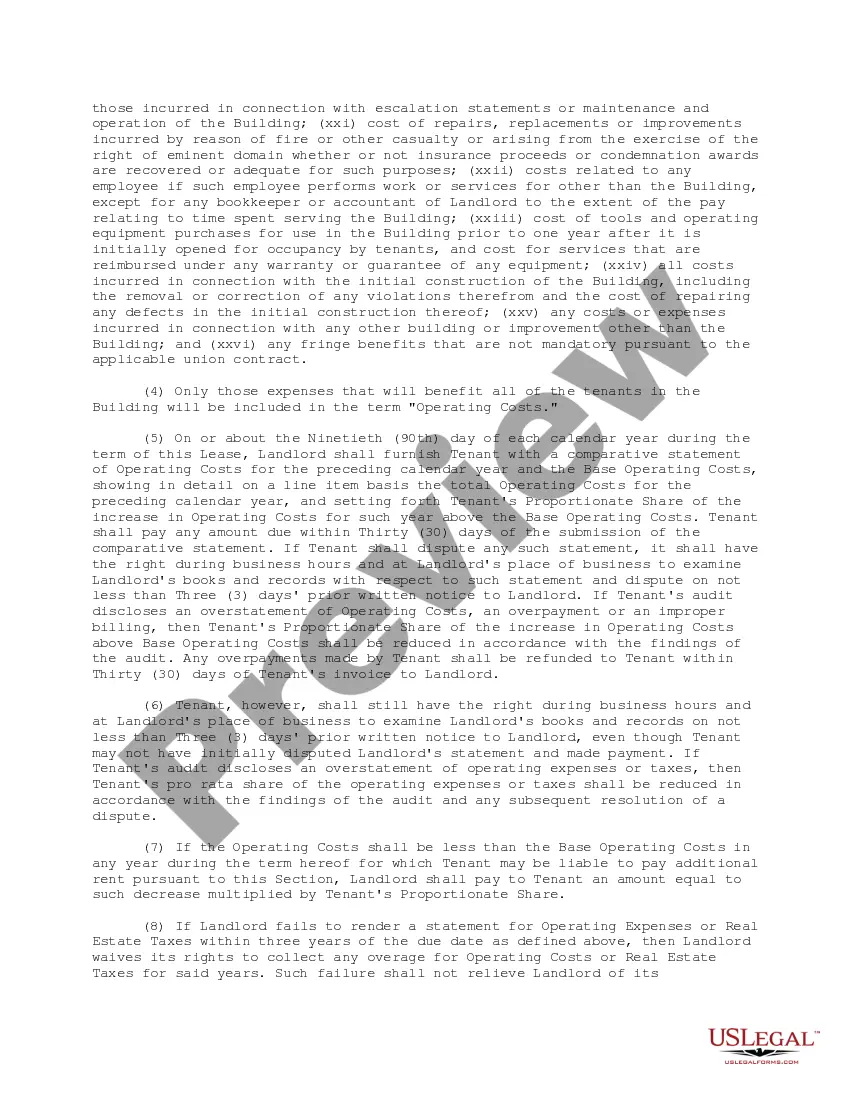

This office lease form describes an operating cost escalations provision.In the event that the operating costs for any calendar year during the term of this lease shall be greater than the base operating costs, the tenant will pay to the landlord additional rent of an amount equal to such an increase.

Arkansas Operating Cost Escalations Provision

Description

How to fill out Operating Cost Escalations Provision?

If you need to total, down load, or printing legitimate document web templates, use US Legal Forms, the most important variety of legitimate kinds, which can be found on-line. Utilize the site`s simple and easy hassle-free research to get the documents you will need. Various web templates for company and personal functions are sorted by classes and says, or search phrases. Use US Legal Forms to get the Arkansas Operating Cost Escalations Provision in a handful of click throughs.

In case you are already a US Legal Forms consumer, log in to the bank account and click the Acquire option to have the Arkansas Operating Cost Escalations Provision. You can even access kinds you in the past downloaded in the My Forms tab of your own bank account.

If you work with US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for that right area/nation.

- Step 2. Use the Preview choice to look over the form`s content material. Never forget to read the description.

- Step 3. In case you are unsatisfied using the kind, take advantage of the Look for area near the top of the display to discover other versions from the legitimate kind template.

- Step 4. Upon having found the shape you will need, click the Purchase now option. Opt for the pricing prepare you prefer and add your accreditations to sign up to have an bank account.

- Step 5. Approach the deal. You can use your bank card or PayPal bank account to complete the deal.

- Step 6. Select the structure from the legitimate kind and down load it on the product.

- Step 7. Full, edit and printing or indicator the Arkansas Operating Cost Escalations Provision.

Each and every legitimate document template you buy is your own property forever. You have acces to every kind you downloaded with your acccount. Select the My Forms segment and pick a kind to printing or down load once again.

Be competitive and down load, and printing the Arkansas Operating Cost Escalations Provision with US Legal Forms. There are millions of specialist and condition-certain kinds you can utilize to your company or personal demands.

Form popularity

FAQ

An escalator clause (also known as an escalation clause or a laddering clause) is a clause or provision in a lease or contract that allows pricing or wages to be adjusted to account for changing market conditions, such as inflation or tax fluctuations.

An expense stop clause is designed to stop the operating expenses of a property from increasing. An expense stop is designed to protect the lessor against annual tax, insurance, utility, CAM and other expense increases by requiring the lessee to pay such increases over a set amount.

Operating cost escalation refers to a hike in the operating and maintenance costs of commercial property, either office or retail. Therefore, when leasing a commercial property, it is crucial to understand what comprises operation cost and how does it impact the tenant.

An expense stop is a contractual provision that protects the property owner from rising expenses over the lease term. In such a case, the property owner typically agrees to pay all of the operating expenses in the first year of the lease, which is known as the ?base year amount? and sets the expense stop.

A mechanism in a Full Service Gross Lease, the Expense Stop is a fixed amount of operating expense above which the tenant is responsible to pay. Thus, the landlord is responsible to pay for all operating expenses below the Expense Stop, while the tenant is responsible for any amount above the Expense Stop.

An expense stop is the maximum amount a landlord will spend on operating expenses. Any amount above the expensive stop becomes the tenant's responsibility.

A ?rental escalation? refers to when the property owner increases the rental charged to the tenant occupying the property. These escalations typically take place on an annual basis and they result in an increase in the rental yield on the property.

Definition of tax stop clause in a lease that stops a lessor from paying property taxes above a certain amount. a clause in a lease that stops a lessor from paying property taxes above a certain amount.