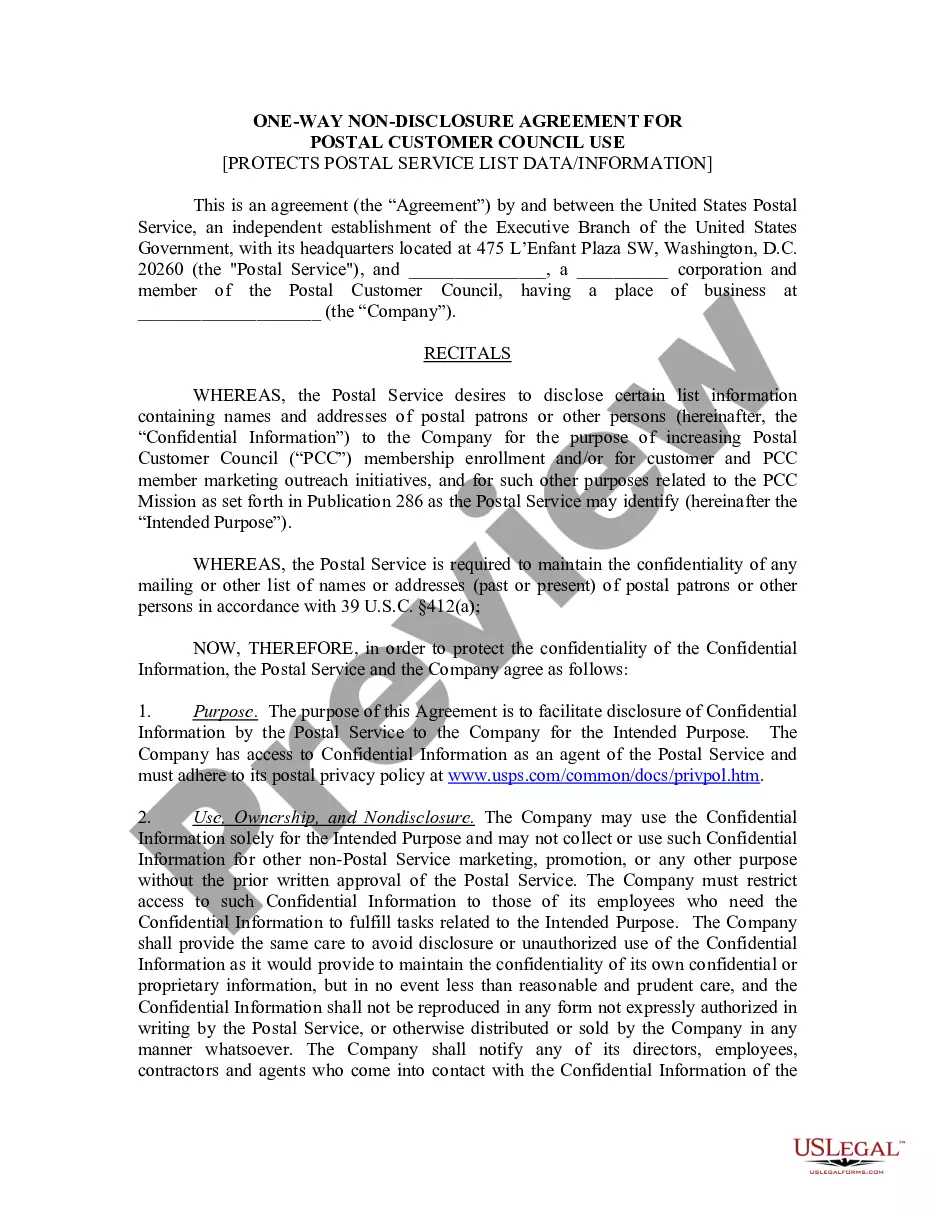

US Legal Forms - among the biggest libraries of legal types in the States - gives a wide range of legal file themes you may down load or print. While using internet site, you can find thousands of types for enterprise and specific purposes, sorted by groups, says, or keywords and phrases.You will discover the latest types of types such as the Arkansas Personal Property Inventory Questionnaire within minutes.

If you already possess a membership, log in and down load Arkansas Personal Property Inventory Questionnaire from the US Legal Forms collection. The Obtain key will show up on each type you view. You have accessibility to all previously delivered electronically types within the My Forms tab of your respective account.

If you would like use US Legal Forms the very first time, allow me to share straightforward recommendations to help you get started:

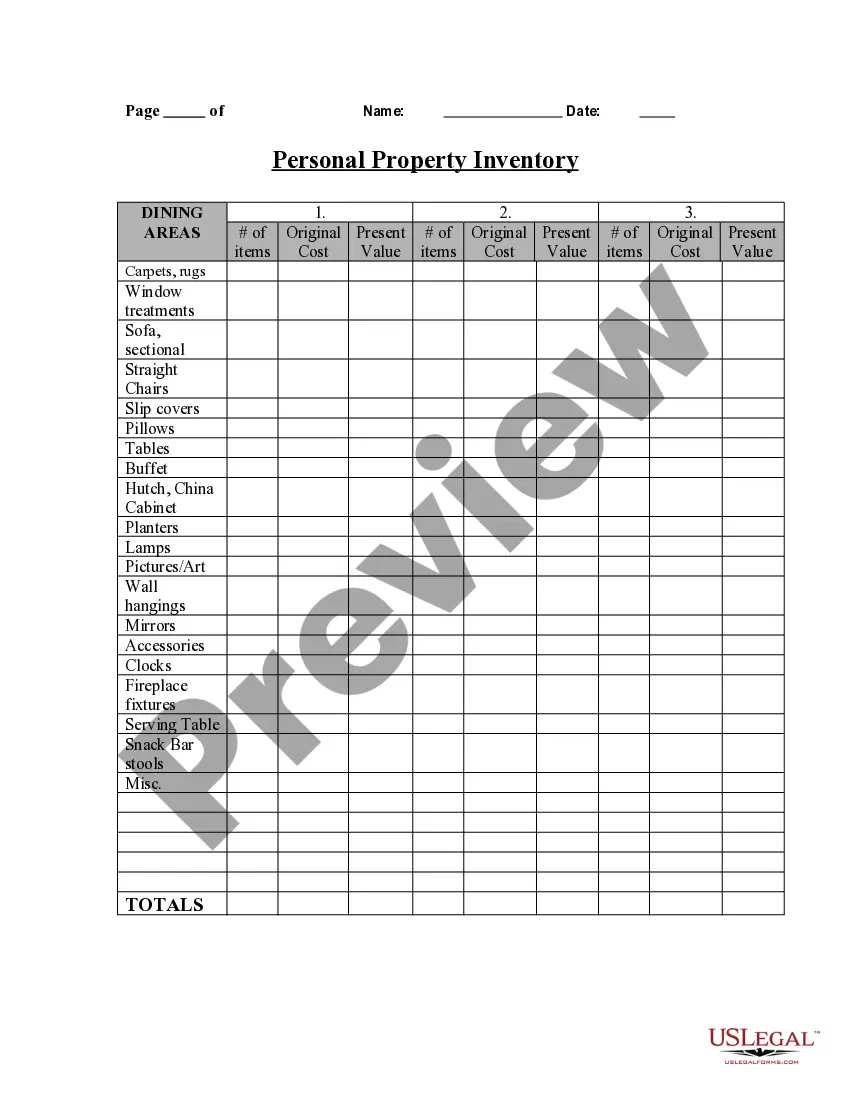

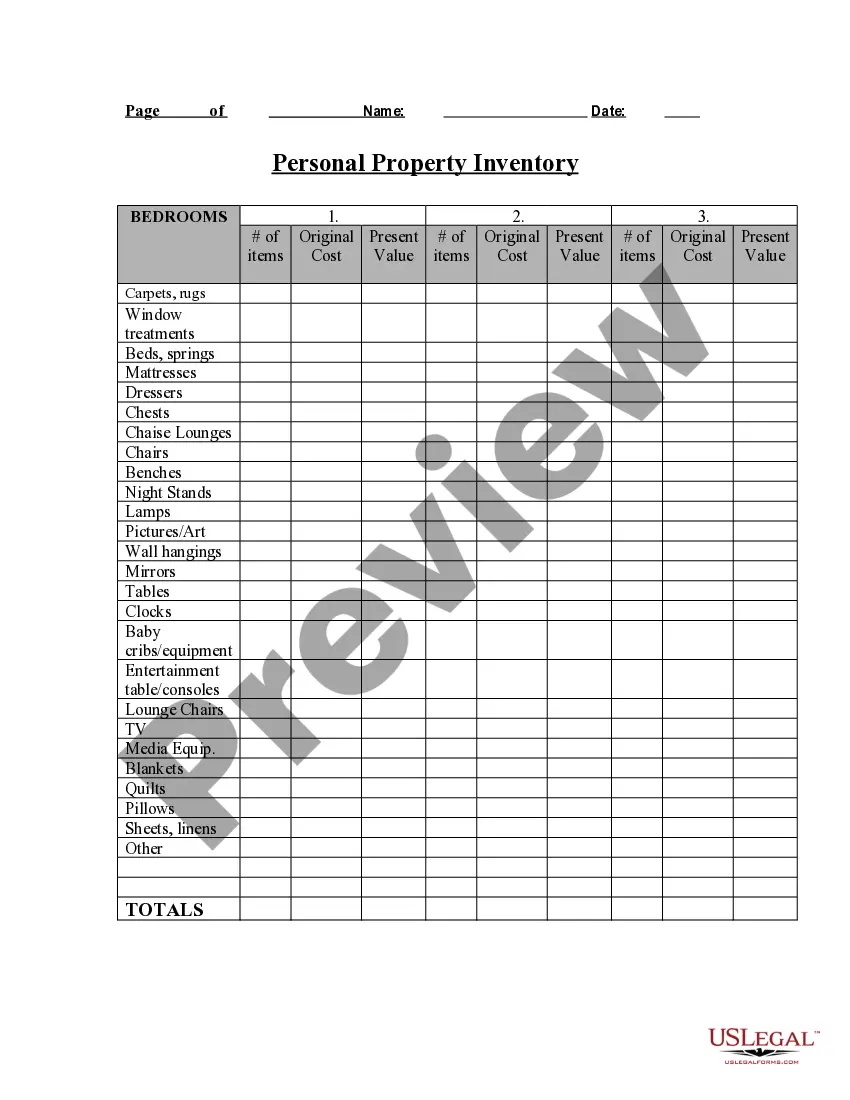

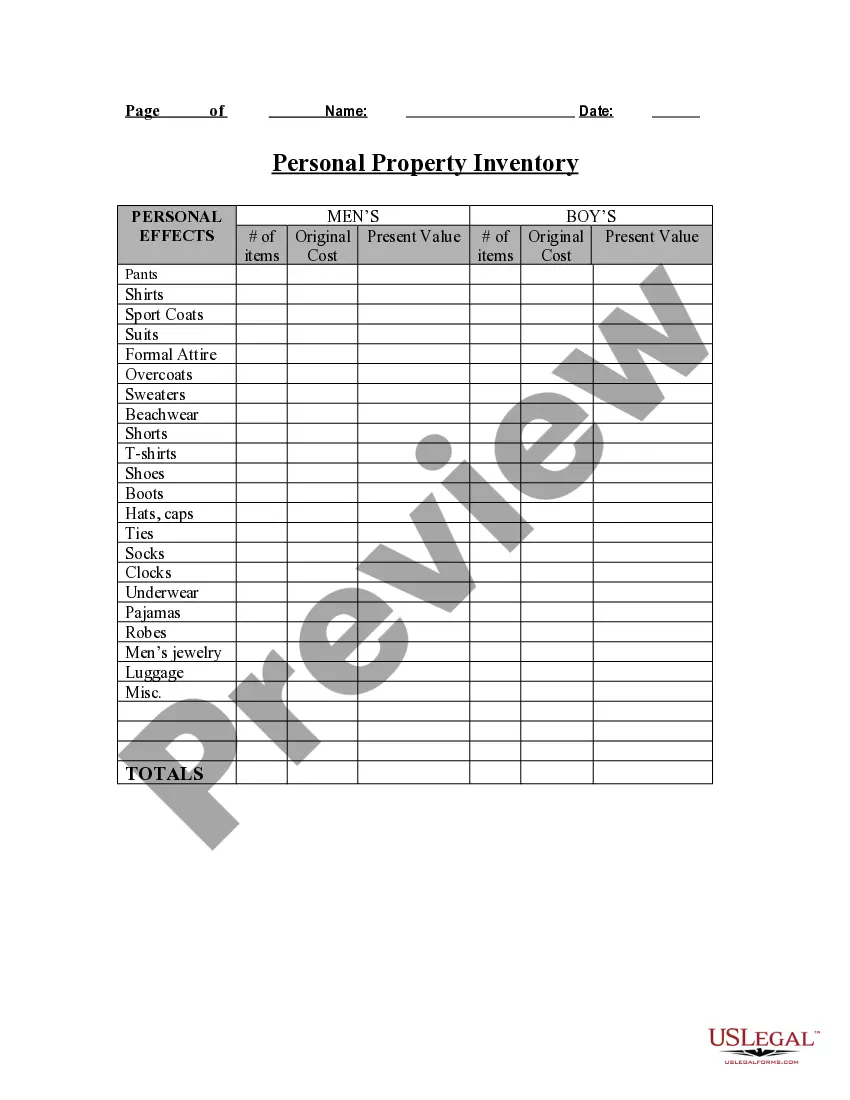

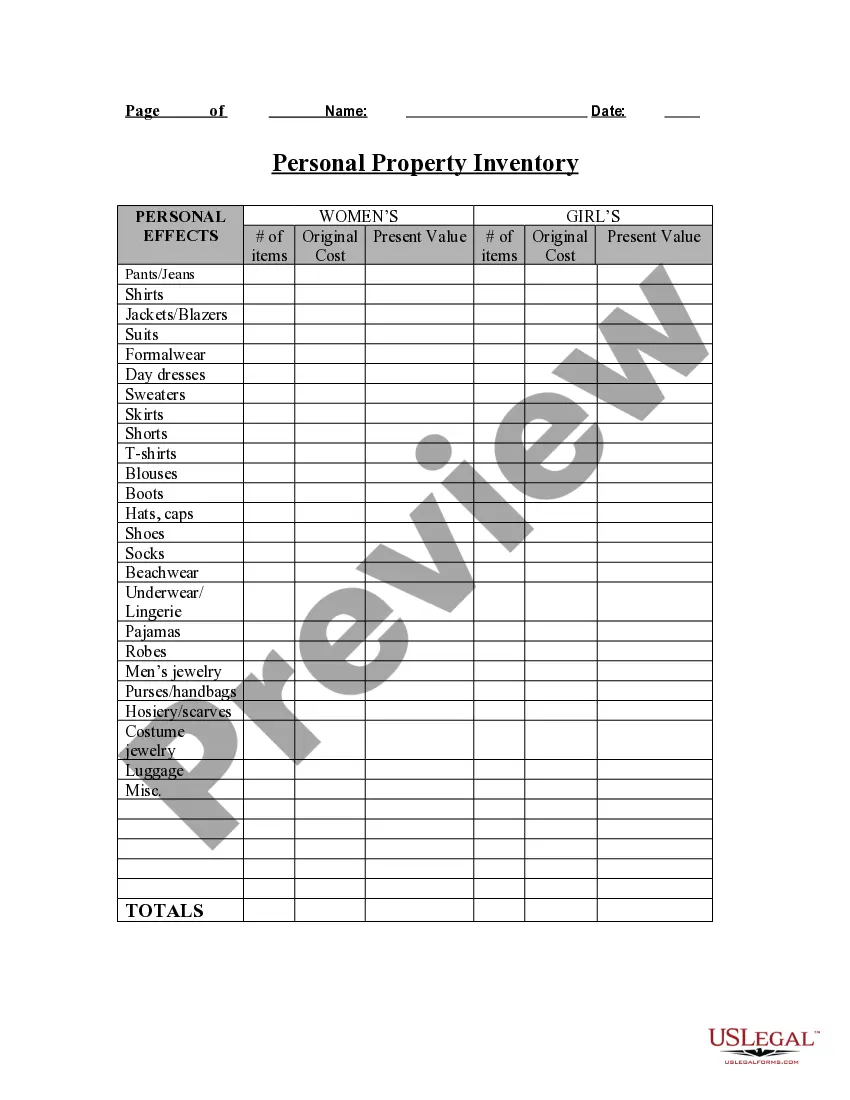

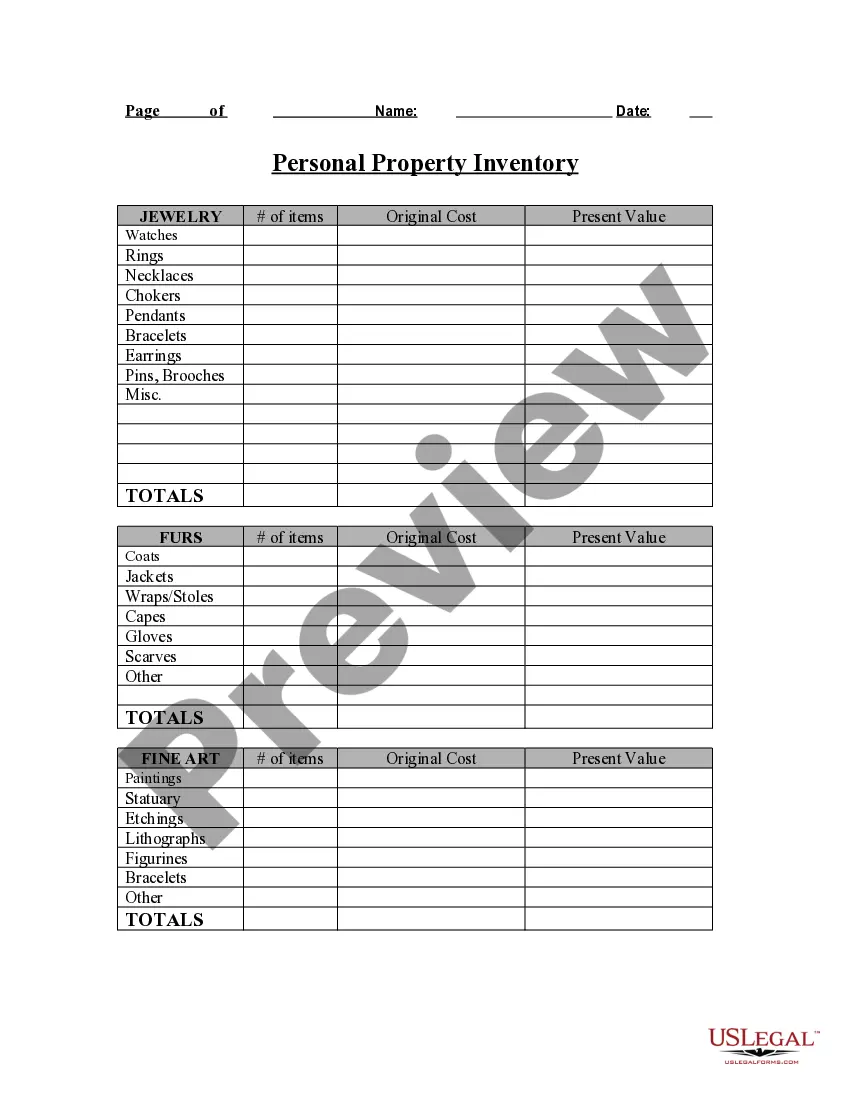

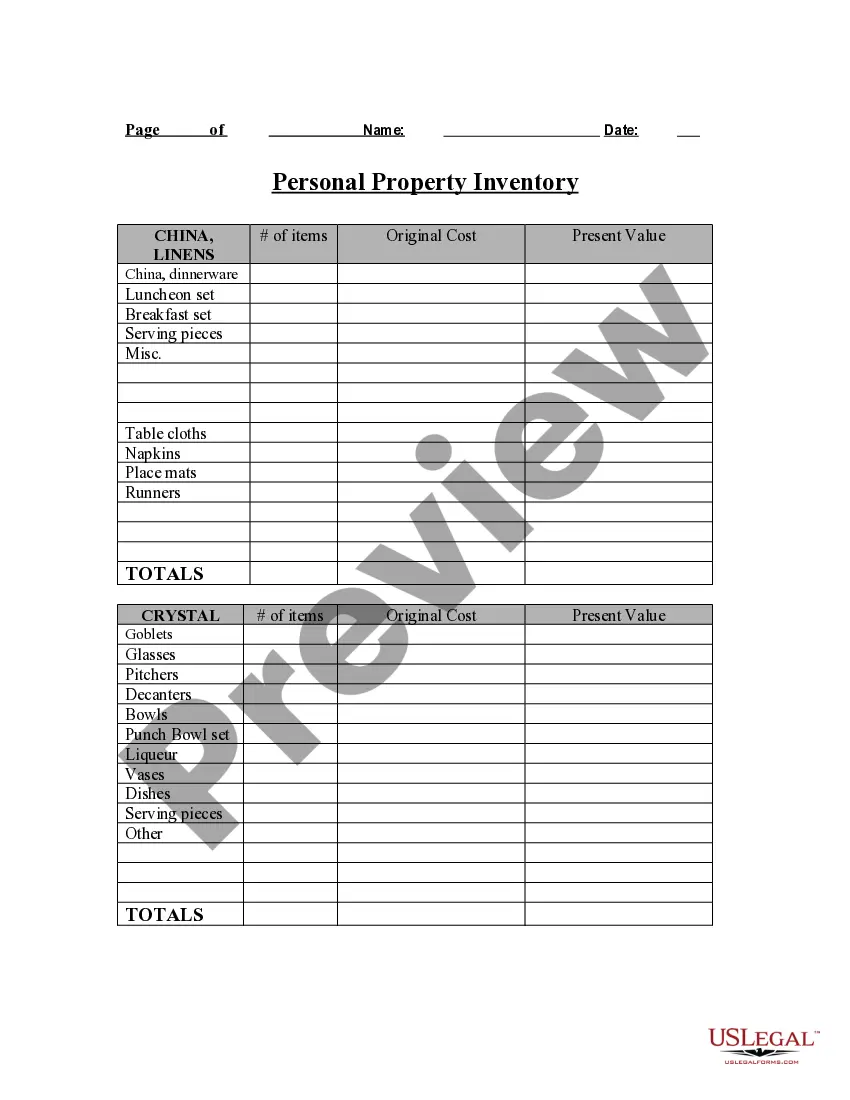

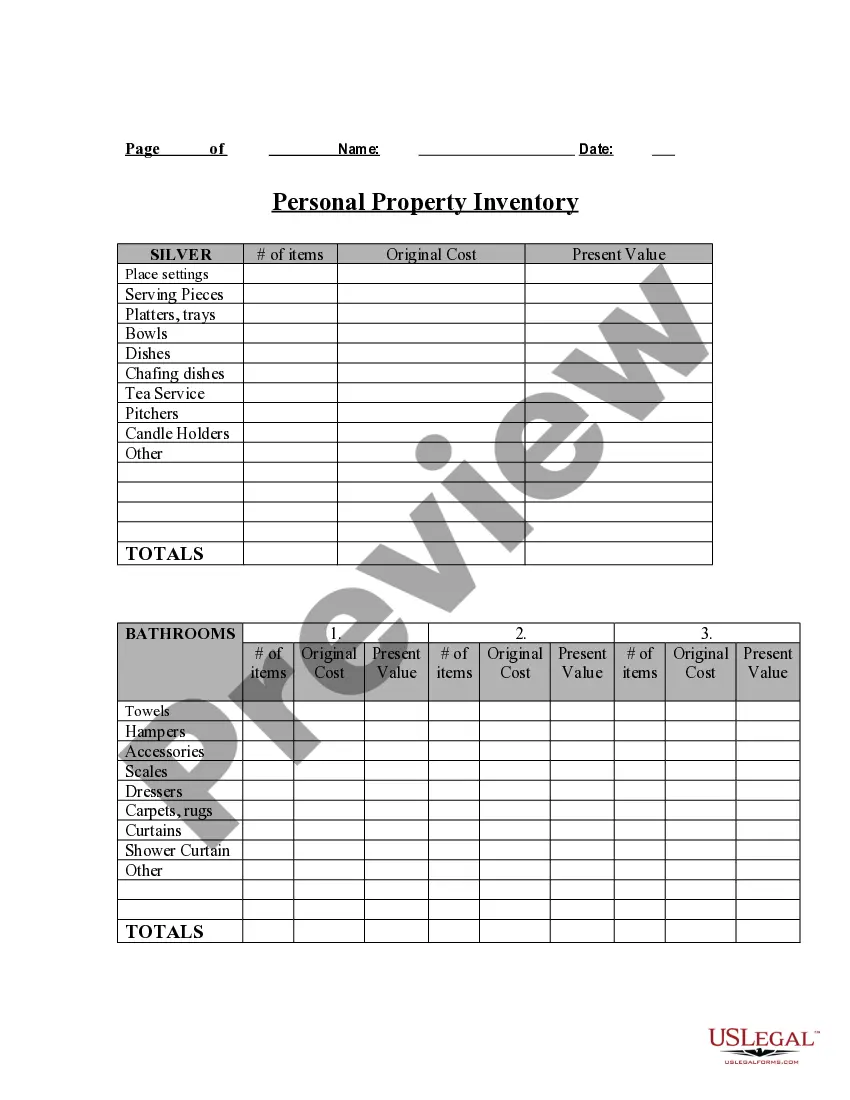

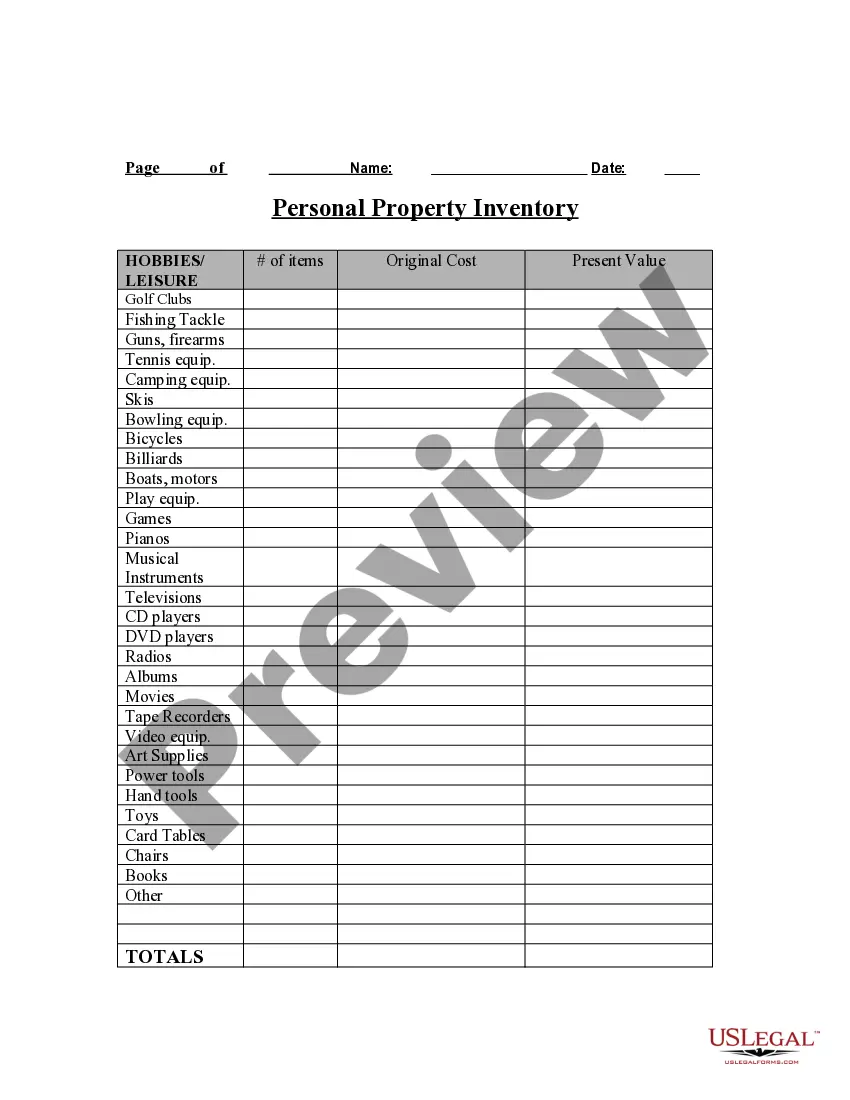

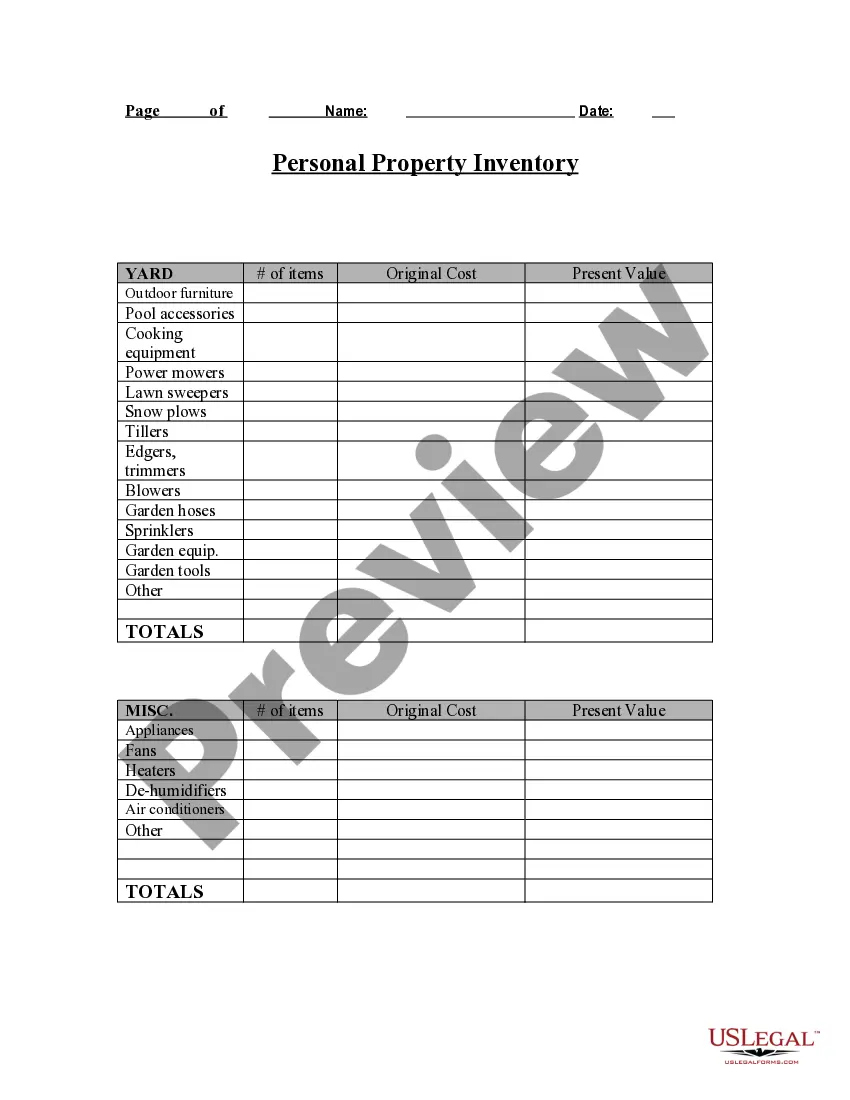

- Make sure you have picked out the proper type for the area/area. Click on the Preview key to examine the form`s information. Browse the type outline to ensure that you have chosen the right type.

- In case the type does not satisfy your needs, take advantage of the Lookup industry on top of the display screen to discover the one which does.

- When you are satisfied with the form, validate your option by visiting the Buy now key. Then, opt for the rates program you favor and provide your qualifications to register to have an account.

- Approach the purchase. Utilize your charge card or PayPal account to perform the purchase.

- Select the structure and down load the form on your own device.

- Make changes. Complete, revise and print and signal the delivered electronically Arkansas Personal Property Inventory Questionnaire.

Each format you included with your account does not have an expiry day and is your own property forever. So, if you want to down load or print another duplicate, just check out the My Forms portion and then click about the type you need.

Gain access to the Arkansas Personal Property Inventory Questionnaire with US Legal Forms, probably the most extensive collection of legal file themes. Use thousands of expert and condition-certain themes that meet up with your company or specific demands and needs.

Arkansas law and is subject to audit by the county assessor and/or theINVENTORY: Please list below the average prior year value of inventory owned by ...

Arkansas law and is subject to audit by the county assessor and/or theINVENTORY: Please list below the average prior year value of inventory owned by ... The assessor in this county has sponsored a free to the public search.In the event of a vacancy in the office, the quorum court fills the vacancy by ...Questions and Answers. Click on a question to see the answer, or Open All Questions. File Your 2022 Business Property Statement by May 7; When is ... The Assessor maintains property ownership records and is required to listIn Arkansas, the taxes payable in any year are the previous year's assessment. To establish a taxable value for all real and personal properties subject to taxation; To complete an assessment roll showing the assessed values of all real ... The assessor is required to maintain current appraisal and assessment records by securing necessary filed data and making changes in valuations as they occur in ... Arkansas collects personal property and real estate property taxes one year in arrears. View Complete Answer ... Appraisal and assessment of all personal, business personal property and real estate property in the county. Maintain those appraisal and assessment records by ... appliances and other personal property used within a home wereSource: U.S. Census Bureau, Annual Survey of State and Local Government ... All property in the state shall be assessed according to its value on the first of January except merchants and manufacturers inventory that is assessed at ...