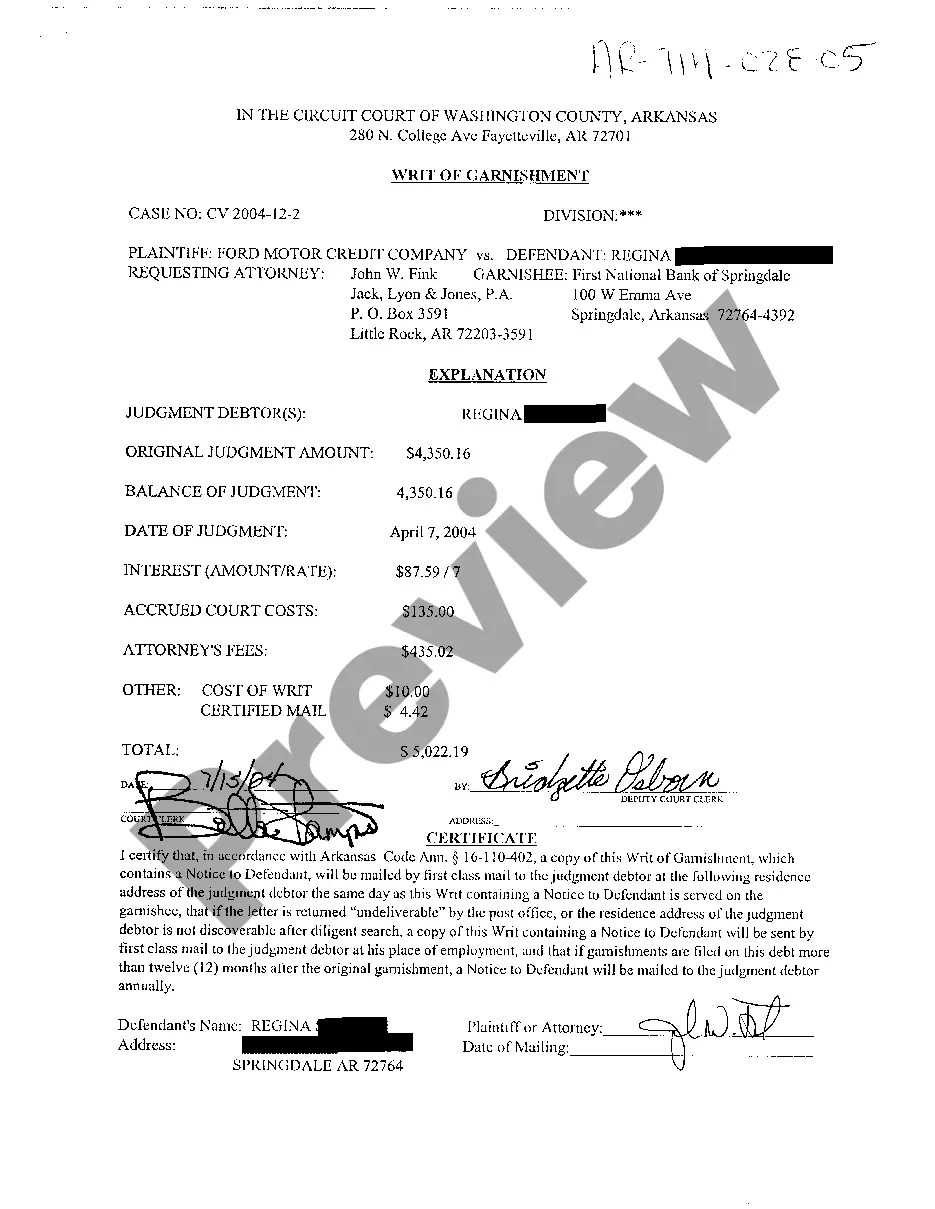

Arkansas Writ of Garnishment

Description

How to fill out Arkansas Writ Of Garnishment?

Among countless complimentary and paid examples available online, you cannot guarantee their dependability.

For instance, who designed them or if they possess the necessary qualifications to handle your specific needs.

Always remain composed and utilize US Legal Forms! Find Arkansas Writ of Garnishment templates crafted by experienced lawyers and bypass the expensive and time-consuming effort of searching for a lawyer and compensating them to draft a document for you that you can easily obtain by yourself.

Once you’ve registered and purchased your subscription, you can utilize your Arkansas Writ of Garnishment as frequently as necessary or for as long as it is valid in your area. Modify it in your preferred online or offline editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Ensure that the form you find is applicable in your location.

- Examine the template by reviewing the details while utilizing the Preview feature.

- Click Buy Now to initiate the buying procedure or look for another example using the Search option located in the header.

- Choose a payment plan and establish an account.

- Complete the payment for the subscription using your credit/debit card or Paypal.

- Download the document in your desired file format.

Form popularity

FAQ

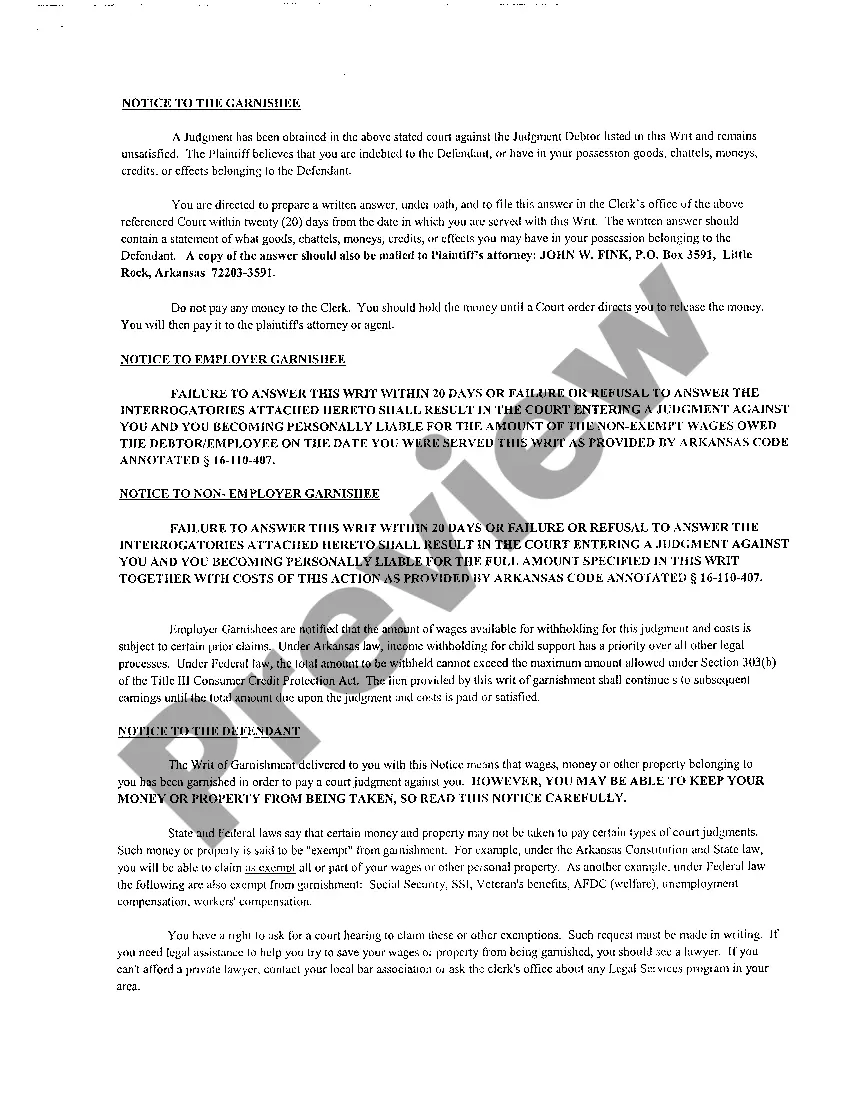

To stop garnishment in Arkansas, you can file a motion with the court that issued the Arkansas Writ of Garnishment. First, gather relevant documentation that supports your request, such as proof of financial hardship. It is crucial to respond promptly to the notice of garnishment to avoid further deductions from your wages or bank account. Consulting with a legal professional can provide guidance and enhance your chances of successfully stopping the garnishment.

A writ of possession in Arkansas is a legal order that directs law enforcement to remove a person from a property they occupy without permission. Unlike the Arkansas Writ of Garnishment, which deals with financial obligations, a writ of possession focuses on real property disputes. Understand that this legal tool can expedite property recovery for landlords. Familiarizing yourself with both documents is essential if you find yourself entangled in legal matters.

The duration to stop wage garnishment can vary depending on the legal actions you take. Typically, if you file a motion to stop the garnishment, it can take a few days to a few weeks for a court to process it. The process depends on the circumstances surrounding the case. Using resources like the Arkansas Writ of Garnishment from US Legal Forms can simplify your path to resolving these issues.

Garnishments do not stop automatically; they remain in effect until the debt is repaid or you take action to stop them. If a court issues a final order, you must address it proactively through proper legal channels. The Arkansas Writ of Garnishment does not automatically expire; it is vital to stay informed about your rights and responsibilities. Engaging legal support can provide the guidance necessary to navigate these complexities.

Stopping a garnishment can happen relatively quickly once you take the right steps. If you file a motion with the court, you may be able to halt the process within a few days. It is advisable to act promptly if you believe the garnishment is unjustified, particularly under the Arkansas Writ of Garnishment. Engaging with legal platforms such as US Legal Forms can help expedite this process efficiently.

The maximum amount that can be garnished from your paycheck in Arkansas is limited to 25% of your disposable earnings. However, if you earn less than a specific income threshold, the amount that can be deducted is further reduced. It’s crucial to consult the Arkansas Writ of Garnishment guidelines to understand the specifics related to your paycheck. If you are facing a wage garnishment, seeking assistance is recommended.

In Arkansas, certain types of income are exempt from garnishment under the Arkansas Writ of Garnishment. These include Social Security benefits, unemployment benefits, and worker's compensation. Moreover, any payments from pension plans or disability payments are also typically protected. Knowing what is exempt can help you safeguard your vital resources.

In Arkansas, the maximum amount that can be garnished from your paycheck depends on your disposable income. Generally, creditors can garnish up to 25% of your disposable earnings. Additionally, federal law also sets limits to ensure your basic living expenses are protected. Understanding the Arkansas Writ of Garnishment can help you figure out how these regulations apply to your specific situation.

Filing for an exemption from wage garnishment in Arkansas involves submitting a written request to the court along with supporting documentation. This request must demonstrate that your income qualifies for protection under Arkansas law. Approaching this matter thoughtfully will aid in preserving your income, as many exemptions can significantly reduce the financial strain of garnishment.

To collect a judgment in Arkansas, you can initiate the garnishment process using an Arkansas Writ of Garnishment. Consider notifying the debtor and attempting to reach an agreement before pursuing legal action. If the debtor does not comply, you may need to engage a collections attorney who can guide you through the legal processes involved in enforcing the judgment effectively.