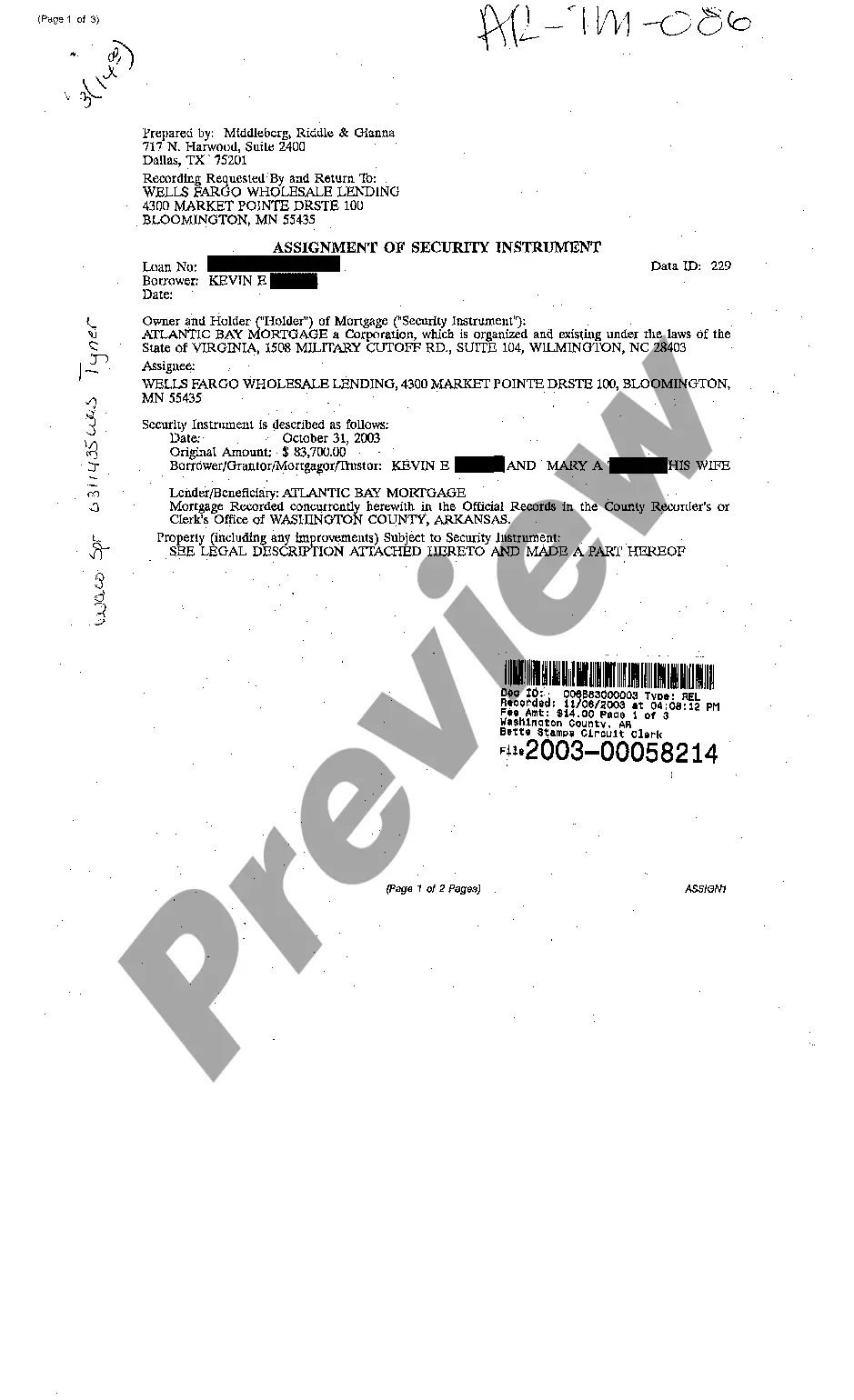

Arkansas Assignment of Security Instrument

Description

How to fill out Arkansas Assignment Of Security Instrument?

Among countless paid and free instances available online, you cannot be assured of their credibility.

For instance, who developed them or whether they are skilled enough to handle what you require them for.

Always remain composed and utilize US Legal Forms!

Review the document by examining the details using the Preview feature. Click Buy Now to initiate the ordering process or search for a different template using the Search bar located in the header.

- Acquire Arkansas Assignment of Security Instrument templates crafted by expert legal professionals.

- Evade the costly and time-intensive process of searching for an attorney and subsequently compensating them to draft a document for you that you could effortlessly locate yourself.

- If you possess a subscription, Log In/">Log In to your account and locate the Download button adjacent to the form you need.

- Additionally, you will have access to all your previously acquired templates in the My documents section.

- If you are utilizing our service for the first time, adhere to the guidelines below to acquire your Arkansas Assignment of Security Instrument effortlessly.

- Ensure that the document you find is applicable in the state where you reside.

Form popularity

FAQ

The Assignment of security refers to the transfer of rights and interests in a security agreement from one party to another. This legal mechanism is often used in financial transactions to enhance security for loans or debts. When dealing with real estate or mortgages, the Assignment of Security Instrument becomes particularly relevant. Knowledge of this process can provide you with greater control in your financial agreements.

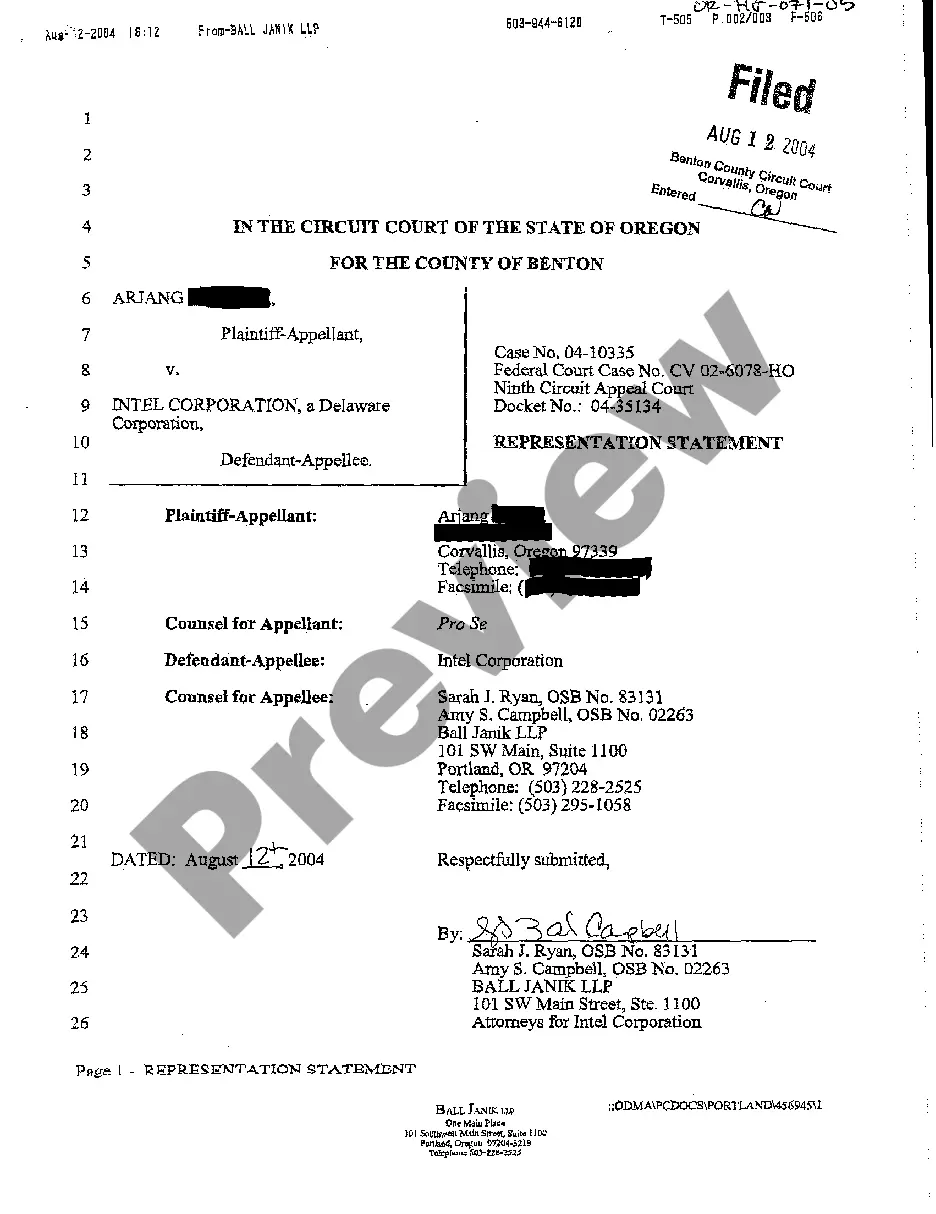

Judicial foreclosure is commonly used when a mortgage serves as the security instrument. This process requires the lender to file a lawsuit to proceed with the foreclosure, allowing the borrower to present a defense. Depending on the jurisdiction, this process can be time-consuming but may provide more transparency. Understanding the implications of your Arkansas Assignment of Security Instrument is vital in these circumstances.

The deed of Assignment of security refers to a legal document transferring rights to a secured asset from one party to another. This deed is essential in ensuring that the new holder has the authority to enforce the terms of the security agreement. In the context of real estate, it often involves mortgages or other security interests. This process is closely related to the Arkansas Assignment of Security Instrument.

The most common type of foreclosure is non-judicial foreclosure. This process allows lenders to sell a property without court intervention, speeding up the timeline. Non-judicial foreclosure is often governed by state laws, which can vary significantly. If you find yourself in this situation, knowing about the Arkansas Assignment of Security Instrument may offer you some protection.

The foreclosure process in the US typically begins when a borrower fails to make mortgage payments. Lenders usually provide a grace period before initiating foreclosure proceedings. They may file a notice of default, followed by a public auction of the property. Understanding your rights during this process is crucial, especially if you are dealing with the Arkansas Assignment of Security Instrument.

To obtain a security license in Arkansas, you must complete specific training and pass a licensing exam. The process typically requires a background check and submission of an application to the Arkansas Department of Finance and Administration. Familiarizing yourself with the requirements of the Arkansas Assignment of Security Instrument can also be beneficial. Ensuring you meet these standards will help you navigate the licensing process more efficiently.

Arkansas primarily operates under a deed of trust system for securing loans. This means that instead of a mortgage, lenders often use a deed of trust to protect their interests in property transactions. With the Arkansas Assignment of Security Instrument, the deed of trust allows for a more streamlined foreclosure process. Knowing this distinction helps you navigate real estate transactions in Arkansas.

Examples of security measures include encryption, access controls, and monitoring systems. These measures are crucial for protecting sensitive information and ensuring compliance with regulations. In relation to the Arkansas Assignment of Security Instrument, implementing robust security measures can safeguard both lender and borrower interests. Adopting comprehensive security practices enhances trust and transparency in financial transactions.

The four basics of security involve confidentiality, integrity, availability, and compliance. Maintaining confidentiality ensures that only authorized individuals access sensitive information. Integrity refers to protecting information from unauthorized changes, ensuring accuracy. Availability guarantees that information and resources are accessible when needed, which is also essential for the Arkansas Assignment of Security Instrument.

A uniform instrument refers to a standardized document used in real estate transactions to simplify and streamline the process. In relation to financial agreements, an Arkansas Assignment of Security Instrument often takes the form of a uniform instrument, making it easier for lenders and borrowers to understand their obligations. By using uniform instruments, parties can ensure consistency and clarity in agreements across various jurisdictions.