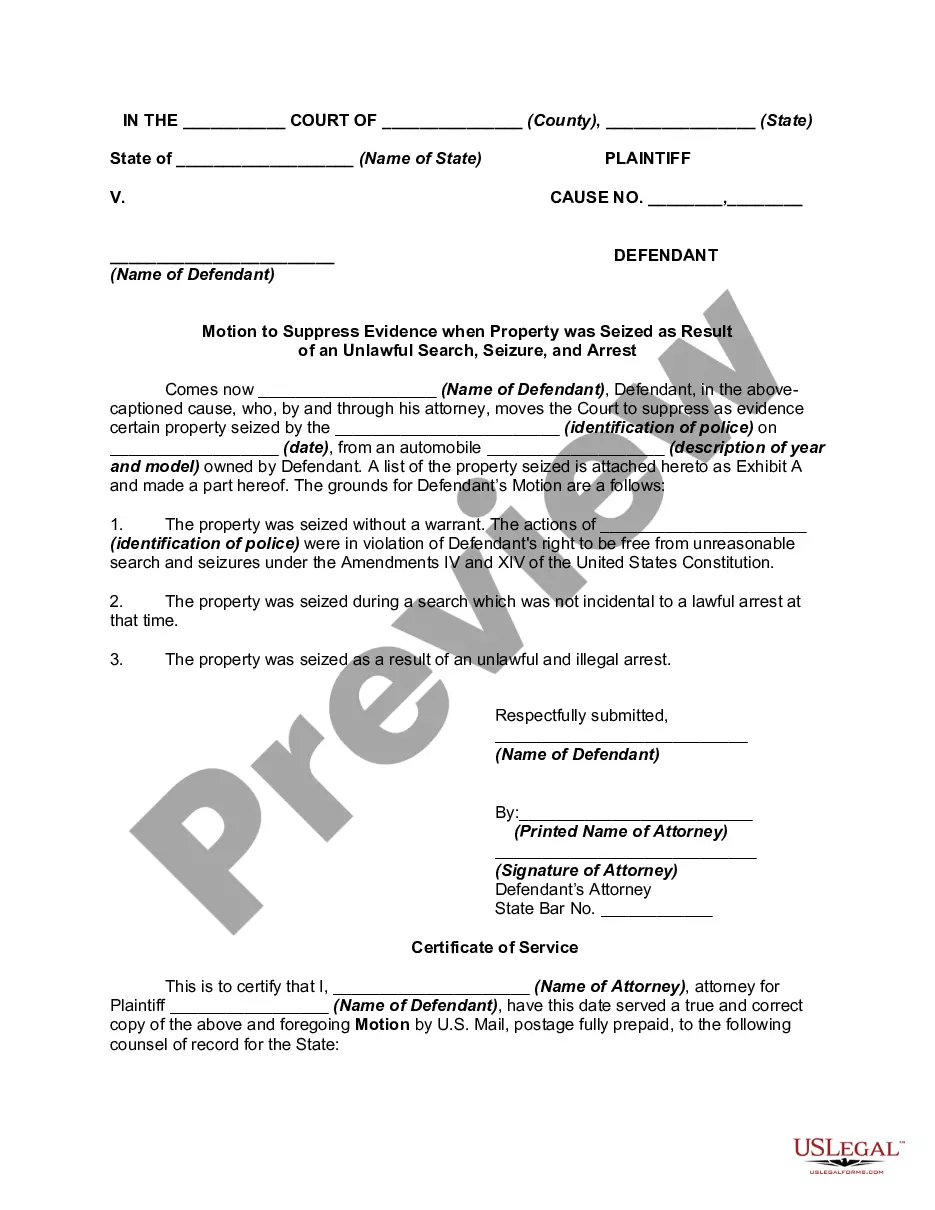

This employee stock option plan grants the optionee (the employee) a non-qualified stock option under the company's stock option plan. The option allows the employee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

Arkansas Employee Stock Option Agreement

Description

How to fill out Employee Stock Option Agreement?

US Legal Forms - one of several largest libraries of legitimate forms in the States - offers a variety of legitimate document web templates you may download or printing. While using site, you can find a large number of forms for company and individual purposes, categorized by types, states, or keywords.You can find the most recent variations of forms much like the Arkansas Employee Stock Option Agreement within minutes.

If you already have a monthly subscription, log in and download Arkansas Employee Stock Option Agreement in the US Legal Forms library. The Obtain button will show up on each and every type you view. You have accessibility to all formerly saved forms inside the My Forms tab of your own bank account.

In order to use US Legal Forms the first time, listed below are basic instructions to obtain started:

- Ensure you have picked the best type to your city/county. Click on the Preview button to check the form`s information. See the type description to actually have chosen the appropriate type.

- In the event the type doesn`t fit your demands, utilize the Search industry near the top of the screen to discover the the one that does.

- When you are content with the form, validate your choice by clicking the Buy now button. Then, choose the prices plan you prefer and offer your references to register on an bank account.

- Approach the financial transaction. Make use of your charge card or PayPal bank account to finish the financial transaction.

- Find the file format and download the form on your own system.

- Make modifications. Fill up, edit and printing and indication the saved Arkansas Employee Stock Option Agreement.

Each format you put into your bank account lacks an expiry particular date which is yours forever. So, in order to download or printing one more duplicate, just visit the My Forms area and then click in the type you need.

Obtain access to the Arkansas Employee Stock Option Agreement with US Legal Forms, by far the most extensive library of legitimate document web templates. Use a large number of expert and state-distinct web templates that fulfill your business or individual demands and demands.

Form popularity

FAQ

Occasionally a stock pays a big dividend and exercising a call option to capture the dividend may be worthwhile. Or, if you own an option that is deep in the money, you may not be able to sell it at fair value. If bids are too low, however, it may be preferable to exercise the option to buy or sell the stock.

Exercising a stock option means purchasing the issuer's common stock at the price set by the option (grant price), regardless of the stock's price at the time you exercise the option. See About Stock Options for more information.

Exercising stock options means you're purchasing shares of a company's stock at a set price. If you decide to exercise your stock options, you'll own a piece of the company. Owning stock options is not the same as owning shares outright.

If the holder of a put option exercises the contract, they will sell the underlying security at a stated price within a specific timeframe. If the holder of a call option exercises the contract, they will buy the underlying security at a stated price within a specific timeframe.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.