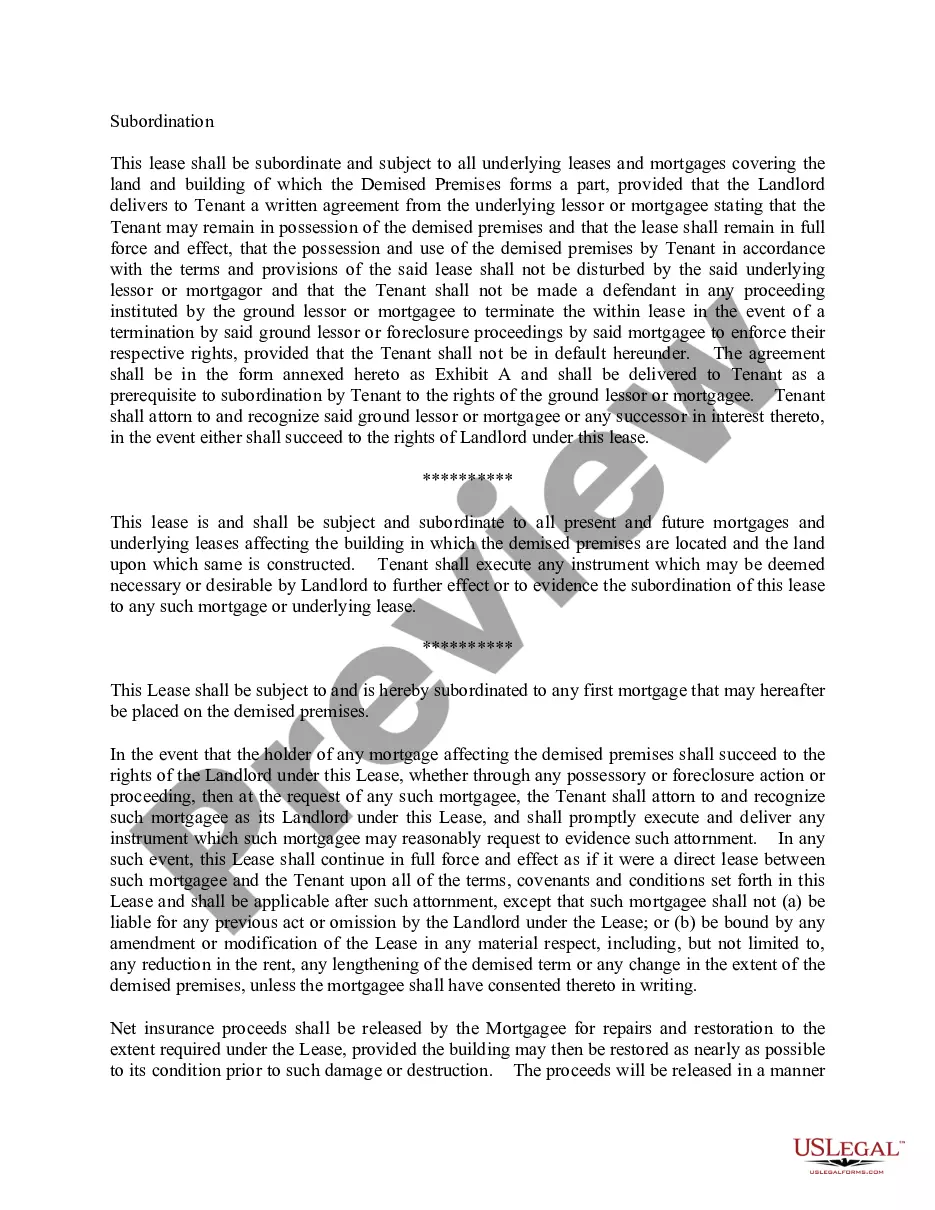

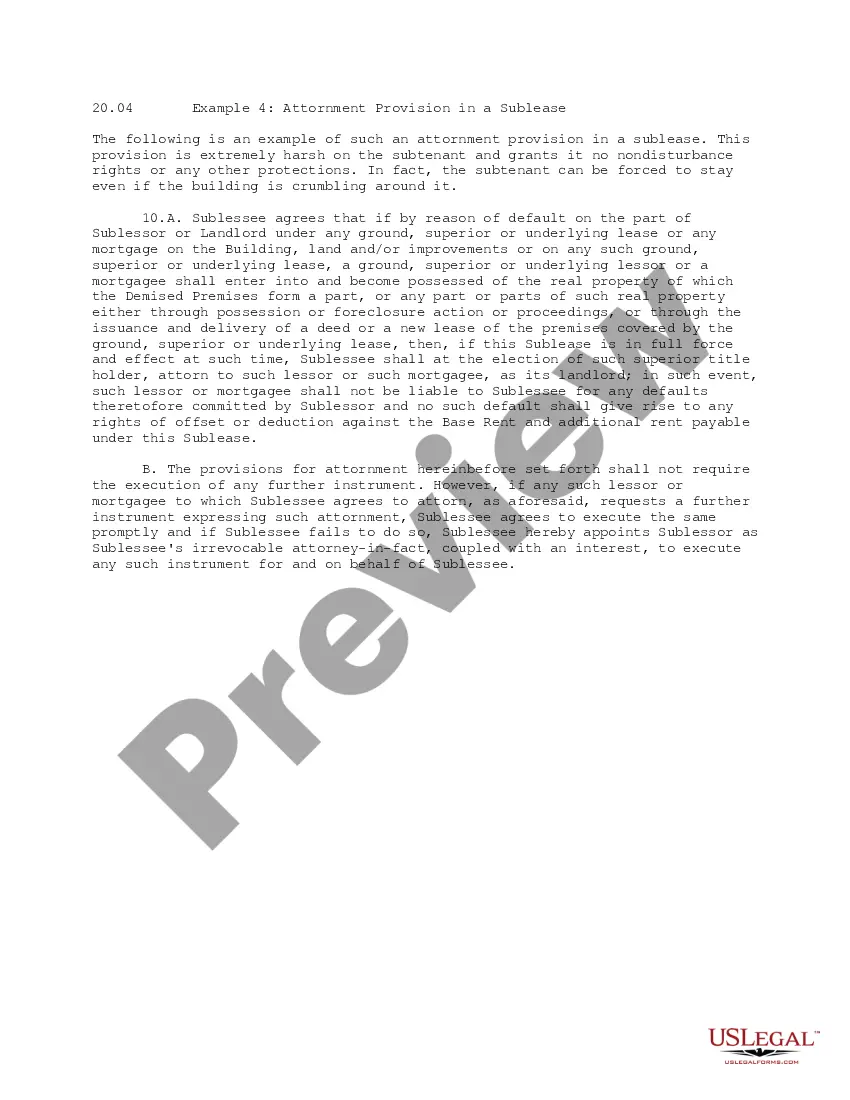

This office lease is subject and subordinate to all ground or underlying leases and to all mortgages which may affect the lease or the real property of which demised premises are a part and to all renewals, modifications, consolidations, replacements and extensions of any such underlying leases and mortgages. This clause shall be self-operative.

Arkansas Subordination Provision

Description

How to fill out Subordination Provision?

You may spend several hours on-line searching for the lawful record format that meets the federal and state demands you will need. US Legal Forms provides thousands of lawful types that happen to be reviewed by experts. It is simple to down load or print out the Arkansas Subordination Provision from the service.

If you currently have a US Legal Forms profile, you may log in and click on the Down load button. Next, you may comprehensive, edit, print out, or sign the Arkansas Subordination Provision. Every single lawful record format you get is your own permanently. To get another backup of any bought kind, go to the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms website for the first time, keep to the straightforward guidelines beneath:

- First, be sure that you have chosen the best record format to the state/area of your liking. See the kind explanation to ensure you have selected the proper kind. If accessible, utilize the Review button to check through the record format too.

- In order to find another edition of the kind, utilize the Search discipline to get the format that fits your needs and demands.

- Upon having located the format you need, click on Acquire now to move forward.

- Choose the costs plan you need, enter your accreditations, and register for your account on US Legal Forms.

- Complete the deal. You can use your credit card or PayPal profile to fund the lawful kind.

- Choose the file format of the record and down load it in your gadget.

- Make alterations in your record if needed. You may comprehensive, edit and sign and print out Arkansas Subordination Provision.

Down load and print out thousands of record templates utilizing the US Legal Forms Internet site, which offers the most important variety of lawful types. Use expert and state-particular templates to deal with your business or specific requires.

Form popularity

FAQ

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future. Subordination is the act of yielding priority.

Subordination is a way of changing the priority of claims against a debtor so that one creditor or group of creditors (the junior creditor(s)) agree that their debt will not be paid until debts owed to another creditor or group of creditors (the senior creditor(s)) have been paid.

Contractual subordination is an arrangement where senior and junior loans are made to the same borrower (common debtor) but the senior creditor and junior creditor agree by contract priority of payment.

The new lender prepares the subordination agreement in conjunction with the subordinating lienholder. Then, the parties typically sign the agreement. But in some cases, just the subordinating lender will need to sign the paperwork.

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks.

Example of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

To adjust their priority, subordinate lienholders must sign subordination agreements, making their loans lower in priority than the new lender. A subordination agreement puts the new lender into first position and reassigns an existing mortgage to second position or third position, and so on.