Arkansas Woodworking Services Contract - Self-Employed

Description

How to fill out Arkansas Woodworking Services Contract - Self-Employed?

Choosing the best legal document web template could be a have a problem. Of course, there are tons of layouts available on the Internet, but how will you discover the legal type you need? Utilize the US Legal Forms website. The services delivers a huge number of layouts, for example the Arkansas Woodworking Services Contract - Self-Employed, that can be used for business and personal requirements. Each of the forms are examined by professionals and meet up with federal and state needs.

If you are presently registered, log in in your accounts and then click the Obtain switch to find the Arkansas Woodworking Services Contract - Self-Employed. Utilize your accounts to search with the legal forms you might have bought formerly. Go to the My Forms tab of your respective accounts and have another version from the document you need.

If you are a new user of US Legal Forms, listed here are easy instructions that you should follow:

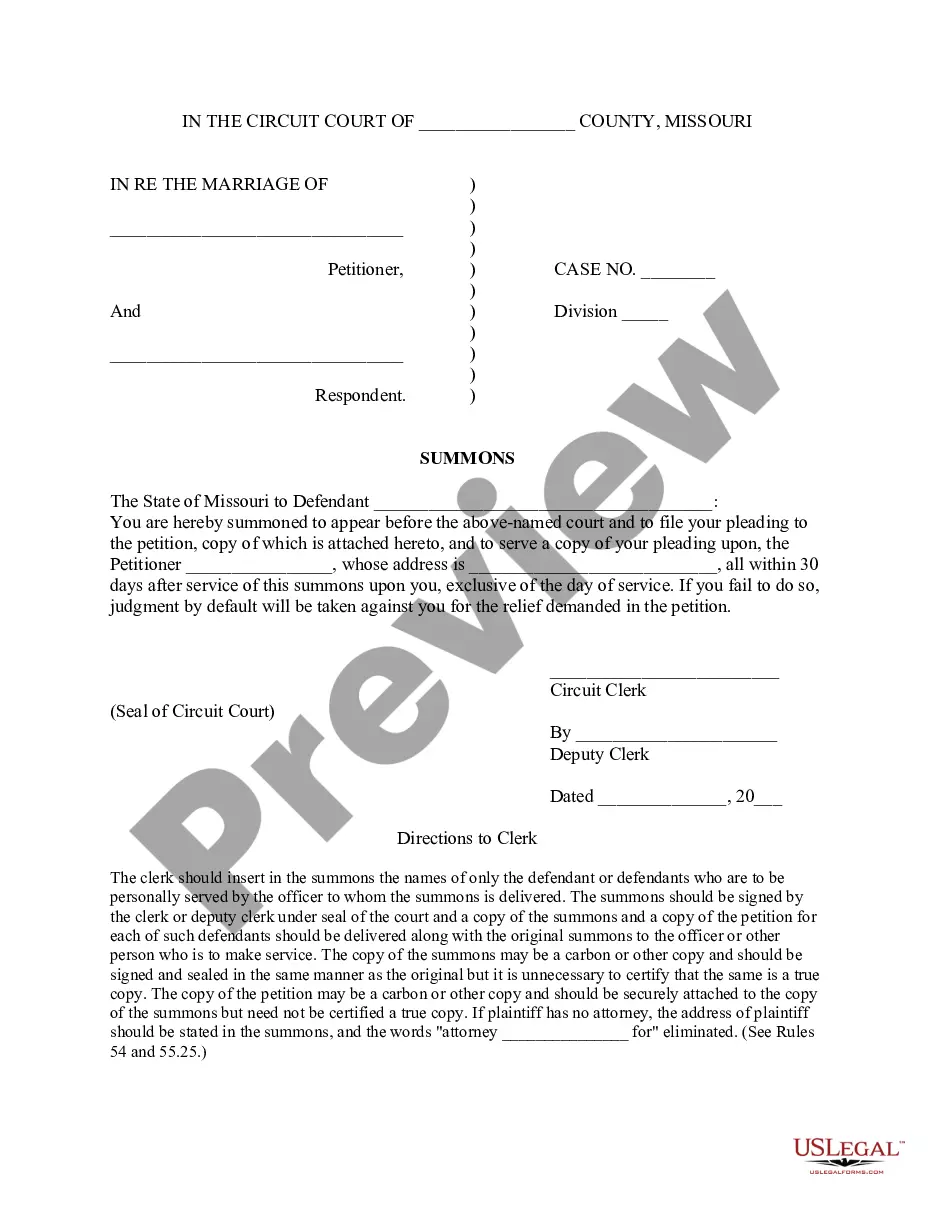

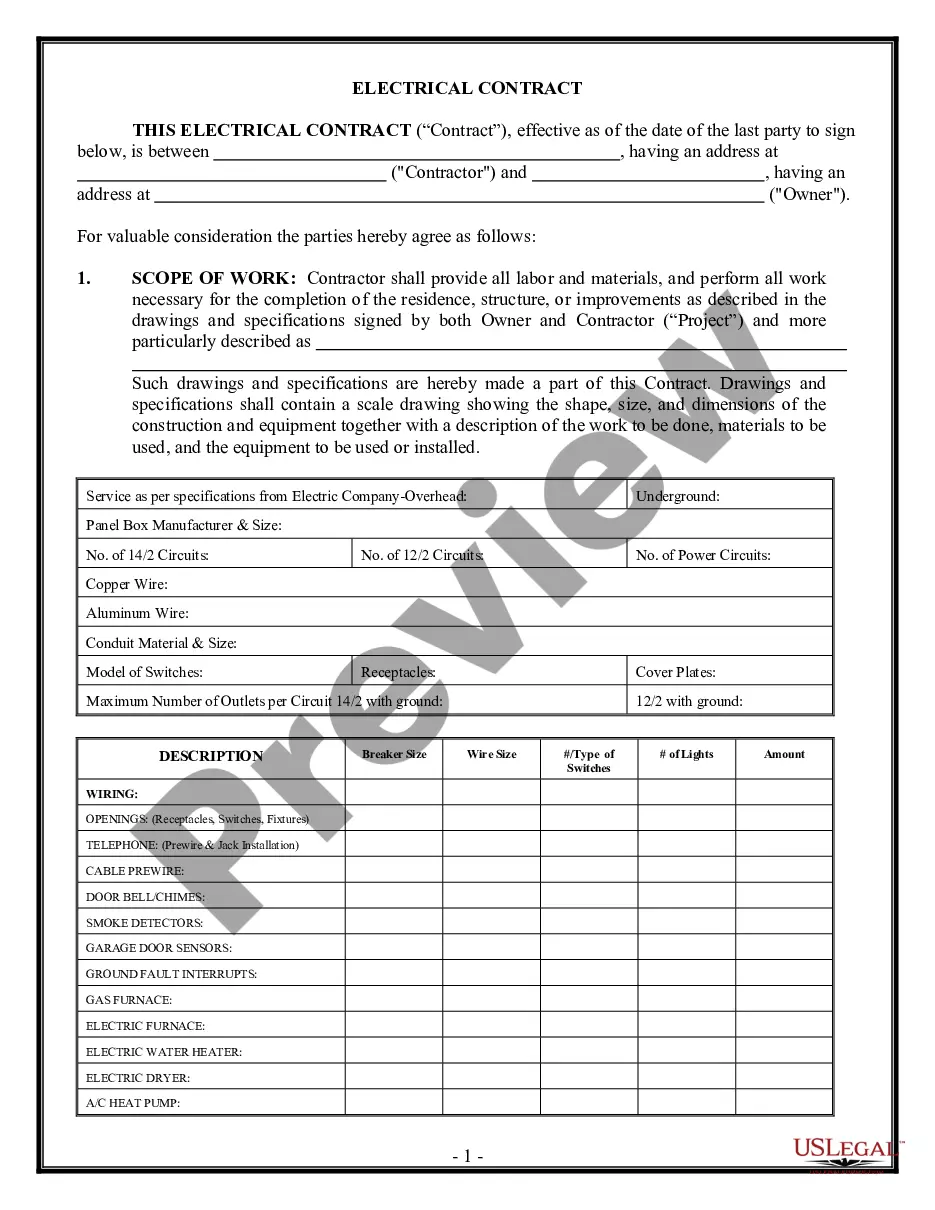

- Initially, be sure you have selected the correct type for your area/state. You may look over the form utilizing the Review switch and read the form information to ensure this is basically the best for you.

- In the event the type will not meet up with your preferences, use the Seach discipline to get the proper type.

- Once you are positive that the form is proper, click the Acquire now switch to find the type.

- Choose the prices strategy you want and enter the required info. Make your accounts and purchase your order using your PayPal accounts or charge card.

- Choose the file format and down load the legal document web template in your system.

- Full, modify and print out and indication the obtained Arkansas Woodworking Services Contract - Self-Employed.

US Legal Forms may be the greatest local library of legal forms where you will find various document layouts. Utilize the service to down load professionally-manufactured files that follow condition needs.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Independent contractor taxes for the self-employedSelf-employed individuals might not have taxes automatically withheld from their paycheck as they would if they had an employer, but that doesn't necessarily mean they are off the hook. In most cases, they're required to pay taxes and file an annual return.

Independent contractors are responsible for their own federal payroll taxes, also known as self-employment tax. This is a two-part tax, with 12.4% going to Social Security and 2.9% going to Medicare, for a total of 15.3%. Payments are usually filed quarterly using Form 1040-ES, Estimated Tax for Individuals.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

Woodworking for Beginners: 6 Easy Tips to Get Started6 Tips for Woodworking for Beginners:Create a simple woodworking setup.Learn how to read a tape measure.Understand lumber dimensions and species.Try to always use straight wood boards.Learn how to use a few essential tools.Sand your wood.

Five Things Your Contracts Should IncludeGet it in Writing. The most important part of every contract is that it must be in writing.Be Specific in Your Terms. Your contract should be specific in its terms.Dictate Terms for Contract Termination.Confidentiality Matters.

For example, if you earn $15,000 from working as a 1099 contractor and you file as a single, non-married individual, you should expect to put aside 30-35% of your income for taxes. Putting aside money is important because you may need it to pay estimated taxes quarterly.

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

More info

Position.