Arkansas Oil and Gas Division Order

Description

How to fill out Oil And Gas Division Order?

You may commit several hours on the Internet searching for the authorized record template that fits the federal and state requirements you need. US Legal Forms gives a huge number of authorized kinds that are examined by experts. You can actually download or print out the Arkansas Oil and Gas Division Order from the services.

If you already have a US Legal Forms bank account, you may log in and click on the Down load key. Following that, you may complete, change, print out, or signal the Arkansas Oil and Gas Division Order. Every single authorized record template you get is your own property permanently. To get an additional backup of any bought type, go to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms web site initially, adhere to the simple guidelines below:

- Very first, be sure that you have selected the right record template for the area/city of your liking. Look at the type explanation to make sure you have chosen the appropriate type. If readily available, use the Review key to check from the record template at the same time.

- If you wish to discover an additional variation from the type, use the Search field to find the template that meets your requirements and requirements.

- Upon having identified the template you need, click on Get now to move forward.

- Select the prices program you need, type your credentials, and register for a free account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal bank account to purchase the authorized type.

- Select the format from the record and download it to your system.

- Make alterations to your record if required. You may complete, change and signal and print out Arkansas Oil and Gas Division Order.

Down load and print out a huge number of record layouts using the US Legal Forms Internet site, that offers the most important selection of authorized kinds. Use expert and status-particular layouts to tackle your company or personal requirements.

Form popularity

FAQ

To put it another way the formula is: lessor's acres in unit ÷ total number of acres in unit × lessor's ownership interest × lessor's royalty percentage = lessor's decimal interest. Calculating the Lessor's Percentage Interest on a Division Order rothmangordon.com ? calculating-the-lessor... rothmangordon.com ? calculating-the-lessor...

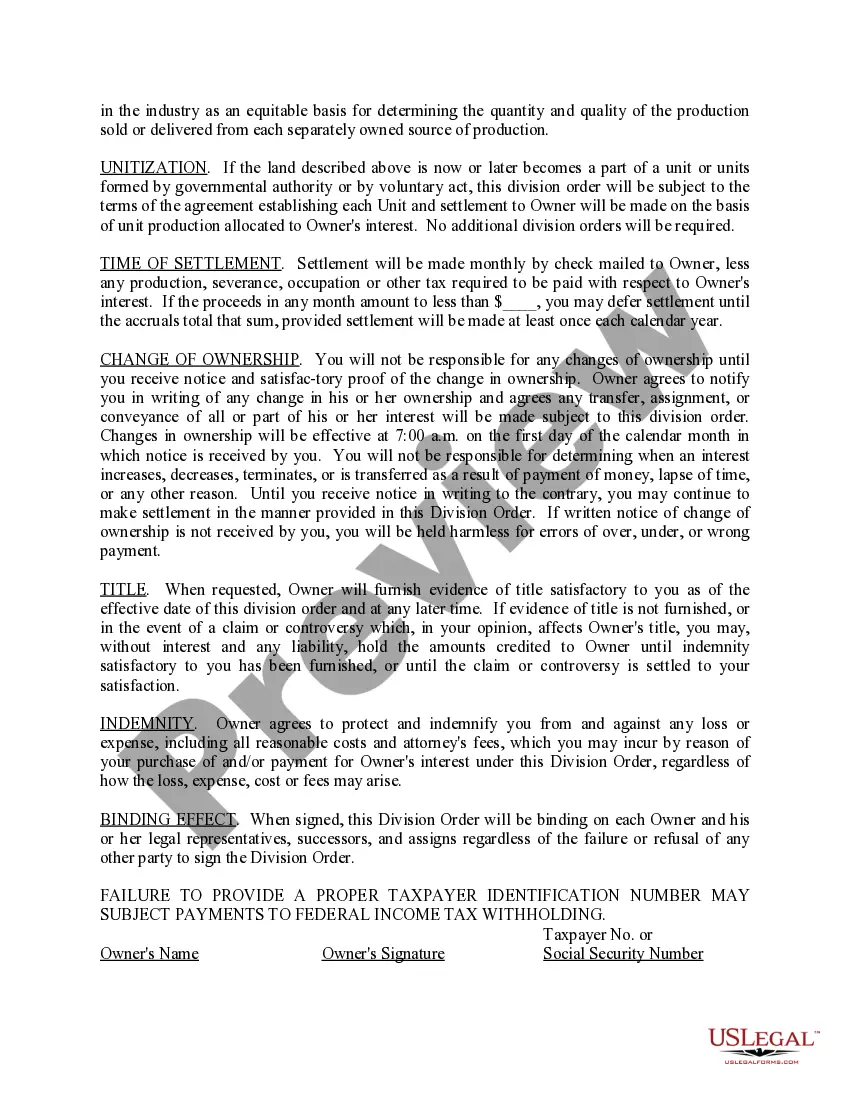

A Division order is an instrument that records an owner's interest in a specific well. It should include the name of the well, the well number, interest type, and your decimal interest. Division Order - ConocoPhillips conocophillips.com ? us-interest-owners ? di... conocophillips.com ? us-interest-owners ? di...

A Division Order is an instrument which sets forth the proportional ownership in produced hydrocarbons, including crude oil, natural gas, and NGL's. Sometimes the Division Order is referred to as a division of interest.

A division order analyst works for a petroleum company and oversees company records. As a division order analyst, you establish, prepare, review, approve, and maintain documents regarding production and land ownership for royalty owners. You generally work as a part of the land department at an oil company.

A mineral deed conveys a seperate estate in minerals in Arkansas. You should use a mineral deed when you wish to deed away the mineral rights to property but not the surface rights. An Arkansas mineral deed is also used to transfer existing mineral rights among mineral owners. Arkansas Mineral Deeds arkansasdeeds.com ? arkansas-mineral-deeds arkansasdeeds.com ? arkansas-mineral-deeds

A division order is a contract between you and the operator (an oil and gas company). Typically, receiving a division order means that the operator is about to drill, or that the operator has already drilled a well and your minerals are producing. The Division Order?What Every Mineral Owner Should Know Graft & Walraven ? the-division-order-what-every-... Graft & Walraven ? the-division-order-what-every-...

The decimal interest is calculated by dividing the number of acres the landowner has in the unit by the total number of acres in the unit, multiplied by the royalty percentage under the gas lease.