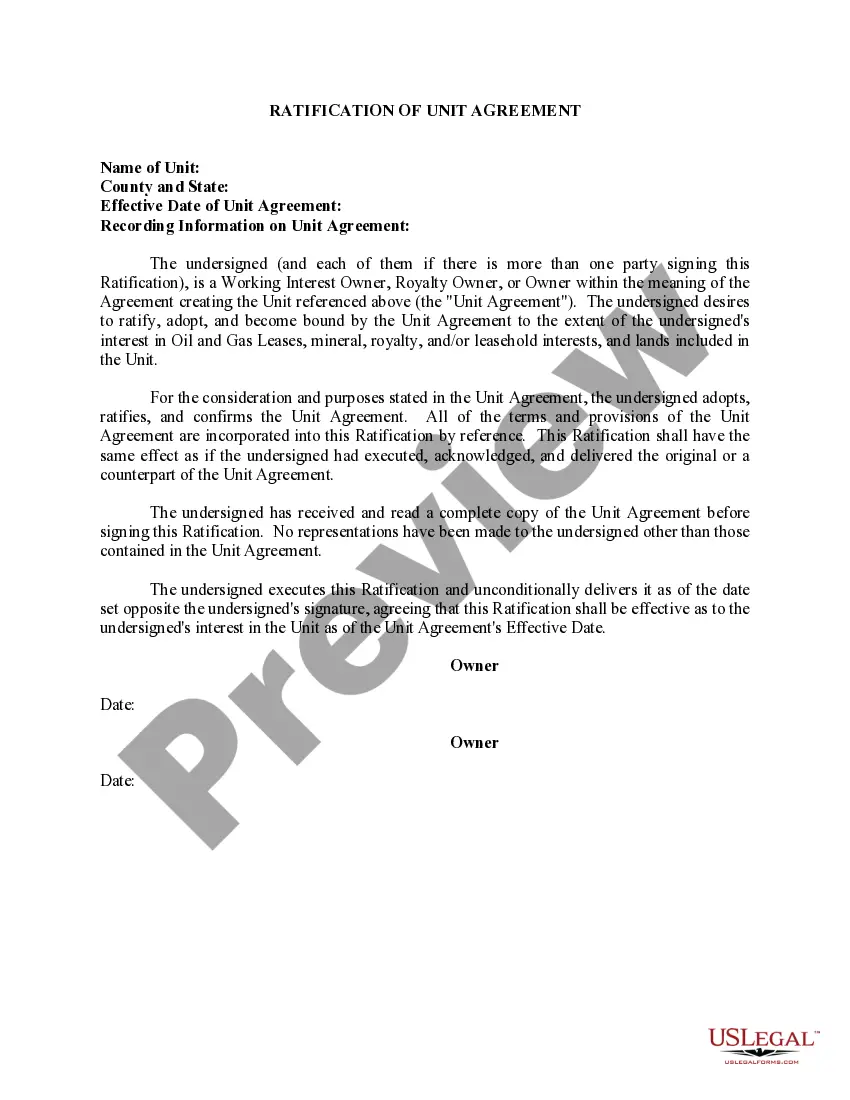

Arkansas Ratification of Prior Deed

Description

How to fill out Ratification Of Prior Deed?

US Legal Forms - one of several largest libraries of legal varieties in the United States - offers a wide range of legal papers web templates it is possible to down load or print out. Utilizing the internet site, you can get a large number of varieties for business and individual reasons, sorted by classes, suggests, or keywords and phrases.You will discover the most up-to-date models of varieties just like the Arkansas Ratification of Prior Deed in seconds.

If you currently have a registration, log in and down load Arkansas Ratification of Prior Deed in the US Legal Forms local library. The Obtain key will appear on each form you perspective. You gain access to all formerly downloaded varieties within the My Forms tab of the account.

If you wish to use US Legal Forms the first time, allow me to share basic guidelines to help you get started out:

- Make sure you have picked the best form for your personal city/area. Click the Preview key to examine the form`s content. See the form explanation to actually have chosen the correct form.

- When the form doesn`t fit your needs, make use of the Research area on top of the screen to get the the one that does.

- Should you be pleased with the shape, confirm your decision by visiting the Buy now key. Then, pick the prices strategy you prefer and offer your credentials to register on an account.

- Method the deal. Make use of your credit card or PayPal account to complete the deal.

- Find the file format and down load the shape on your product.

- Make changes. Load, change and print out and indicator the downloaded Arkansas Ratification of Prior Deed.

Every format you put into your account does not have an expiry date which is your own eternally. So, in order to down load or print out an additional version, just visit the My Forms area and click on in the form you want.

Get access to the Arkansas Ratification of Prior Deed with US Legal Forms, one of the most extensive local library of legal papers web templates. Use a large number of expert and state-particular web templates that fulfill your small business or individual requires and needs.

Form popularity

FAQ

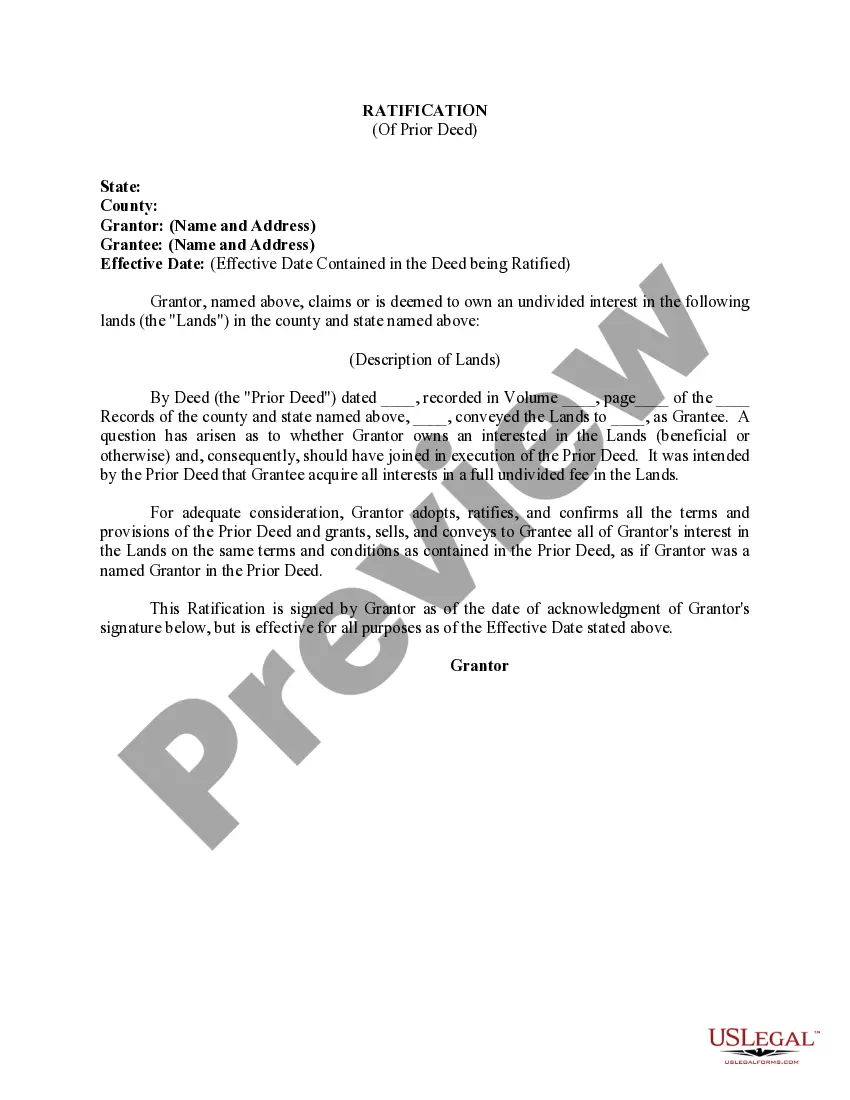

Arkansas charges a real property transfer tax for real estate transfers involving more than $100.00 in payment. The total transfer tax rate is $3.30 per $1,000.00 of consideration?two-thirds of which is expressly the new owner's responsibility.

The Real Property Transfer Tax is levied on each deed, instrument, or writing by which any lands, tenements, or other realty sold shall be granted, assigned, transferred, or otherwise conveyed. The tax rate is $3.30 per $1,000 of actual consideration on transactions that exceed $100.

Signing Requirements: Arkansas Code § 18-12-104: Arkansas quitclaim deeds require the grantor to sign in front of a notary public and two (2) disinterested witnesses with no claim in the transaction.

Arkansas Title Transfer Fees How much does it cost to transfer a car title in Arkansas? The fee to transfer the title is only $10. However, you will likely be paying sales tax, registration fees, and any other local taxes for your registration at the same time.

When transferring property, a seller (often called the grantor), writes out a deed, transferring property to the buyer (often called the grantee). The deed is then recorded with the recorder in the county in which the property is located.

The deed must be acknowledged and notarized by a notary public in Arkansas. Per § 18-12-102 of the Arkansas Code, a warranty deed must contain the words ?grant, bargain, and sell? when stating how the property is being transferred.

Real Estate Recording Requirements Original Instrument. Notarized signature. Tax statement return address on document. Name of Instrument preparer. Revenue stamps on warranty deeds (if revenue changed hands) ?I Certify? statement on all warranty deed (and any deed that has revenue stamps affixed)