The Arkansas Gift Deed of Mineral Interest with No Warranty is a legal document that transfers ownership of mineral interests from one party to another without any warranties or guarantees of title. This type of gift deed is commonly used in Arkansas to transfer mineral rights from a donor (the person giving the gift) to a done (the person receiving the gift). This specific type of gift deed is used when the donor wants to gift their mineral interests to someone else, typically a family member or a loved one. By using this deed, the donor is essentially transferring their ownership rights to the minerals, including any rights to explore, mine, or profit from them, to the done. It's important to note that the Arkansas Gift Deed of Mineral Interest with No Warranty does not provide any warranties or guarantees regarding the validity of the title. This means that the donor does not guarantee that they own the mineral interests free and clear of any liens, claims, or encumbrances. It is the responsibility of the done to conduct their own due diligence and assess the validity of the title before accepting the gift. Different types of Arkansas Gift Deed of Mineral Interest with No Warranty: 1. Individual to Individual: This type of gift deed is used when an individual wants to gift their mineral interests to another individual. It could be a parent gifting the mineral interests to a child or a grandparent gifting the interests to a grandchild. 2. Family Trust to Individual: In this scenario, the donor transfers the mineral interests owned by a family trust to an individual recipient, usually a family member, as a gift. 3. Corporation or LLC to Individual: This type of gift deed involves the transfer of mineral interests from a corporation or limited liability company (LLC) to an individual. 4. Trust to Trust: This situation arises when an existing trust (such as a revocable living trust) transfers its mineral interests to another trust as a gift. In summary, the Arkansas Gift Deed of Mineral Interest with No Warranty is a legal document used to transfer ownership of mineral interests as a gift. However, it's essential for the done to conduct their due diligence and assess the title's validity before accepting the gift. Various types of gift deeds exist depending on the transferor's relationship and entity type.

Arkansas Gift Deed of Mineral Interest with No Warranty

Description

How to fill out Arkansas Gift Deed Of Mineral Interest With No Warranty?

Are you currently in a placement that you will need documents for both enterprise or person uses just about every time? There are plenty of authorized document templates available on the net, but getting types you can depend on is not straightforward. US Legal Forms provides a huge number of type templates, such as the Arkansas Gift Deed of Mineral Interest with No Warranty, that happen to be composed to fulfill state and federal demands.

If you are presently familiar with US Legal Forms site and have your account, simply log in. Afterward, you can down load the Arkansas Gift Deed of Mineral Interest with No Warranty web template.

Unless you provide an bank account and would like to start using US Legal Forms, abide by these steps:

- Get the type you want and ensure it is for that right area/region.

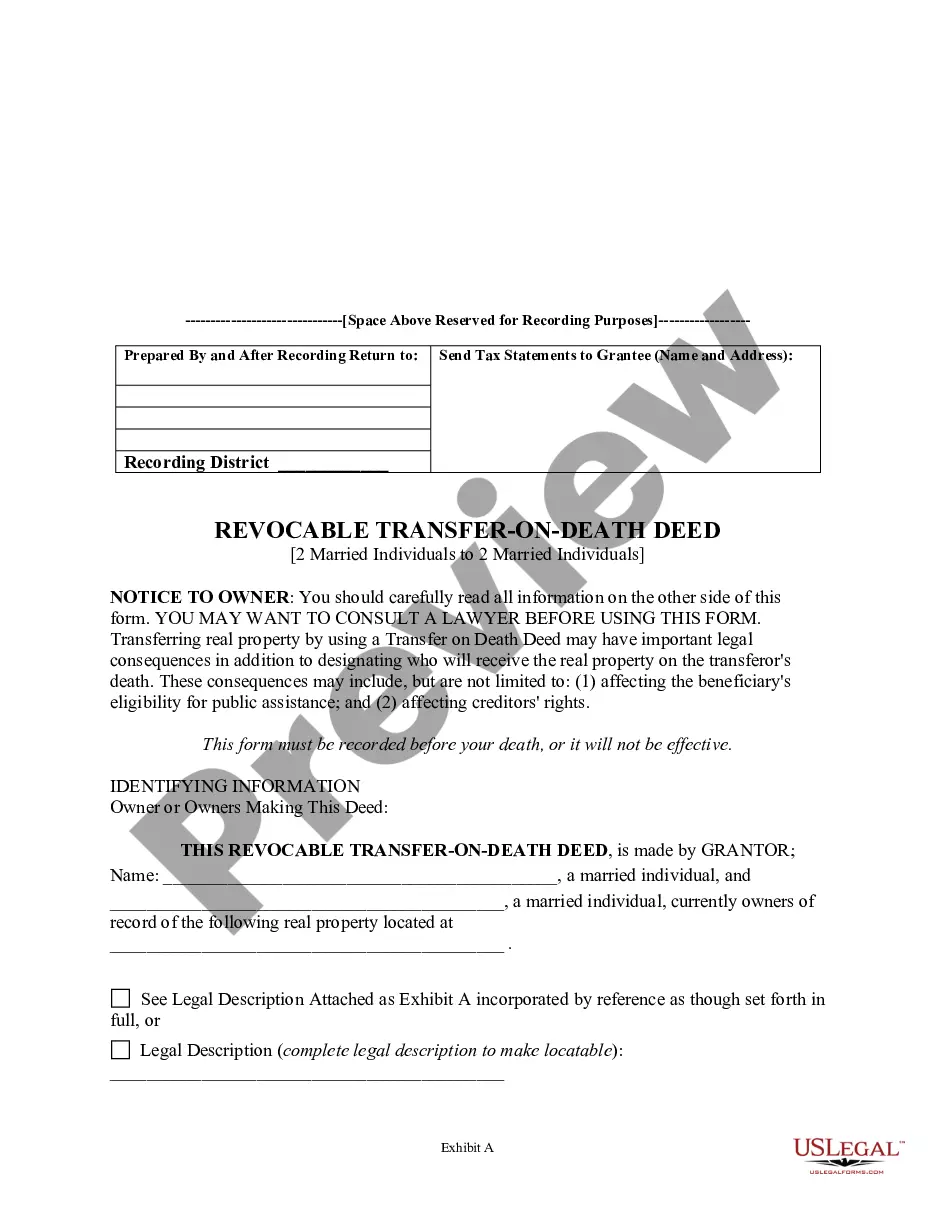

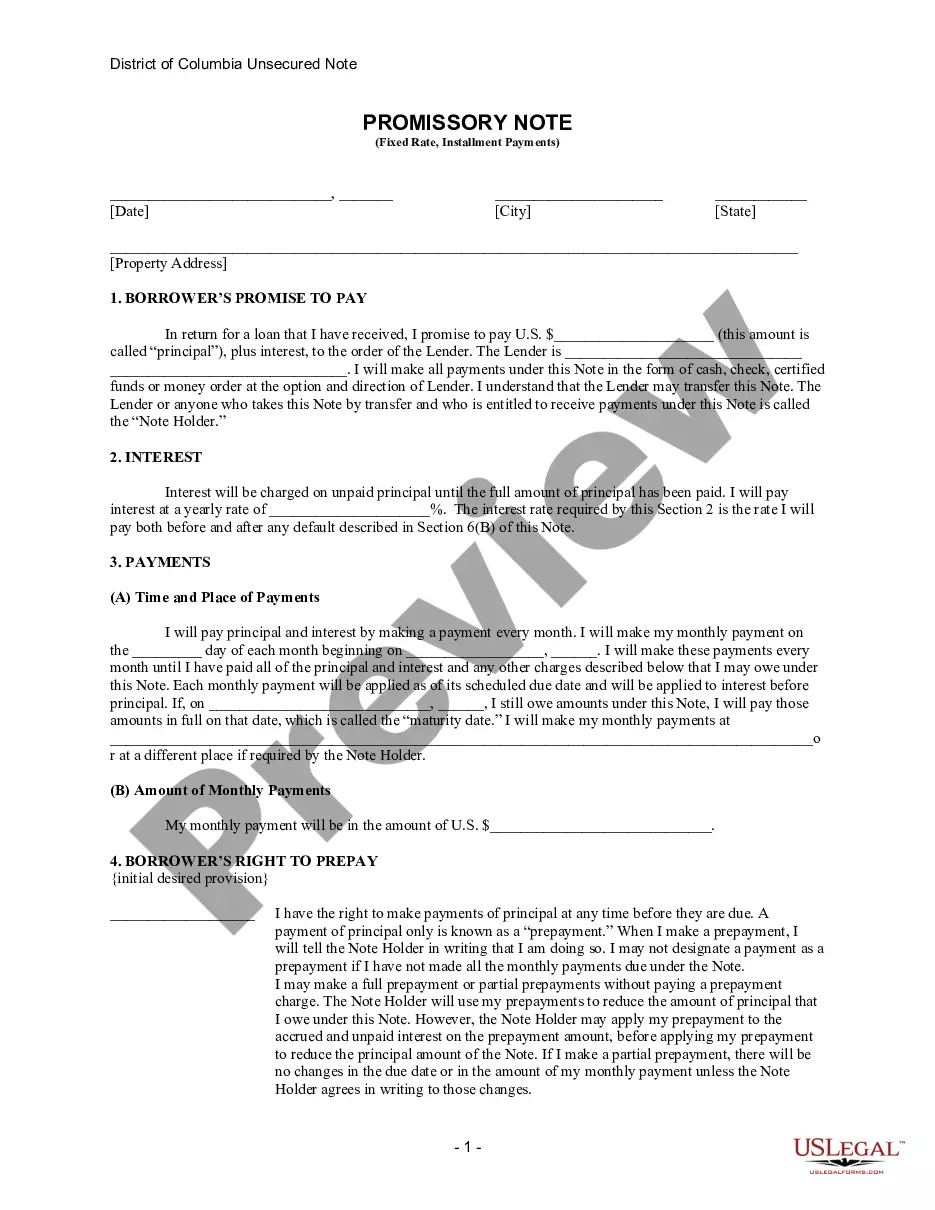

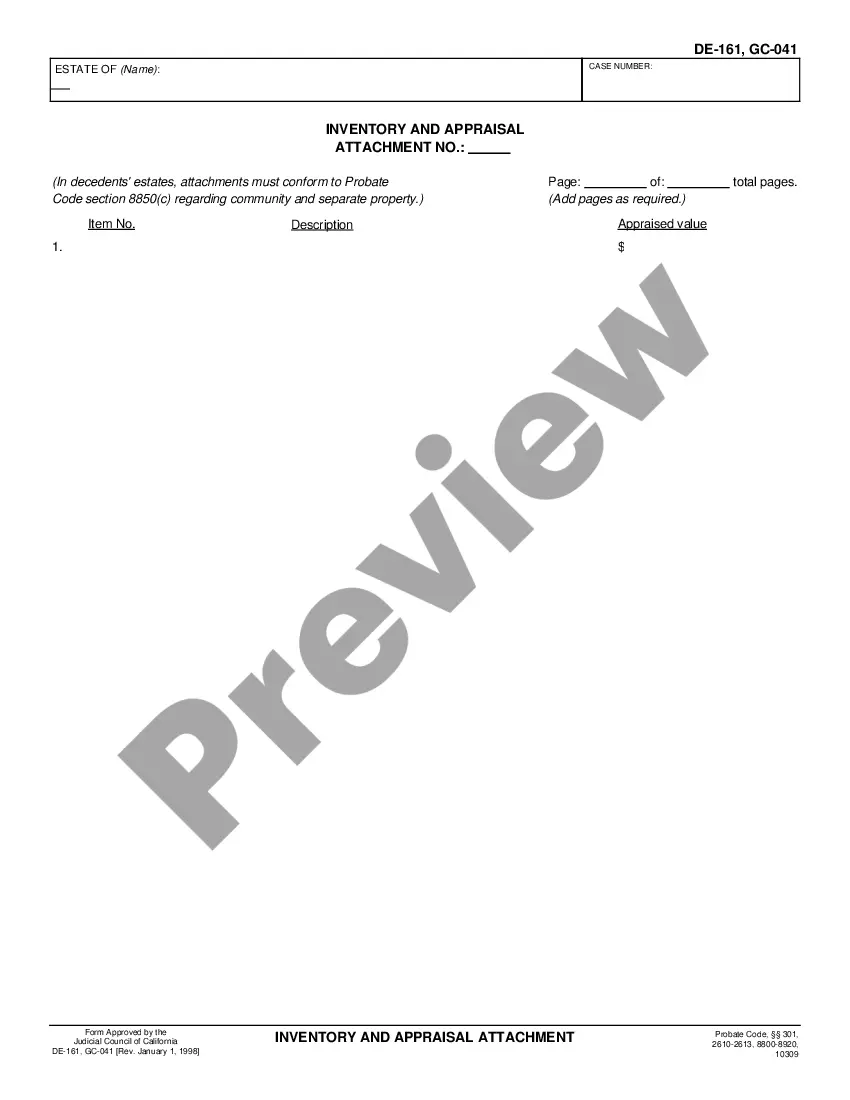

- Make use of the Review button to check the form.

- See the outline to ensure that you have chosen the proper type.

- If the type is not what you are searching for, utilize the Research field to get the type that meets your requirements and demands.

- When you discover the right type, simply click Buy now.

- Opt for the costs program you want, fill in the specified info to make your bank account, and pay money for the transaction using your PayPal or Visa or Mastercard.

- Choose a practical document format and down load your copy.

Get each of the document templates you have bought in the My Forms food list. You may get a further copy of Arkansas Gift Deed of Mineral Interest with No Warranty any time, if required. Just select the essential type to down load or print the document web template.

Use US Legal Forms, one of the most substantial variety of authorized varieties, to save efforts and stay away from faults. The service provides skillfully created authorized document templates which you can use for a selection of uses. Create your account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

A mineral deed conveys a seperate estate in minerals in Arkansas. You should use a mineral deed when you wish to deed away the mineral rights to property but not the surface rights. An Arkansas mineral deed is also used to transfer existing mineral rights among mineral owners.

Arkansas charges a real property transfer tax for real estate transfers involving more than $100.00 in payment. The total transfer tax rate is $3.30 per $1,000.00 of consideration?two-thirds of which is expressly the new owner's responsibility.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

Minerals include gold, silver, coal, oil, and gas. If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease. Before you transfer mineral rights, you should confirm that you own the rights that you seek to transfer.

In Arkansas, there are a number of different situations in which real property is transferred from one person to another, but they each have one thing in common ? a deed. A deed is the legal document which officially transfers ownership of a piece of property. Without a deed, there cannot be an actual transfer.

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.

A Deed of Gift is a great way to formalise an intention to gift money or assets to someone. A Deed of Gift is particularly effective for recording a gift from parents to children for the purpose of purchasing a home.

County Records and Tax Assessor's Office and Documents It gives you a clear indication of the direction to search for mineral ownership rights. The deed contains the description of the property, rights-of-way, oil and gas liens, mineral rights and easements.