Arkansas Assignment of Contract Rights to Interests in Oil and Gas Leases

Description

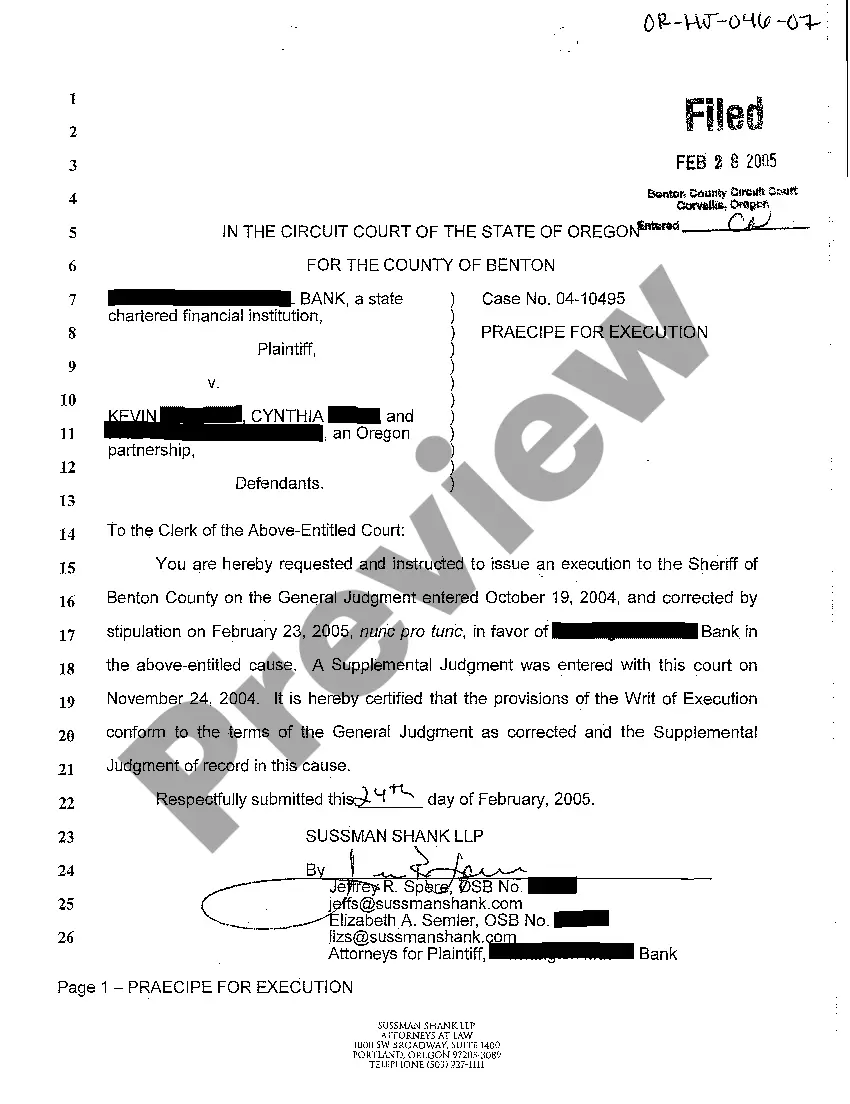

How to fill out Assignment Of Contract Rights To Interests In Oil And Gas Leases?

Finding the right legitimate file web template can be a have difficulties. Obviously, there are plenty of themes accessible on the Internet, but how do you obtain the legitimate kind you require? Use the US Legal Forms website. The services delivers 1000s of themes, such as the Arkansas Assignment of Contract Rights to Interests in Oil and Gas Leases, that you can use for enterprise and private requirements. Each of the types are inspected by specialists and meet federal and state specifications.

In case you are previously listed, log in for your bank account and click the Down load button to have the Arkansas Assignment of Contract Rights to Interests in Oil and Gas Leases. Make use of your bank account to appear through the legitimate types you have acquired formerly. Check out the My Forms tab of the bank account and acquire another backup of the file you require.

In case you are a brand new customer of US Legal Forms, listed below are basic guidelines for you to adhere to:

- Initially, ensure you have chosen the right kind for your personal city/region. You are able to look through the shape utilizing the Review button and study the shape information to make certain this is basically the right one for you.

- In case the kind will not meet your expectations, use the Seach industry to find the proper kind.

- Once you are sure that the shape would work, go through the Acquire now button to have the kind.

- Choose the prices program you need and enter the required details. Make your bank account and pay for the transaction with your PayPal bank account or Visa or Mastercard.

- Pick the document file format and acquire the legitimate file web template for your device.

- Total, revise and print and signal the attained Arkansas Assignment of Contract Rights to Interests in Oil and Gas Leases.

US Legal Forms is the most significant catalogue of legitimate types that you can see different file themes. Use the service to acquire expertly-created papers that adhere to status specifications.

Form popularity

FAQ

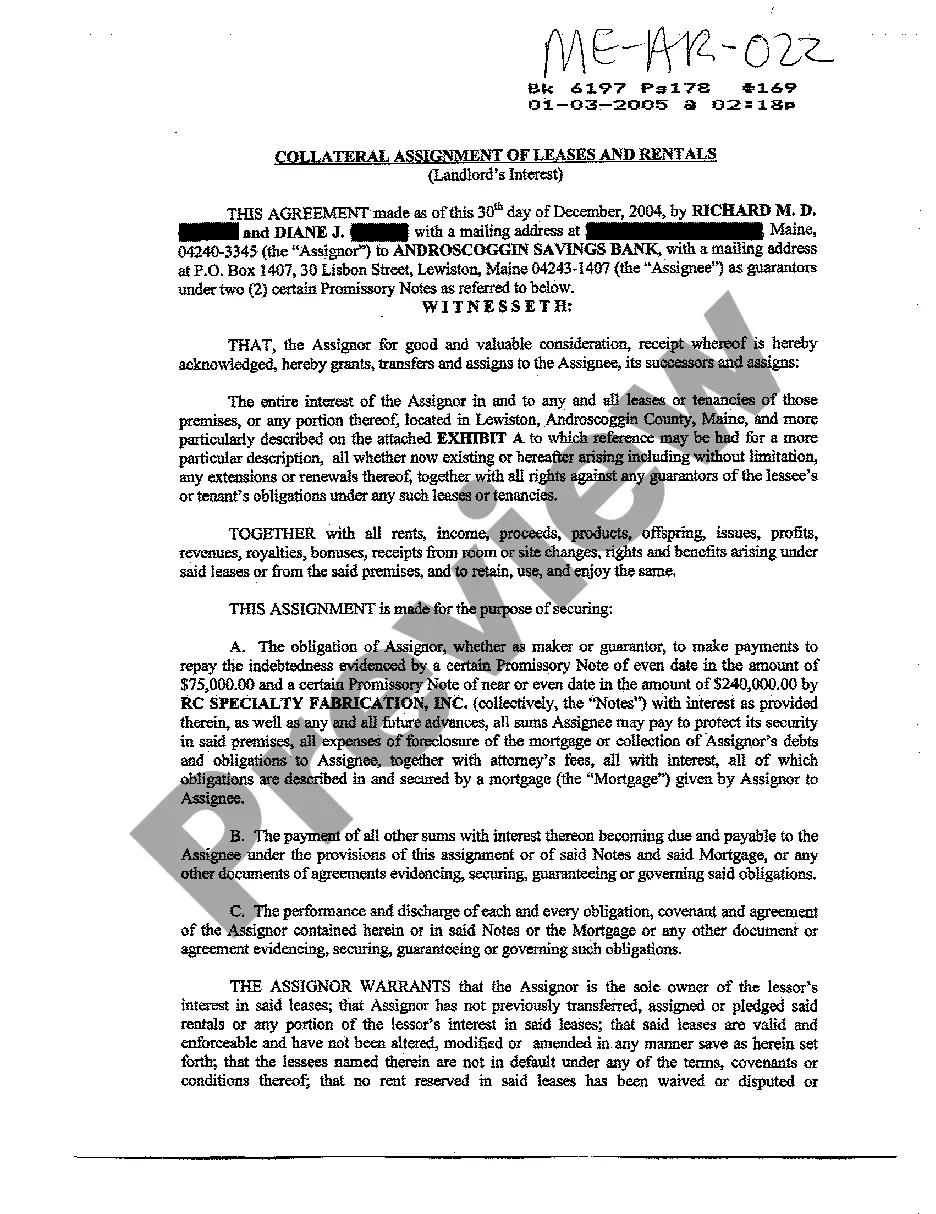

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

Negotiating an oil and gas lease will require some research upfront. If you're a landowner interested in working with an oil and gas company, you should explore their history and experience. You'll want to work with a reputable company that works in your best interests, holds a high standard, and maintains insurance.

Total operated basis: The total reserves or production associated with the wells operated by an individual operator. This is also commonly known as the "gross operated" or "8/8ths" basis.

ASSIGNMENT: The legal instrument whereby Oil and Gas Leases or Overriding Royalty interests are assigned or conveyed. ASSIGNMENT CLAUSE: A clause in any legal instrument that allows either party to the contract to assign all or part of his or her interest to others.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Any partial assignment of any lease shall segregate the assigned and retained portions thereof, and as above provided, release and discharge the assignor from all obligations thereafter accruing with respect to the assigned lands; and such segregated leases shall continue in full force and effect for the primary term ...

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

Wellbore. An assignment can be limited to the wellbore of a well. A wellbore limitation means that the assignor is assigning only those rights to production from the wellbore of a certain well, arguably at the total depth it existed at the time of the assignment.