue and equity sharing arrangements are fair, transparent, and legally binding. Parties entering into these agreements should consult legal professionals to ensure compliance with Arkansas state laws and to draft a document that suits their specific needs and circumstances. By fostering clear expectations and a balanced distribution of benefits, SHARE agreements play a pivotal role in promoting harmonious business relationships and ensuring long-term success for all parties involved.

Arkansas Simple Harmonious Agreement for Revenue and Equity

Description

How to fill out Arkansas Simple Harmonious Agreement For Revenue And Equity?

Discovering the right authorized record web template can be a have difficulties. Naturally, there are a lot of layouts available on the Internet, but how will you discover the authorized form you want? Take advantage of the US Legal Forms web site. The support delivers a huge number of layouts, such as the Arkansas Simple Harmonious Agreement for Revenue and Equity, which you can use for enterprise and private needs. All the types are checked out by specialists and meet federal and state demands.

In case you are currently listed, log in to the account and click the Down load option to have the Arkansas Simple Harmonious Agreement for Revenue and Equity. Make use of account to check through the authorized types you have acquired in the past. Visit the My Forms tab of your account and get one more version of the record you want.

In case you are a new user of US Legal Forms, listed here are simple directions that you should follow:

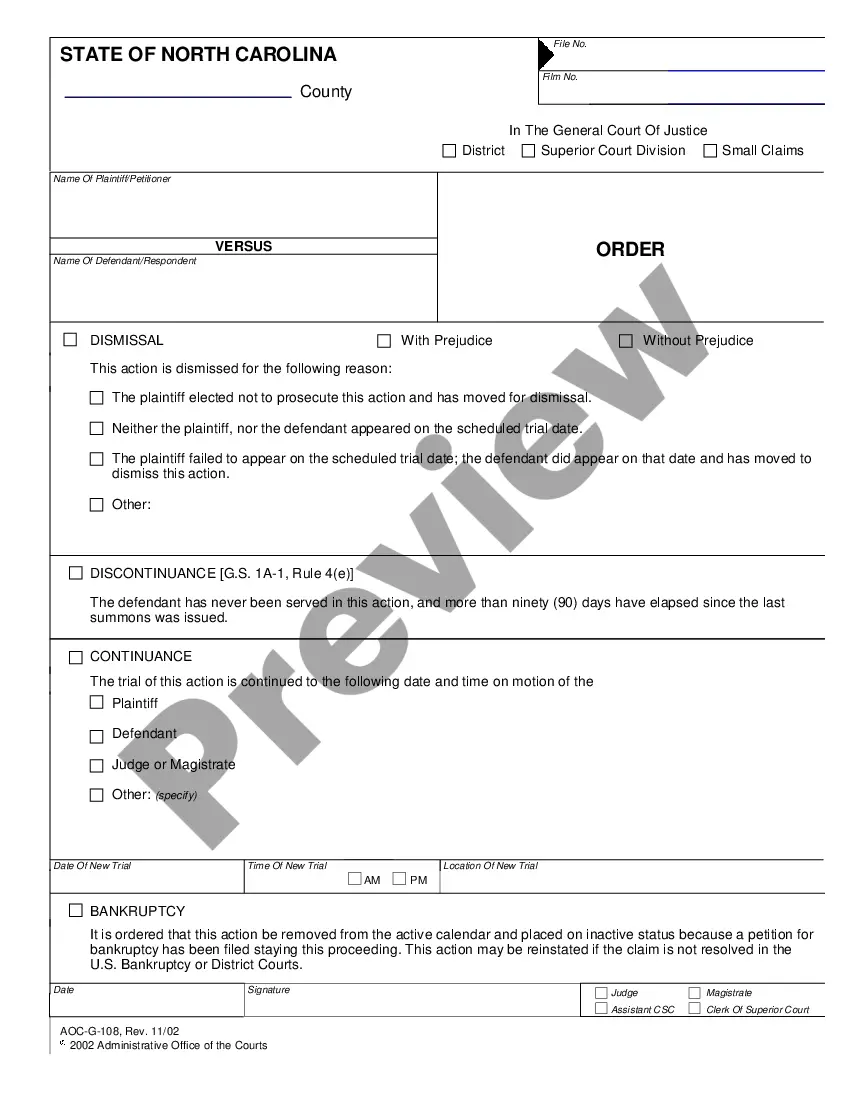

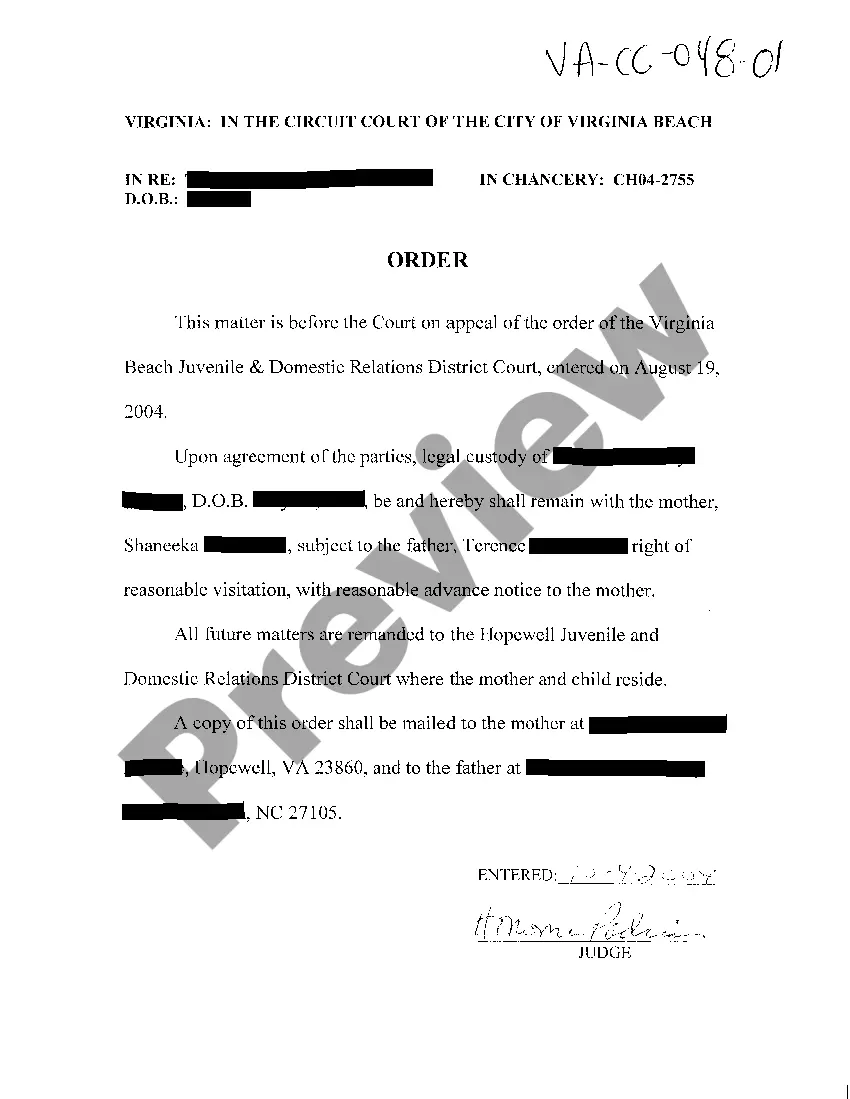

- Initial, make certain you have chosen the proper form for the city/area. You can examine the form while using Review option and look at the form outline to guarantee this is the best for you.

- If the form fails to meet your expectations, take advantage of the Seach industry to obtain the correct form.

- Once you are sure that the form would work, click the Acquire now option to have the form.

- Select the costs prepare you need and enter the required information. Make your account and pay for an order with your PayPal account or credit card.

- Opt for the data file structure and acquire the authorized record web template to the device.

- Full, revise and print and indication the acquired Arkansas Simple Harmonious Agreement for Revenue and Equity.

US Legal Forms will be the biggest library of authorized types in which you can see different record layouts. Take advantage of the company to acquire skillfully-produced files that follow status demands.