The Arkansas Investors Rights Agreement is a legally binding document that outlines the rights and protections granted to investors in Arkansas. This agreement is designed to safeguard the interests of investors and promote transparency in investment activities within the state. It serves as a crucial tool for both individual and institutional investors when engaging in business ventures in Arkansas. One key aspect covered in the Arkansas Investors Rights Agreement is the protection of investor rights. It ensures that investors are granted certain fundamental rights, such as access to accurate and timely financial information, the right to vote on significant business decisions, and the right to inspect company records. These rights empower investors to make informed decisions and actively participate in the management and direction of their investments. Moreover, the agreement addresses the concept of investor liability and risk management. It sets clear parameters regarding the extent of investor liability, protecting them from excessive legal and financial burdens in case of business failure. Differentiating types and classes of investors may also be outlined within this agreement, depending on their level of involvement, investment amount, or position in the business. Another crucial component of the Arkansas Investors Rights Agreement is conflict resolution and dispute mechanisms. It commonly includes provisions for arbitration or mediation procedures, which provide a cost-effective and efficient way of resolving conflicts between investors and business entities. These mechanisms help maintain a favorable investment climate by offering fair and impartial resolutions to disputes and minimizing legal uncertainty. Furthermore, the agreement may specify the obligations and responsibilities of both investors and the company, ensuring mutual adherence to them. It might outline the conditions under which an investor can exit an investment and the process for offering their shares to potential buyers. This flexibility allows investors to assess their investment strategy and make informed decisions based on market conditions, personal preferences, or other factors. Regarding different types of Arkansas Investors Rights Agreements, they can vary based on the specific industry, investment structure, or company's legal status. For example, there may be distinct agreements for venture capital investments, private equity investments, or crowdfunding initiatives. Each type of agreement tailors its provisions to accommodate the unique dynamics and requirements of those investments. In conclusion, the Arkansas Investors Rights Agreement is a comprehensive legal document designed to protect and promote the rights of investors involved in business activities within Arkansas. It covers essential aspects like investor rights, liability management, conflict resolution, and obligations. While various types of agreement exist to suit different investment scenarios, they all share the common goal of ensuring a transparent and equitable investment environment.

Arkansas Investors Rights Agreement

Description

How to fill out Arkansas Investors Rights Agreement?

Are you currently in the position the place you require files for both organization or person reasons almost every working day? There are tons of legal file layouts accessible on the Internet, but discovering types you can trust isn`t straightforward. US Legal Forms delivers thousands of develop layouts, just like the Arkansas Investors Rights Agreement, which can be published in order to meet federal and state needs.

Should you be previously knowledgeable about US Legal Forms site and possess an account, merely log in. After that, it is possible to down load the Arkansas Investors Rights Agreement web template.

Unless you offer an account and want to begin using US Legal Forms, follow these steps:

- Get the develop you need and make sure it is for the appropriate town/area.

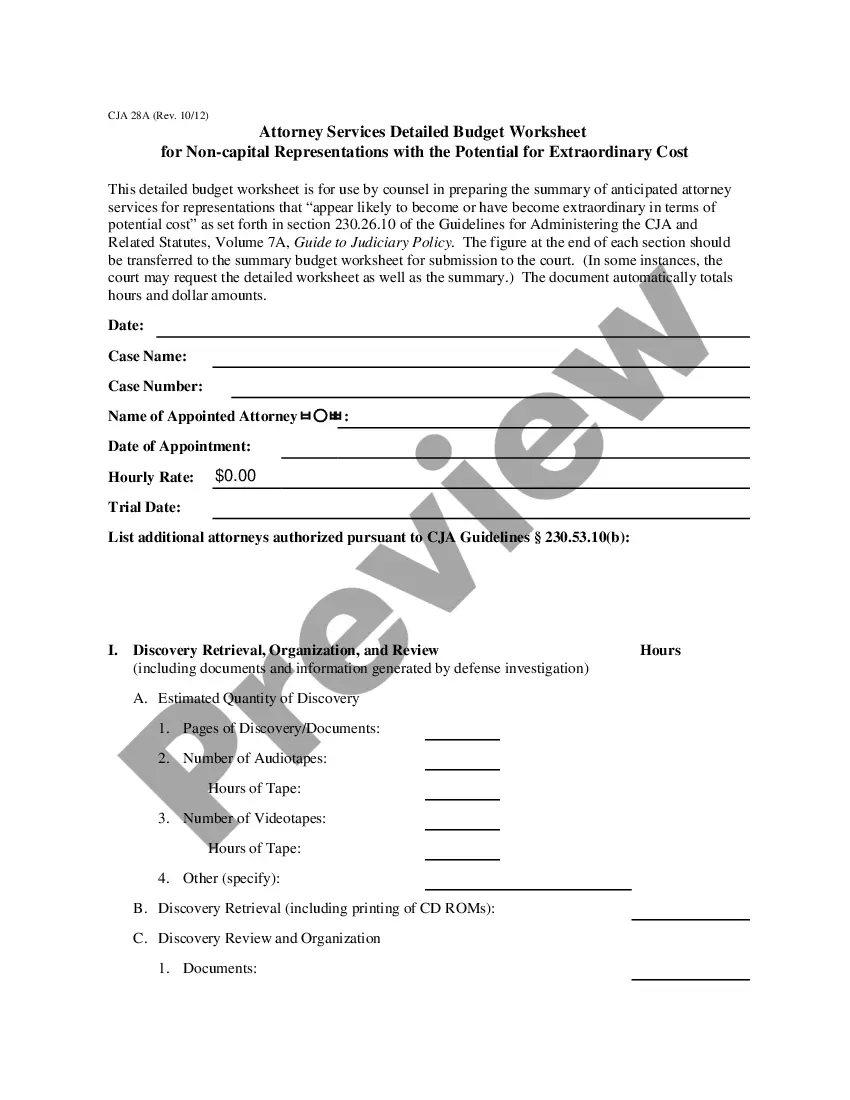

- Use the Review switch to examine the form.

- Look at the description to ensure that you have selected the appropriate develop.

- In the event the develop isn`t what you`re searching for, take advantage of the Research area to find the develop that suits you and needs.

- When you discover the appropriate develop, just click Buy now.

- Opt for the prices strategy you would like, submit the desired information to create your account, and purchase the transaction using your PayPal or bank card.

- Choose a hassle-free file file format and down load your copy.

Find every one of the file layouts you possess bought in the My Forms food selection. You may get a further copy of Arkansas Investors Rights Agreement any time, if required. Just select the necessary develop to down load or produce the file web template.

Use US Legal Forms, probably the most substantial selection of legal kinds, to conserve time and steer clear of mistakes. The assistance delivers appropriately manufactured legal file layouts which can be used for an array of reasons. Produce an account on US Legal Forms and begin making your lifestyle easier.