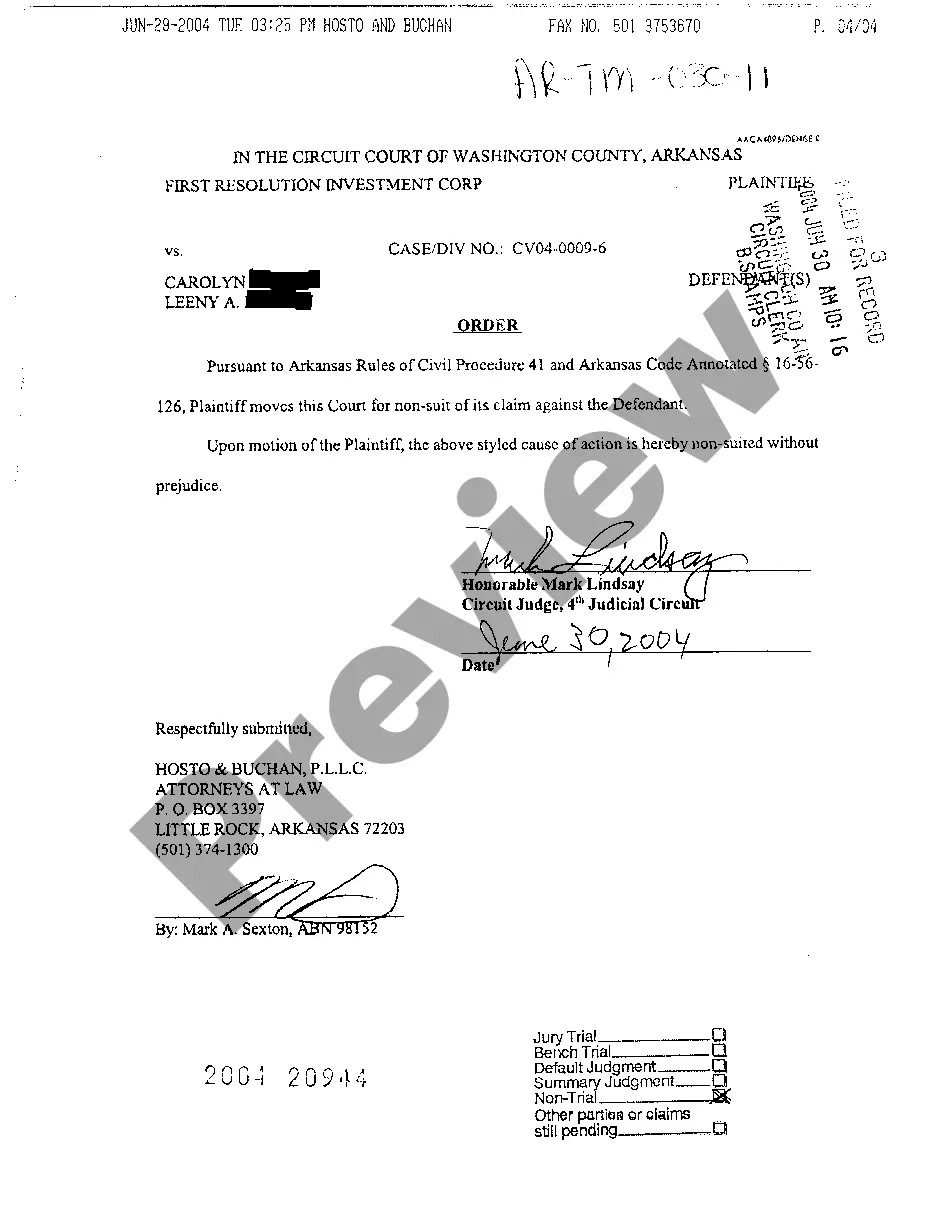

Arkansas Order on Complaint for Collection of Debt

Description

How to fill out Arkansas Order On Complaint For Collection Of Debt?

Amid numerous paid and free examples available online, you cannot guarantee their trustworthiness.

For instance, who created them or whether they possess the expertise to address your needs.

Stay composed and utilize US Legal Forms!

Ensure the document you locate is legitimate in your area. Review the template by consulting the information through the Preview function. Click Buy Now to commence the ordering process or seek another sample using the Search box in the header. Choose a pricing plan to register an account. Make payment for the subscription using your credit/debit card or PayPal. Download the form in the desired format. After you have registered and procured your subscription, you can use your Arkansas Order on Complaint for Collection of Debt as frequently as needed while it remains valid in your region. Edit it with your chosen editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- Explore Arkansas Order on Complaint for Collection of Debt templates crafted by skilled lawyers.

- Eliminate the expensive and lengthy process of searching for a legal counsel, then compensating them to draft documents that you can obtain independently.

- If you already possess a subscription, Log In/">Log In to your account to locate the Download button adjacent to the file you are after.

- You will also have access to all your previously saved templates in the My documents section.

- If you are utilizing our service for the first time, adhere to the guidelines below to swiftly acquire your Arkansas Order on Complaint for Collection of Debt.

Form popularity

FAQ

In Arkansas, the statute of limitations typically allows creditors to collect a debt for three to five years, depending on the type of debt. Once this period expires, you may be able to assert your rights under the Arkansas Order on Complaint for Collection of Debt and defend against any legal claims. It is important to understand that while the debt may be deemed uncollectible, this does not erase the debt itself. To navigate these complexities, consider utilizing resources available through USLegalForms, where you can find templates and guidance relevant to your situation.

In Arkansas, the statute of limitations varies depending on the type of debt but generally ranges from three to six years. After this period, collectors cannot pursue legal action against you. If you receive an Arkansas Order on Complaint for Collection of Debt, knowing this timeline is essential.

Educate yourself on your rights and keep detailed records of all communications. Ask for validation of the debt and do not provide personal information without verification. These steps are especially crucial when handling claims like an Arkansas Order on Complaint for Collection of Debt.

This federal law protects consumers from abusive debt collection tactics. In Arkansas, this means that collectors must follow specific rules about their communication methods. If you’re confronted with an Arkansas Order on Complaint for Collection of Debt, understanding these protections can empower you.

Start by clearly stating your intention to dispute the collection. Include your account details and express your reasons for the dispute. If you receive an Arkansas Order on Complaint for Collection of Debt, speaking with a legal expert can improve the letter’s effectiveness.

Speak clearly about your intentions and what is legally owed, if anything. Avoid making promises you cannot keep or admitting liability if you are unsure. When dealing with matters like an Arkansas Order on Complaint for Collection of Debt, clarity is vital.

While this involves a specific context in India, it’s essential to communicate effectively if you receive documents similar to an Arkansas Order on Complaint for Collection of Debt. Use a naturally assertive tone to express your desire to end communication.

The phrase is 'I do not want to discuss this debt further.' This achieves a formal request to cease communication. However, if you face an Arkansas Order on Complaint for Collection of Debt, it’s crucial to understand your rights before stating this phrase.

You can tell debt collectors that you wish to exercise your rights under the Fair Debt Collection Practices Act. Specifically, you should inform them that you no longer wish to communicate. If you receive an Arkansas Order on Complaint for Collection of Debt, consult a legal professional to help guide your communication.

The most frequent violation of the Fair Debt Collections Practices Act involves harassment or abusive practices by debt collectors. This can include threats, misleading statements, or calling at inconvenient times. Understanding these violations is crucial, especially if you face an Arkansas Order on Complaint for Collection of Debt. Awareness empowers you to take appropriate action and protect your rights against unfair collection tactics.