Arkansas Carrier Services Contract - Self-Employed Independent Contractor

Description

How to fill out Arkansas Carrier Services Contract - Self-Employed Independent Contractor?

Choosing the right legitimate record design can be quite a struggle. Naturally, there are tons of web templates available online, but how would you find the legitimate develop you require? Make use of the US Legal Forms internet site. The support gives thousands of web templates, such as the Arkansas Carrier Services Contract - Self-Employed Independent Contractor, which you can use for enterprise and private requirements. All of the forms are checked out by specialists and meet up with state and federal requirements.

When you are presently listed, log in to your accounts and click the Down load option to obtain the Arkansas Carrier Services Contract - Self-Employed Independent Contractor. Make use of accounts to look throughout the legitimate forms you have ordered in the past. Check out the My Forms tab of your respective accounts and get an additional duplicate from the record you require.

When you are a whole new user of US Legal Forms, here are easy guidelines so that you can comply with:

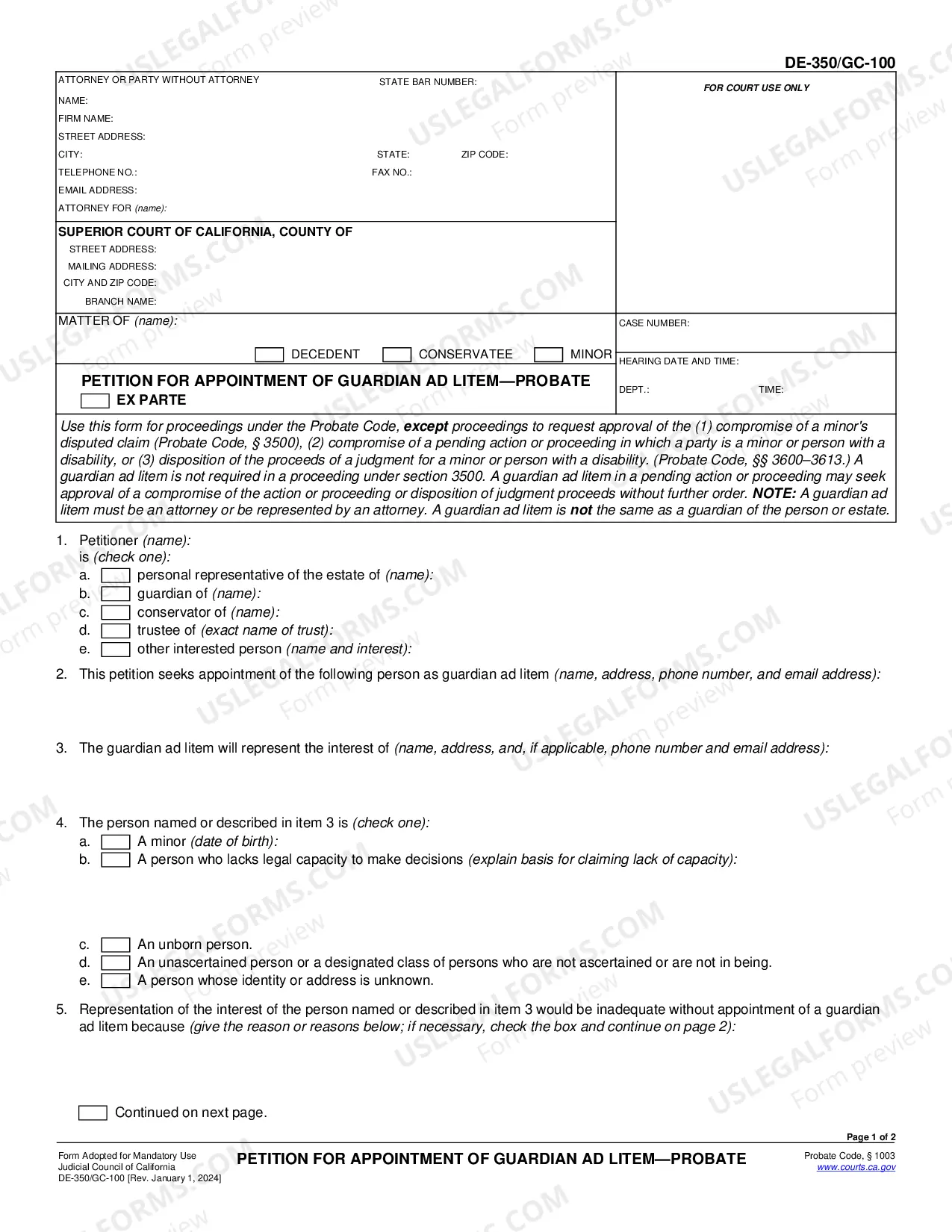

- Initial, be sure you have selected the correct develop for your personal city/state. You can look over the form using the Review option and browse the form description to make certain it is the right one for you.

- In the event the develop is not going to meet up with your expectations, use the Seach field to get the correct develop.

- Once you are certain that the form is acceptable, click the Get now option to obtain the develop.

- Opt for the prices plan you want and type in the essential information and facts. Build your accounts and purchase an order with your PayPal accounts or charge card.

- Pick the data file structure and obtain the legitimate record design to your gadget.

- Full, modify and print out and indication the acquired Arkansas Carrier Services Contract - Self-Employed Independent Contractor.

US Legal Forms is the biggest catalogue of legitimate forms in which you can see a variety of record web templates. Make use of the company to obtain expertly-created files that comply with status requirements.

Form popularity

FAQ

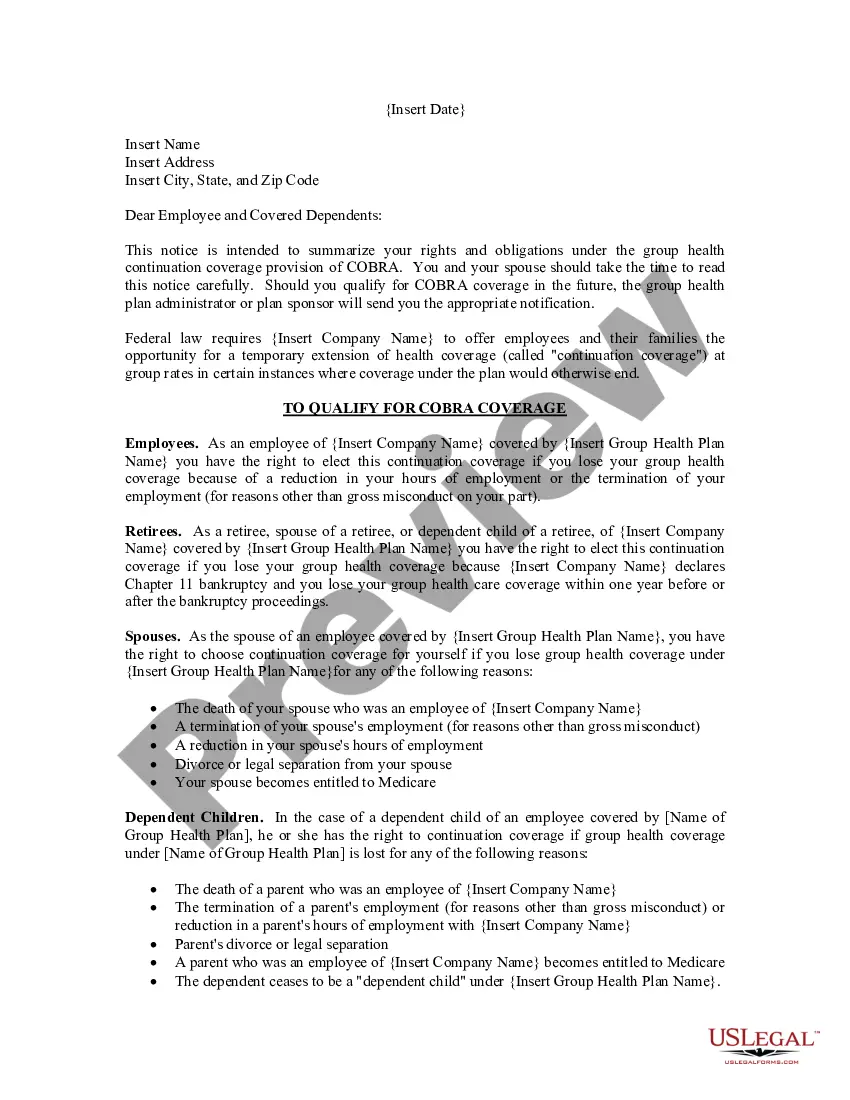

Independent contractors are not employees, nor are they eligible for employee benefits. They do not have taxes withheld from their paychecks but instead must pay estimated income taxes in advance through quarterly payments.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

As an independent contractor, you'll usually make more money than if you were an employee. Companies are willing to pay more for independent contractors because they don't have the enter into expensive, long-term commitments or pay health benefits, unemployment compensation, Social Security taxes, and Medicare taxes.

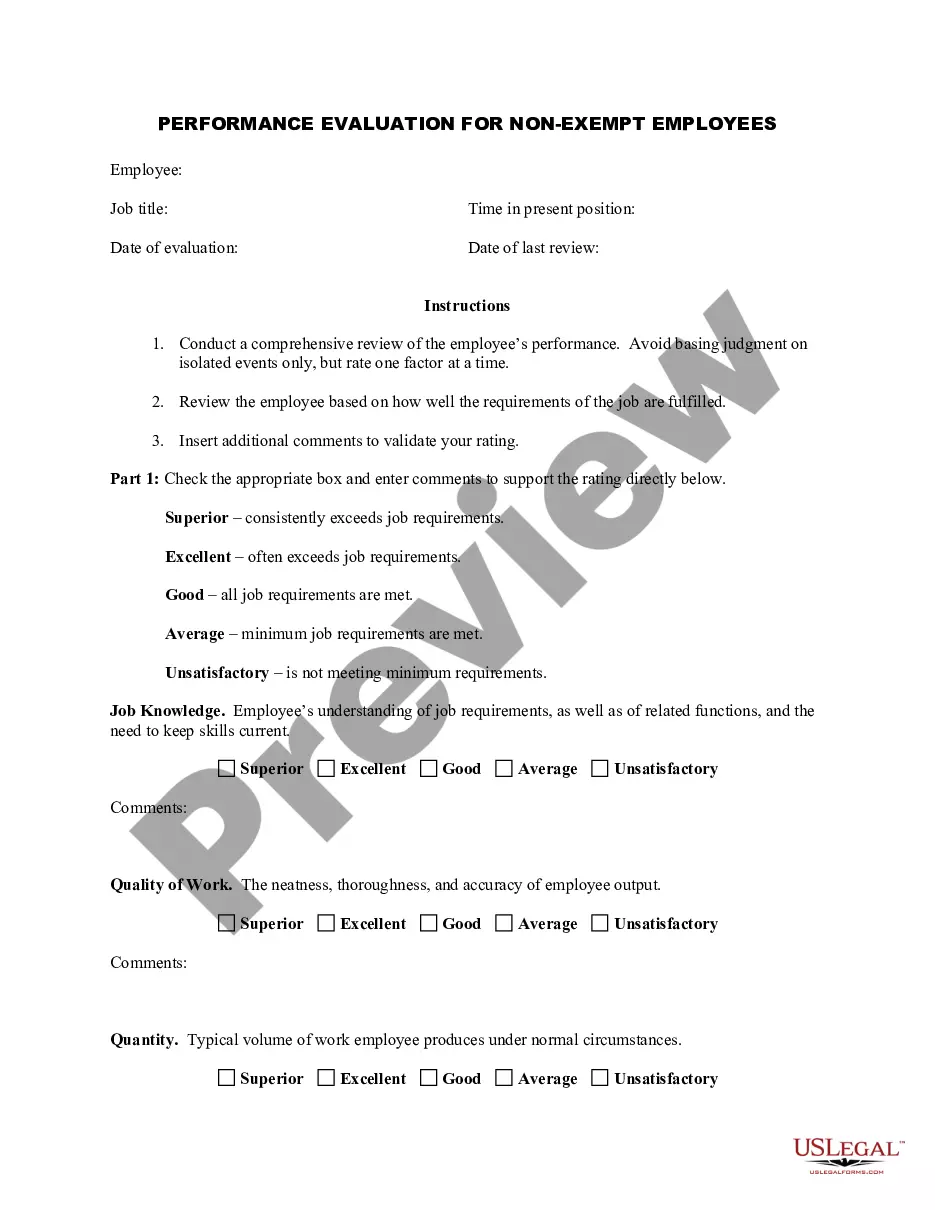

Using our template will ensure you complete the necessary steps:State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Arkansas uses an ABC test for unemployment insurance, where in order to obtain independent contractor status under the Employment Security Act, it is necessary that an employer prove each of three statutory subsections: that an individual has been and will continue to be free from control or direction in connection

Under the law, the general rule is that the copyright in and to the work product of an individual employee or independent contractor is owned by that individual unless an exception applies. The Work for Hire doctrine is an exception to such rule.

Independent Contractor Responsibilities:Liaising with the client to elucidate job requirements, as needed.Gathering the materials needed to complete the assignment.Overseeing the assignment, from inception to completion.Tailoring your approach to work to suit the job specifications, as required.More items...