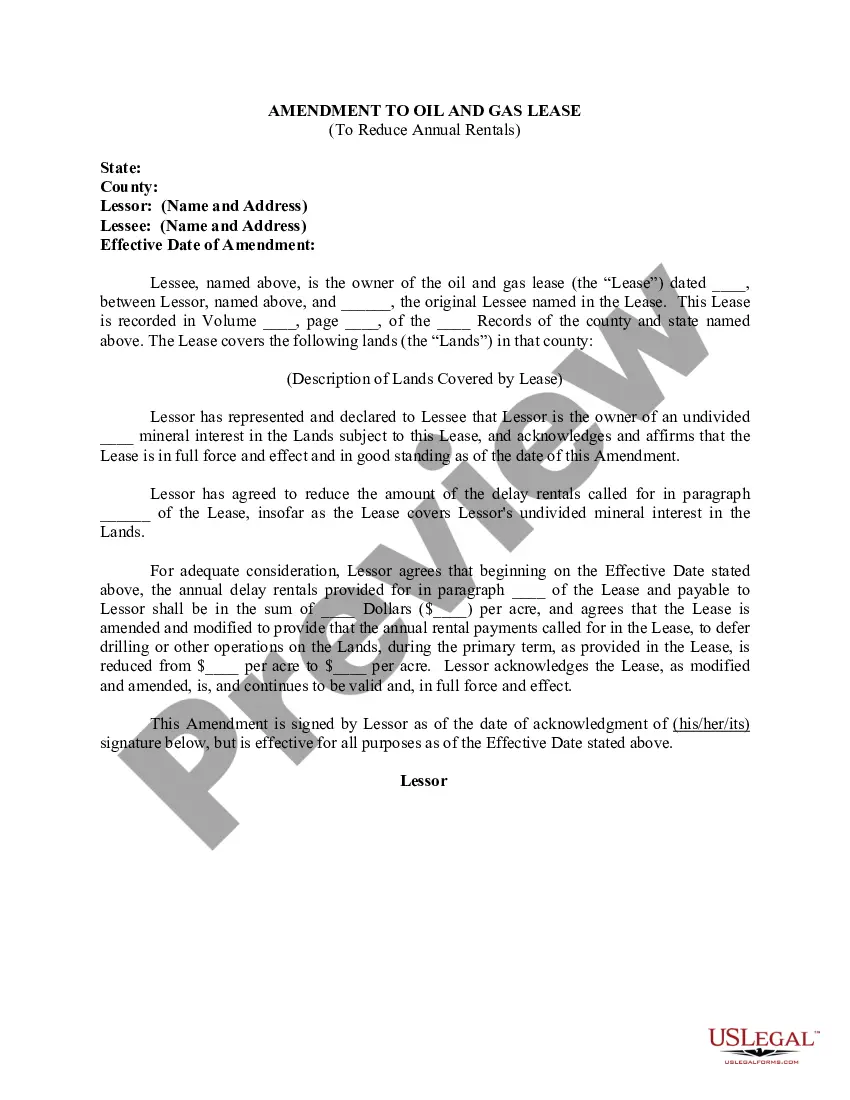

This form is used when the Lessor and Lessee desire to amend the description of the Lands subject to the Lease by dividing the Lands into separate tracts, with each separate tract being deemed to be covered by a separate and distinct oil and gas lease even though all of the lands are described in the one Lease.

Arkansas Amendment to Oil and Gas Lease to Reduce Annual Rentals refers to a modification made to an existing oil and gas lease agreement in Arkansas, aimed at decreasing the annual rental fees associated with the lease. This amendment is designed to provide relief to oil and gas lessees, allowing them to reduce their financial burden while continuing to operate within the state. The Arkansas Amendment to Oil and Gas Lease to Reduce Annual Rentals typically includes provisions that outline the revised rental fee structure, taking into consideration factors such as market conditions, production volumes, and other relevant industry parameters. This amendment aims to align the lease terms with economic realities, providing lessees with more flexibility in maintaining the lease and ensuring its long-term sustainability. There are several types of Arkansas Amendments to Oil and Gas Lease to Reduce Annual Rentals that may be implemented, with the specific type depending on different circumstances and negotiations between the lessor and lessee. Some common types include: 1. Percentage reduction amendment: This type of amendment allows the lessee to reduce their annual rental fees by a certain percentage, calculated based on the prevailing market conditions and other factors specified in the amendment. 2. Production-based amendment: This amendment considers the actual production volumes achieved by the lessee on the leased property. It provides a mechanism to reduce the annual rentals based on the amount of oil or gas produced within a specified timeframe. 3. Market-adjustment amendment: In this type of amendment, the rental fees are adjusted based on changes in the market conditions, such as fluctuations in oil and gas prices or shifts in supply and demand dynamics. It ensures that the rental fees reflect the prevailing market realities. 4. Length of lease amendment: This amendment alters the duration of the lease, thereby reducing the overall rental obligations. It may involve extending the lease term to accommodate lower annual rental fees or shortening the lease term to provide relief to the lessee. Arkansas Amendments to Oil and Gas Lease to Reduce Annual Rentals play a crucial role in maintaining the competitiveness of the state's oil and gas industry. By allowing lessees to adjust their financial commitments, these amendments promote continued exploration, production, and investment in Arkansas, while balancing the needs of the lessees with those of the lessors.