Arkansas Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner

Description

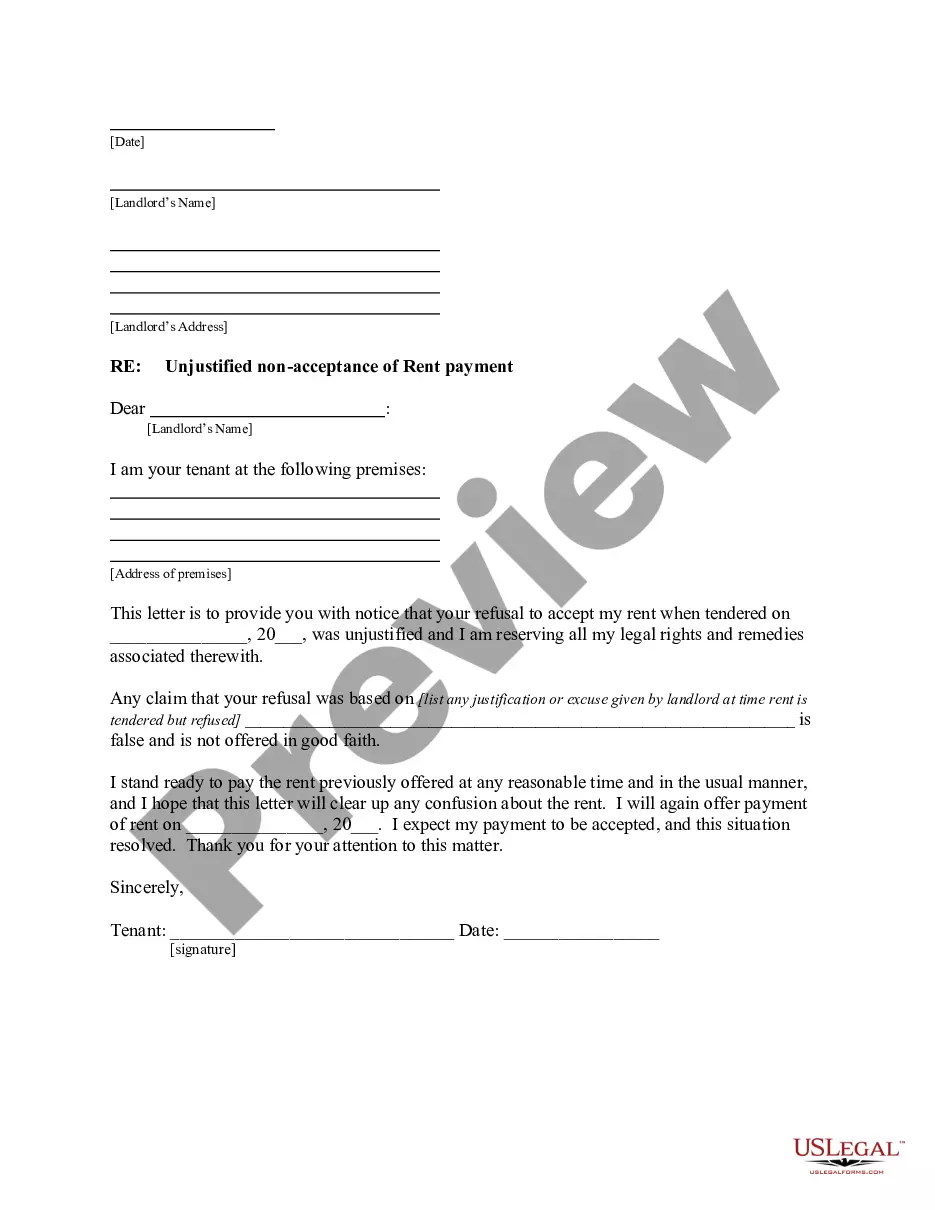

How to fill out Bonus Receipt, Lease Ratification, And Rental Division Order By Mineral Owner?

If you need to full, obtain, or printing legal record themes, use US Legal Forms, the most important variety of legal forms, that can be found on the Internet. Make use of the site`s simple and hassle-free lookup to get the documents you need. Different themes for company and specific purposes are sorted by classes and suggests, or search phrases. Use US Legal Forms to get the Arkansas Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner within a few clicks.

Should you be presently a US Legal Forms consumer, log in to your profile and then click the Down load switch to find the Arkansas Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner. You can even accessibility forms you formerly acquired inside the My Forms tab of your respective profile.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that correct area/region.

- Step 2. Make use of the Review option to look over the form`s content material. Never overlook to read the description.

- Step 3. Should you be not happy with all the type, use the Search area at the top of the screen to discover other versions of the legal type web template.

- Step 4. Once you have found the form you need, click on the Purchase now switch. Pick the pricing plan you like and put your qualifications to sign up for an profile.

- Step 5. Procedure the deal. You can use your Мisa or Ьastercard or PayPal profile to perform the deal.

- Step 6. Pick the formatting of the legal type and obtain it on the device.

- Step 7. Full, edit and printing or sign the Arkansas Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner.

Every single legal record web template you acquire is the one you have permanently. You have acces to every single type you acquired inside your acccount. Click the My Forms portion and choose a type to printing or obtain once more.

Contend and obtain, and printing the Arkansas Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner with US Legal Forms. There are many specialist and status-certain forms you may use for your personal company or specific requires.