Arkansas Subordination Agreement (Deed of Trust)

Description

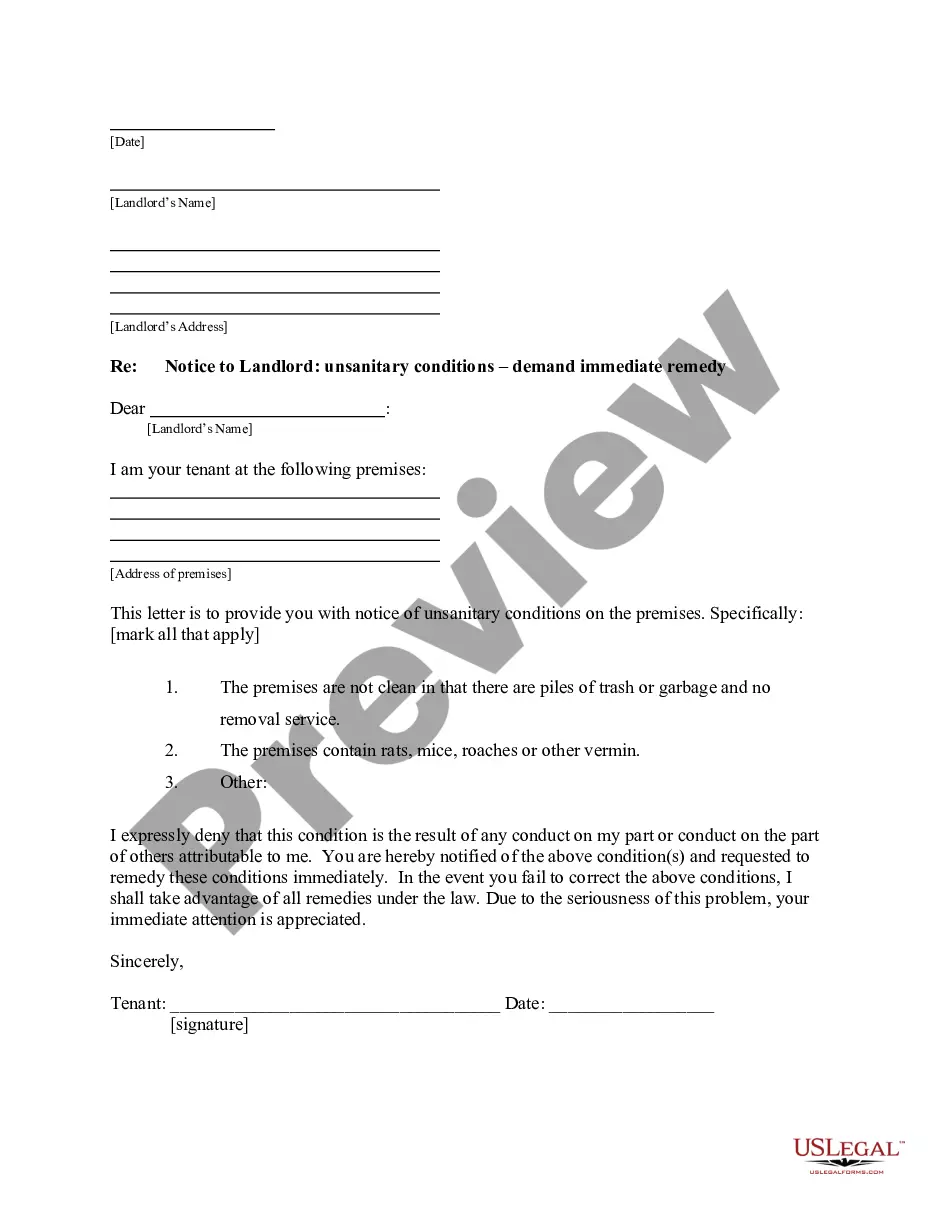

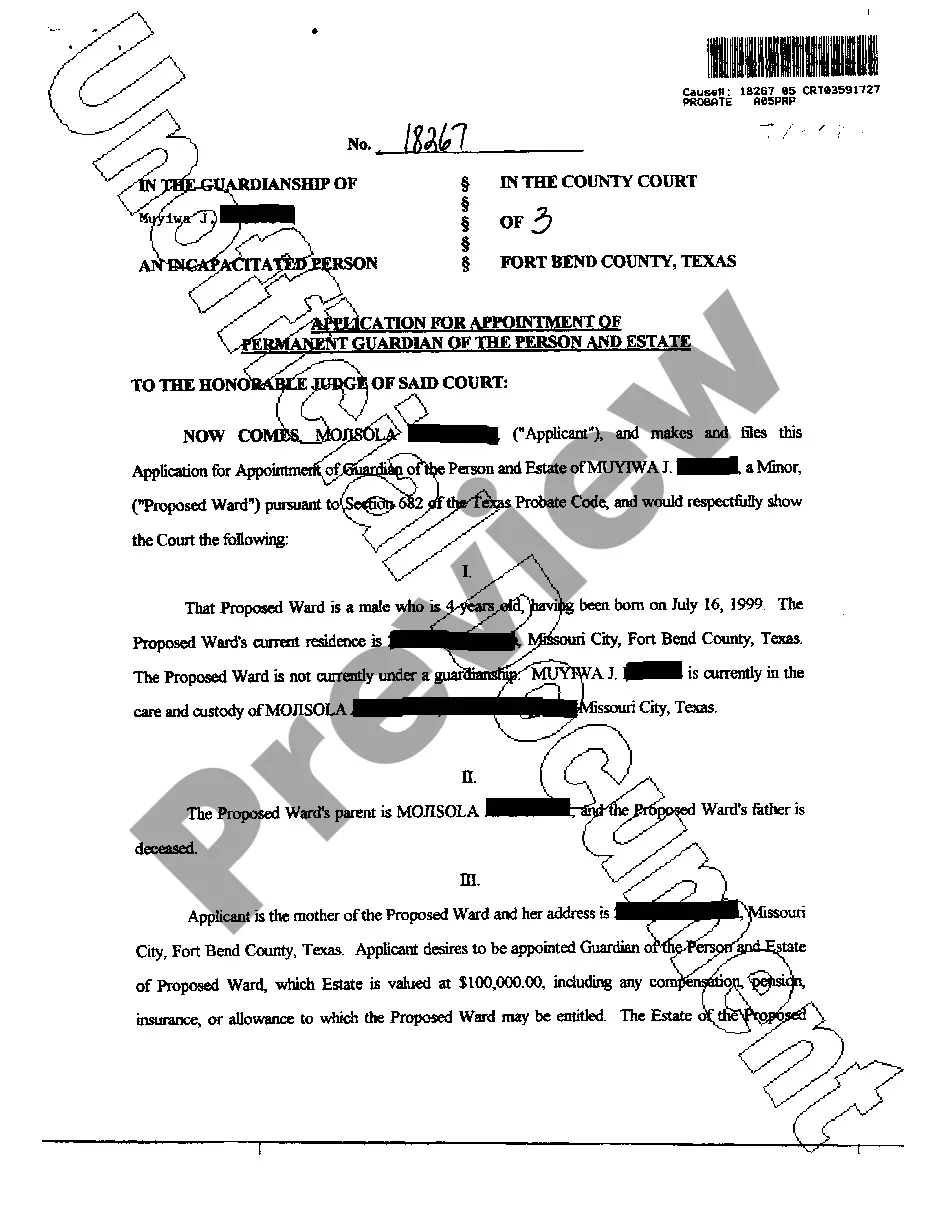

How to fill out Subordination Agreement (Deed Of Trust)?

If you need to complete, download, or printing legal papers web templates, use US Legal Forms, the most important collection of legal types, which can be found on the web. Take advantage of the site`s easy and handy lookup to obtain the paperwork you will need. Various web templates for business and person uses are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to obtain the Arkansas Subordination Agreement (Deed of Trust) with a few clicks.

Should you be presently a US Legal Forms buyer, log in to your accounts and then click the Acquire switch to get the Arkansas Subordination Agreement (Deed of Trust). You can even entry types you in the past saved from the My Forms tab of your accounts.

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the form for your appropriate area/country.

- Step 2. Take advantage of the Preview choice to look through the form`s information. Never overlook to read the explanation.

- Step 3. Should you be unsatisfied together with the develop, make use of the Search discipline near the top of the monitor to get other models of the legal develop design.

- Step 4. Once you have discovered the form you will need, go through the Acquire now switch. Opt for the rates strategy you favor and add your credentials to register on an accounts.

- Step 5. Procedure the purchase. You can utilize your credit card or PayPal accounts to perform the purchase.

- Step 6. Find the formatting of the legal develop and download it on the gadget.

- Step 7. Full, change and printing or indication the Arkansas Subordination Agreement (Deed of Trust).

Every legal papers design you purchase is your own property forever. You possess acces to each develop you saved with your acccount. Click on the My Forms portion and pick a develop to printing or download yet again.

Contend and download, and printing the Arkansas Subordination Agreement (Deed of Trust) with US Legal Forms. There are many expert and status-particular types you can use for your business or person demands.

Form popularity

FAQ

The Subordinated Lender hereby agrees that all Subordinated Obligations (as defined below) and all of his right, title and interest in and to the Subordinated Obligations shall be subordinate and junior in right of payment to the Senior Lender Loan and all rights of Senior Lender in respect of the Senior Lender Loan, ...

The party that primarily benefits from a subordination clause in real estate is the lender. However, if you decide to pursue a second mortgage, then the subordination clause prioritizes the first lender's repayment and contract rights. The most common application of subordination clauses is when refinancing a property.

By Practical Law Banking and Finance. This is a standard subordination deed to change or regulate an arrangement between two creditors that are owed debts by a common debtor, under which one creditor agrees to defer payment of its debt in favour of the debt of another creditor.

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks.

Subordination agreements ensure that a primary lender will be paid in the event the borrower takes on more debt. As with most legal documents, subordination agreements need to be notarized in order to be official in the eyes of the law.

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

Subordination. This Security Instrument is and shall be automatically subordinate to a loan made to Borrower evidenced by a purchase money promissory note and secured by a first deed of trust (the ?First Deed of Trust?) recorded concurrently herewith on the Property.