Arkansas Breeder Agreement - Self-Employed Independent Contractor

Description

How to fill out Arkansas Breeder Agreement - Self-Employed Independent Contractor?

Are you currently inside a placement that you will need files for both business or personal purposes virtually every day time? There are a lot of legitimate papers templates available online, but locating ones you can depend on isn`t easy. US Legal Forms gives thousands of form templates, like the Arkansas Breeder Agreement - Self-Employed Independent Contractor, that are written to meet state and federal needs.

In case you are currently knowledgeable about US Legal Forms internet site and have an account, just log in. After that, you may acquire the Arkansas Breeder Agreement - Self-Employed Independent Contractor design.

If you do not come with an profile and wish to start using US Legal Forms, adopt these measures:

- Get the form you need and ensure it is for that proper metropolis/county.

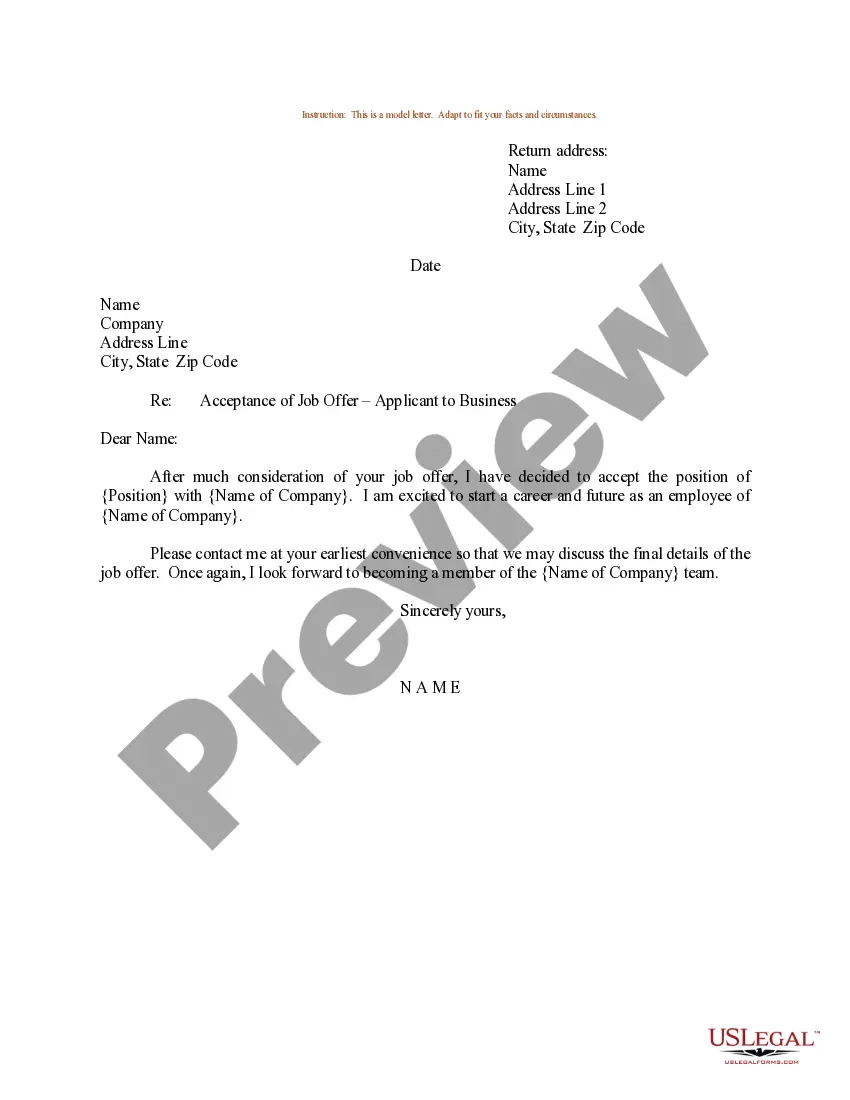

- Take advantage of the Review button to examine the form.

- Browse the explanation to actually have selected the proper form.

- When the form isn`t what you`re searching for, use the Research industry to get the form that meets your needs and needs.

- If you get the proper form, click Get now.

- Choose the pricing plan you desire, complete the desired information to produce your money, and pay for your order using your PayPal or Visa or Mastercard.

- Select a handy file file format and acquire your version.

Get each of the papers templates you may have bought in the My Forms menus. You can get a more version of Arkansas Breeder Agreement - Self-Employed Independent Contractor at any time, if possible. Just click the needed form to acquire or print the papers design.

Use US Legal Forms, by far the most extensive variety of legitimate varieties, to save lots of efforts and steer clear of faults. The service gives expertly produced legitimate papers templates that can be used for a variety of purposes. Generate an account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

contract is kind of commitment where you write down what you want to achieve as well as how to achieve it. Often, it also clearly states any rewards for completing the contract as well as any penalties for breaking it.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The Self-Contract is a tool that can help you move towards your goals. The idea is to make a commitment to yourself to make positive, effective change in your life.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.