Arkansas Employment of Independent Contractors Package

Description

How to fill out Employment Of Independent Contractors Package?

Choosing the best lawful papers web template could be a battle. Naturally, there are plenty of templates available on the Internet, but how can you find the lawful develop you need? Take advantage of the US Legal Forms site. The services offers a huge number of templates, such as the Arkansas Employment of Independent Contractors Package, that you can use for enterprise and personal requirements. All of the forms are checked out by pros and meet federal and state demands.

If you are previously signed up, log in to your account and then click the Down load option to obtain the Arkansas Employment of Independent Contractors Package. Make use of account to look with the lawful forms you might have purchased earlier. Go to the My Forms tab of your own account and have an additional duplicate from the papers you need.

If you are a whole new user of US Legal Forms, listed below are easy directions that you can adhere to:

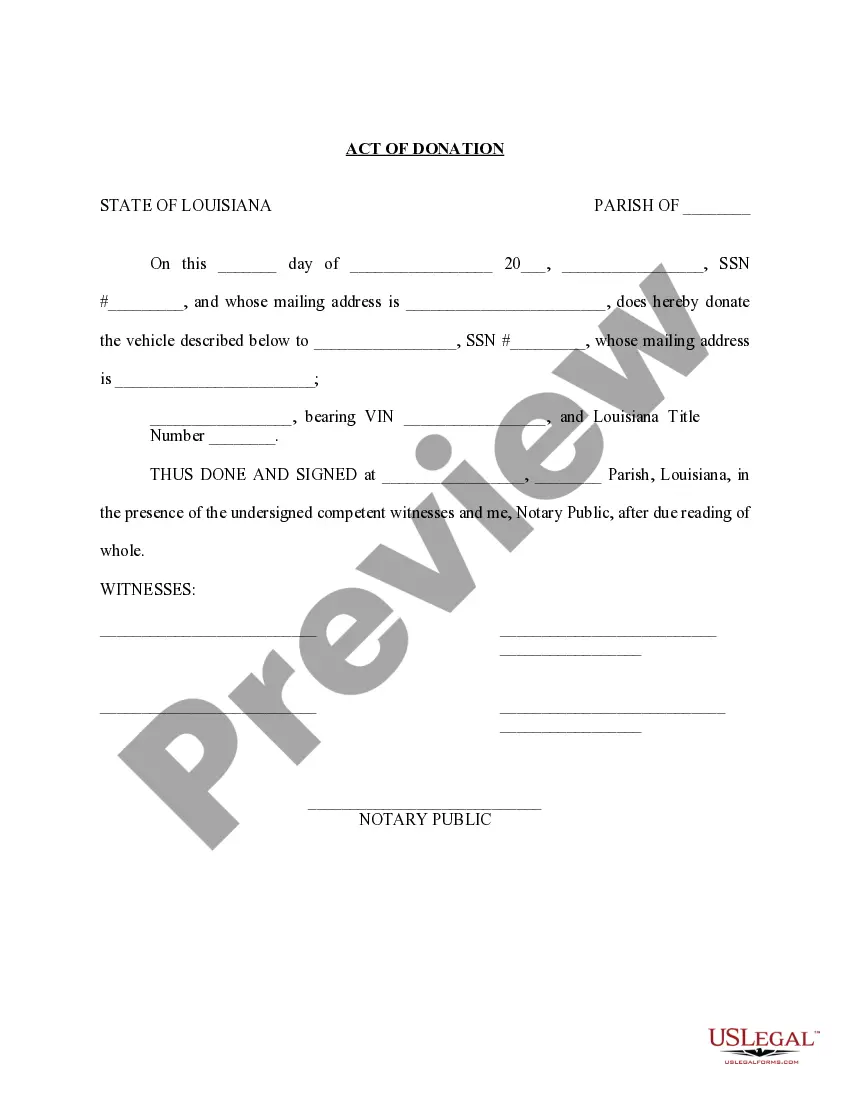

- First, make certain you have chosen the correct develop for your area/county. You can examine the form making use of the Preview option and study the form description to ensure it will be the right one for you.

- In case the develop does not meet your expectations, make use of the Seach area to obtain the correct develop.

- When you are positive that the form is acceptable, click on the Get now option to obtain the develop.

- Choose the prices plan you desire and enter the essential information and facts. Design your account and pay money for the transaction utilizing your PayPal account or bank card.

- Pick the submit formatting and acquire the lawful papers web template to your device.

- Full, modify and produce and signal the acquired Arkansas Employment of Independent Contractors Package.

US Legal Forms may be the most significant library of lawful forms in which you can find a variety of papers templates. Take advantage of the company to acquire expertly-made documents that adhere to condition demands.

Form popularity

FAQ

Misclassification of a worker occurs when a worker is treated as contract labor when the law does not allow for such classification. Arkansas law determines the proper classification of a worker for unemployment insurance (UI) tax purposes.

Instead, the ABC test looks at the following 3 factors: the control that the company exerts on the worker, whether the work is outside the company's typical business, and. whether the worker normally provides this type of work as an independent business.

Independent contractors typically do not receive the same rights afforded to employees and are responsible for their own retirement plans, insurance and other benefits. When you work as an independent contractor, you are an individual entity.

An employee may quit work at any time without liability on the employer's part. Independent Contractors normally pay all of their own business and travel expenses without reimbursement. An independent contractor is legally responsible for job completion and, on quitting, becomes liable for breach of contract.

An employee performs services in the order or sequence set by the employer. An independent contractor uses his own methods and thus need not receive training from the purchaser of those services.

The ABC test is used in some states to determine whether a person is an employee or an independent contractor for the purpose of determining state unemployment tax.

Arkansas uses an ABC test for unemployment insurance, where in order to obtain independent contractor status under the Employment Security Act, it is necessary that an employer prove each of three statutory subsections: that an individual has been and will continue to be free from control or direction in connection ...