This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement with regards to taxes or insurance considerations.

Arkansas Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations

Description

How to fill out Indemnity Provisions - Dollar Exposure Of The Indemnity Regarding Tax And Insurance Considerations?

US Legal Forms - among the most significant libraries of lawful varieties in the USA - offers an array of lawful document layouts you can acquire or print. Making use of the web site, you will get a large number of varieties for organization and person uses, sorted by classes, says, or key phrases.You can get the latest types of varieties much like the Arkansas Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations in seconds.

If you have a monthly subscription, log in and acquire Arkansas Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations through the US Legal Forms local library. The Down load option will show up on each develop you perspective. You get access to all earlier saved varieties inside the My Forms tab of the account.

If you would like use US Legal Forms the first time, here are basic instructions to help you get started out:

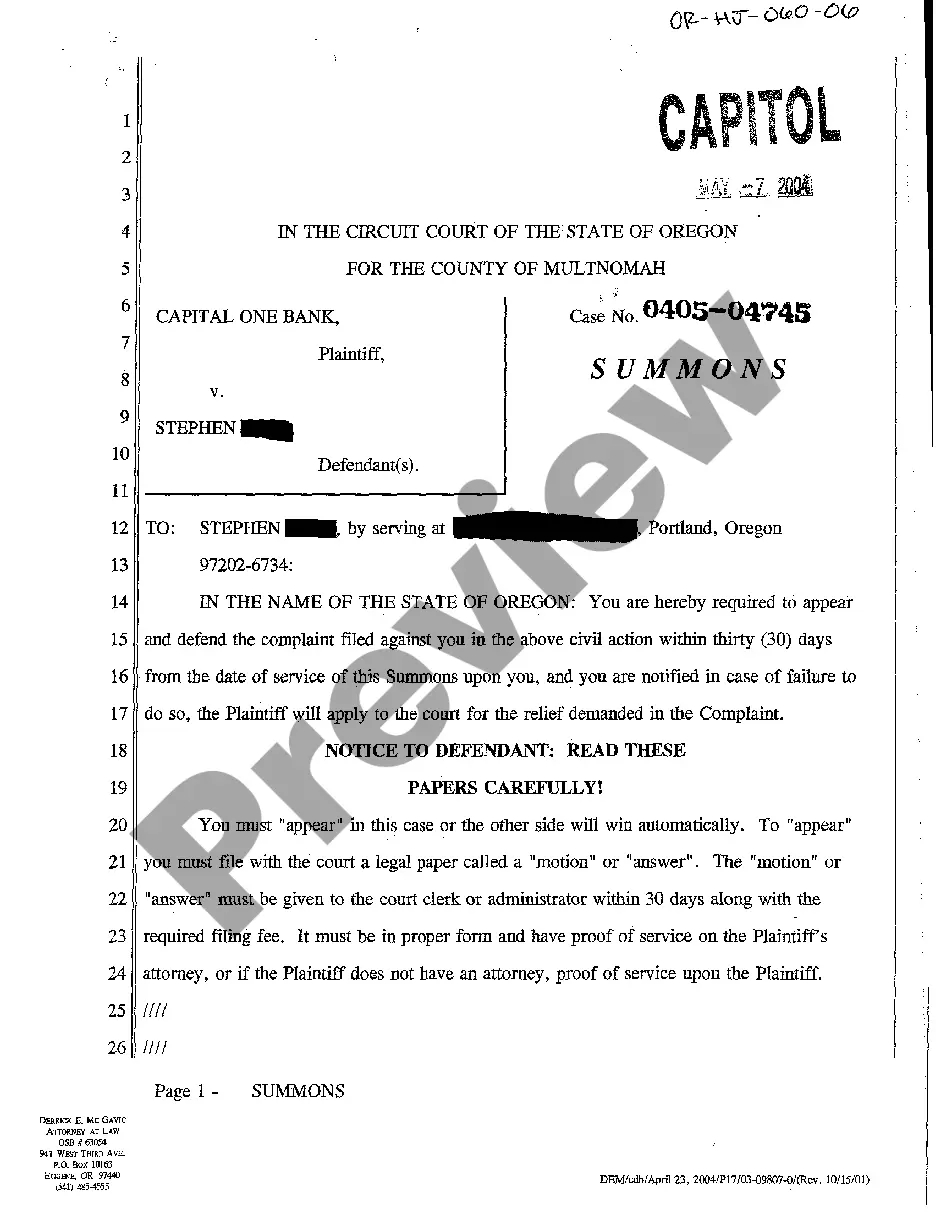

- Be sure you have selected the proper develop to your town/region. Select the Review option to review the form`s articles. Browse the develop outline to actually have chosen the appropriate develop.

- In the event the develop does not match your specifications, utilize the Search area towards the top of the monitor to get the one who does.

- When you are satisfied with the form, verify your selection by visiting the Get now option. Then, choose the costs strategy you want and offer your references to register for the account.

- Approach the transaction. Make use of your bank card or PayPal account to perform the transaction.

- Choose the formatting and acquire the form in your product.

- Make changes. Fill up, revise and print and sign the saved Arkansas Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations.

Every single web template you added to your money does not have an expiry date and it is your own eternally. So, if you would like acquire or print another duplicate, just check out the My Forms segment and then click on the develop you want.

Gain access to the Arkansas Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations with US Legal Forms, the most extensive local library of lawful document layouts. Use a large number of skilled and condition-specific layouts that meet your company or person requires and specifications.

Form popularity

FAQ

An LOI must clearly list all of the parties involved (shipper, carrier and when applicable, consignee or recipient) and should include as much detail as possible (i.e. vessel name, ports of origin and destination, description of goods, container number, specifics from the original bill of lading, etc.).

It is primarily intended to protect the person who is providing goods or services from being held legally liable for the consequences of actions taken or not taken in providing that service to the person who signs the form. Indemnity clauses vary widely.

A typical example is an insurance company wherein the insurer or indemnitor agrees to compensate the insured or indemnitee for any damages or losses he/she may incur during a period of time.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

The purpose of an indemnity is to provide guaranteed compensation to a buyer on a dollar for dollar basis in circumstances in which a breach of warranty would not necessarily give rise to a claim for damages or to provide a specific remedy that might not otherwise be legally available.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.