Arkansas Self-Employed Independent Contractor Chemist Agreement

Description

How to fill out Arkansas Self-Employed Independent Contractor Chemist Agreement?

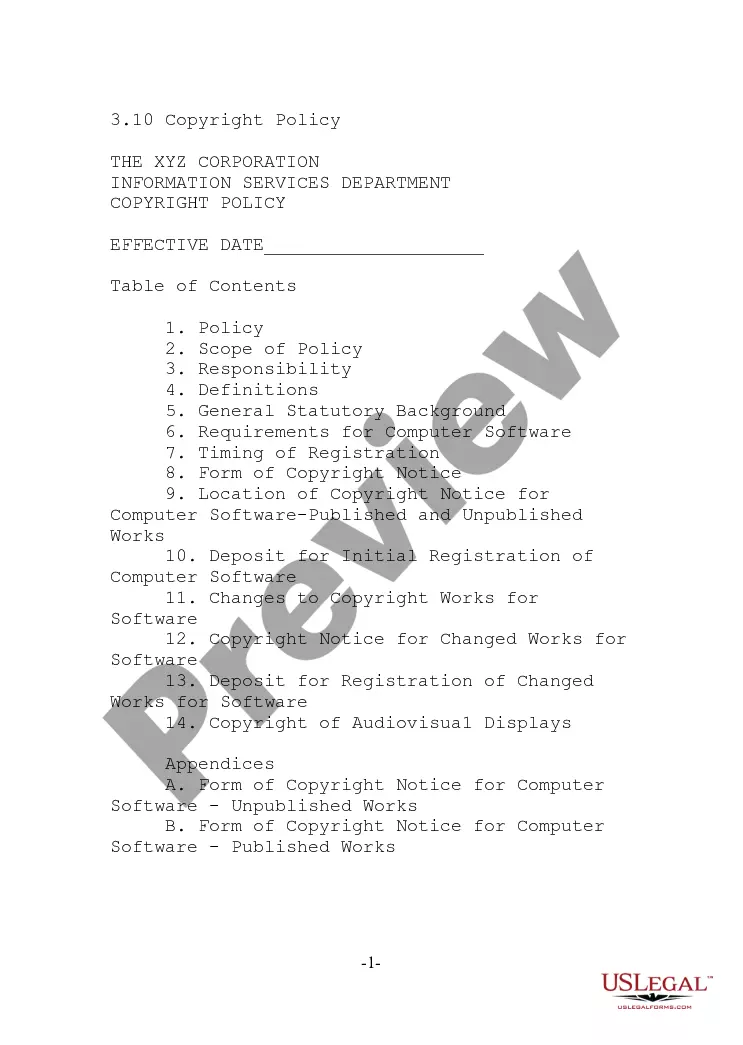

US Legal Forms - among the greatest libraries of legitimate varieties in the USA - delivers a variety of legitimate file layouts it is possible to download or print. Making use of the website, you can get a huge number of varieties for enterprise and specific reasons, sorted by classes, suggests, or key phrases.You can get the most up-to-date models of varieties much like the Arkansas Self-Employed Independent Contractor Chemist Agreement within minutes.

If you already possess a registration, log in and download Arkansas Self-Employed Independent Contractor Chemist Agreement through the US Legal Forms library. The Down load key will show up on each and every kind you perspective. You gain access to all earlier acquired varieties from the My Forms tab of your respective profile.

If you wish to use US Legal Forms for the first time, here are basic directions to help you get started:

- Ensure you have selected the proper kind for the metropolis/county. Click on the Preview key to review the form`s content. Read the kind information to ensure that you have selected the correct kind.

- In case the kind doesn`t fit your demands, utilize the Search discipline towards the top of the monitor to obtain the one which does.

- If you are content with the shape, verify your selection by clicking on the Acquire now key. Then, opt for the prices strategy you favor and supply your references to register for an profile.

- Approach the transaction. Make use of bank card or PayPal profile to perform the transaction.

- Choose the formatting and download the shape in your system.

- Make adjustments. Load, change and print and indication the acquired Arkansas Self-Employed Independent Contractor Chemist Agreement.

Every template you included with your money lacks an expiration date and is also the one you have permanently. So, in order to download or print another copy, just check out the My Forms area and click about the kind you need.

Get access to the Arkansas Self-Employed Independent Contractor Chemist Agreement with US Legal Forms, one of the most comprehensive library of legitimate file layouts. Use a huge number of specialist and condition-certain layouts that meet your organization or specific needs and demands.

Form popularity

FAQ

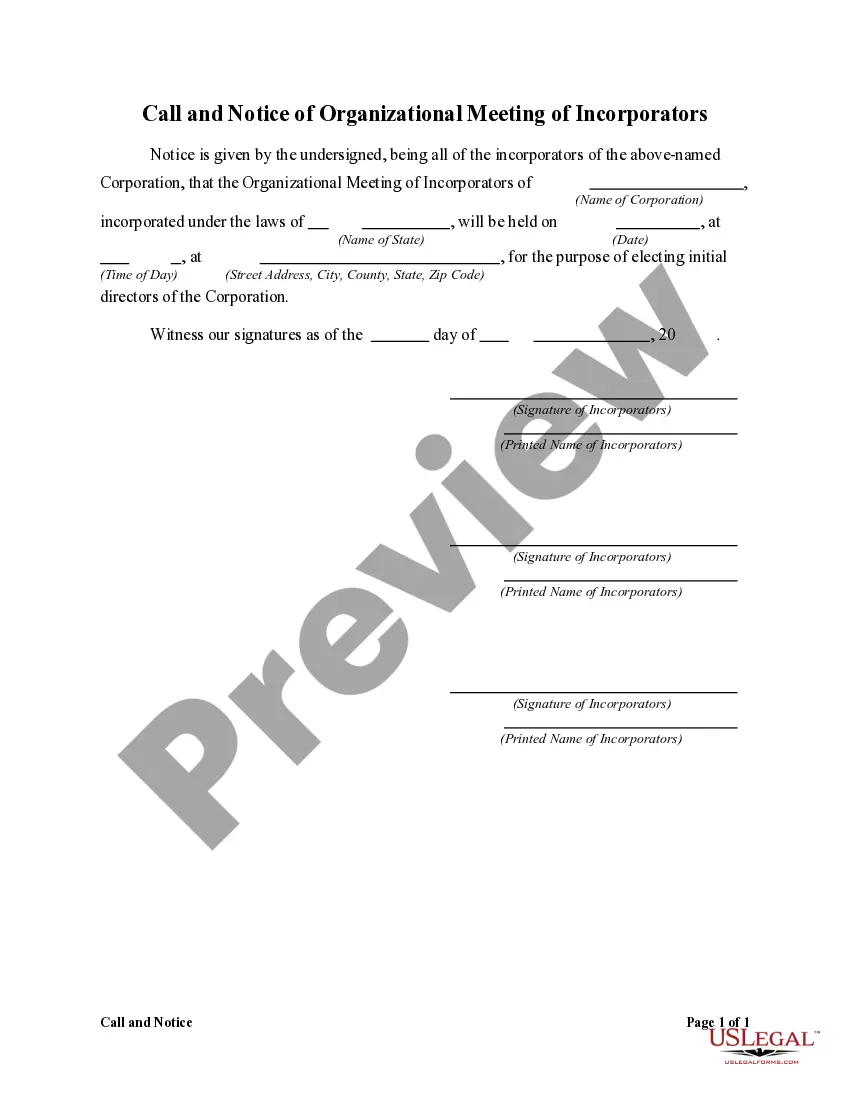

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.