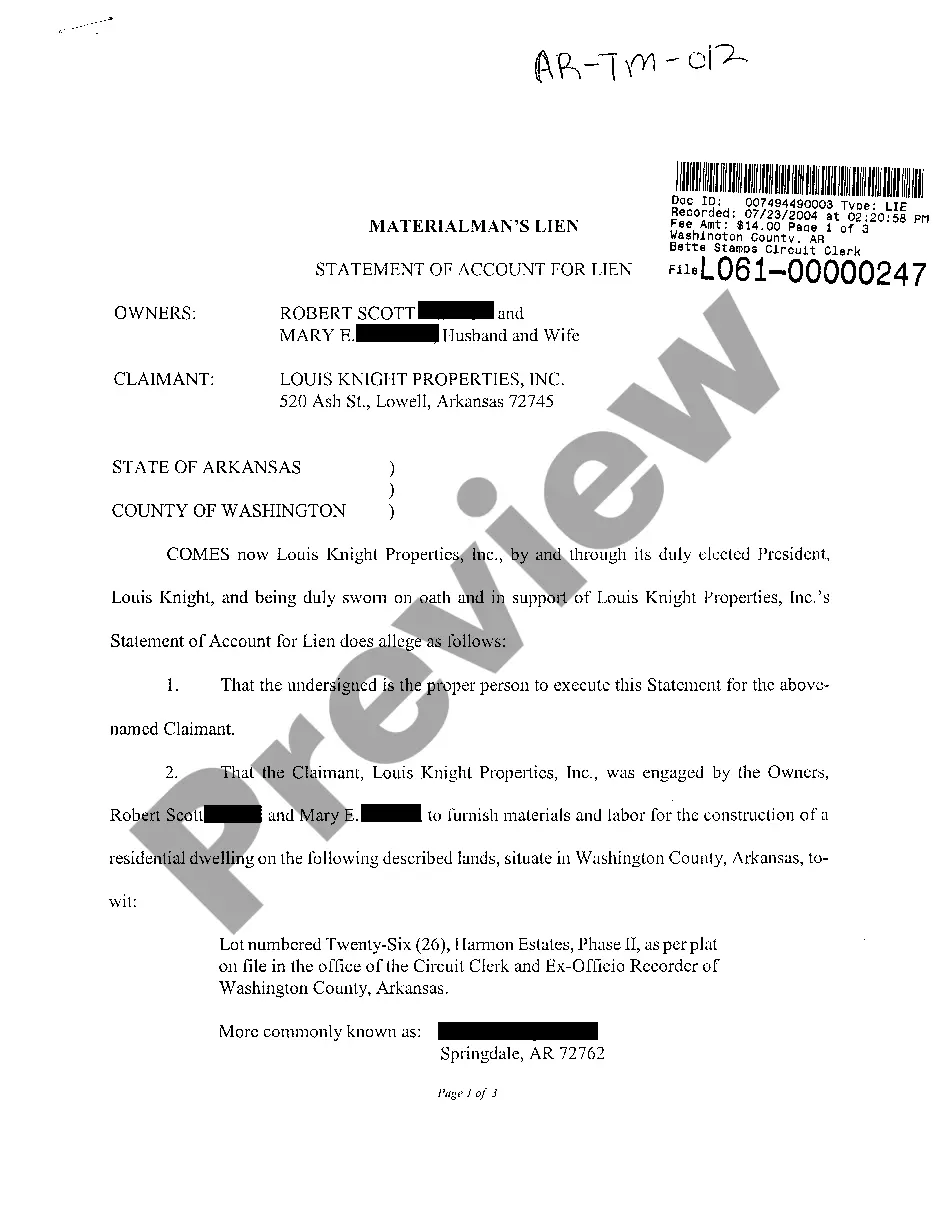

Arkansas Materialman's Lien

Description

Key Concepts & Definitions

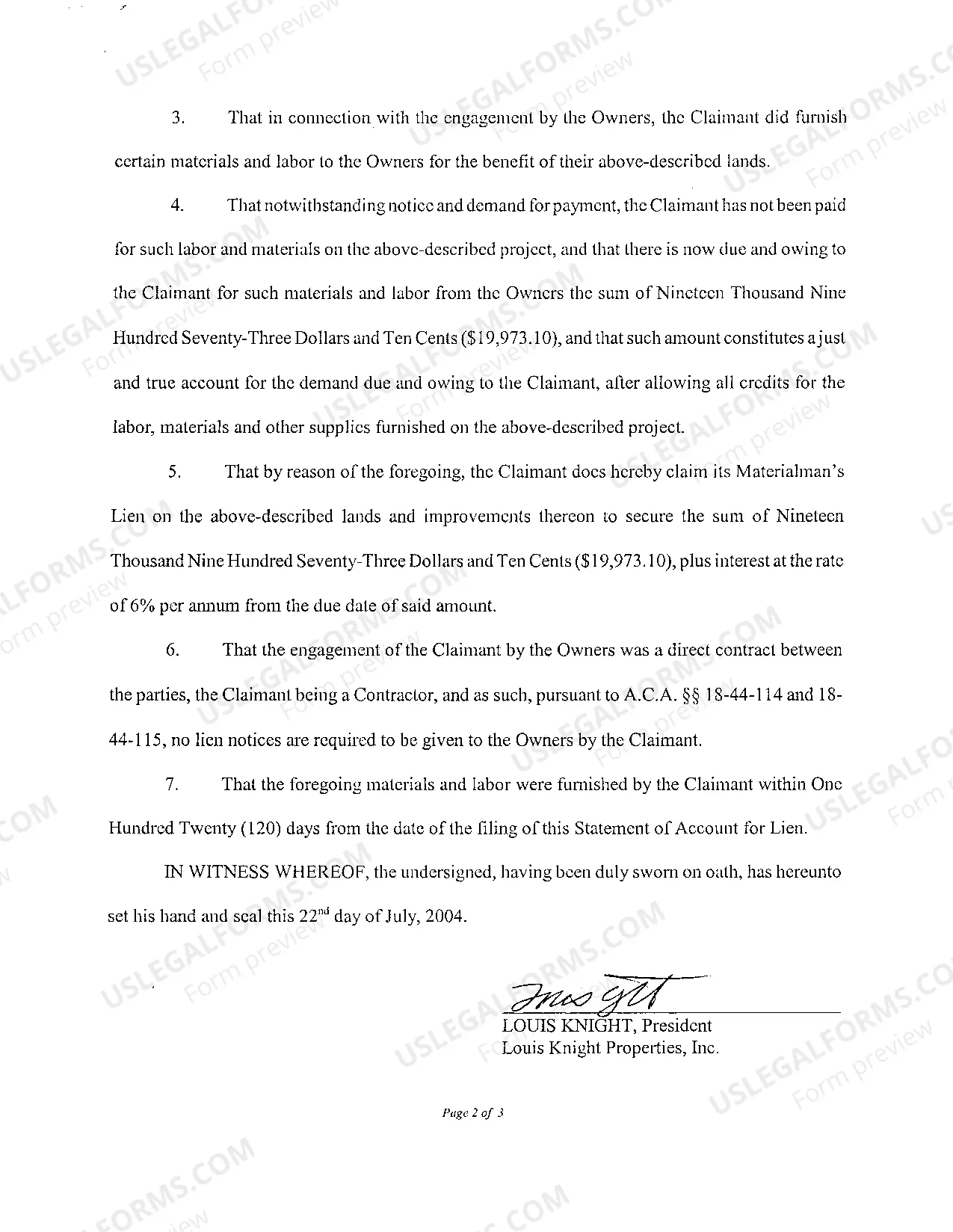

Materialman's Lien: A legal claim filed by contractors, subcontractors, or suppliers against property where they provided labor or materials but were not paid. This lien assures that the property cannot be refinanced or sold until the debts are settled. Preliminary Notice Requirements: Many states require that a preliminary notice be given to the property owner within a specific timeframe before a lien can be filed. This serves as a formal warning intended to resolve disputes before pursuing a lien.

Step-by-Step Guide to Filing a Materialman's Lien

- Determine Eligibility: Verify that your situation meets the state requirements for filing a lien, including involvement in a construction or property improvement project.

- Contact a Financial Lawyer: It's advisable to consult with a lawyer who specializes in real estate disputes to navigate federal tax law and local legal conditions.

- Apply for an EIN Online: If you're a subcontractor or independent contractor, applying for an Employer Identification Number (EIN) may be necessary for tax and identity verification purposes.

- File Preliminary Notice: Comply with preliminary notice requirements specific to your state to inform the property owner officially about the unpaid debt.

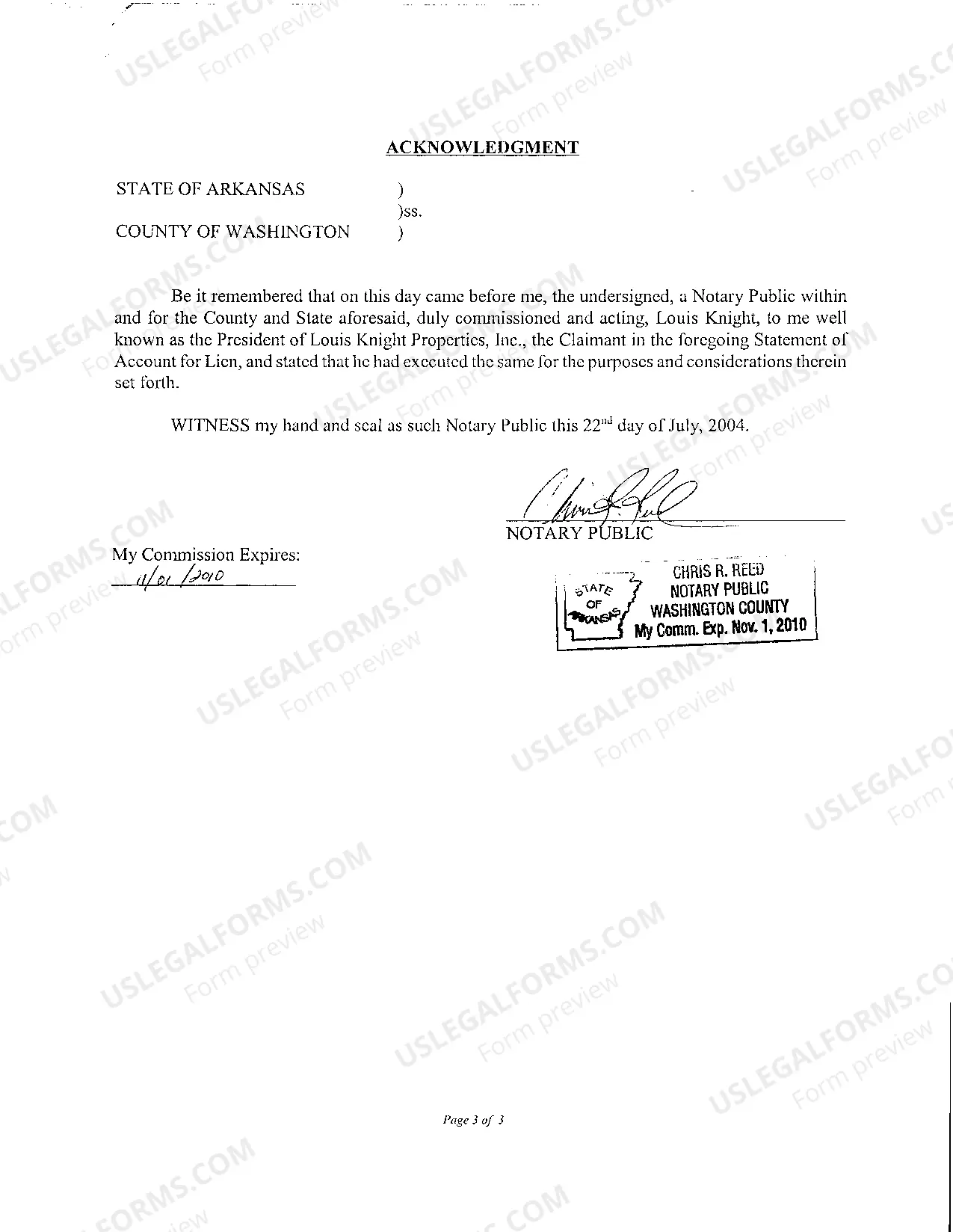

- Prepare Materialmans Lien Documentation: Gather all necessary documents evidencing the labor or materials provided and the agreed terms.

- File the Lien: Submit the lien to the appropriate county office where the property is located before the construction project deadlines.

Risk Analysis

- Legal Risks: Incorrect filing or missing deadlines can invalidate the lien, leading to financial losses. Always ensure compliance with local legal claim procedures.

- Relationship Risks: Filing a lien can strain or sever professional relationships with commercial property owners, which may impact future business opportunities.

- Financial Risks: The lien filing process can be costly, especially if drawn into lengthy legal disputes requiring extensive legal support.

Best Practices

- Timely Action: Take action quickly to meet all deadlines for notice and lien filing, which are critical to preserving lien rights.

- Accurate Documentation: Maintain detailed records of all labor and materials provided as proof for lien claims.

- Legal Consultation: Regularly consult with a lawyer skilled in real estate and construction law to navigate complex state and federal statutes effectively.

FAQ

What happens if I file the lien after the construction project deadline? Filing late generally invalidates your right to claim a lien, potentially leading to an unrecoverable financial loss. Can I apply for an EIN online if I'm not a U.S. citizen? Yes, non-U.S. citizens can apply for an EIN online, which is necessary for filing taxes and can be required for legal processes like lien filings.

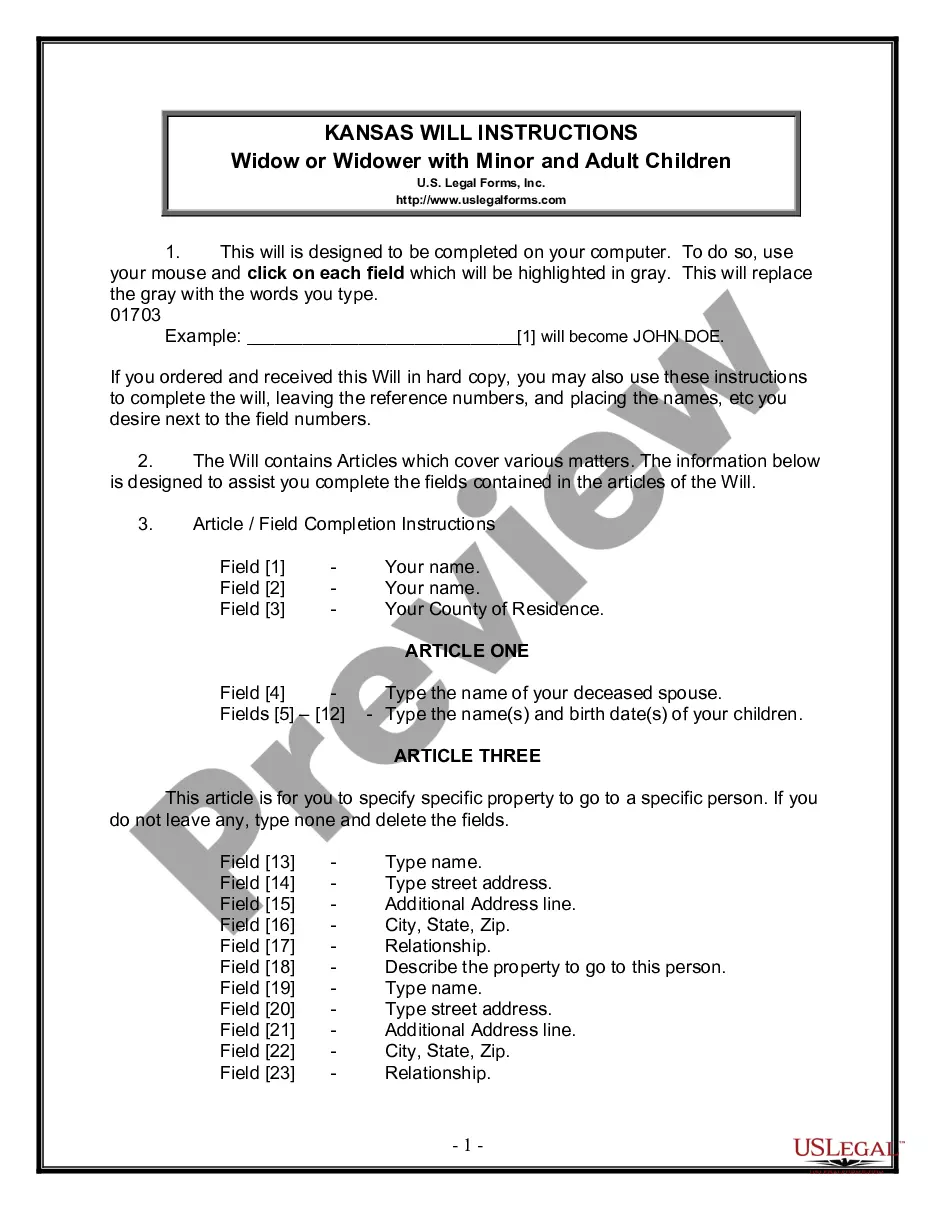

How to fill out Arkansas Materialman's Lien?

Among numerous gratis and paid samples that you can find online, you can't be sure about their dependability. For instance, who developed them or if they are competent enough to cater to your requirements.

Always stay composed and utilize US Legal Forms! Acquire Arkansas Materialman's Lien templates created by experienced legal professionals and avoid the expensive and time-consuming task of searching for a lawyer and then compensating them to draft a document for you that you might locate on your own.

If you have a subscription, Log In to your account and locate the Download button next to the form you are searching for. You will also have access to your previously saved templates in the My documents section.

Once you have registered and purchased your subscription, you can utilize your Arkansas Materialman's Lien as often as you need or for as long as it stays active in your area. Modify it in your favorite editor, complete it, sign it, and create a physical copy of it. Achieve more for less with US Legal Forms!

- Ensure that the document you find is valid in your jurisdiction.

- Examine the document by reading the description using the Preview feature.

- Click Buy Now to commence the buying process or search for another template using the Search bar located in the header.

- Select a pricing plan and establish an account.

- Remit payment for the subscription with your credit/debit card or Paypal.

- Download the document in your preferred file type.

Form popularity

FAQ

To navigate around a mechanic's lien, you should first understand your rights under the Arkansas Materialman's Lien laws. Engaging with a qualified attorney can provide clarity on your options, such as negotiating with contractors or suppliers. You may also consider filing for a bond to discharge the lien, giving you more time to resolve the dispute. Additionally, utilizing platforms like US Legal Forms can help you find the necessary forms and guidance to manage the lien effectively.

To put a lien on property in Arkansas, you must gather the necessary documentation, including a detailed account of services or materials provided, and complete the appropriate forms. After preparing these documents, file them with the county clerk's office. For a streamlined process, platforms like USLegalForms offer resources that guide you through filing an Arkansas Materialman's Lien effectively and efficiently.

In Arkansas, you generally have 120 days from the completion of work or delivery of materials to file a lien. This timeframe is crucial for anyone looking to protect their financial interests related to an Arkansas Materialman's Lien. Be mindful of this deadline, as failing to file within this period may result in the loss of your lien rights.

An intent to lien letter in Arkansas is a document sent to notify a property owner of the impending lien filing for unpaid work or materials. This letter outlines the details of the claim and emphasizes the need for prompt payment. It is an important step in the process for those pursuing an Arkansas Materialman's Lien, as it helps establish a formal record of the claim.

A notice of intent to lien in Arkansas serves as a formal warning to parties involved that a lien may be placed on property due to unpaid debts. It informs the property owner of the claim against their property and gives them a chance to address the situation. Understanding this notice is vital for anyone dealing with an Arkansas Materialman's Lien, as it can impact property rights and obligations.

To file a lien on a car in Arkansas, you need to complete the necessary paperwork and submit it to the Arkansas Department of Finance and Administration. Ensure you provide all required information like the vehicle identification number, owner's details, and the reason for the lien. Utilizing services like USLegalForms can simplify this process, providing you with the forms and guidance needed for an Arkansas Materialman's Lien.

A contractor has 120 days to file an Arkansas materialman's lien after the completion of their work. If you miss this deadline, you forfeit your right to enforce the lien. Timely action is crucial, so maintain a calendar of important dates related to your projects. Always consult with a legal expert if you have questions regarding the process.

Yes, Arkansas does levy tax liens against property for unpaid taxes. These liens provide security for the tax authorities to recover funds owed. While the process differs from Arkansas materialman's liens, it's essential to understand both when dealing with property ownership. Always stay updated on your tax obligations to avoid complications.

To file a lien in Arkansas, you need to prepare a lien statement that includes specific information about the debt and the property. Once you complete the statement, file it with the county clerk in the county where the property is located. Utilizing UsLegalForms can simplify this process, providing you with templates and guidance tailored to Arkansas materialman's lien requirements.

You can perform a lien search in Arkansas by visiting the local county clerk’s office or their online portal. Start by gathering information such as property details and the owner's name. This search will help you identify any existing Arkansas materialman's liens associated with the property. A comprehensive search ensures you are informed of all financial claims.